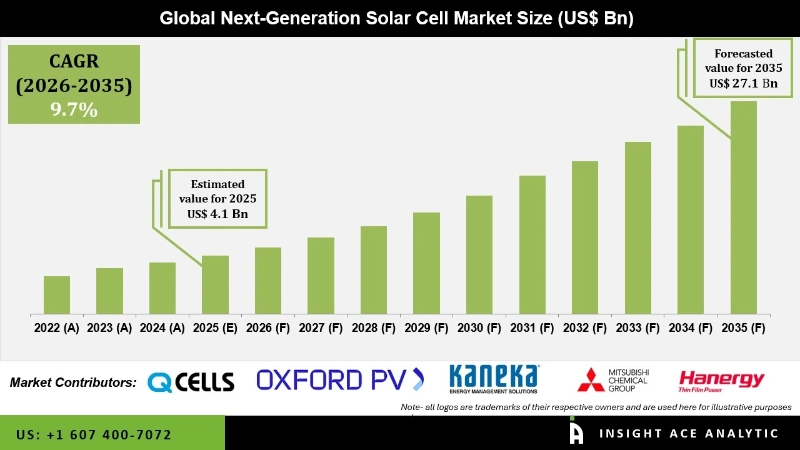

Next-Generation Solar Cell Market Size is valued at USD 4.1 Bn in 2025 and is predicted to reach USD 27.1 Bn by the year 2035 at a 21.0% CAGR during the forecast period for 2026 to 2035.

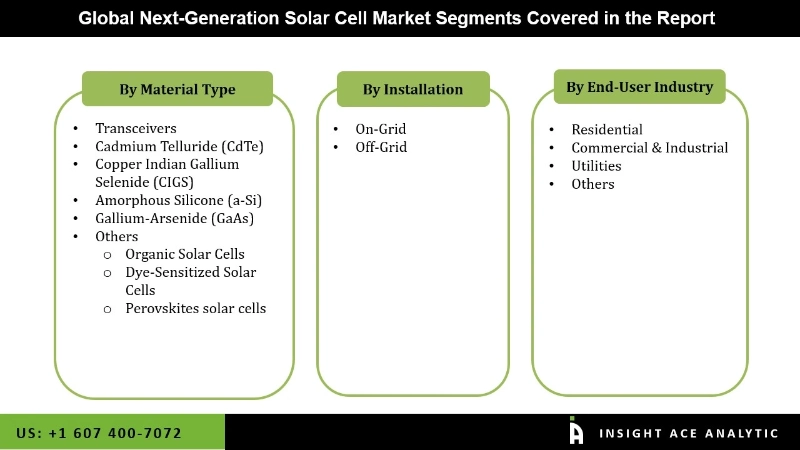

Next-Generation Solar Cell Market Size, Share & Trends Analysis Report By Material Type (Transceivers, Cadmium Telluride (CdTe), Copper Indian Gallium Selenide (CIGS), Amorphous Silicone (a-Si), Gallium-Arsenide (GaAs), Others), By Installation, By End-User Industry), By Region, And By Segment Forecasts, 2026-2035.

Next-generation solar cells are advanced technologies that improve classic silicon-based solar cells' efficiency, cost-effectiveness, and adaptability. These technologies provide novel techniques for capturing and converting sunlight into electricity, frequently overcoming the limitations of traditional solar cells. Improving manufacturing techniques and utilizing novel materials can potentially lower the manufacturing costs of next-generation solar cells. This lowers the cost of solar energy and makes it more competitive with other energy generation sources.

Rapid advances in materials science, nanotechnology, and manufacturing techniques drive the development of next-generation solar cell technologies. Efficiency, stability, and scalability innovations are critical for achieving a competitive advantage in the market. Materials science, nanotechnology, and manufacturing process advancements have enabled the creation of novel solar cell technologies with increased efficiency and stability.

However, manufacturing firms encountered difficulties in keeping operations running while complying with safety procedures. Reduced workforce, slower output, and changes in work arrangements may have hampered the production of next-generation solar cells.

The Next-Generation Solar Cell Market is segmented on the basis of material type, installation and end-use industry. Based on material type, the market is segmented as transceivers, Cadmium Telluride (CdTe), Copper Indian Gallium Selenide (CIGS), Amorphous Silicone (a-Si), Gallium-Arsenide (GaAs), and others. The others are segmented into organic solar cells, dye-sensitized solar cells, and perovskite solar cells. By installation, the market is segmented into on-grid and off-grid. The end-users segment consists of residential, commercial & industrial, utilities, and others.

The perovskites solar cells category is expected to hold a major share of the global Next-Generation Solar Cell Market in 2022. Other material includes perovskite solar cells, organic solar cell, and dye-sensitized solar cells. Perovskite-structured materials utilized in solar cells are typically hybrid organic-inorganic lead or tin-halide compounds, such as methylammonium lead halide. Because these materials are solution-processed, their production is straightforward and economical. Hybrid metal halide perovskite solar cells (PSCs) have received a lot of attention due to their inexpensive cost, smaller design, low-temperature production, and outstanding light absorption qualities (high performance in low and diffuse light).

The commercial & industrial segment is projected to grow at a rapid rate in the global Next-Generation Solar Cell Market. Technological improvements, market trends, and environmental considerations contribute to the growing adoption of next-generation solar cells in the commercial and industrial sectors. Next-generation solar cells now have better efficiency, stability, and cost. Business processes are increasingly likely to include these technologies as they develop and become more dependable.

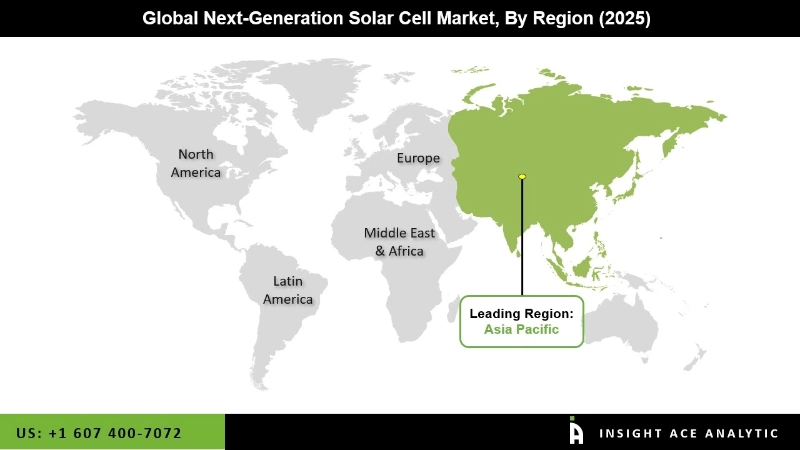

Asia Pacific's Next-Generation Solar Cell Market is anticipated to register the maximum market share in terms of revenue in the near future. The regional market is expanding as a result of the rising use of PV modules in countries like China, Japan, and India. Next-generation solar cells are more efficient than silicon-based cells and work well in both natural and artificial light. A next-generation solar cell is less than one micron thick and can be produced at low temperatures utilizing inexpensive methods like printing. Additionally, North America is anticipated to experience rapid growth during the projection period. The potential for next-generation solar cells to improve energy efficiency and advance sustainability goals has boosted attention in the region.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 4.1 Bn |

| Revenue forecast in 2035 | USD 27.1 Bn |

| Growth rate CAGR | CAGR of 21.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Material Type, Installation, End-User Industry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Hanwha Q CELLS (South Korea), Oxford PV (UK), Kaneka Solar Energy (Japan), Flisom (Switzerland), Mitsubishi Chemical Group (Japan), and Hanergy thin film power group (China), Heliatek (Germany), 3D-Micromac(Germany), Suntech Power Holdings (China), Sharp Corporation(Japan), Trina Solar (China), Panasonic Corporation(Japan), Sol Voltaics(Sweden), Geo Green Power(England), Jinko Solar (China), Canadian Solar(Canada), Yingli Solar(China), REC Group(Norway), First Solar (US), Ascent Solar Technologies (US), Solactron (US), MiaSole (US), Polysolar Technology (US), NanoPV technologies(US), Sunpower Corporation(US) |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Next-Generation Solar Cell Market By Material Type-

Next-Generation Solar Cell Market By Installation-

Next-Generation Solar Cell Market By End-User Industry-

Next-Generation Solar Cell Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.