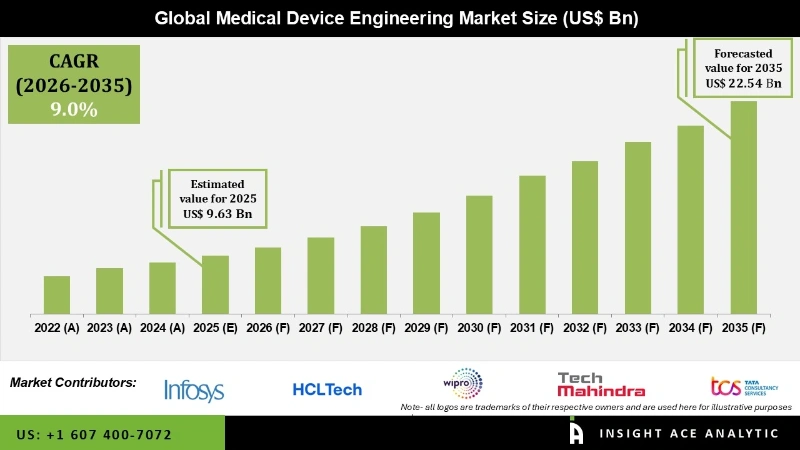

The Medical Device Engineering Market Size is valued at USD 9.63 billion in 2025 and is predicted to reach USD 22.54 billion by the year 2035 at a 9.0% CAGR during the forecast period for 2026 to 2035.

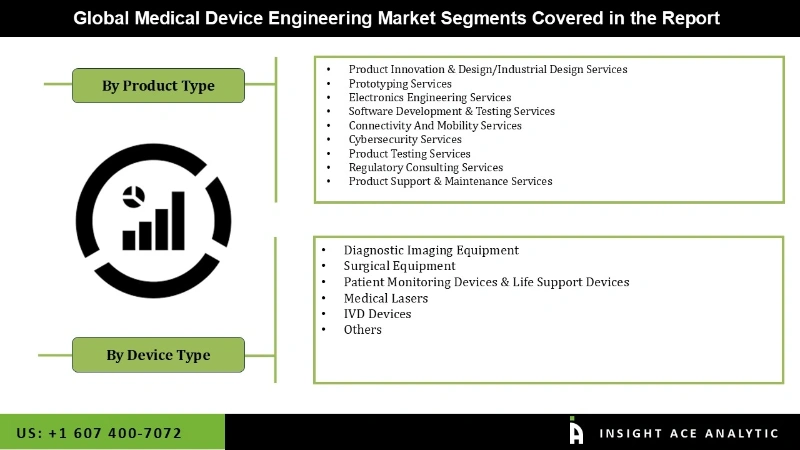

Medical Device Engineering Market Size, Share & Trends Analysis Report By Service Type (Product Innovation & Design/Industrial Design Services, Prototyping Services, Electronics Engineering Services, Software Development & Testing Services, Connectivity And Mobility Services, Cybersecurity Services, Product Testing Services, Regulatory Consulting Services, Product Support & Maintenance Services), By Device Type, By Region, And By Segment Forecasts, 2026 to 2035.

Medical device engineering focuses on developing and refining instruments used in healthcare for disease detection, prognosis, treatment, and prevention. Engineers specializing in medical devices make sure they are up to code, work as intended, and improve health outcomes for patients. Several important factors are propelling the medical device engineering industry. Devices to manage age-related health concerns, such as mobility challenges, cardiovascular illnesses, and arthritis, are seeing a major uptick in demand due to the ageing population.

Additionally, this industry is experiencing innovation and growth due to supportive regulations and the expansion of healthcare infrastructure worldwide. Moreover, there is a growing demand for better diagnosis and treatment tools due to the increasing number of cases of long-term diseases such as cancer and diabetes. The demand for precise, high-tech devices has increased due to the increasing preference for less invasive operations. Rising medical technology investments and supportive government policies also bode well for future market expansion.

However, market expansion is hampered by the accessibility and affordability of medical devices, which a lack of knowledge, technical manufacturing hurdles, and high costs can hinder. Furthermore, the COVID-19 pandemic has boosted demand for medical device engineering products, like ventilators, diagnostic devices, and telemedicine technologies. There were initial delays in development and manufacturing due to supply chain interruptions and regulatory delays. In addition, the demand for medical device engineering is being propelled by the expanding healthcare infrastructure, increased healthcare expenditure, and an ever-increasing emphasis on health promotion and disease prevention.

The global medical device engineering market is segmented based on the service type and device type. Based on service type, the market is segmented into product innovation & design/industrial design services, prototyping services, electronics engineering services, software development & testing services, connectivity and mobility services, cybersecurity services, product testing services, regulatory consulting services, and product support & maintenance services. By device type, the market is segmented into diagnostic imaging equipment, surgical equipment, patient monitoring devices & life support devices, medical lasers, IVD devices, and others.

The software development & testing service in the medical device engineering market is expected to hold a major global market share in 2023. This is because software is progressively included in medical devices for therapy, monitoring, and diagnosis. Demand for strong development and testing services to guarantee flawless device performance and patient safety is driven by the need for dependable, safe, and compliant software as well as strict regulatory standards for safety and efficacy.

The diagnostic imaging equipment in the medical device engineering market is growing due to developments in imaging technology, the growing need for early and precise disease diagnosis, and the growing frequency of long-term diseases. Further driving demand for innovative diagnostic imaging technology are the increasing acceptance of less invasive techniques and the incorporation of AL and machine learning into imaging systems.

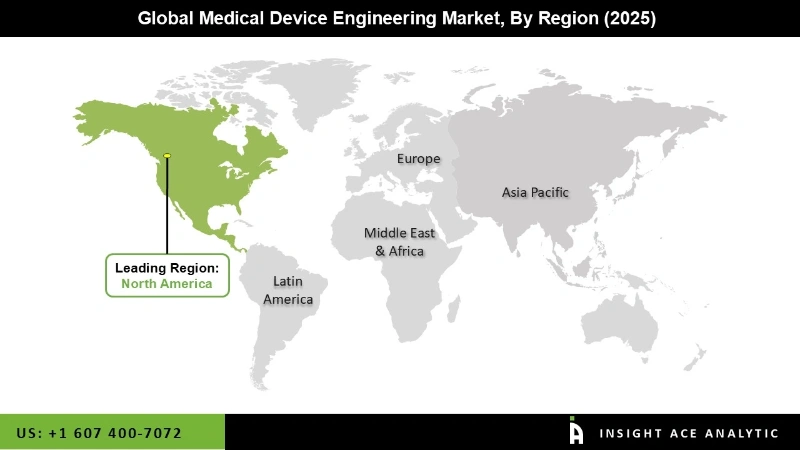

The North American global medical device engineering market is anticipated to note the highest market share in revenue in the near future. This is because of the swift uptake of cutting-edge medical technology and government measures that encourage healthcare innovation and provide strong support to the region. Moreover, medical device engineering is in high need due to the growing number of older people and the rising incidence of long-term illnesses. In addition, the Asia Pacific is anticipated to grow rapidly in the global medical device engineering market because this is because of developments in medical technology, more people living with chronic conditions, rising healthcare expenditure, more healthcare funding, and government policies that encourage research and development throughout the Asia-Pacific region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 9.63 Bn |

| Revenue Forecast In 2035 | USD 22.54 Bn |

| Growth Rate CAGR | CAGR of 9.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Service Type, Device Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | L&T Technology Services Limited, Infosys Limited, HCL Technologies Limited, Cyient, Wipro, Tech Mahindra Limited, TATA Consultancy Services Limited, FlEX LTD, Capgemini, Embien Technologies India Pvt Ltd., Alten Group, Accenture, Consonance, Althea Group, MED INSTITUTE, Saraca Solutions Private Limited, Nemedio Inc., Sternum, Medcrypt, MCRA, LLC, North American Science Associates, LLC, MedQtech, Veranex, Ontogen Medtech LLC, Seisa Media, and Simplexity Product Development. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Medical Device Engineering Market By Service Type-

Medical Device Engineering Market By Device Type-

Medical Device Engineering Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.