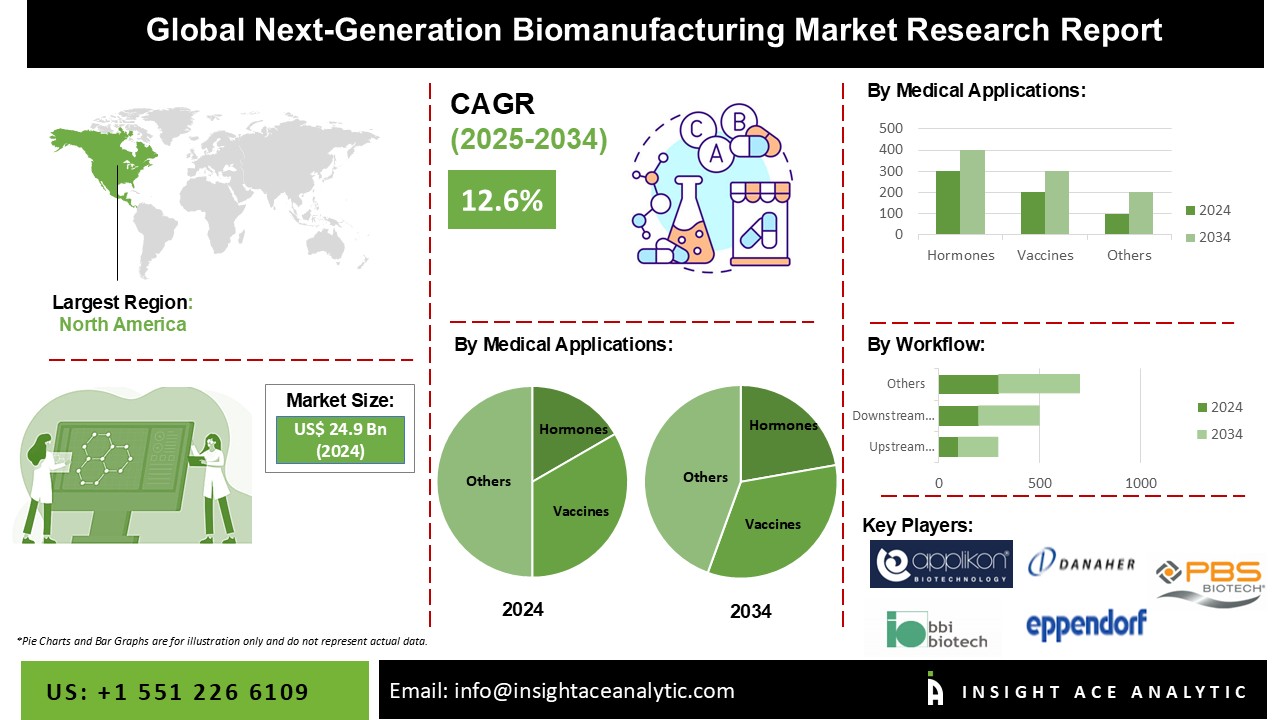

Next-Generation Biomanufacturing Market Size is valued at 24.9 Billion in 2024 and is predicted to reach 80.0 Billion by the year 2034 at a 12.6% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Biomanufacturing is the production process of biomolecules by utilizing biological services to use in medical & industrial applications. Next-generation biomanufacturing products provide superior services in terms of quality and efficiency compared to first-generation biomanufacturing products.

Major driving factors of the next-generation biomanufacturing market are rising government funding for the development of modern bioprocessing technologies, rapid adoption of advanced technologies, increasing investments by pharma companies to develop & adopt next-generation biomanufacturing products, growing patient population, and increasing awareness among the people regarding the benefits of next-generation biomanufacturing. With the growing demand for drugs and therapies, many biopharmaceutical companies prefer adopting next-generation biomanufacturing services to balance the process design, performance, & efficiency with time and cost. This development is estimated to propel the market growth opportunities over the forecast years. However, complex manufacturing and development procedures and a lack of specialized expertise may hinder the market growth during the estimated timeframe.

The next-generation biomanufacturing market is segmented into medical applications, products, workflow, end-users, and regions. The medical applications segment comprises monoclonal antibodies, hormones, vaccines, recombinant proteins, and other applications. Due to their increasing medical applications, the monoclonal antibodies segment will dominate this market during the forecast years. Based on the products, the market is divided into continuous upstream biomanufacturing products, single-use upstream biomanufacturing products, and downstream biomanufacturing products. The market is classified into upstream and downstream biomanufacturing based on workflow. By end-users, the market is segmented into biopharmaceutical companies, CMOs (contract manufacturing organizations)/CDMOs (contract development and manufacturing organization), and research institutions. Biopharmaceutical companies are estimated to hold a significant market share in the coming years owing to the growing prevalence of chronic diseases and the high demand for protein/drug production. Region-wise, the market is studied across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

North America led the market due to the robust presence of large biopharmaceutical businesses, the improved infrastructure in biological research, and the rising usage of innovative technologies. The Asia-Pacific market is expected to witness the fastest growth during the forecast period due to the rapid adoption of advanced technologies, rising patient pool, and the high prevalence of chronic diseases. Apart from this, Europe holds the second position in this market regarding revenue share.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 24.9 Billion |

| Revenue forecast in 2034 | USD 80.0 Billion |

| Growth rate CAGR | CAGR of 12.6% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Medical Applications, Products, Workflow, End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia |

| Competitive Landscape | Applikon Biotechnology BV (Netherlands), bbi-biotech GmbH (Germany), Danaher Corporation (US), Eppendorf AG (Germany), Esco Group of Companies (US), GEA Group Aktiengesellschaft (Germany), Meissner Filtration Products, Inc. (US), Merck KGaA (Germany), PBS Biotech, Inc. (US), Pierre Guérin (France), Sartorius AG (Germany), Shanghai Bailun Biotechnology Co. Ltd. (China), Solaris Biotechnology Srl. (Italy), Thermo Fisher Scientific Inc. (US), ZETA GmbH (Austria), and other. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Next-Generation Biomanufacturing Market, by Medical Applications,

Global Next-Generation Biomanufacturing Market, by Products,

Global Next-Generation Biomanufacturing Market, by Workflow,

Global Next-Generation Biomanufacturing Market, by End-Users,

Global Next-Generation Biomanufacturing Market, by Region,

North America Next-Generation Biomanufacturing Market, by Country,

Europe Next-Generation Biomanufacturing Market, by Country,

Asia Pacific Next-Generation Biomanufacturing Market, by Country,

Latin America Next-Generation Biomanufacturing Market, by Country,

Middle East & Africa Next-Generation Biomanufacturing Market, by Country,

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.