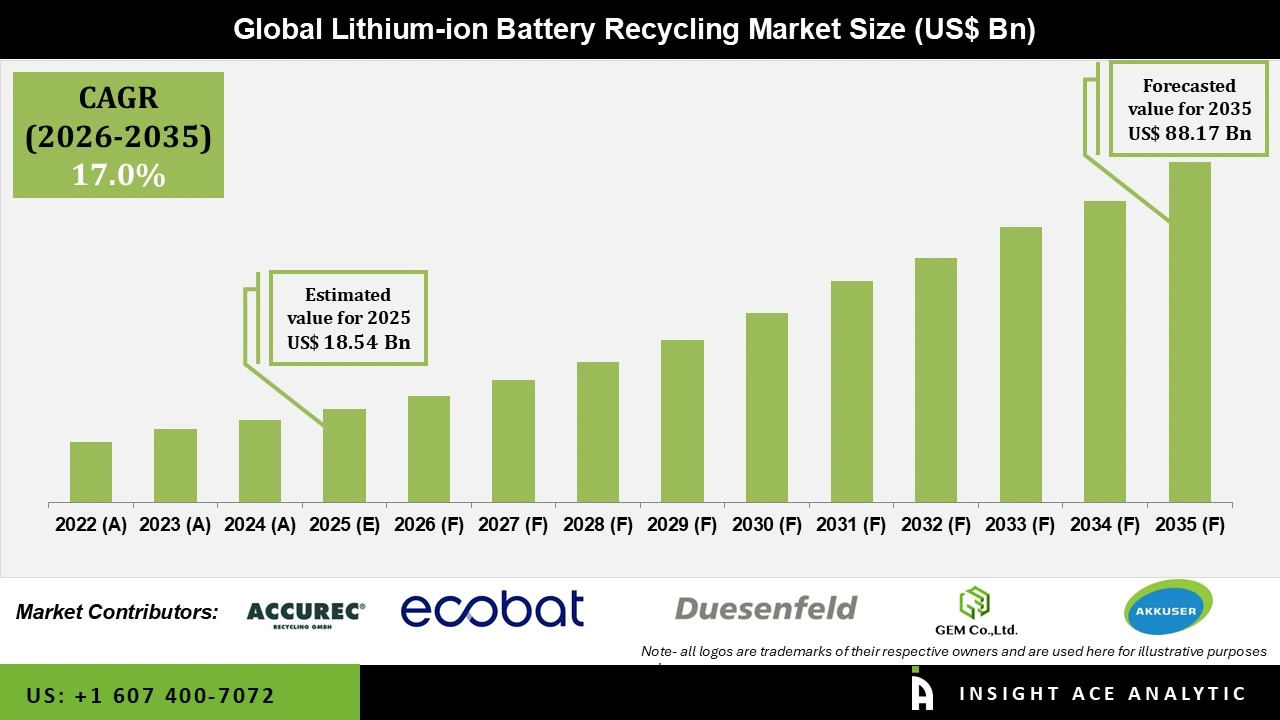

Global Lithium-ion Battery Recycling Market Size is valued at USD 18.54 Billion in 2025 and is predicted to reach USD 88.17 Billion by the year 2035 at a 17.0% CAGR during the forecast period for 2026 to 2035.

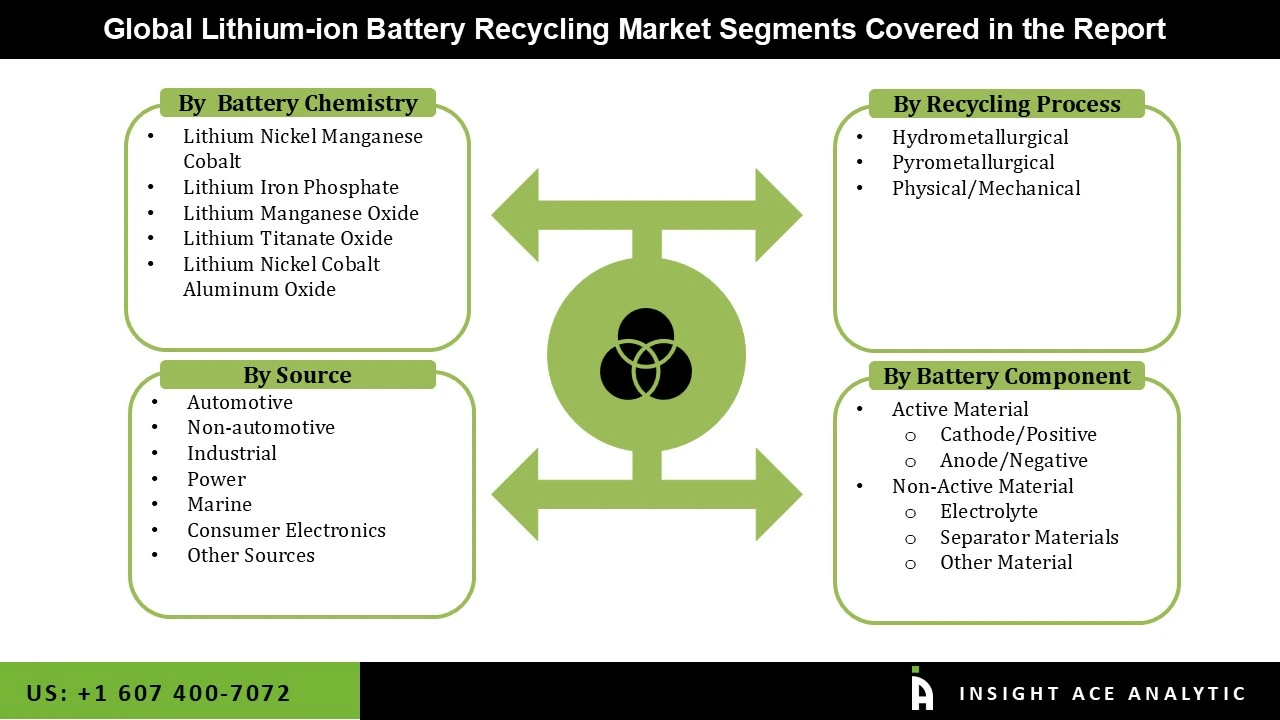

Lithium-ion Battery Recycling Market Size, Share & Trends Analysis Report By Battery Chemistry (Lithium-Iron Phosphate, Lithium-Manganese Oxide, Lithium-Nickel-Cobalt-Aluminum Oxide, Lithium-Nickel-Manganese Cobalt & Lithium-Titanate Oxide), Source (Electric Vehicles, Electronics, Power Tools), Recycling Process & End-Use, By Region, & Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Lithium-ion battery recycling refers to gathering lithium-ion batteries from various sources, such as automobiles, industrial equipment, consumer goods, and electronic devices, as well as the recovery of metals through recycling procedures. The global lithium-ion battery recycling market is anticipated to expand due to governmental laws, environmental safety, and public awareness.

The availability of protective layers to reduce the risk of fire and short-circuiting, as well as the attractive design of batteries, are predicted to open up new growth potential in the global market. Furthermore, the battery recycling businesses will likely have a huge opportunity to invest in and refocus their resources to develop a breakthrough battery recycling technology due to advancements in battery technologies that result in the development of technologically advanced batteries being developed by manufacturers.

However, the market for lithium-ion battery recycling is constrained by the high capital costs associated with building new recycling facilities and the specialization of supply and collecting chains. Additionally, the increased recycling of other chemistries like lead-acid batteries and the lack of an appropriate legislative framework in many developing countries to remove battery materials may hinder the Lithium-ion Battery Recycling market expansion.

The lithium-ion battery recycling market is segmented by source, recycling process, battery component, battery chemistry. Based on source, the market is segmented as automotive and non-automotive. Non-automotive is further segmented into industrial, power, marine, consumer electronics, other sources. By recycling process market is segmented into hydrometallurgical, pyrometallurgical, physical/mechanical. By battery component market is segmented into active material and non-active material. Active material is subdivided into cathode/positive and anode/negative. Non-active material is sub segmented into electrolyte, separator materials, other material. By battery chemistry market is segmented into lithium nickel manganese cobalt, lithium iron phosphate, lithium manganese oxide, lithium titanate oxide, lithium nickel cobalt aluminum oxide.

The growing demand for consumer electronics like smartphones, laptops, and tablets has led to a surge in lithium-ion battery usage. As these devices reach the end of their lifespan, a significant number of used batteries will require disposal. With increasing awareness among producers and consumers about the environmental risks of improper disposal, this waste presents a major opportunity for recycling. Additionally, the presence of valuable metals like lithium and cobalt further drives investment in the recycling market, making the consumer electronics segment the primary source of recyclable lithium-ion batteries.

The lithium-ion battery recycling market is growing rapidly, with NCA batteries leading due to their rising use in EVs and energy storage. Their high energy density drives demand for long-lasting power solutions, while sustainability efforts and regulations fuel investment in recycling technologies to recover valuable metals like nickel, cobalt, and lithium. As green consumerism gains traction, NCA is a key driver of market expansion.

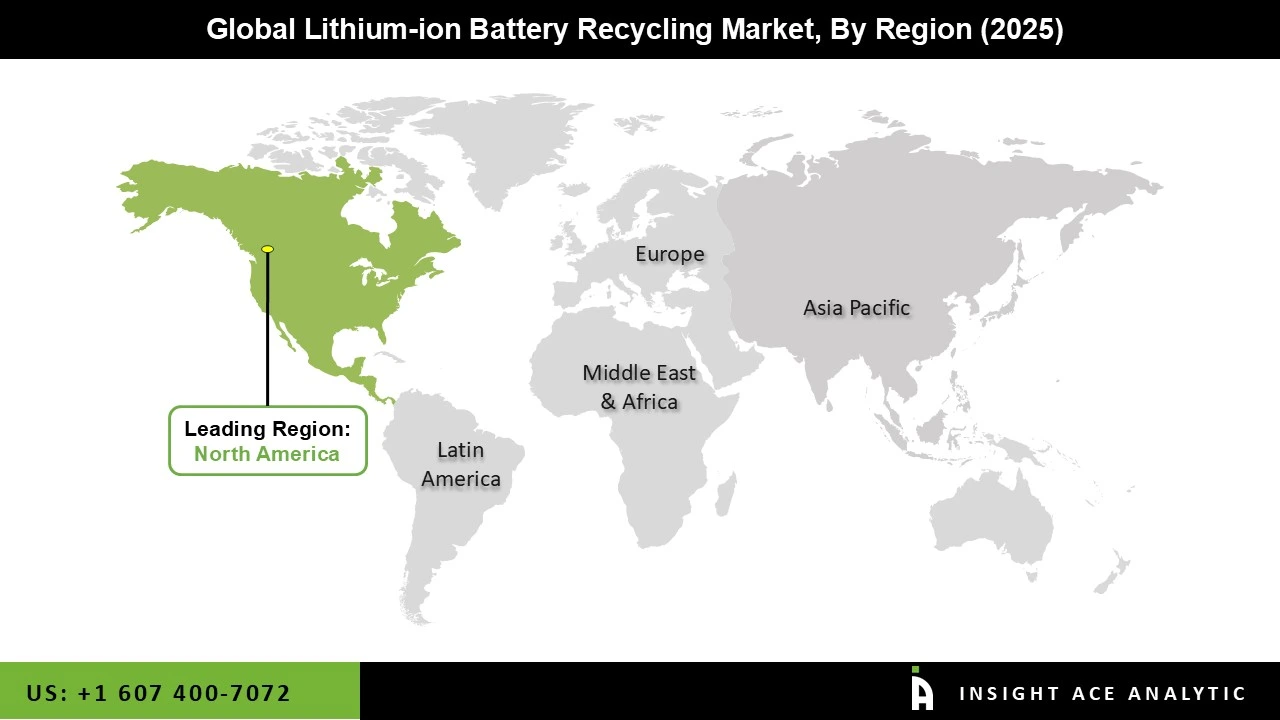

The North America lithium-ion battery recycling market is expected to register the largest market share in revenue in the near future. The two main factors propelling market revenue growth in this area are the high adoption of photovoltaic systems in homes and commercial buildings and the growing demand for electric vehicles.

In several of the nations in this area, the automobile industry is a significant consumer of lithium-ion batteries, which helps drive market revenue growth. In addition, Asia Pacific is projected to grow at a rapid rate in the global lithium-ion battery recycling market due to the growing popularity of EVs. In essence, the region's developing economies' growing consumer understanding of EVs' environmental advantages is expected to spur industry growth. Manufacturers focus on recycling spent batteries to meet autos' demand for Li-ion batteries.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 18.54 Billion |

| Revenue forecast in 2035 | USD 88.17 Billion |

| Growth rate CAGR | CAGR of 17.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, Volume (Unit), and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Source, Recycling Process, Battery Component, Battery Chemistry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia; |

| Competitive Landscape | Ganfeng Lithium Co., Ltd., American Battery Technology Company, Accurec Recycling GmbH, Akkuser Oy, Duesenfeld GmbH, Li-Cycle Corp., Fortum Corporation, Retriev Technologies, Inc., Lithion Recycling, Inc., and Umicore |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Lithium-ion Battery Recycling Market By Battery Chemistry

Lithium-ion Battery Recycling Market By Source

Lithium-ion Battery Recycling Market By Recycling Process

Lithium-ion Battery Recycling Market By Battery Component

Lithium-ion Battery Recycling Market By Region-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.