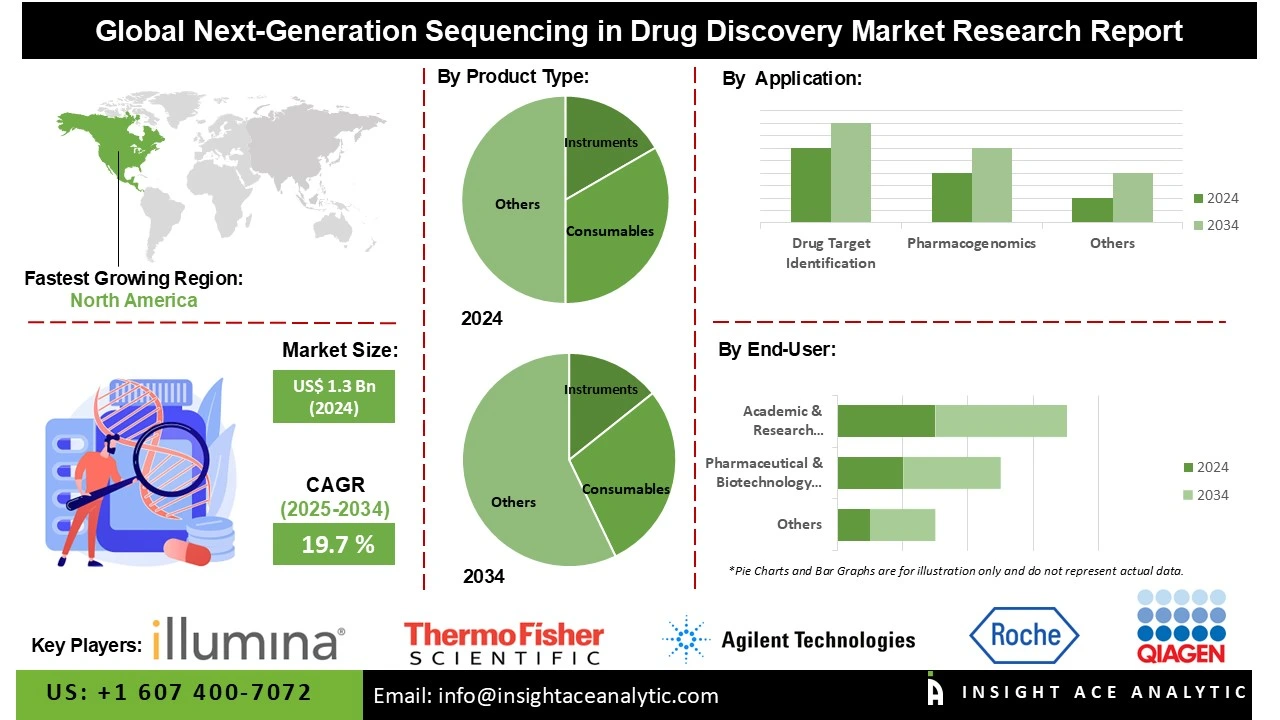

Next-Generation Sequencing in Drug Discovery Market Size is valued at US$ 1.3 Bn in 2024 and is predicted to reach US$ 7.5 Bn by the year 2034 at an 19.7% CAGR during the forecast period for 2025 to 2034.

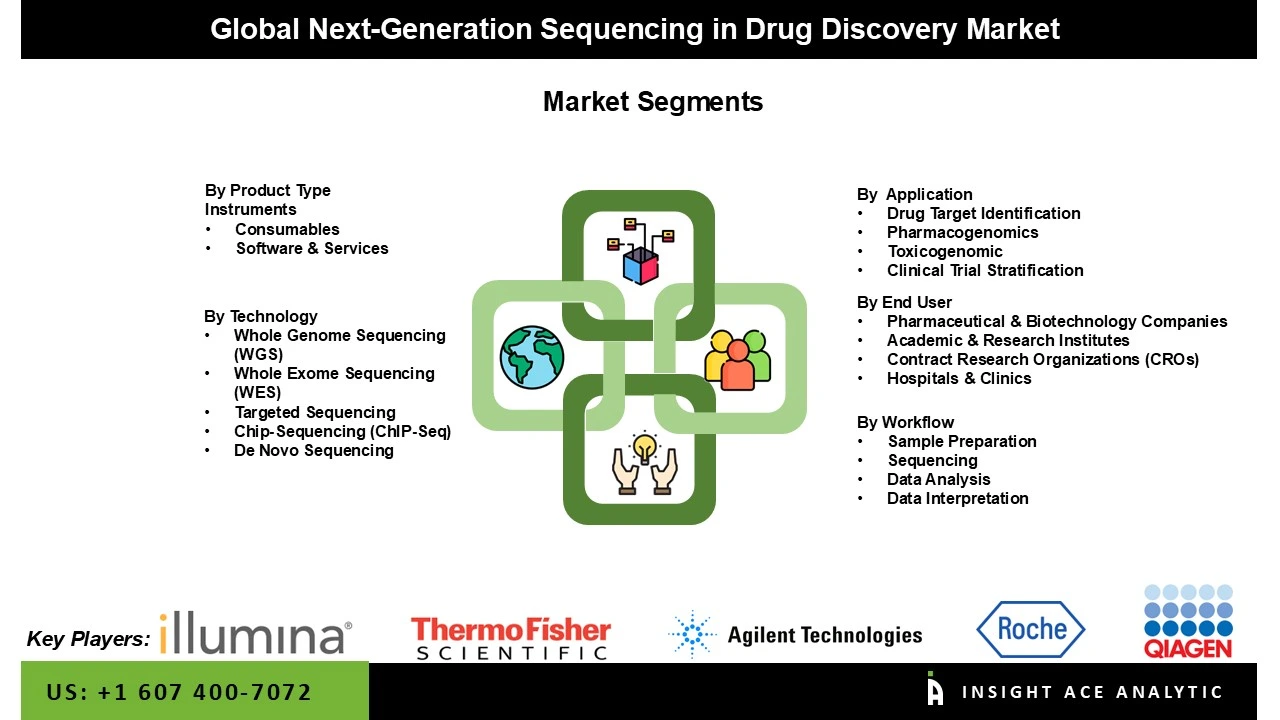

Next-Generation Sequencing in Drug Discovery Market Size, Share & Trends Analysis Distribution by Product Type (Instruments, Consumables, and Software & Services) By Technology (Whole Genome Sequencing (WGS), Whole Exome Sequencing (WES), Targeted Sequencing, Chip-Sequencing (ChIP-Seq), and De Novo Sequencing) By Application, By End-User, By Workflow, and Segment Forecasts, 2025 to 2034

Next-generation sequencing (NGS) in drug discovery refers to the application of high-throughput DNA and RNA sequencing technologies to identify genetic variations, elucidate disease mechanisms, and discover novel therapeutic targets. It facilitates biomarker identification, companion diagnostic development, and personalized medicine approaches, thereby accelerating and enhancing the efficiency, precision, and success rate of the drug development process.

The increasing incidence of diseases such as cancer, neurological disorders, and autoimmune diseases is a primary motivator for next-generation sequencing in drug discovery adoption. NGS facilitates high-throughput genomic analysis, allowing researchers to identify disease-causing mutations, molecular targets, and biomarkers more quickly and precisely. This is advancing the design of targeted therapy and personalized medicine strategies. As complex diseases increasingly require more accurate diagnosis and treatment strategies, the incorporation of NGS into drug discovery pipelines is rapidly becoming crucial for novel therapeutic strategies.

The adoption of next-generation sequencing in drug discovery is being significantly driven by increasing R&D investment by pharmaceutical companies. NGS allows for rapid and affordable genomic profiling, making it possible for researchers to determine genetic mutations, biomarkers, and therapeutic targets with unprecedented specificity.

As pharmaceutical firms are spending more budget on research and personalized medicine, NGS is being incorporated into early-stage drug development for target identification and validation. Its capacity for high-speed production of enormous quantities of data improves predictive models and shortens drug development timelines. Increasing dependence on NGS technologies is fueling innovation, enhancing the efficacy and safety of drugs, and enabling the development of precision therapeutics.

Some of the Key Players in the Next-Generation Sequencing in Drug Discovery Market:

The Next-generation sequencing in drug discovery market is segmented by by product type, technology, application, end-user, and workflow. By product type, the market is segmented into instruments, consumables, and software & services. By technology, the market is segmented into whole genome sequencing (WGS), whole exome sequencing (WES), targeted sequencing, chip-sequencing (ChIP-Seq), de novo sequencing.

By application, it includes drug target identification, pharmacogenomics, toxicogenomics, and clinical trial stratification. By end-user, the market comprises pharmaceutical and biotechnology companies, academic and research institutes, contract research organizations (CROs), and hospitals and clinics. Based on workflow, it is segmented into sample preparation, sequencing, data analysis, and data interpretation.

In 2024, the rising demand for its ability to deliver high-throughput, precise genomic data, accelerating target identification, biomarker discovery, and personalized medicine development, caused the instruments sector to hold the major market share. NGS allows researchers to study genetic differences and mechanisms of disease in a timely manner, increasing drug effectiveness and shortening time to development. Its use in oncology, rare diseases, and infectious disease research drives pharma innovation, and NGS becomes a necessity in contemporary drug development pipelines.

The next-generation sequencing in drug discovery market is dominated by whole genome sequencing (WGS) due to the increasing demand for personalized medicine & precision treatments, which drives NGS adoption for drug discovery. Sequencing technology advancements have cut costs and time drastically, allowing full genomic understanding. The increasing incidence of genetic diseases and cancer drives the demand for targeted drugs. Bioinformatics and AI integration further improve data analysis, allowing quicker identification of therapeutic targets.

North America leads the next-generation sequencing industry in drug discovery owing to its capacity for high-throughput genomic analysis, identification of novel therapeutic targets, and acceleration of biomarker development. In North America, the increasing investment in precision medicine, robust biotechnology infrastructure, and supportive regulatory environments is propelling adoption. Pharmaceutical firms increasingly use NGS to map disease mechanisms and tailor therapies, increasing R&D efficiency and compressing time-to-market. This technological progress considerably boosts the region's capability for drug development and innovation potential.

However, Europe is the second-largest region in the market for next-generation sequencing in drug discovery. This is due to high-throughput genomic analysis, which enables researchers to detect novel drug targets and biomarkers with higher accuracy. The increasing demand for personalized medicine, combined with government support and rising investment in genomics, is driving NGS adoption. Europe's robust biopharmaceutical pipeline and partnerships between research and academic institutions further fuel innovation, rendering NGS a vital instrument for boosting the efficacy of drugs, minimizing development time, and increasing patient benefits.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1.3 Bn |

| Revenue Forecast In 2034 | USD 7.5 Bn |

| Growth Rate CAGR | CAGR of 19.7% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Technology, By Application, By End-User, By Workflow |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd. (Roche), QIAGEN N.V, BGI Genomics Co., Ltd., Bio-Rad Laboratories, Inc., Oxford Nanopore Technologies plc, Pacific Biosciences of California, Inc. (PacBio), PerkinElmer, Inc., Genapsys, Inc., Eurofins Scientific, Macrogen, Inc., Takara Bio Inc., and DNAnexus, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Next-Generation Sequencing in Drug Discovery Market by Product Type-

· Instruments

· Consumables

· Software & Services

Next-Generation Sequencing in Drug Discovery Market by Technology -

· Whole Genome Sequencing (WGS)

· Whole Exome Sequencing (WES)

· Targeted Sequencing

· Chip-Sequencing (ChIP-Seq)

· De Novo Sequencing

Next-Generation Sequencing in Drug Discovery Market by Application -

· Drug Target Identification

· Pharmacogenomics

· Toxicogenomic

· Clinical Trial Stratification

Next-Generation Sequencing in Drug Discovery Market by End-User-

· Pharmaceutical & Biotechnology Companies

· Academic & Research Institutes

· Contract Research Organizations (CROs)

· Hospitals & Clinics

Next-Generation Sequencing in Drug Discovery Market by Workflow-

· Sample Preparation

· Sequencing

· Data Analysis

· Data Interpretation

Next-Generation Sequencing in Drug Discovery Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.