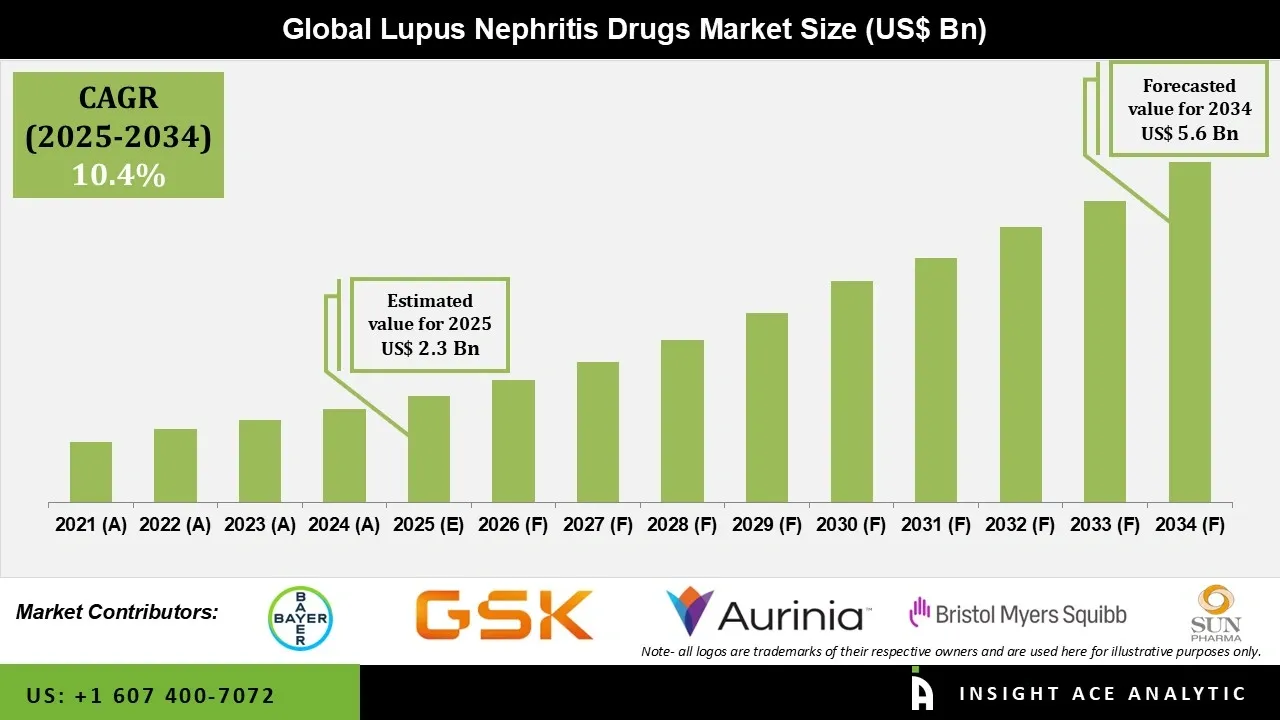

Lupus Nephritis Drugs Market Size is valued at USD 2.3 Bn in 2025 and is predicted to reach USD 5.6 Bn by the year 2034 at a 10.4% CAGR during the forecast period for 2025 to 2034.

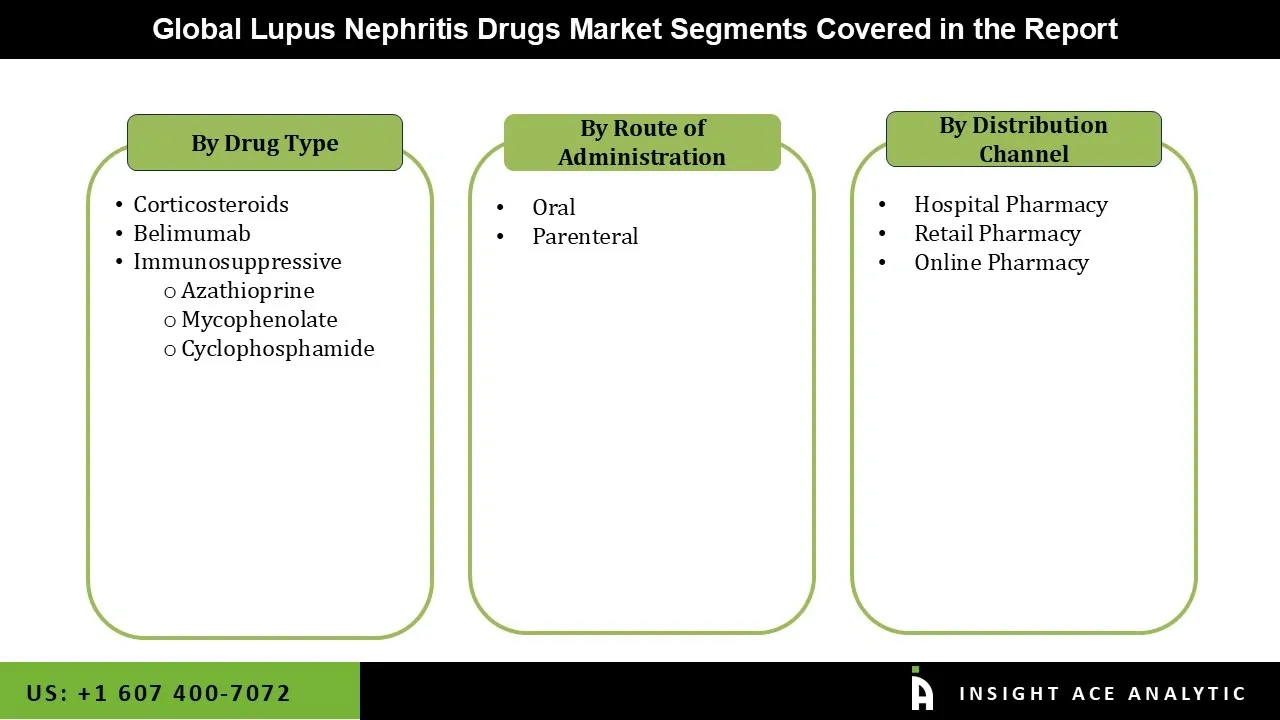

Lupus Nephritis Drugs Market Size, Share & Trends Analysis Distribution by Drug Type (Corticosteroids, Belimumab, and Immunosuppressive (Azathioprine, Mycophenolate, Cyclophosphamide)), Route of Administration (Oral and Parenteral), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Segment Forecasts, 2025 to 2034

Lupus nephritis drugs are employed to manage kidney inflammation resulting from systemic lupus erythematosus (SLE), an autoimmune disorder characterized by immune-mediated tissue damage. These therapies aim to suppress immunological hyperactivity, reduce inflammation, prevent further renal injury, and preserve kidney function. Commonly used treatments include immunosuppressive agents to mitigate immune-mediated renal damage and corticosteroids for rapid inflammation control.

In recent years, targeted biologic therapies such as voclosporin and belimumab have been introduced to enhance therapeutic efficacy through more precise immune modulation. The expansion of the lupus nephritis drugs market is primarily driven by the increasing prevalence of SLE, advancements in treatment modalities, and supportive government initiatives for individuals with autoimmune diseases.

The growing patient demand for more effective and personalized treatments, such as biologics and targeted therapies, is driving the expansion of the lupus nephritis drugs market. The treatment options are also being improved through ongoing research and clinical trials focused on novel therapeutics, such as NK cell-based therapies and immunoproteasome inhibitors. Moreover, improved healthcare infrastructure and higher healthcare spending are driving growth in the lupus nephritis drugs market, especially in developing nations.

The growth in the lupus nephritis drugs market is also anticipated to be fueled by the launch of innovative drugs and treatments to address unmet needs in the disease. Additionally, the market's upward trajectory is being aided by the emphasis on individualized drug and early diagnosis. The lupus nephritis drugs market is expected to grow significantly as pharmaceutical companies continue to develop treatments, offering patients more efficient and targeted therapeutic options.

The increasing number of drug approvals for lupus nephritis treatment is expected to accelerate the growth of the global lupus nephritis drugs market. For example, in February 2023, GSK plc received the US Food and Drug Administration's (FDA) Orphan Drug Designation (ODD) for Benlysta (belimumab), a monoclonal antibody that inhibits B cells and may be used to treat systemic sclerosis.

Benlysta (belimumab), a B-lymphocyte stimulator (BLyS)-specific inhibitor, binds to soluble BLyS, which is elevated in individuals with systemic autoimmune diseases such as lupus nephritis (LN) and systemic lupus erythematosus (SLE). However, stringent regulatory requirements for drug approval are expected to hinder the expansion of the global lupus nephritis drugs market. Additionally, treatment-related side effects and the high cost of drug development are anticipated to further constrain market growth during the forecast period.

• Abbott

• Roche

• Bayer AG

• Sanofi

• GlaxoSmithKline

• AstraZeneca

• Aurinia Pharmaceuticals Inc.

• Bristol-Myers Squibb

• Eli Lilly and Company

• Johnson & Johnson Private Limited

• Sun Pharmaceutical Industries Ltd

The need for efficient management of lupus nephritis has increased due to the rising incidence of SLE worldwide, driving the lupus nephritis drugs market. Up to 60% of SLE patients are thought to develop lupus nephritis at some point in their lives, making it a serious public health issue. Although the precise causes are yet unknown, hormones, the environment, and genetics all play a role. It primarily affects fertile women, with estimates indicating an 8:1 female-to-male ratio. Furthermore, the absolute number of individuals developing lupus nephritis has increased significantly due to the rising frequency of SLE, creating a sizable prospective patient pool. Overall, a growing target audience looking for efficient lupus nephritis drugs and management alternatives is indicated by the disease's rising prevalence and serious renal consequences.

One significant obstacle to the growth potential of the lupus nephritis drugs market is the high cost of biologic medicines. Belimumab and other biologics have transformed the treatment of lupus, but they are quite expensive. For many patients, a year's worth of treatment might cost more than six figures. Due to this financial strain, many patients find it difficult to regularly afford and follow their recommended course of therapy.

Additionally, the prospects for commercial expansion in those regions will likely remain hampered by limited access to novel, targeted biologic treatments. In less developed healthcare markets worldwide, high drug prices continue to be a barrier to both patients and market penetration. To improve economic access to necessary treatments for lupus nephritis, particularly biologics, more funding and work are still required globally.

The Corticosteroids category held the largest share in the Lupus Nephritis Drugs market in 2024 due to its well-established role as a first-line treatment for immune-mediated kidney injury and its ability to rapidly reduce inflammation. Due to their potent immunosuppressive and anti-inflammatory properties, rapid onset of action, and comparatively inexpensive cost when compared to more recent biologics, corticosteroids are frequently used in induction therapy and during disease flare-ups. Additionally, the increasing incidence of systemic lupus erythematosus with renal involvement, particularly in poorer nations where access to cutting-edge treatments may be restricted, supports growth even further.

In 2024, the Hospital Pharmacy category dominated the Lupus Nephritis Drugs market, driven primarily by the disease's complexity and severity, which often require expert diagnosis, careful observation, and the use of cutting-edge treatments in hospital settings. Hospital pharmacies are an important distribution channel because patients with lupus nephritis often require immunosuppressive drugs, biologics, and combination therapy, which are usually started and administered under professional supervision. This segment's growth is further supported by the rising frequency of hospital admissions brought on by severe renal problems, flare-ups, and comorbidities related to systemic lupus erythematosus.

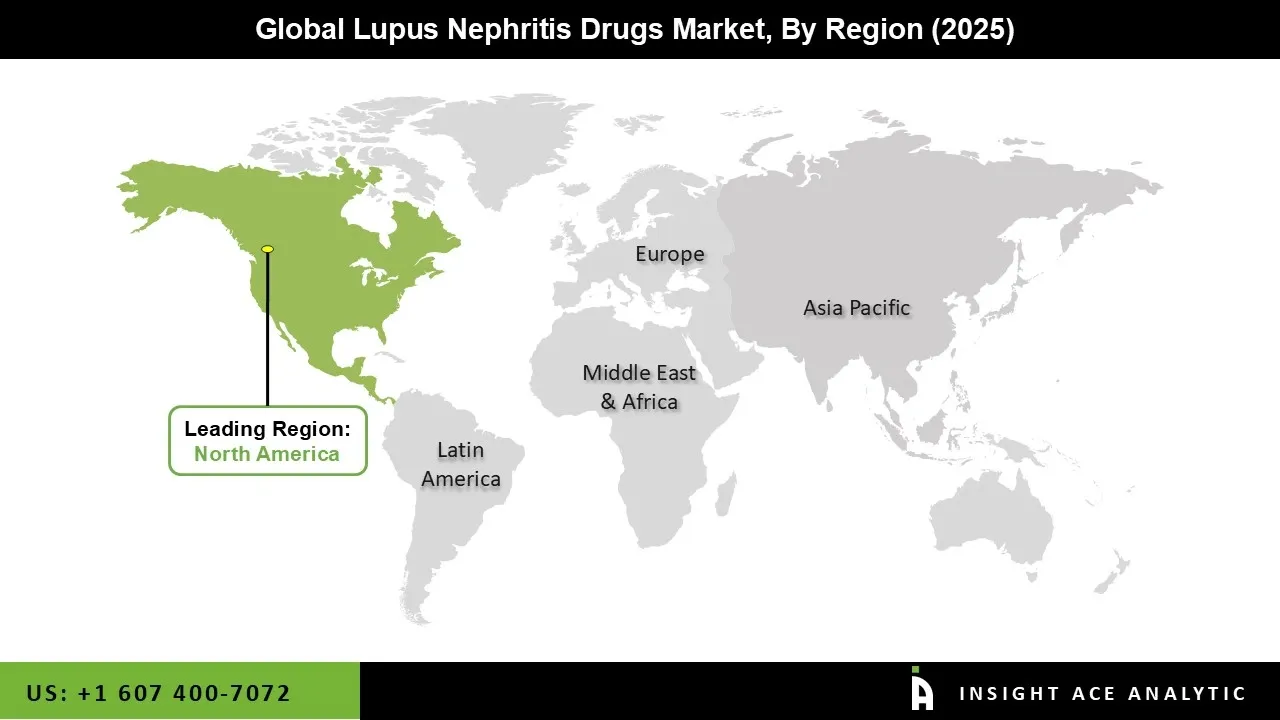

The Lupus Nephritis Drugs market was dominated by the North American region in 2024, driven by the high incidence of systemic lupus erythematosus (SLE), sophisticated medical facilities, and growing awareness of lupus nephritis, early detection, and focused therapy. Strong acceptance of biologic and creative treatments, including monoclonal antibodies and new immunosuppressive drugs, is beneficial to the region.

This adoption is bolstered by active clinical research and a supportive regulatory environment, especially in the United States. Additionally, rising healthcare costs, greater access to rheumatology and nephrology specialists, and the availability of insurance coverage for specialized drugs all support the growth of the lupus nephritis drugs market.

• March 2024: With a focus on patients with proliferative lupus nephritis, Novartis progressed its monoclonal antibody Ianalumab (VAY736) into Phase III clinical trials. The purpose of the trials is to assess Ianalumab's safety, effectiveness, and tolerability as a supplemental treatment for lupus nephritis and systemic lupus erythematosus (SLE). Participants in the randomized, double-blind, placebo-controlled trials receive either Ianalumab or a placebo in addition to their existing conventional therapies.

• February 2024: Everest Medicines and Kezar Life Sciences, Inc. announced that Kezar's Investigational New Drug (IND) application for the Phase 2b PALIZADE trial of zetomipzomib in Chinese lupus nephritis patients had been approved by the Center for Drug Evaluation (CDE) of China's National Medical Products Administration (NMPA). Zetomipzomib is a novel, selective immunoproteasome inhibitor with great promise for treating a range of autoimmune diseases.

• June 2023: The FDA approved Kyverna Therapeutics, a US-based cell therapy firm, for KYV-101, a treatment for refractory lupus nephritis. The drug depletes B cells, particularly autoreactive B cells, found in patients with this autoimmune disease by a unique anti-CD19 chimeric antigen receptor T-cell (CAR T) therapy.

| Market size value in 2025 | USD 2.3 Bn |

| Revenue forecast in 2034 | USD 5.6 Bn |

| Growth Rate CAGR | CAGR of 10.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Drug Type, Route of Administration, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Abbott, Roche, Bayer AG, Sanofi, GlaxoSmithKline, AstraZeneca, Aurinia Pharmaceuticals Inc., Bristol-Myers Squibb, Eli Lilly and Company, Johnson & Johnson Private Limited, and Sun Pharmaceutical Industries Ltd |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Lupus Nephritis Drugs Market by Drug Type-

• Corticosteroids

• Belimumab

• Immunosuppressive

o Azathioprine

o Mycophenolate

o Cyclophosphamide

Lupus Nephritis Drugs Market by Route of Administration-

• Oral

• Parenteral

Lupus Nephritis Drugs Market by Distribution Channel-

• Hospital Pharmacy

• Retail Pharmacy

• Online Pharmacy

Lupus Nephritis Drugs Market- By Region

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.