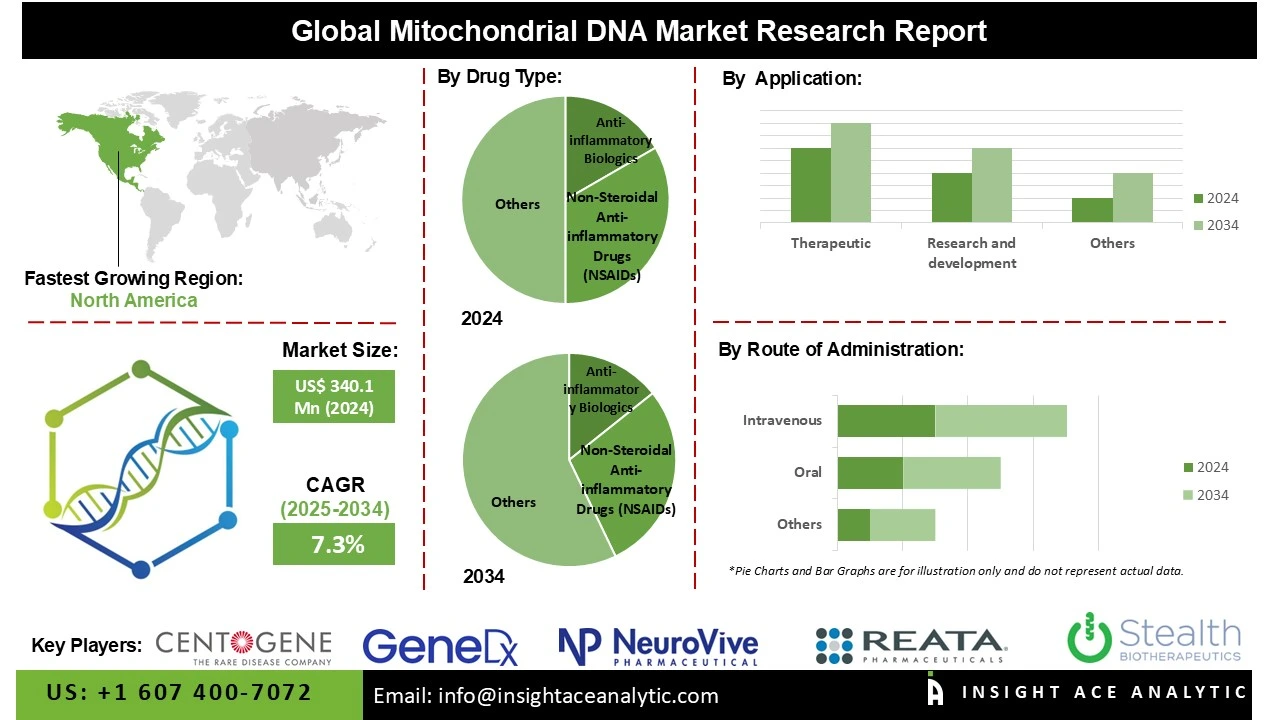

Mitochondrial DNA Market Size is valued at US$ 340.1 Mn in 2024 and is predicted to reach US$ 669.6 Mn by the year 2034 at an 7.3% CAGR during the forecast period for 2025 to 2034.

Mitochondrial DNA Market Size, Share & Trends Analysis Distribution by Drug Type (Corticosteroids, Anti-inflammatory Biologics, and Non-Steroidal Anti-inflammatory Drugs (NSAIDs)), Route of Administration (Oral and Intravenous (IV)), Application (Diagnostic, Therapeutic, Research and development), Distribution Channel (Hospital Pharmacies, Drug Stores, Online Pharmacies, and Retail Pharmacies), and Segment Forecasts, 2025 to 2034

The mitochondria, which are the cell's powerhouses, contain a small, circular DNA molecule called mitochondrial DNA (mtDNA). This genome is essential for cellular energy production and other metabolic processes. Its unique characteristics, including a high cellular copy number, a high mutation rate, and strict maternal inheritance, have made it a subject of intense interest across numerous research fields.

The market for mitochondrial DNA has enormous potential because of the growing need for precision medicine and the development of next-generation sequencing technology.

Additionally, mitochondrial DNA and MRT (mitochondrial replacement therapy) are used extensively in a range of cancer research and development activities. For instance, peripheral mtDNA levels (in blood and saliva) may be linked to stress and depression, though the precise mechanisms are still being investigated.

Furthermore, it plays a vital role in forensic research, particularly in the hypervariable regions, and is used for maternity testing, ancestry tracking, and individual discovery. This will help the market grow in the years to come. In addition, solid development prospects are also presented by rising consumer interest in ancestry testing and the growing use of mitochondrial DNA in forensic investigations. Since mtDNA may be used to track down members of a mother's line in forensic instances, it is a valuable tool for both legal and genetic studies.

Some of the Key Players in the Mitochondrial DNA Market:

The mitochondrial dna market is segmented by drug type, route of administration, application, and distribution channel. By drug type, the market is segmented into corticosteroids, anti-inflammatory biologics, and non-steroidal anti-inflammatory drugs (NSAIDS). As per the route of administration, the market is segmented into oral and intravenous (IV). By application, the market segmentation consists of diagnostic, therapeutic, research and development. The distribution channel includes hospital pharmacies, drug stores, online pharmacies, and retail pharmacies.

In 2024, the anti-inflammatory biologics sector dominated the mitochondrial DNA market by drug type. This is because biologic medicines have revolutionized the treatment of patients with severe osteoporosis and inflammatory autoimmune illnesses. When mitochondria release mitochondrial DNA, it sets off a variety of pro-inflammatory signalling pathways. As a result, there is a chance to develop anti-inflammatory biologics that target mtDNA or similar pathways. Additionally, they are used in mitochondrial dysfunction, and the growth of the entire segment is being boosted by increased immunological activity.

The therapeutic category dominated the mitochondrial DNA market in 2024 because therapeutic techniques that target mtDNA have significant implications for medical treatment and anti-cancer medication research. By focusing on mtDNA, malignancies can be completely removed and medication resistance overcome. This is because cancers have acquired certain biological physiognomies that are linked to mtDNA. Since mtDNA plays a vital role in cells, changes to it make it a desirable target for treatments.

The global market for mitochondrial DNA is dominated by North America in 2024. The United States leads the world in mitochondrial DNA research. As forensic DNA and ancestry testing become increasingly popular, more mtDNA is required for diagnostic studies. As the prevalence of mitochondrial illnesses rises, there is also a boom in demand for precision medicine and genetic counselling.

Moreover, cutting-edge sequencing technologies and supportive laws help to promote the growth of the mitochondrial DNA market. Research is also gaining fresh life because of partnerships between academic institutions and biotechnology companies.

In addition, the Asia-Pacific region is anticipated to grow rapidly over the forecast period as a result of an increase in mitochondrial myopathies and other cancers linked to the mitochondria, which is facilitating the creation of diagnostic and therapeutic tools. Additionally, the substantial modernization of nations like Southeast Asia and India is creating highly complex medical facilities and increasing the need for advanced testing. Government-backed biotech technologies and support for genetic research are significantly bolstering the R&D industry in ASAP.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 340.1 Mn |

| Revenue Forecast In 2034 | USD 669.6 Mn |

| Growth Rate CAGR | CAGR of 7.3% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Drug Type, By Route of Administration, By Application, By Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Reata Pharmaceuticals Inc., GeneDx, Centogene AG, Stealth Biotherapeutics, and NeuroVive Pharmaceutical AB |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Mitochondrial DNA Market by Drug Type-

· Corticosteroids

· Anti-inflammatory Biologics

· Non-Steroidal Anti-inflammatory Drugs (NSAIDs)

Mitochondrial DNA Market by Route of Administration -

· Oral

· Intravenous (IV)

Mitochondrial DNA Market by Application-

· Diagnostic

· Therapeutic

· Research and development

Mitochondrial DNA Market by Distribution Channel-

· Hospital Pharmacies

· Drug Stores

· Online Pharmacies

· Retail Pharmacies

Mitochondrial DNA Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.