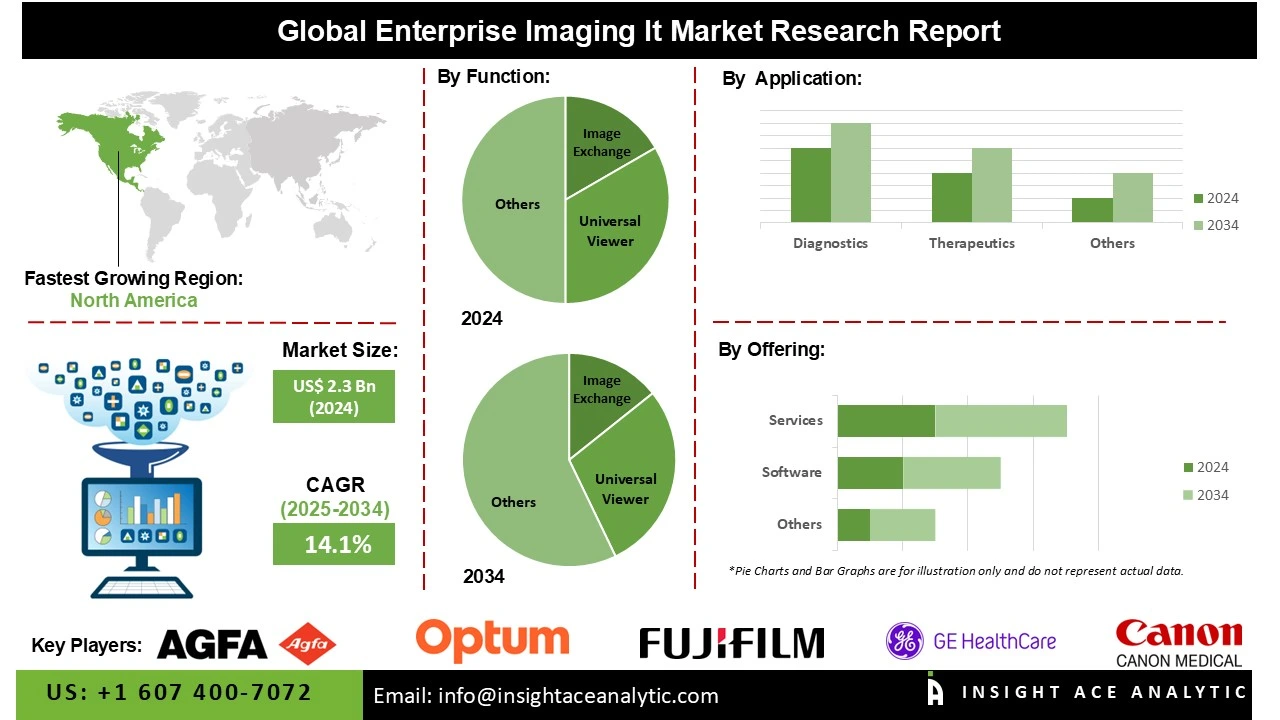

Global Enterprise Imaging IT Market Size is valued at US$ 2.3 Bn in 2024 and is predicted to reach US$ 8.5 Bn by the year 2034 at an 14.1% CAGR during the forecast period for 2025-2034.

Enterprise Imaging IT is a centralized strategy and technology platform that consolidates all medical images and clinical multimedia (from radiology, cardiology, dermatology, etc.) across a healthcare system. Its goal is to make every image universally accessible to any authorized provider through the electronic health record (EHR) to improve care coordination and decision-making.

Enterprise imaging solutions integrate a number of imaging modalities into a single platform, allowing specialists to access, share, and analyze patient images effectively. Cross-specialty access improves clinical decision-making, reduces treatment planning delays, and supports precision medicine. Increasing cancer prevalence and the requirement for multidisciplinary treatment are key drivers propelling this trend towards enterprise imaging adoption.

The Enterprise Imaging IT market is experiencing robust growth based on increasing use of mobile diagnostic imaging. Mobile imaging technologies provide quicker access to vital diagnostic information so that healthcare providers are able to provide timely care, especially in rural and underserved locations. The portability of mobile platforms facilitates point-of-care diagnostics, decreases travel for patients, and improves workflow effectiveness. Integration with enterprise IT systems for imaging in hospitals and clinics ensures smooth sharing of data between hospitals and clinics, allowing collaborative decision-making. The growing need for low-cost, portable, and accessible imaging technologies is forcing healthcare organizations to invest in sophisticated enterprise imaging IT platforms.

Some of the Key Players in the Enterprise Imaging IT Market:

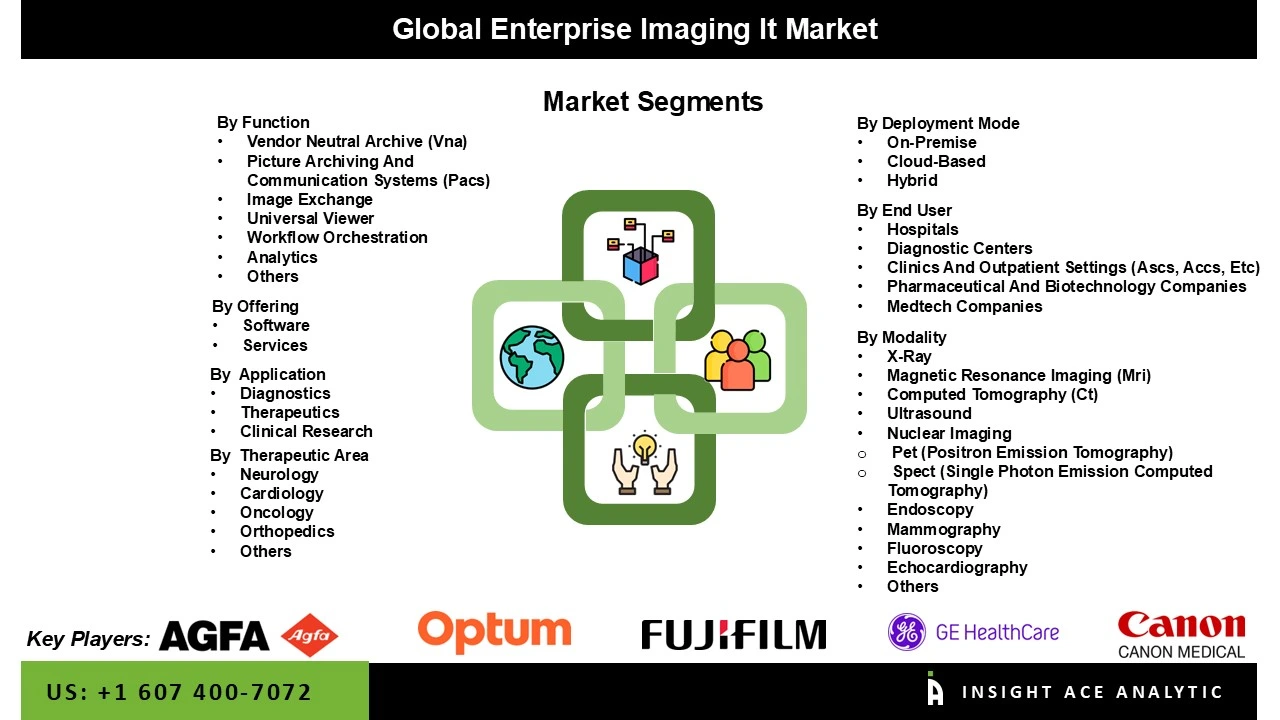

The enterprise imaging IT market is segmented by function, modality, application, offering, deployment mode, therapeutic area, end-user and By Region. The enterprise imaging IT market is segmented into multiple categories. It is divided by function, which includes vendor neutral archive (VNA), picture archiving & communication systems (PACS), image exchange, universal viewer, workflow orchestration, analytics, and others. Segmentation by modality covers X-Ray, MRI, CT, ultrasound, nuclear imaging, endoscopy, mammography, fluoroscopy, and echocardiography. Furthermore, the market is categorized by application (diagnostic, therapeutics, clinical research), offering (software, services), and therapeutic area (neurology, cardiology, oncology, orthopedics). Additional segments include deployment mode (on-premises, cloud-based, hybrid) and end-user (hospitals, diagnostic centers, clinics, outpatient settings, pharmaceutical and biotechnology companies, medtech companies, research & academia). Finally, the market is also analyzed by region.

In 2024, the growing need for centralized management of medical images across multiple departments and facilities expand market growth. Healthcare providers are shifting toward interoperable, vendor-agnostic solutions to eliminate data silos, reduce storage costs, and enhance accessibility. Rising adoption of electronic health records (EHRs), compliance with regulatory standards, and the rising demand for seamless image sharing across care networks further accelerate VNA adoption, improving workflow efficiency and patient care delivery.

The enterprise imaging IT market is dominated by software due to the growing need for centralized management of medical imaging data across healthcare enterprises. Hospitals and clinics are shifting from siloed PACS to enterprise-wide platforms that integrate radiology, cardiology, pathology, and other specialties into a unified system. This ensures seamless data sharing, improves collaboration, and enhances clinical decision-making. Rising patient volumes, demand for faster diagnostics, and the push toward value-based care further accelerate adoption. Additionally, regulatory requirements for interoperability and the integration of artificial intelligence (AI) for advanced imaging analytics strengthen market growth.

North America dominates the market for enterprise imaging IT due to region’s increasing demand for comprehensive healthcare systems integrating imaging data between various departments facilitates effective clinical collaboration. Increasing acceptance of electronic health records (EHRs) and value-based care models is driving demand for solutions which combine disparate imaging formats into one patient-centric record. Increased use of cloud-based storage and AI-powered diagnostics is improving accessibility and clinical decision-making. Growing healthcare expenditure, combined with government focus on interoperability and patient data protection, accelerates adoption within hospitals, diagnostic centres, and specialty clinics in the market.

Europe is the second-largest region in the market for enterprise imaging IT. This is attributed to growing need for integrated healthcare systems that centralize imaging data across departments to improve clinical workflows and patient care. Growing use of electronic health records (EHRs) and integration of Picture Archiving and Communication Systems (PACS) facilitates smooth image exchange, eliminating duplications and delays in diagnosis. Growing incidence of chronic ailments and geriatric populations drive the need for sophisticated diagnostic imaging products. In addition, government focus on data interoperability, along with increasing expenditure in digital healthcare infrastructure and cloud-based imaging platforms, deeply propels regional market growth.

Enterprise Imaging IT Market by Function-

· Vendor Neutral Archive (VNA)

· Picture Archiving & Communication Systems (PACS)

· Image Exchange

· Universal Viewer

· Workflow Orchestration

· Analytics

· Others

Enterprise Imaging IT Market by Modality -

· X-Ray

· MRI

· CT

· Ultrasound

· Nuclear Imaging, Endoscopy

· Mammography

· Fluoroscopy

· Echocardiography

· Others

Enterprise Imaging IT Market by Application-

· Diagnostic

· Therapeutics

· Clinical Research

Enterprise Imaging IT Market by Offering-

· Software

· Services

Enterprise Imaging IT Market by Deployment Mode-

· On-Premises

· Cloud-Based

· Hybrid

Enterprise Imaging IT Market by Therapeutic Area-

· Neurology

· Cardiology

· Oncology

· Orthopedics

· Others

Enterprise Imaging IT Market by End-User-

· Hospitals

· Diagnostic Centers

· Clinics & Outpatient Settings (ASCS, ACCS, Etc)

· Pharmaceutical & Biotechnology Companies

· Medtech Companies

· Research & Academia

· Others

Enterprise Imaging IT Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.