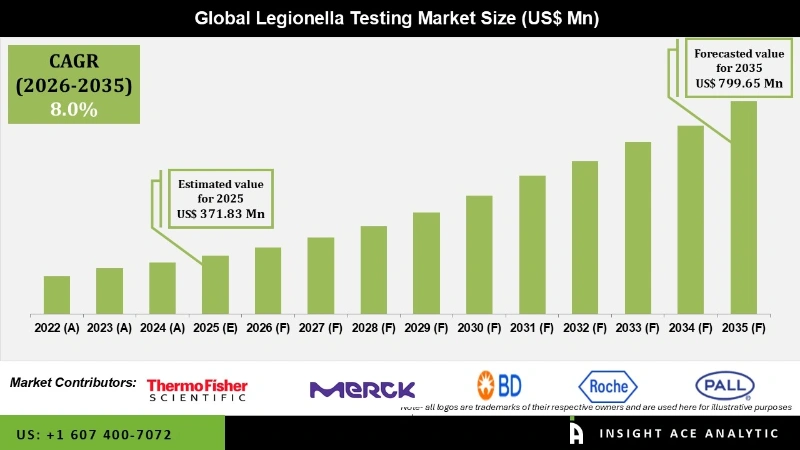

The Legionella Testing Market Size is valued at USD 371.83 Mn in 2025 and is predicted to reach USD 799.65 Mn by the year 2035 at a 8.0% CAGR during the forecast period for 2026 to 2035.

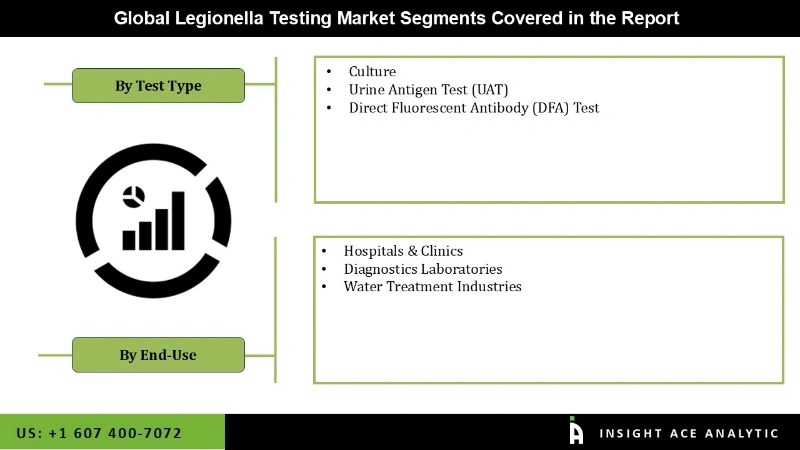

Legionella Testing Market Size, Share & Trends Analysis Report By Test Type (Culture, Urine Antigen Test (UAT), Direct Fluorescent Antibody (DFA) Test), By End-Use (Hospitals & Clinics, Diagnostics Laboratories, Water Treatment Industries), By Region, And By Segment Forecasts, 2026 to 2035.

Legionella testing detects the presence of the bacterium Legionella pneumophila and other related species in water sources. The testing procedure is critical for identifying potential Legionella contamination sources and averting Legionnaires' disease outbreaks. Legionella testing procedures have become more efficient and accurate as testing technology has advanced.

PCR-based testing and next-generation sequencing (NGS) are two technologies that have gained popularity as a result of their shorter turnaround times and ability to deliver more detailed information. The technologies that power molecular diagnostics are fast improving to aid in the fight against rapidly spreading infectious disease pandemics. The traditional Legionella testing method based on microbial culture technology is time-consuming and labor-intensive.

However, certain industries, such as hospitality and tourism, were significantly affected by the pandemic, leading to reduced occupancy or temporary closures of hotels, resorts, and other facilities. These changes could have influenced the demand for Legionella testing in these sectors.

The Legionella Testing Market is segmented on the basis of test type and end-use. Acording to test type, the market is segmented as culture, Urine Antigen Test (UAT), and Direct Fluorescent Antibody (DFA) Test. The end-user segment includes hospitals & clinics, diagnostics laboratories, and water treatment industries.

The Urine Antigen Test (UAT) category is expected to hold a major share of the global Legionella Testing Market in 2022. This is the most widely used laboratory test for detecting legionella bacteria in urine. It can offer results on the same day as the sample collection, as opposed to culture media approaches, which take 7 to 8 days. Furthermore, it is a low-cost test that is more popular among people from underdeveloped or developing countries. Rapidly rising PCR technology to dominate the market with a higher CAGR over the forecast period due to the maximum selectivity and specificity of the test.

The diagnostics laboratories segment is projected to grow at a rapid rate in the global Legionella Testing Market. This is due to the increasing prevalence of Legionnaire disease, more awareness, and increased penetration of improved assays for Legionella infection detection. This dominance is expected to persist throughout the projection period. The other segment, which encompasses environmental testing in addition to clinical Legionella bacteria testing, is expected to grow rapidly due to the advent of onsite testing methodologies and the enforcement of rigorous rules for routine water check-ups.

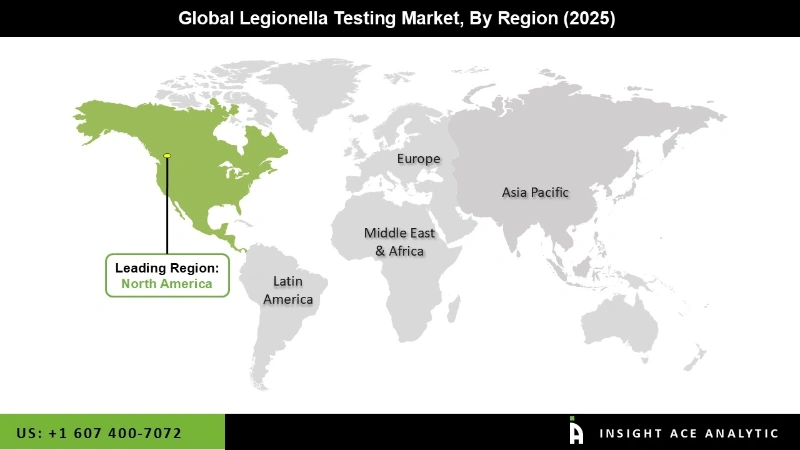

The North America Legionella Testing Market is expected to register the topmost market share in terms of revenue in the near future. The market in this region is distinguished by high Legionnaire disease diagnostic rates, the presence of world-class healthcare infrastructure, high illness awareness, and severe water testing requirements.

The presence of a large geriatric population that is readily infected, together with the high risk of mortality owing to associated pneumonia among such patients, prioritizes Legionella testing in countries such as the United States, which is adding momentum to the regional market. The Asia-Pacific market is expected to grow at a substantial CAGR within the forecast period due to economic development, an empowered healthcare industry, and increased awareness of available test products in the region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 371.83 Mn |

| Revenue Forecast In 2035 | USD 799.65 Mn |

| Growth Rate CAGR | CAGR of 8.0 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Test Type, End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Thermo Fisher Scientific Inc., Becton, Dickinson and Company, Biomérieux, Merck KGaA, Quidel Corporation, Abbott Laboratories, Aquacert Ltd, Phigenics, LLC, Pall Corporation, and Evoqua Water Technologies LLC |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Legionella Testing Market By Test Type-

Legionella Testing Market By End-Use-

Legionella Testing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.