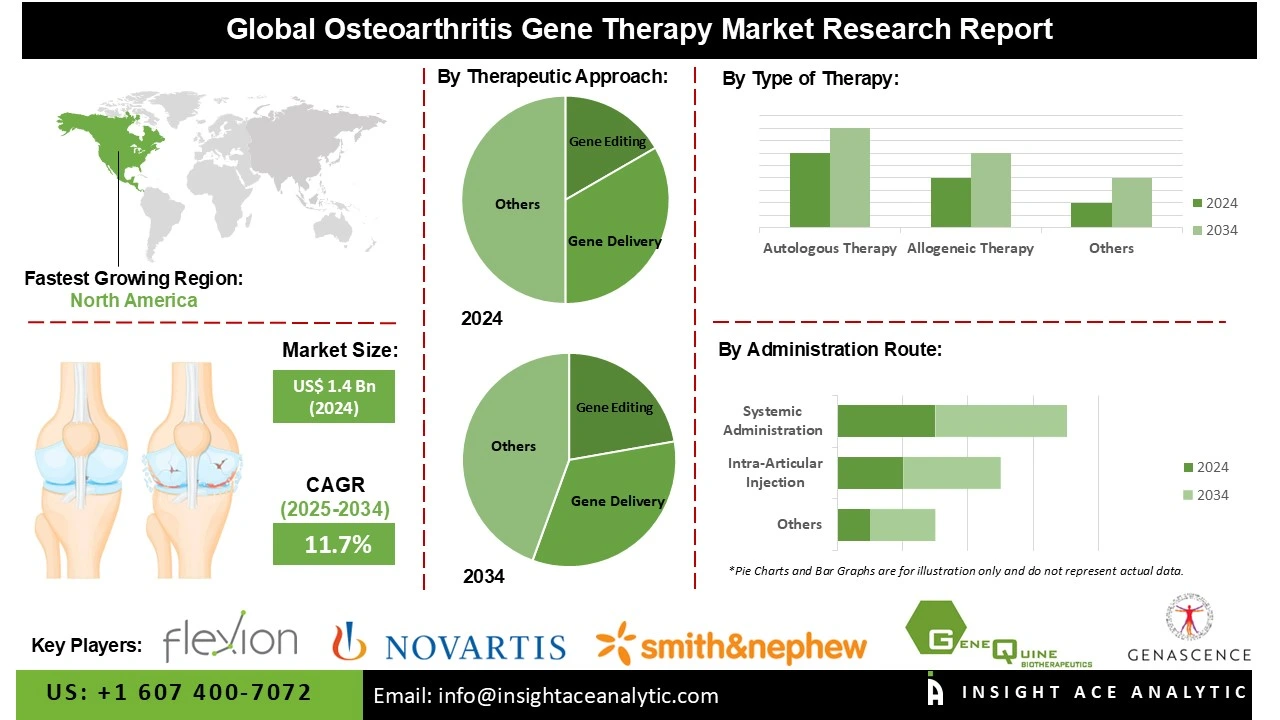

Osteoarthritis Gene Therapy Market Size is valued at US$ 1.4 Bn in 2024 and is predicted to reach US$ 4.0 Bn by the year 2034 at an 11.7% CAGR during the forecast period for 2025 to 2034.

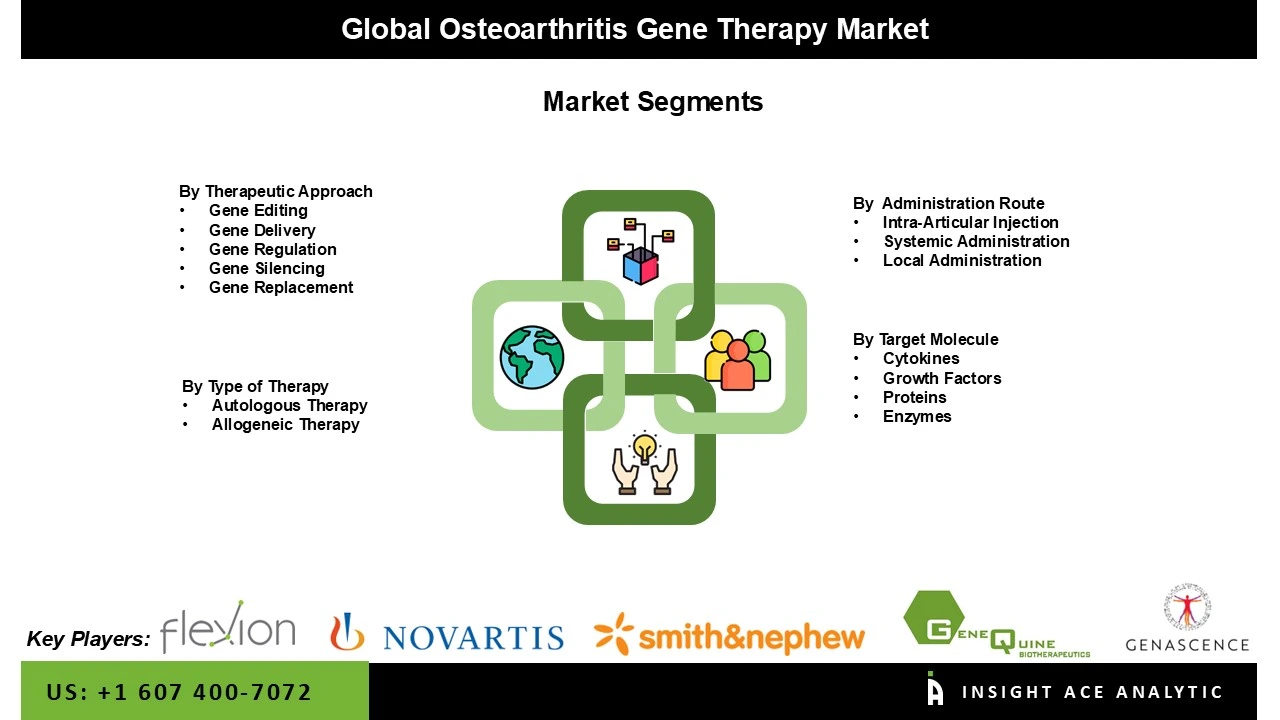

Osteoarthritis Gene Therapy Market Size, Share & Trends Analysis Distribution by Therapeutic Approach (Gene Editing, Gene Delivery, Gene Regulation, Gene Silencing, Gene Replacement), by Type of Therapy (Autologous Therapy, Allogeneic Therapy), By Administration Route, By Target Molecule, By Region and Segments Forecasts, 2025 to 2034

Gene therapy for osteoarthritis involves the direct delivery of therapeutic genes into affected joints. This approach aims to combat the disease on a molecular level by reducing inflammation, promoting cartilage regeneration, and slowing overall disease progression. By addressing underlying causes, gene therapy can provide long-lasting pain relief and significantly improve joint function.

As a disease-modifying treatment, this modality represents a new class of therapy that could potentially reduce the reliance on repeated steroid injections or eventual joint replacement surgery. It is being developed for osteoarthritis in various weight-bearing joints, including the knee and hip.Furthermore, gene therapy advances the field of personalized medicine, paving the way for tailored treatments based on a patient's unique genetic and molecular profile. Overall, it stands as a promising and transformative alternative to conventional pharmacological and surgical interventions.

The global market for Osteoarthritis Gene Therapy is expanding due to the increasing prevalence of osteoarthritis, which is another key factor driving the osteoarthritis gene therapy market. The rising prevalence of osteoarthritis assist market growth by creating demand for effective, long-term, minimally invasive treatments, motivating development and utilization of the superior effectiveness of gene therapies targeting the mechanisms of disease onset and progression.

Arthritis constitutes a major public health problem. The CDC estimates that 1 in 5 (or 53.2 million) US adults report some form of arthritis. Despite a high prevalence, the development of osteoarthritis gene therapy has obstacles to growth, including high development costs, complicated delivery routes, reimbursement and access issues. Throughout the duration of the forecast period, opportunities for the osteoarthritis gene therapy market will occur as the high incidence in the ageing population and obese populations increases, as well as advancements in targeted gene delivery, and an increase in funding will spur research development, clinical trials, and commercialisation.

Some of the Key Players in the Osteoarthritis Gene Therapy Market:

The osteoarthritis gene therapy market is segmented by therapeutic approach, type of therapy, administration route, and target molecule. By therapeutic approach, the market is segmented into gene editing, gene delivery, gene regulation, gene silencing, and gene replacement. By type of therapy, the market is segmented into autologous therapy and allogeneic therapy. By administration route, the market is segmented into intra-articular injection, systemic administration, and local administration. By target molecule, the market is segmented into cytokines, growth factors, proteins, enzymes, and micrornas.

The gene editing segment category led the osteoarthritis gene therapy market in 2024. This dominance is fueled by the ability to make targeted gene alterations to more accurately treat the underlying disease process, delivering long-term targeting therapeutic benefits. Gene editing can use tools like CRISPR-Cas9 and TALENs to modify molecular pathways involved in cartilage degeneration and the inflammatory process, relieving pain while decreasing dependency on ongoing symptomatic treatments and providing longer tangible benefits with delayed dementia modifying effects.

Notably, there is apparent commitment to continued research initiatives for osteoarthritis including the gene-editing method, enhanced development of and increase in novel delivery technologies, an influx of clinical studies examining gene-editing in patients with knee osteoarthritis, and its efficient, more animal and human specific, ability to progressively treat osteoarthritis in a way that fits with modern principles/initiatives of precision medicine allows gene editing to be the preferred global therapeutic approach.

The largest and fastest-growing type of therapy is autologous therapy, as it utilizes a patient’s own cells. This eliminates immune rejection and enhances safety; hence, it can provide individualised, targeted treatment for the repair of cartilage, the reduction of inflammation, and the regeneration of joints.

The increasing clinical success and positive patient responses enhance the rate of adoption by both clinicians and patients alike. Moreover, autologous therapies are in line with regulatory agency preferences for safer, more personalized treatment options and increasingly supported by investment in health care and clinical studies. The ease of use with minimally invasive therapies and the promise of long-term effectiveness also reinforce its preeminence over allogeneic and other types of therapies.

North america dominated the osteoarthritis gene therapy market in 2024. The united states is at the forefront of this expansion. This is due to a well-established healthcare system, an early and strong acceptance of advanced biotechnologies, and an increase in investment related to regenerative medicine and clinical research.

In addition, the established presence of important pharmaceutical and biotechnology companies, relatively supportive regulatory environments, and high patient awareness and acceptance of innovative therapeutic options are other contributors to market leadership. Disease prevalence in the ageing population will also contribute to heightened demand for minimally invasive, disease-modifying therapies in the region.

With increasing investment in healthcare, growing Biotechnology and regenerative medicine industries, and the continued rise of osteoarthritis in the asia-pacific area, the osteoarthritis gene therapy market is expanding at the strongest and fastest rate in this region. There is an increasing demand for innovative and cost-efficient therapies in countries. The rapid growth of the market in the region can also be attributed to the support of government initiatives to facilitate innovation, expand clinical trial infrastructures, and enhance patient awareness of gene therapy solutions.

Osteoarthritis Gene Therapy Market by Therapeutic Approach-

· Gene Editing

· Gene Delivery

· Gene Regulation

· Gene Silencing

· Gene Replacement

Osteoarthritis Gene Therapy Market by Type of Therapy-

· Autologous Therapy

· Allogeneic Therapy

Osteoarthritis Gene Therapy Market by Administration Route-

· Intra-Articular Injection

· Systemic Administration

· Local Administration

Osteoarthritis Gene Therapy Market by Target Molecule-

· Cytokines

· Growth Factors

· Proteins

· Enzymes

Osteoarthritis Gene Therapy Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.