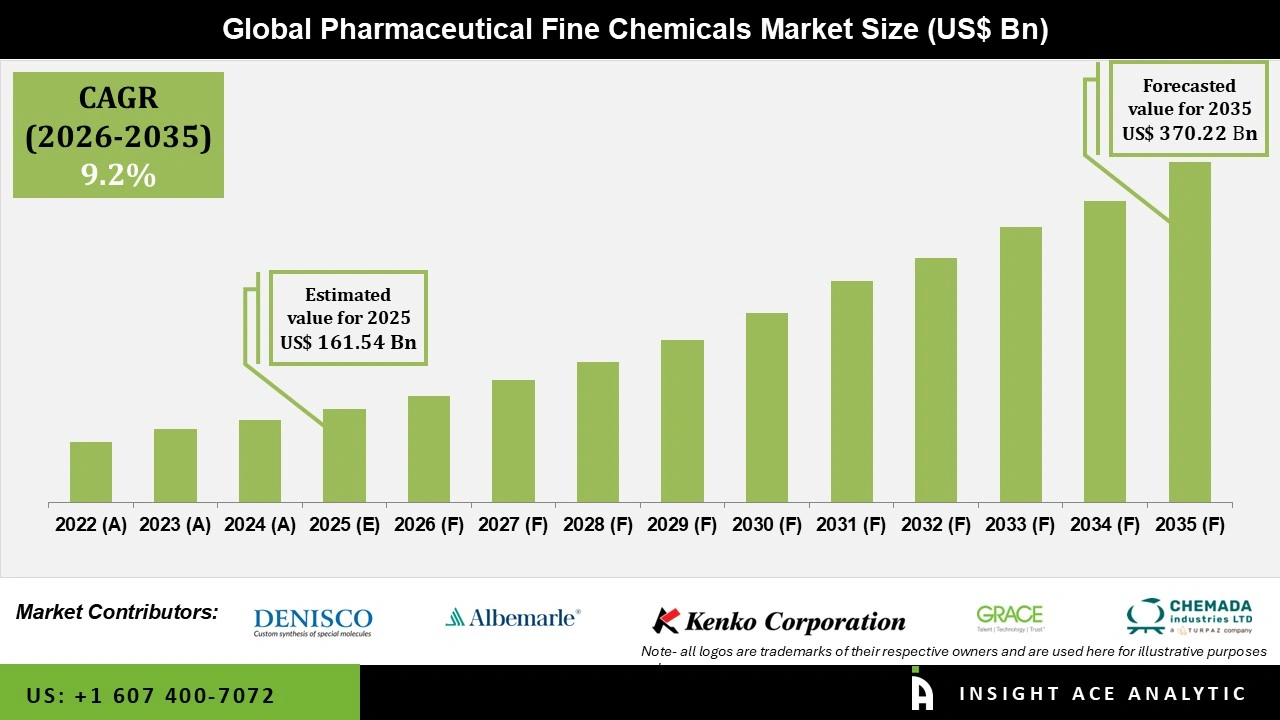

Global Pharmaceutical Fine Chemicals Market Size is valued at USD 161.54 Bn in 2025 and is predicted to reach USD 370.22 Bn by the year 2035 at a 9.20% CAGR during the forecast period for 2026 to 2035.

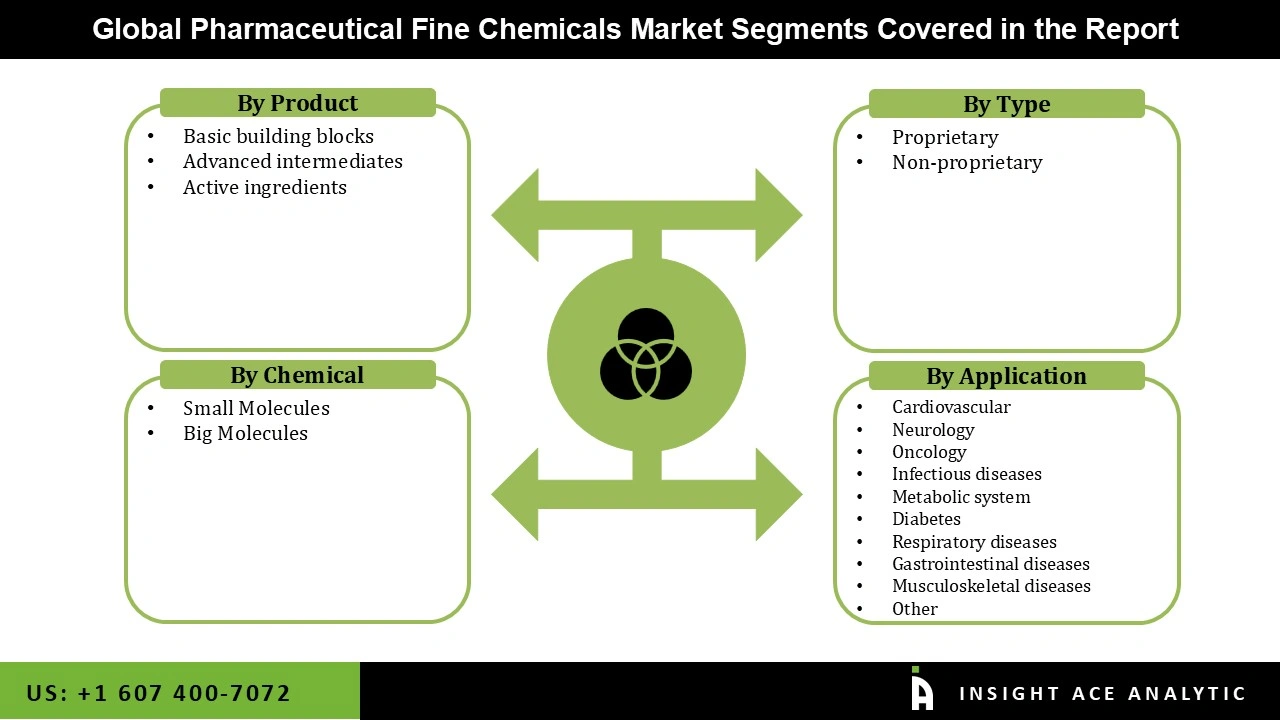

Pharmaceutical Fine Chemicals Market By Product (Basic Building Blocks, Advanced intermediates, and Active ingredients), Type (Proprietary, Non-proprietary), Chemical (Small Molecules, Big Molecules), By Application (Cardiovascular, Neurology, Oncology, Infectious diseases, Metabolic system, Diabetes, Respiratory diseases, Gastrointestinal diseases, Musculoskeletal diseases, and Other), By Region, And By Segment Forecasts, 2026 to 2035.

Pharmaceutical fine chemicals describe the class of chemicals that are employed in the pharmaceutical industry. In contrast to the processed compounds found in most pharmaceuticals, they are pure substances.

The number of people with various chronic health conditions is expected to experience a rapid rise in the following years. Thus, it is projected to mainly fuel the pharmaceutical fine chemicals industry's expansion. Furthermore, the continuously growing global pharmaceutical sector coupled with increasing healthcare spending, development of novel therapies, and growth in the biologics and biosimilars market will further aid the market growth. However, the market growth is expected to be hampered by the strict regulatory criteria for the safety of the pharmaceutical fine chemicals market.

The pharmaceutical fine chemicals market is segmented based on product, type, chemical and application. Based on product, the market is segmented into basic building blocks, advanced intermediates, and active ingredients. Based on type, the market is segmented into proprietary and non-proprietary. Based on chemicals, the market is segmented into small and big molecules. By application, the market is segmented into cardiovascular, neurology, oncology, infectious diseases, metabolic systems, diabetes, respiratory diseases, gastrointestinal diseases, musculoskeletal diseases, and others.

The basic building blocks of the pharmaceutical fine chemicals market are expected to hold a major global market share in 2024. These compounds are used in a wide array of medications. The broad range of applications for these compounds, in conjunction with the strategies adopted by the building block producers, are anticipated to be the primary factors propelling this market's expansion.

The proprietary segment is estimated to account for the largest revenue share in 2024. Most pharmaceutical fine chemicals are used as building blocks for proprietary drugs. Market players focus on developing proprietary drugs to have maximum profit as these drugs are patent-protected. Thus, pharma companies focus on developing proprietary drugs that are expected to boost this segment.

The cardiovascular industry uses the bulk of pharmaceutical fine chemicals because of the global rise in the need for pharmaceutical compounds to treat arterial and cardiovascular ailments. With more and more people suffering from heart conditions, the pharmaceutical fine chemicals market is seeing growth in the cardiovascular application area, especially in countries like the US, Germany, the UK, China, and India.

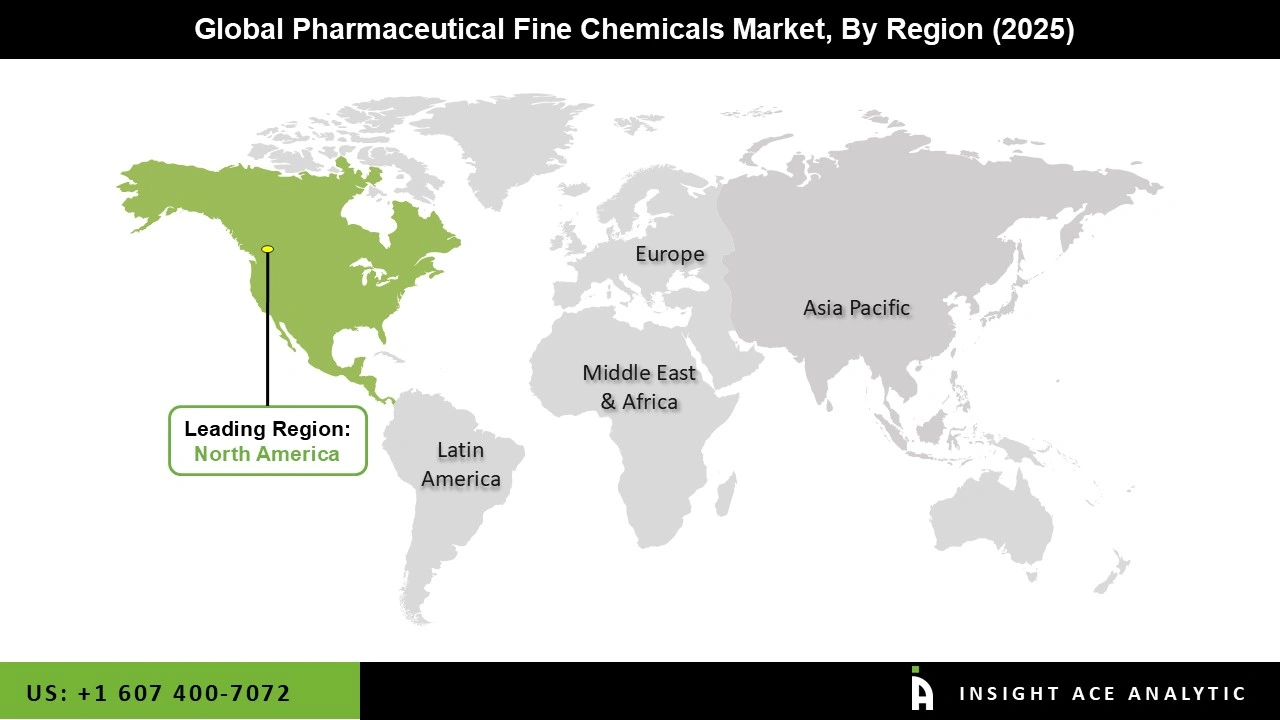

The North American pharmaceutical fine chemicals market is expected to register the highest market share in revenue in the near future. This can be attributed to the presence of major pharma players and favourable government mandates for producing fine Pharmaceutical Fine Chemicals in the region.

However, Asia-Pacific is expected to grow at the fastest CAGR during the study period, majorly due to high population growth in countries such as China and India, rising disposable income as well the increasing standard of living, increasing API production and growing investment in R&D sector by key market players in the region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 161.54 Bn |

| Revenue Forecast In 2035 | USD 370.22 Bn |

| Growth Rate CAGR | CAGR of 9.20% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Chemical, Type, Application Type, Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Denisco; Albemarle Corporation; Kenko Corporation; GRACE; CHEMADA; JMP Statistical Discovery LLC.; Pfizer Inc.; GSK plc |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.