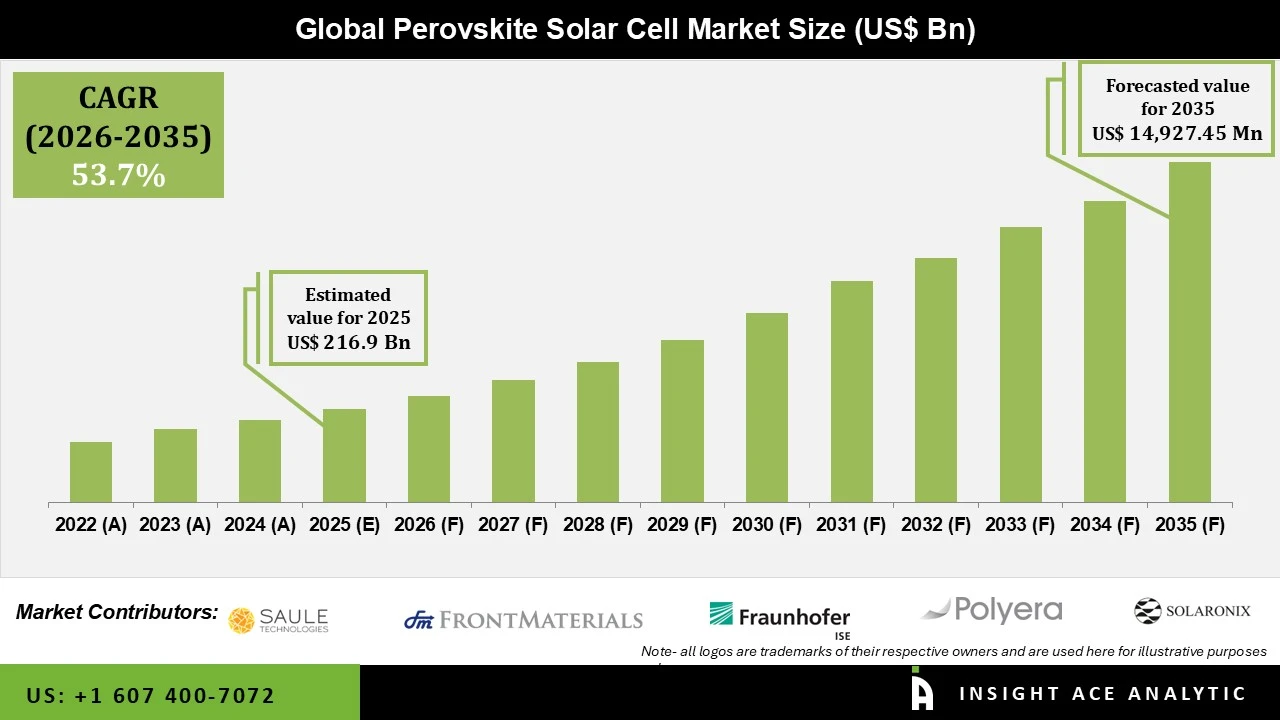

Perovskite Solar Cell Market Size is valued at USD 216.9 Mn in 2025 and is predicted to reach USD 14927.45 Mn by the year 2035 at an 53.57% CAGR during the forecast period for 2026 to 2035.

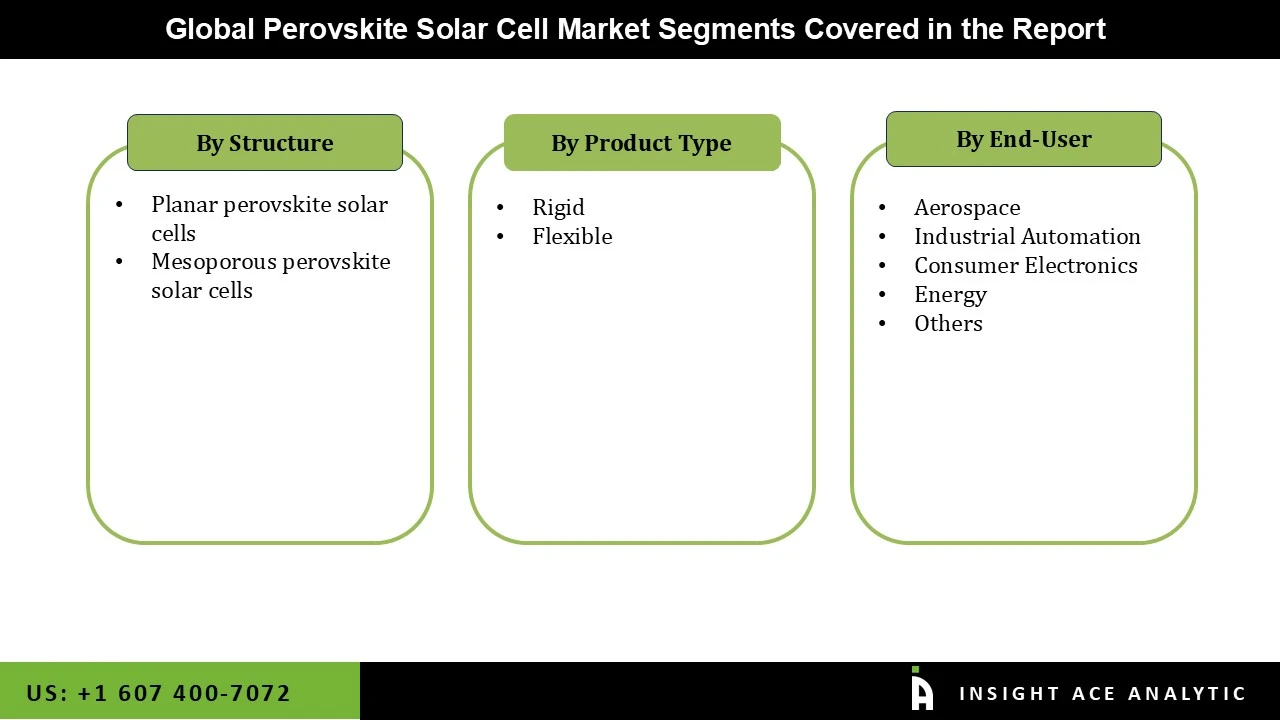

Perovskite Solar Cell Market Share & Trends Analysis Report, By Structure (Planar Perovskite Solar Cells and Mesoporous Perovskite Solar Cells), By Product Type (Rigid and Flexible), By End User, By Region, and Segment Forecasts, 2026 to 2035

Perovskites, a class of materials with a distinctive crystalline structure, exhibit a remarkable array of properties, including magnetoresistance and superconductivity, which make them valuable across multiple advanced technology applications. These easily produced materials are widely considered the future of solar cells due to their unique structure, which supports the development of affordable, efficient photovoltaics. Perovskites are also anticipated to play roles in next-generation electric vehicle applications such as sensors, lasers, and batteries. Falling under the category of third-generation photovoltaics (PVs), perovskite PVs join quantum dot (QD) PVs, organic photovoltaics (OPVs), and dye-sensitized solar cells (DSSCs), all of which are based on novel materials and have the potential to break through existing limits of performance and efficiency.

Perovskite solar cells are designed to make solar energy more cost-effective and efficient. With the capability to respond to multiple light wavelengths, perovskite PVs can convert a broader portion of sunlight into electricity, giving them a significant advantage over conventional solar technology. This combined potential for high efficiency, low material costs, and reduced processing expenses further strengthens their appeal as a transformative solution in renewable energy.

Government policies and incentives, such as feed-in tariffs and tax credits, play a significant role in accelerating the adoption of perovskite solar technology. The market for perovskite solar cells is rapidly expanding as the global demand for solar energy rises. These cells are highly valued for their versatility and portability, making them ideal for a wide range of applications across different industries. The pressing need for sustainable energy sources and the exceptional efficiency of perovskite materials in converting sunlight into electrical power drive this demand.

Additionally, priorities like energy stability and economic growth are supporting the market's expansion, as efficient energy use becomes crucial for reducing poverty and improving living standards in growing economies. This emphasis on energy stability has led to increased investments and advancements in solar technologies, with perovskite cells recognized as vital for enhancing energy accessibility.

A major factor driving the market is the surge in solar installations, which aligns with rising urbanization and evolving consumer preferences. As a cost-effective alternative to traditional solar panels, perovskite solar cells attract consumers seeking innovative solar solutions. Their popularity is fueled by their high-power conversion efficiency, affordability, and ease of production, making them more accessible and appealing than conventional solar options. These qualities not only enhance their appeal but also position perovskite solar cells as a strong catalyst for market growth by delivering high performance at a lower cost.

The Perovskite Solar Cell market is segmented based on structure, product type, and end user. Based on the structure, the market is divided into planar perovskite solar cells and mesoporous perovskite solar cells. Based on the product type, the market is divided into rigid and flexible. Based on the end user, the market is divided into aerospace, industrial automation, consumer electronics, energy, and others.

Based on the structure, the market is divided into planar perovskite solar cells and mesoporous perovskite solar cells. Among these, the planar perovskite solar cells segment is expected to have the highest growth rate during the forecast period. Planar perovskite solar cells have a straightforward, layer-by-layer structure without the need for a mesoporous scaffold. This simplicity reduces the number of fabrications steps and allows for quicker, more cost-effective production. Manufacturers favor this because it facilitates scalability, which is critical for commercialization. Planar cells can achieve high power conversion efficiencies with relatively simpler architectures. Advances in materials and deposition techniques have improved the quality of perovskite films in planar configurations, enhancing efficiency and performance. The research community and industry investors have primarily focused on planar structures for large-scale applications. With more research efforts concentrated here, advances in stability, performance, and manufacturing for planar cells have progressed rapidly, further solidifying their market dominance.

Based on the end user, the market is divided into aerospace, industrial automation, consumer electronics, energy, and others. Among these, the energy segment dominates the market. Perovskite materials are less costly and require simpler manufacturing processes than traditional silicon cells. The potential for low-cost, high-volume manufacturing makes them attractive for large-scale energy applications, as they can be deployed more affordably compared to conventional solar technologies.

Many governments worldwide have introduced incentives, subsidies, and policies promoting renewable energy adoption. These initiatives encourage investment in solar technologies, and perovskite cells, with their potential for higher efficiency and lower cost, stand out as a promising solution in the energy segment. The energy sector benefits from the development of tandem solar cells, where perovskites are layered with silicon or other materials to achieve efficiencies beyond those possible with single-material cells. This application supports higher energy output, which is essential for utility-scale solar installations and helps meet rising energy demands.

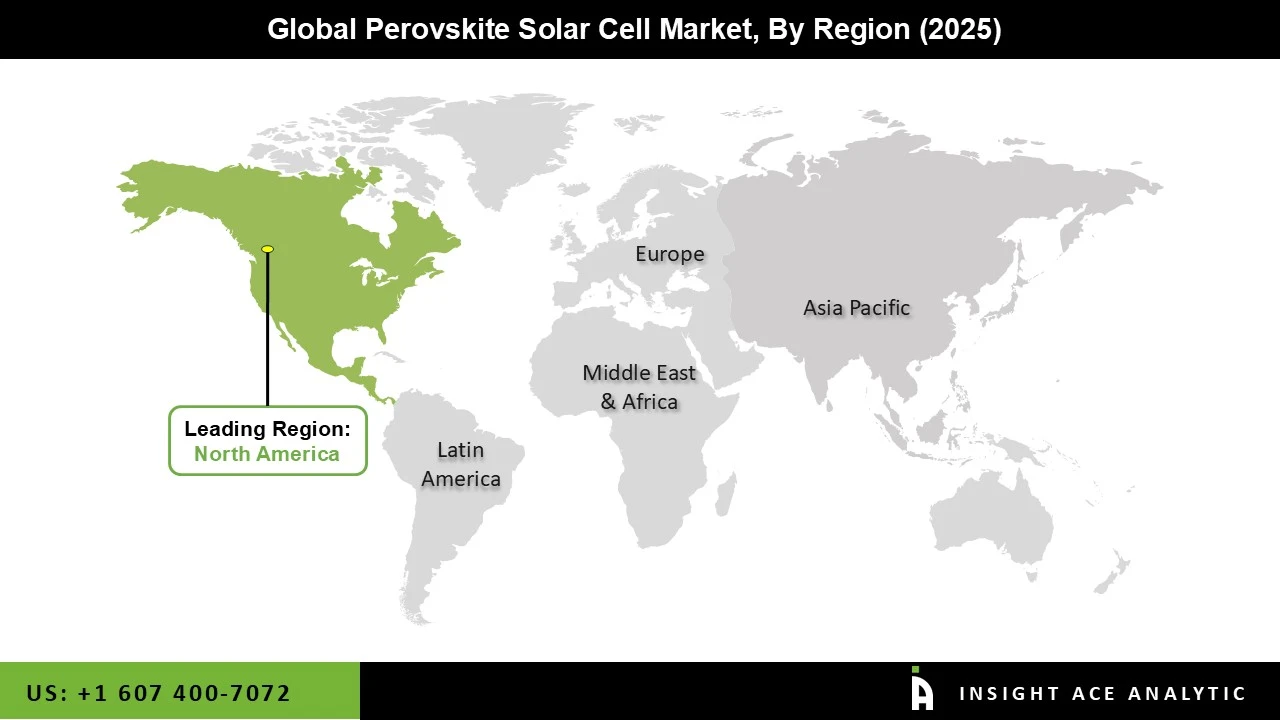

North America is home to leading research institutions, universities, and private companies focused on renewable energy and photovoltaic innovation. With dedicated funding and a robust ecosystem for technological advancement, the region has become a hub for perovskite solar research, helping accelerate commercialization. The U.S. and Canadian governments have introduced a range of policies and incentives to encourage renewable energy adoption, including solar energy. Subsidies, tax credits, grants, and research funding have fueled the development and deployment of solar technologies like perovskite cells, making North America a leading market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 216.9 Mn |

| Revenue Forecast In 2035 | USD 14927.45 Mn |

| Growth Rate CAGR | CAGR of 53.70% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Structure, Product Type, and End User. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Saule Technologies, FrontMaterials Co. Ltd., Xiamen Weihua Solar Co. Ltd., Fraunhofer ISE, Polyera Corporation, Solaronix SA, Dyesol, FlexLink Systems Inc., New Energy Technologies Inc, Oxford Photovoltaics, Hanwha Q CELLS, CubicPV, EneCoat Technologies, Microquanta Semiconductor, Greatcell Energy, P3C, Perovskia Solar AG, Panasonic Corporation, ALFA CHEMISTRY MATERIALS, SOLRA PV, Dyenamo AB, FrontMaterials Co. Ltd., G24 Power Ltd., SWIFT SOLAR, Energy Materials Corp, TOSHIBA CORPORATION, EVOLAR |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Perovskite Solar Cell Market- By Structure

Global Perovskite Solar Cell Market – By Product Type

Global Perovskite Solar Cell Market – By End User

Global Perovskite Solar Cell Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.