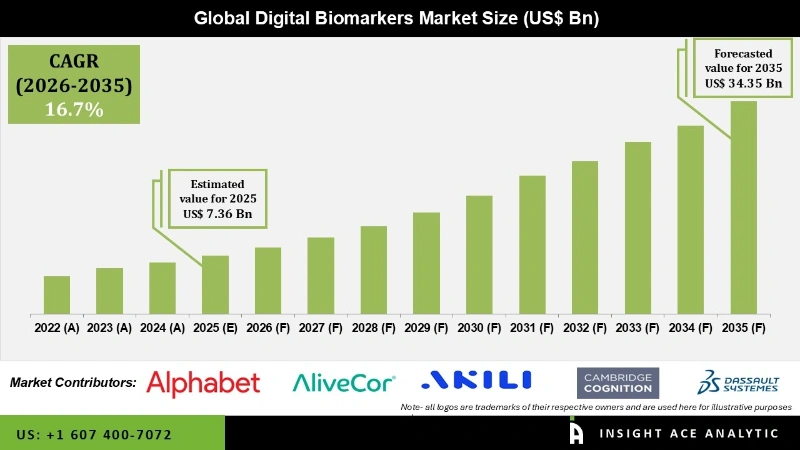

The Digital Biomarkers Market Size is valued at 7.36 Billion in 2025 and is predicted to reach 34.55 Billion by the year 2035 at a 16.7 % CAGR during the forecast period for 2026 to 2035.

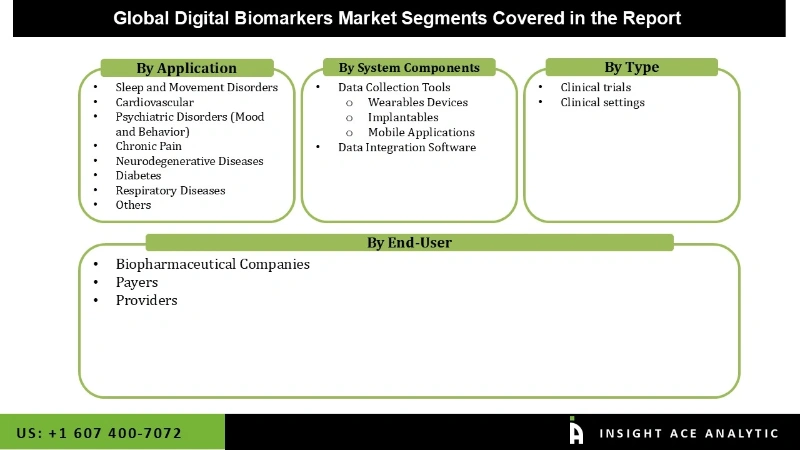

Digital Biomarkers Market Size, Share & Trends Analysis Report By Applications (Sleep and Movement Disorders, Cardiovascular, Psychiatric Disorders (Mood and Behavior), Chronic Pain, Neurodegenerative Diseases, Diabetes, Respiratory Diseases, Others), By System Components, By Type, by End-User, Region And Segment Forecasts, 2026 to 2035.

Digital Biomarkers are nothing, but the data measured through specific devices to help researchers and doctors track healthy processes, diagnose diseases and other health conditions, monitor responses to medication, and identify health risks in a person. The digital biomarker could potentially facilitate the effective use of a DHT in evaluating a therapeutic product, potentially growing patient access to safe and effective medical products. It can detect non-biological external factors (e.g., environmental features like pollen count) and provides an opportunity to identify predictors and influences on health, which will require the systematic development of scientific evidence in the future.

Passive digital biomarkers are simple digital biomarkers that are collected via unnoticed actions. Passive data from sensors integrated into wearable devices is generated when a user wears the device. Active digital biomarkers are digital biomarkers collected via prompted actions. Digital biomarker data can be generated and captured from smart devices, such as smartphones and tablets, when a user interacts with the device in response to an active prompt.

Biomarkers are popular nowadays in drug development, so it is widely used, positively affecting the market growth. Factors such as the rising employment of vocal digital biomarkers and regulatory flexibility toward digital healthcare are also responsible for the growth of the digital biomarkers market. Vast use of wearable smart devices and smartphone applications in healthcare will continually fuel the market. Failure of Drugs for Neurodegenerative Disorders accelerates the requirement of digital biomarkers.

The increasing innovations and product designs in the global market and the growing use in emerging economies are the driving factors for the market's growth. The increasing number of product launches and rising number of Food and Drug Administration (FDA) approvals are forecast to propel the market growth. In 2019, FDA granted an approval to KardiaMobile ( AliveCor). It is an AI-enabled wearable device that monitors the vital signs connected to heart arrhythmias. Earlier, Altoida Raises $6.3M Series A to Predict Alzheimer's Disease Risk Using Artificial Intelligence, Machine Learning and Augmented Reality.

Need for Standardized and Interoperable Solutions, Incorrectness in Data Measurements, Lack of Integration, Interoperability between Medical Records & User Generated Data, Lack of Use Cases of the Return on Investment (ROI) Analysis and high costing, these are the prominent factors which will restrain the progress of digital biomarkers market.

The market is segmented into Application, System Components, Type, End-User and Region. Based on Application, the market is segmented into Sleep and Movement Disorders, Cardiovascular, Psychiatric Disorders (Mood and Behavior), Chronic Pain, Neurodegenerative Diseases, Diabetes, Respiratory Diseases, and Others. On the other hand system components segment is divided into Data Collection Tools (Wearables Devices, Implantable and Mobile Applications) and Data Integration Software. The Type segment consists of Clinical Trials and Clinical Settings. The last segment is the End-User segment which is divided into Biopharmaceutical Companies, Payers and Providers.

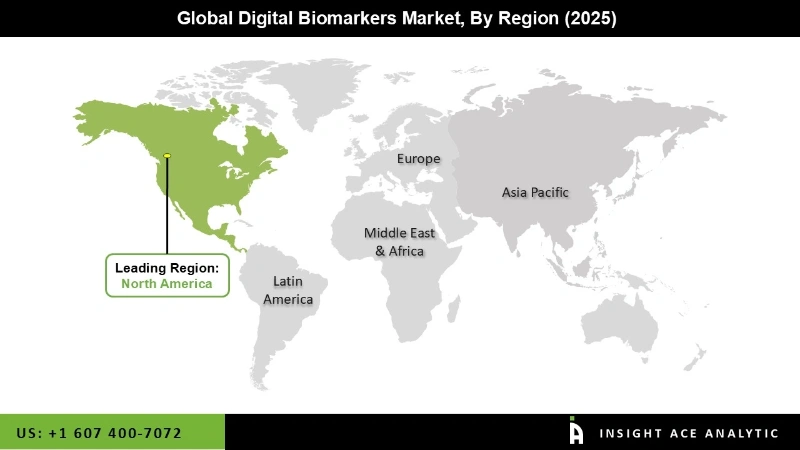

North America is forecast to hold the main share in the global digital biomarkers market. The presence of leading industry players is expected to contribute to regional development in the global digital biomarkers market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 7.36 Billion |

| Revenue Forecast In 2035 | USD 34.35 Billion |

| Growth Rate CAGR | CAGR of 16.7 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Applications, By System Components, By Type, by End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Alphabet Inc., AliveCor Inc., Akili Interactive Labs, Inc., Cambridge Cognition Ltd, Dassault Systèmes, IXICO plc, Koninklijke Philips N.V, Shimmer , Quanterix Corporation, Altoida AG, Evidation Health, Inc., Happify, Inc., Huma, Human API, Mindstrong Health, Neurotrack Technologies, Inc, Orikami, Winterlight Labs Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Digital Biomarkers Market, by Application

Global Digital Biomarkers Market, by System Components

Global Digital Biomarkers Market, by Type

Global Digital Biomarkers Market, by End-User

Global Digital Biomarkers Market, by Region

North America

Europe

Asia Pacific

Latin America

Middle East & Africa Digital

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.