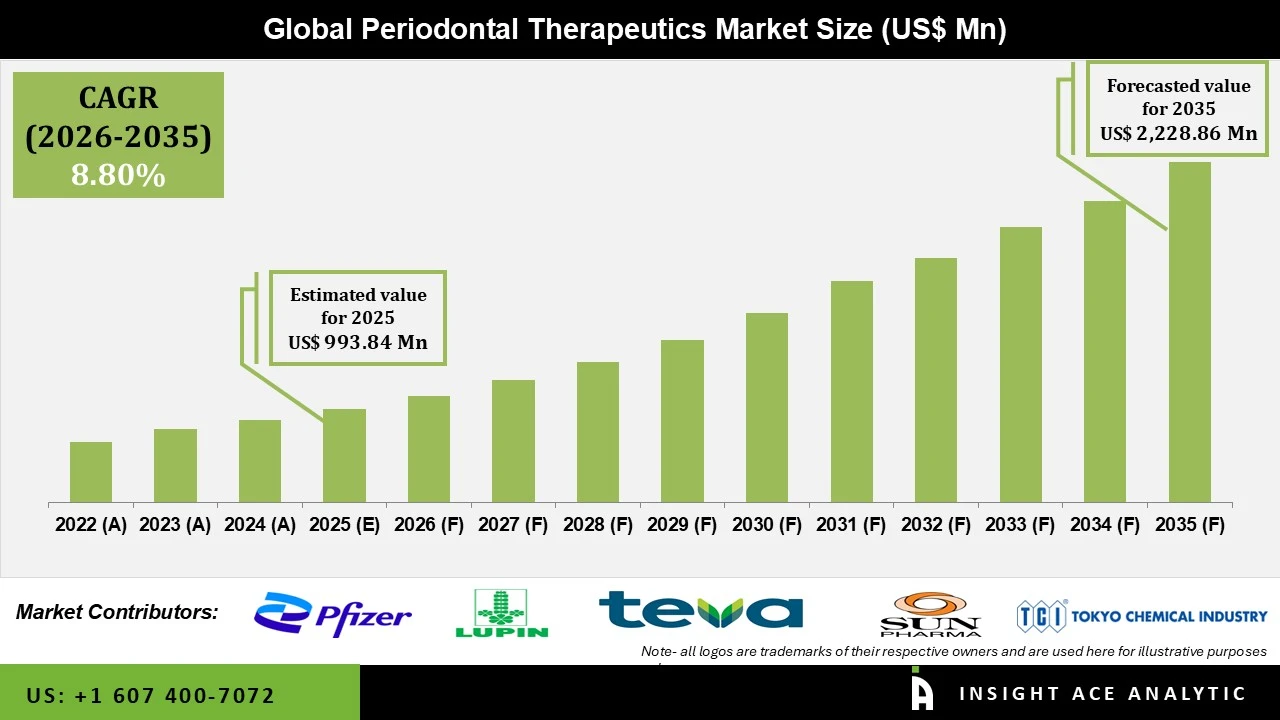

Periodontal Therapeutics Market Size was valued at USD 993.84 Mn in 2025 and is predicted to reach USD 2228.86 Mn by 2035 at a 8.80% CAGR during the forecast period for 2026 to 2035.

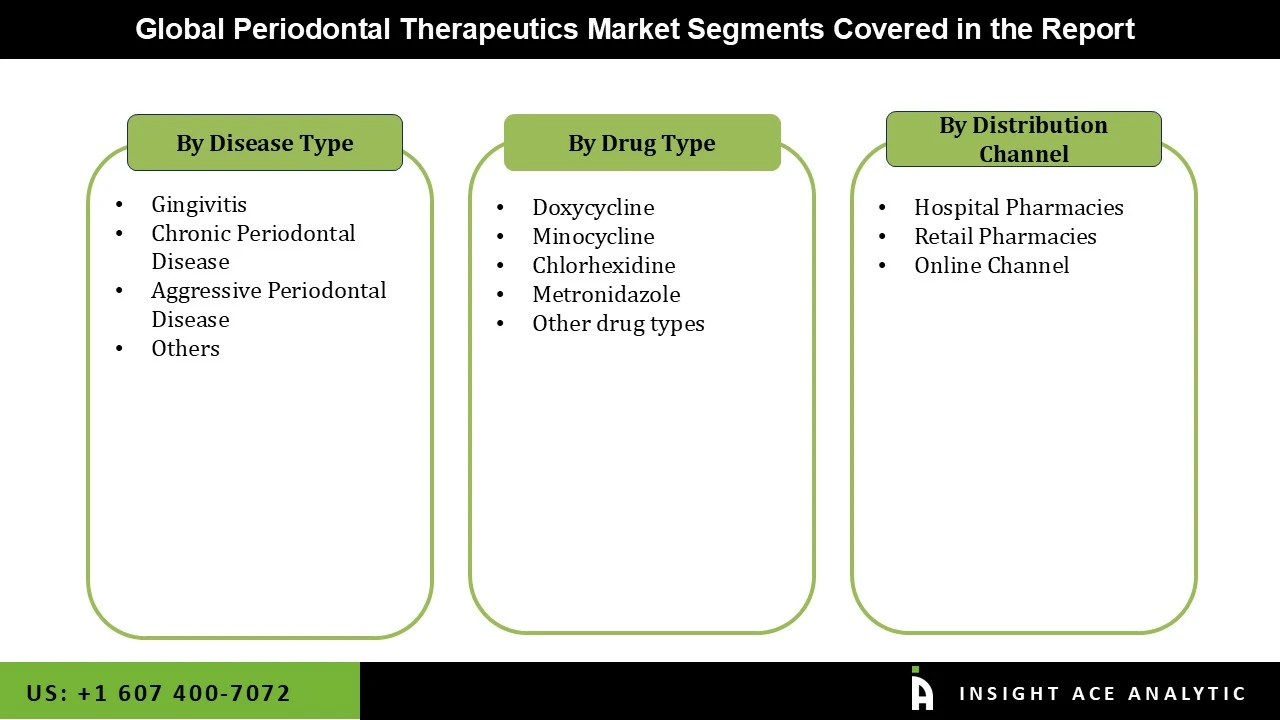

Periodontal Therapeutics Market Size, Share & Trends Analysis Report, By Disease (Chronic Periodontal Disease, Aggressive Periodontal Disease, Gingivitis), By Drug Type (Doxycycline, Minocycline, Chlorhexidine, Metronidazole)), By Distribution Channel, By Region, Forecasts, 2026 to 2035

Periodontal disease encompasses a wide range of inflammatory conditions affecting the tissues surrounding the teeth. It primarily includes gingivitis (mild inflammation of the gums) and periodontitis (severe inflammation that can lead to tooth loss). Gingivitis is reversible with the help of proper care, but if it is left untreated, it can lead to periodontitis, which is more challenging to manage. The growth of the market is due to the growing prevalence of periodontal diseases. Increasing awareness about oral health, the rising geriatric population, and technological advancements in dentistry are further propelling the growth of the market. Also, the recommendation of drugs like antibiotics is rising in the same field. It is quite advantageous for the growth of the periodontal market.

The COVID-19 pandemic has significantly impacted the periodontal therapeutics market. Dental clinics and periodontal practices faced temporary closures and reduced patient visits due to lockdowns and social distancing measures. It led to a decline in the demand for periodontal treatments. However, the pandemic also heightened awareness of the importance of oral health, potentially driving future market growth. Telehealth services and remote consultations emerged as alternative approaches, aiding in patient management during the crisis. As restrictions ease and normalcy returns, the market is expected to recover, with an increased focus on infection control and preventive care.

The periodontal therapeutics market is segmented on the basis of disease, drug type, and distributional channel. By Disease type, the market segments include gingivitis, chronic periodontal disease, aggressive periodontal disease, and others. On the basis of drug type, the segments are doxycycline, minocycline, chlorhexidine, metronidazole, and others. By distribution channel, the segmentation includes hospital pharmacies, retail pharmacies, and online channels.

The gingivitis segment of the periodontal therapeutics market is growing due to increased awareness of oral health and the prevalence of gum diseases. Gingivitis, an early stage of periodontal disease, is the inflammation of the gums as well as can lead to many severe conditions if untreated. The market includes various treatment options, such as antiseptic mouthwashes, antibiotics, and professional dental cleanings. Innovations in dental care products and a rising focus on preventive healthcare are driving market growth. Additionally, increased dental visits and advancements in diagnostic tools contribute to the expansion of this segment within the periodontal therapeutics market.

The doxycycline segment of the periodontal therapeutics market is a significant component in treating periodontal diseases. Doxycycline, a type of antibiotic, is commonly used in the form of gel or subgingival fibers to target specific bacteria causing periodontitis. It works by reducing inflammation and inhibiting bacterial growth in the periodontal pockets. The segment is seen to grow due to the effectiveness of doxycycline in managing periodontal conditions, its ease of application, and favorable patient outcomes. With increasing emphasis on oral health and advancements in periodontal treatments, the doxycycline segment plays a crucial role in the periodontal therapeutics market.

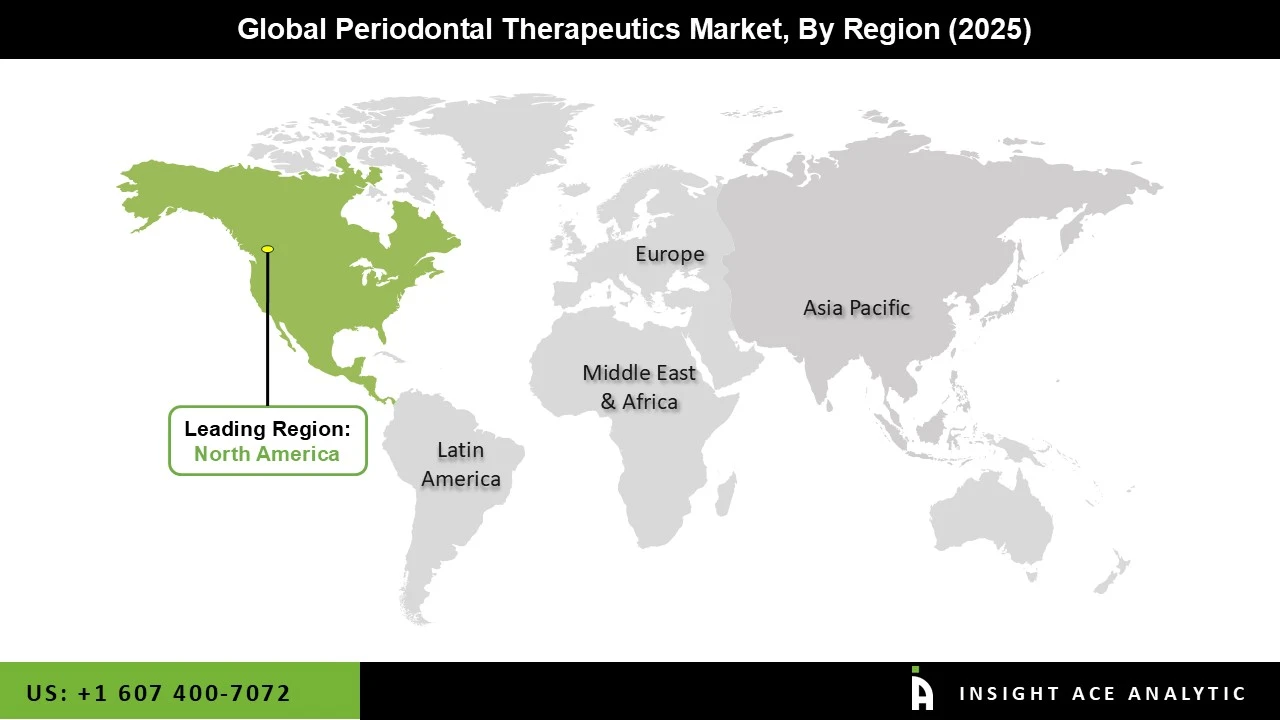

North America's periodontal therapeutics market dominates the market. It has been initiated to increase awareness about oral health—the rise in effective procedures for the treatment and diagnosis of periodontal diseases. Hence, the sales of periodontal treatment products, including both drugs and devices, in the region are quite high. Asia Pacific is to be seen to grow at a rapid rate in the global periodontal therapeutics market due to growing concerns about rapid industrialization, government initiatives, and increasing funding in various industries.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 993.84 Mn |

| Revenue Forecast In 2035 | USD 2228.86 Mn |

| Growth Rate CAGR | CAGR of 8.80% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Disease, By Drug Type, By Distribution Channel and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Pfizer Inc., Lupin Ltd., Teva Pharmaceuticals USA, Inc., Sun Pharmaceutical Industries Ltd., Tokyo Chemical Industry Co., Ltd., Bausch Health Companies Inc., USAntibiotics, Melinta Therapeutics LLC, Cipla, Inc., Chartwell Pharmaceuticals LLC, and other prominent players. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Periodontal Therapeutics Market - By Disease

Periodontal Therapeutics Market - By Drug Type

Periodontal Therapeutics Market - By Distribution Channel

Periodontal Therapeutics Market - By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.