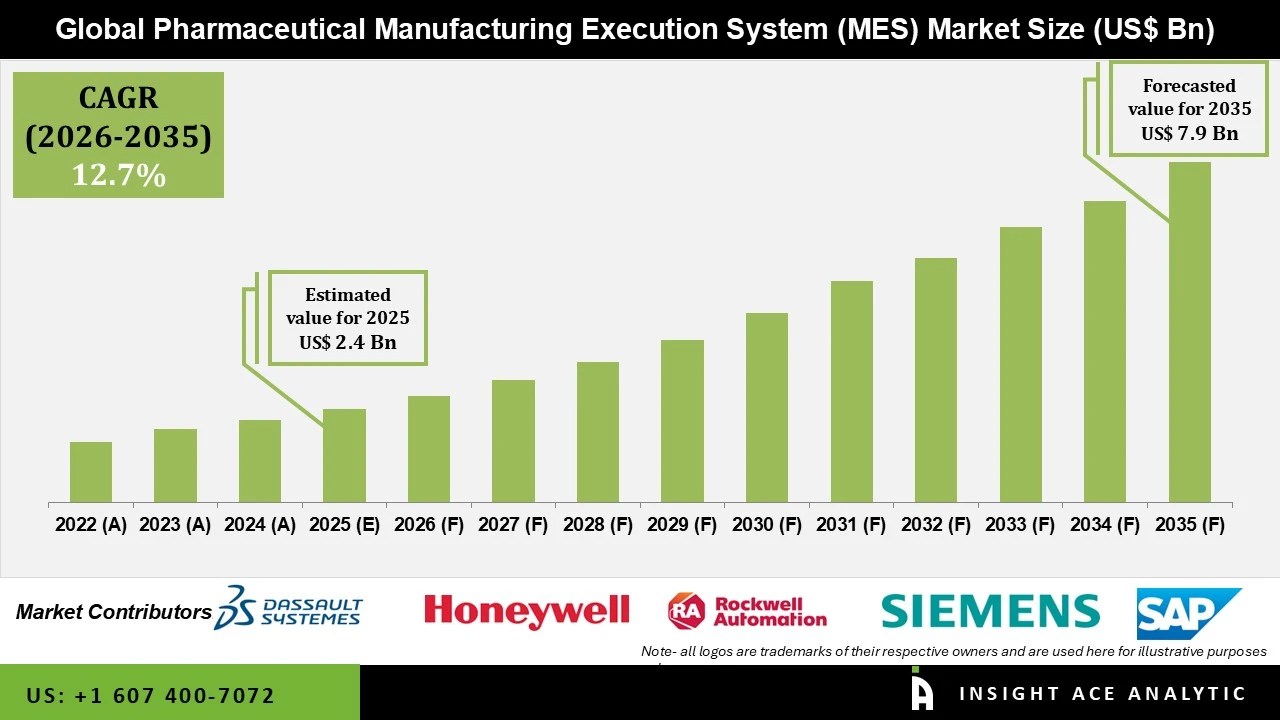

Pharmaceutical Manufacturing Execution System Market Size is valued at USD 2.4 Bn in 2025 and is predicted to reach USD 7.9 Bn by the year 2035 at a 12.7% CAGR during the forecast period for 2026 to 2035.

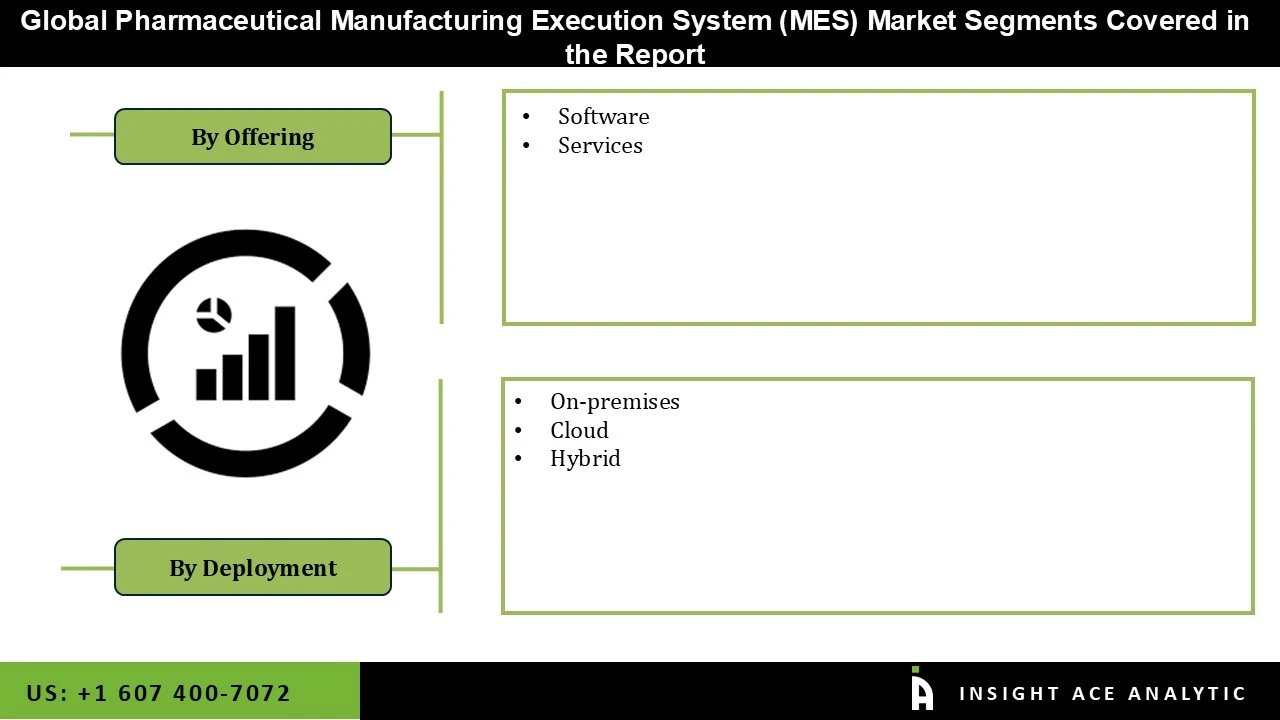

Pharmaceutical Manufacturing Execution System Market Size, Share & Trends Analysis Distribution by Offering (Software and Services), Deployment Mode (Cloud, On-premises, and Hybrid), Application (Quality Management, Production Management, Maintenance Management, Material and Inventory Management, Performance Analysis), and Segment Forecasts, 2026 to 2035

Pharmaceutical producers utilize a sophisticated software program called a pharmaceutical manufacturing execution system (MES) to strictly adhere to regulations while monitoring, controlling, documenting, and optimizing the production process in real time. It serves as a link between shop-floor equipment and enterprise-level systems like ERP, allowing for end-to-end visibility throughout manufacturing processes. Critical operations like electronic batch records (EBR), material tracking, equipment status monitoring, recipe management, quality inspections, and deviation management are supported by pharmaceutical MES. The need for real-time data management, regulatory compliance, and the growing demand for operational efficiency are some of the major drivers propelling the pharmaceutical manufacturing execution system market's growth.

The increasing pressure on pharmaceutical companies to optimize their manufacturing processes while maintaining compliance with strict standards is one of the primary developments in the pharmaceutical manufacturing execution system market growth. The adoption of a pharmaceutical manufacturing execution system has become essential with the emergence of more complicated medicinal items and personalized medicine, which call for precise and traceable production techniques.

Additionally, technological developments have a significant impact on the pharmaceutical manufacturing execution system market. The industry 4.0 technologies, such as increased automation, artificial intelligence (AI), and the Internet of Things (IoT), are encouraging innovation in the manufacturing industry. Through improved decision-making and process optimization, these technologies help businesses stay competitive in a market that is becoming more and more international.

In addition, the pharmaceutical companies are being forced to use MES due to strict international laws, the requirement for electronic batch records, and the growing emphasis on data integrity. Thus, the pharmaceutical manufacturing execution system implementation is strengthened throughout pharmaceutical facilities worldwide by the rapid rise of biologics, vaccines, and high-complexity pharmaceuticals, which further propels the digitalization, real-time monitoring, and automated quality control.

Additionally, real-time data analytics is one of the investment sectors that is receiving more attention as businesses seek to use data from several sources to provide insights into quality metrics and production performance. There are growth opportunities for the pharmaceutical manufacturing execution system market designed to satisfy the continuous need for improved traceability and transparency in manufacturing processes.

The ever-tightening regulatory environment that oversees the pharmaceutical business is the main driver of growth for the pharmaceutical manufacturing execution system market. To guarantee traceability, batch record management, and adherence to Good Manufacturing Practices (GMP), regulatory organizations like the FDA, EMA, and WHO have set strict criteria for drug manufacturing that need businesses to implement cutting-edge MES systems. These tools assist pharmaceutical companies in reducing human error, automating documentation, and quickly responding to audits. Additionally, traditional paper-based approaches have become outdated due to the growing complexity of drug formulations, customized medicine, and biologics production. As a result, digital MES platforms that can manage complex workflows and provide end-to-end quality assurance are required.

For many pharmaceutical companies, the high costs of system integration and execution serve as major obstacles to the growth of the pharmaceutical manufacturing execution system market. Smaller businesses may be discouraged from implementing MES technology due to the upfront cost as well as continuing maintenance and training expenses. Larger companies may become dominant in the market as a result, which would hinder competition and the expansion of the market as a whole. Additionally, the significant obstacles in the pharmaceutical manufacturing execution system market growth are also presented by the implementation of stringent regulations. One of the industries with the highest levels of regulation is the pharmaceutical sector, and meeting compliance standards can be difficult and time-consuming.

The software category held the largest share in the Pharmaceutical Manufacturing Execution System market in 2025 because there is a growing demand for interoperable, scalable, and adaptable solutions that can easily interface with current business systems. To meet the changing demands of pharmaceutical makers, vendors are concentrating on improving user interfaces, integrating advanced analytics, and facilitating cloud-based deployments. Additionally, the strong electronic batch record (EBR) and electronic device history record (eDHR) features in MES software are becoming more and more necessary as regulatory requirements get stricter.

In 2025, the Production Management category dominated the Pharmaceutical Manufacturing Execution System market. A fundamental feature of MES is production tracking, which provides real-time visibility into batch status, equipment use, and manufacturing processes. This feature is crucial for maximizing resource allocation, reducing downtime, and guaranteeing adherence to production schedules. MES is used by pharmaceutical producers to support programs for continuous process improvement, create electronic batch records, and collect comprehensive production data. In order to comply with regulations and enable product recalls when needed, it is also essential to be able to monitor and trace products throughout the manufacturing lifecycle.

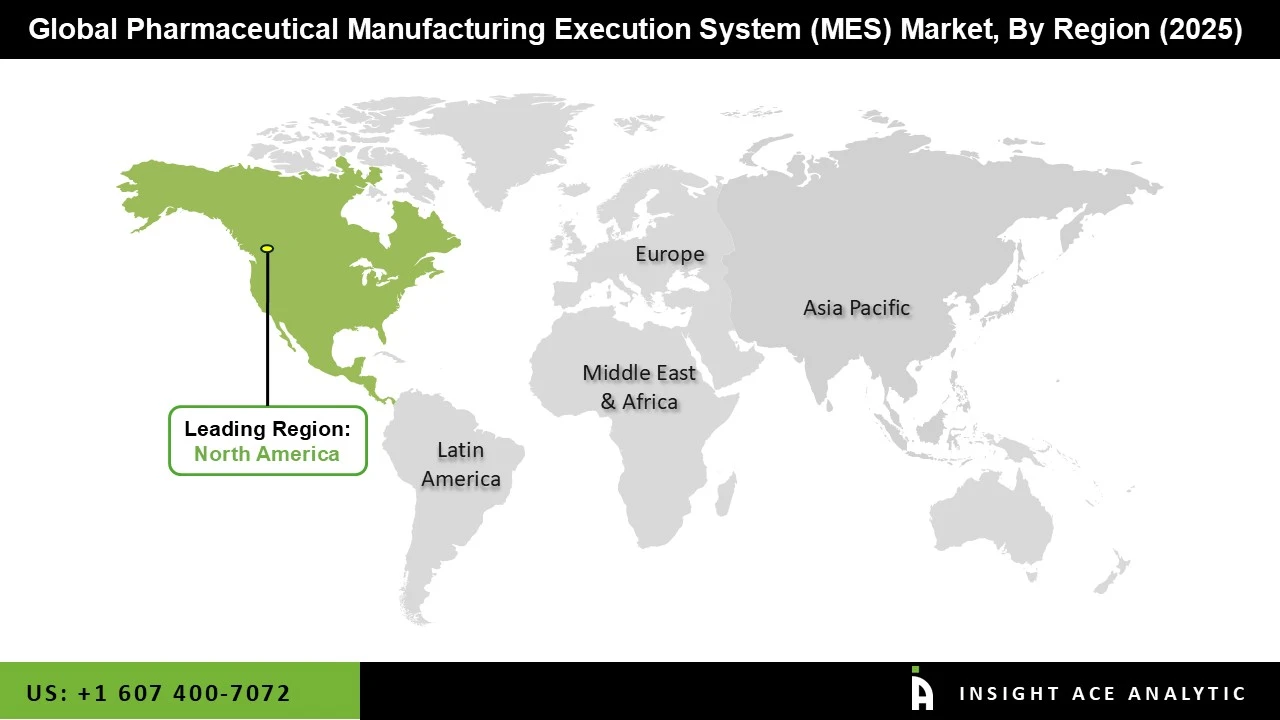

The Pharmaceutical Manufacturing Execution System market was dominated by North America region in 2025 because of its robust presence of top MES vendors, a highly developed and regulated pharmaceutical manufacturing ecosystem, and stringent FDA regulations requiring data integrity, electronic batch records, and GMP compliance.

The region's quick adoption of digital quality systems, automation, and Industry 4.0 speeds up MES integration even more. Strong MES adoption is also fueled by significant R&D spending, the expansion of biologics and customized treatments, and the requirement for effective, legal production in both US and Canadian facilities. Additionally, the region's substantial adoption of MES platforms across major and mid-sized pharmaceutical businesses has been fueled by the region's strong regulatory environment and high investment in life sciences digitalization.

January 2024: MES (manufacturing execution systems) software was introduced by Siemens. This software gives manufacturers previously unheard-of flexibility due to Mendix's low-code technology. Manufacturing in a variety of industries is redefined by this creative solution.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 2.4 Bn |

| Revenue forecast in 2035 | USD 7.9 Bn |

| Growth Rate CAGR | CAGR of 12.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Offering, Deployment Mode, Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Yokogawa Electric Corporation, Siemens, Dassault Systèmes, Emerson Electric Co, Honeywell International Inc, ABB, SAP SE, Aptean, Critical Manufacturing SA, Cerexio, Rockwell Automation, Schneider Electric, Körber AG, Miracom, INC, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.