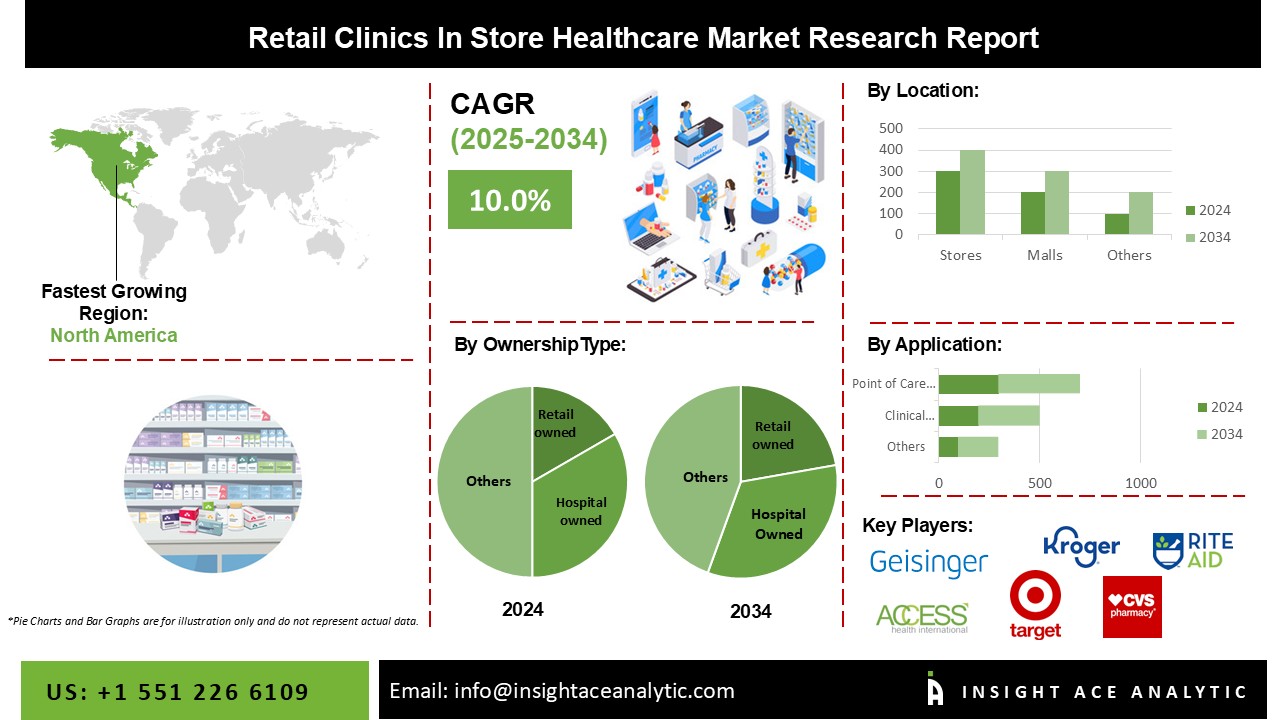

Retail Clinics in Store Healthcare Market is expected to grow at an 10.0% CAGR during the forecast period for 2025-2034.

A retail clinic is a healthcare location that provides services and medications from a qualified clinician outside of a typical office or emergency department. Retail clinics do not have observation beds and are only open for walk-ins. The main advantage of these clinics is that no appointment is required to receive medical treatment. Increasing disease prevalence, increased focus on healthcare, growing geriatric population, and increasing burden on other traditional healthcare institutions is among the significant factors driving the market growth. Rising healthcare expenditure &spending and the growing popularity of retail clinics are other factors governing the retail clinics' market potential.

The global focus on healthcare has grown as the prevalence of chronic diseases has skyrocketed. Better healthcare infrastructure is especially important in emerging nations with rising per capita disposable income. Retail, medical clinics are predicted to grow in popularity in emerging markets such as India, China, and Brazil. Retail clinics have been shown to be crucial in vaccination delivery programs around the world, which is projected to increase their market potential during the forecast period. Retail, medical clinics are located in popular areas, making them an appealing venue for effectively and quickly delivering immunizations.

One of the key factors projected to impede the growth of the global retail clinics market during the forecast period is the general population's hesitancy to seek treatment at retail clinics in emerging countries. Single treatment for mild or superficial infections, insufficient infrastructure, and a preference for treatment in retail clinics are factors limiting the market's growth potential.

The Retail Clinics In Store Healthcare Market is segmented by location, ownership type, and by application. As per the location, the market is segmented into stores, malls, other locations. The market is segmented by ownership type into retail owned, hospital owned. The market is segmented by application clinical chemistry, immunoassay, point of care diagnostics, vaccination, other applications.

Retail-oriented enterprises usually hold Retail medical clinics, and this practice has been increasingly prevalent over the years. Retail-owned clinics have increased in number around the world and continue to account for the vast majority of the market share. This trend is projected to continue during the projection period. There is an increasing demand for retail clinics due to the rising occurrence of illnesses and disorders such as sore throat, infections, flu, cold, cough, fever, and allergies. There is less waiting time, more ease of access, and lower comparable costs. Such advantages contribute to their growing appeal, propelling total expansion.

Stores will acquire a majority market share and lead the distribution channel category in the retail clinics market landscape. This tendency is projected to continue during the projection period. Stores industry like drug store consists of businesses that sell prescription and non-prescription pharmaceuticals as well as other "front-end" products. The majority of drug store sales are attributed to the number of prescriptions filled, as prescriptions are the primary source of customer activity in the store. The high demand for prescription pharmaceuticals has resulted in increased external competition for the drug store business. In response to increasing competition from mail-order retailers and supercentres, industry operators have prioritized convenience aspects such as extended store hours and drive-through locations to attract and retain customers.

The retail clinics market in North America is estimated to grow rapidly over the forecast period, accounting for a sizable market share during the forecast period. The presence of significant retail clinic providers such as CVS Healthcare and Walgreens, as well as the expanding number of retail care clinics in the region, can be credited to the region's growth. The United States and Canada are projected to drive demand for retail health clinics in this region. The United States is well-known for its well-established healthcare infrastructure, making it a highly profitable market for most healthcare businesses. Retail health clinics are extremely popular in the country due to their cost-effective and convenient approach to healthcare, which would otherwise be prohibitively expensive in the United States. Government initiatives and increased healthcare awareness are projected to be significant trends in the US for the retail clinics business. throughout the forecast period.

Some Major Key Players In the Retail Clinics in Store Healthcare Market:

| Report Attribute | Specifications |

| Growth rate CAGR | CAGR of 10.0% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Location, By Ownership Type, and By Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia; |

| Competitive Landscape | Access Health, AMA, Geisinger, Care Today, CVS, MedDirect, My Healthy Access, Now Medical Centers, The Little Clinic, Walgreens Boots Alliance, Wellness Express, Kroger, Rite Aid, Doctors Care, Clear Balance, Target Brands Inc., U.S. HealthWorks, Inc. and other market players |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Retail Clinics In Store Healthcare Market- By Location

Retail Clinics In Store Healthcare Market- By Ownership Type

Retail Clinics In Store Healthcare Market- By Application

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.