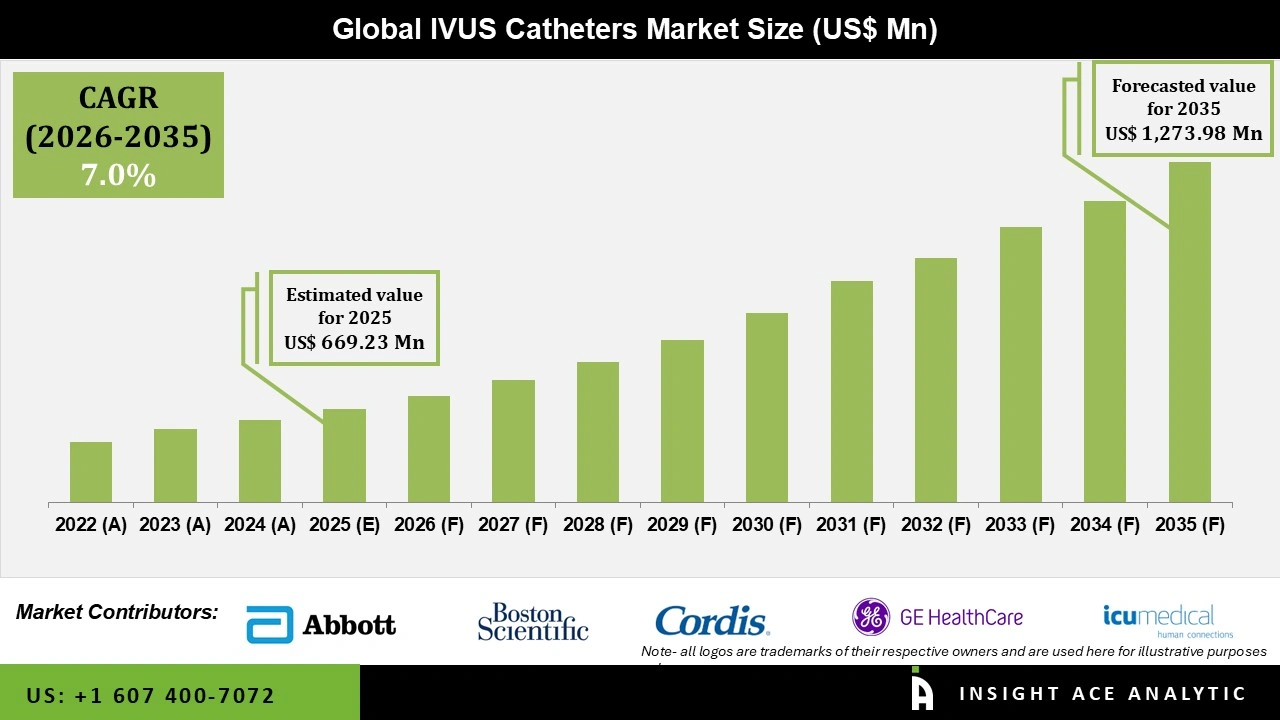

Global IVUS Catheters Market Size is valued at USD 669.23 Mn in 2024 and is predicted to reach USD 1273.98 Mn by the year 2035 at a 7.0% CAGR during the forecast period for 2026 to 2035.

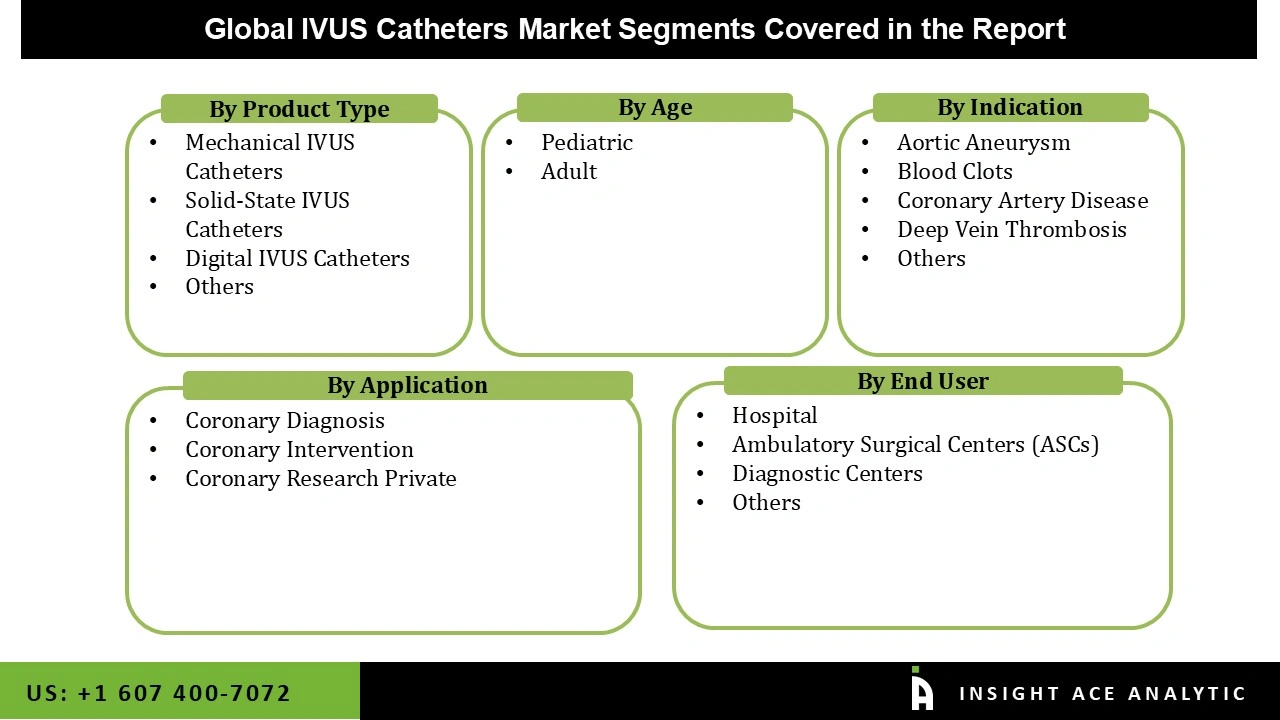

IVUS Catheters Market Size, Share & Trends Analysis Report By Product Type (Mechanical IVUS Catheters, Solid-State IVUS Catheters, Digital IVUS Catheters, Others), By Age (Pediatric, Adult), By Indication (Aortic Aneurysm, Blood Clots, Coronary Artery Disease, Deep Vein Thrombosis, Others), By Application, By End User, By Region, And By Segment Forecasts, 2026 to 2035.

Catheters designed specifically for intravascular ultrasound (IVUS) are used to produce high-resolution, real-time images of the inside of blood vessels. Through the use of a catheter fitted with an ultrasound transducer, this minimally invasive procedure enables doctors to examine the state of vessel walls and atherosclerotic plaques from within, as well as gauge the degree of arterial blockages and direct the implantation of stents. IVUS catheters have become an essential tool in cardiovascular diagnostics and interventions, enhancing the ability of physicians to diagnose and treat vascular diseases more effectively. The market for IVUS catheters is witnessing a breakthrough in cardiovascular therapies' accuracy and effectiveness. With the use of these catheters, medical personnel can see blood vessels in great detail and in real-time, which helps them make wise judgements while doing diagnostic and interventional operations.

The COVID-19 pandemic significantly impacted the Intravascular Ultrasound (IVUS) catheters market, disrupting manufacturing, distribution, and elective medical procedures. Hospitals prioritized resources for critical care, causing a decline in non-urgent procedures like IVUS examinations. Additionally, reduced patient visits and financial strains on healthcare systems further dampened market growth. However, as healthcare systems stabilize and vaccination rates increase, a gradual recovery in the IVUS catheters market is anticipated.

The IVUS Catheters market is segmented into product type, age, indication, application, and end-user. By Product Type, the market is segmented into Mechanical IVUS Catheters, Solid-State IVUS Catheters, Digital IVUS Catheters. By Age, the market is divided into Pediatric, Adult). According to Indication, market consists of Aortic Aneurysm, Blood Clots, Coronary Artery Disease, Deep Vein Thrombosis, Others. By application the market is categorised into Coronary Diagnosis, Coronary Intervention, Coronary Research. On the basis of end-users, the market is segmented into Hospitals, Ambulatory Surgical Centers (ASCs), Diagnostic Centers, and Others.

This product segment growth is due to the soaring application of various catheters, which constitute a critical component of an IVUS test. The increasing usage of guidewires in real-time organ observation in medical techniques like angiograms, cardiac surgeries, and stent placements is further propelling the growth of this segment. The mechanical IVUS catheter product type segment dominated the industry. Mechanical IVUS catheters use a rotating ultrasound transducer to produce cross-sectional images of the blood vessel. These catheters offer high resolution, which allows clinicians to visualize small structures within blood vessels with great detail. They are also useful in identifying plaque build-up, which helps indicate cardiovascular disease.

Based on application, coronary Intervention is the dominant segment in the IVUS catheters market. This segment accounts for the largest share due to the high frequency of cardiovascular diseases and the widespread adoption of IVUS technology for coronary artery assessment and guidance during percutaneous coronary interventions. The demand for minimal incision procedures and the increasing prevalence of coronary artery diseases globally further contribute to the prominence of coronary Intervention as the leading application segment in the IVUS catheters market.

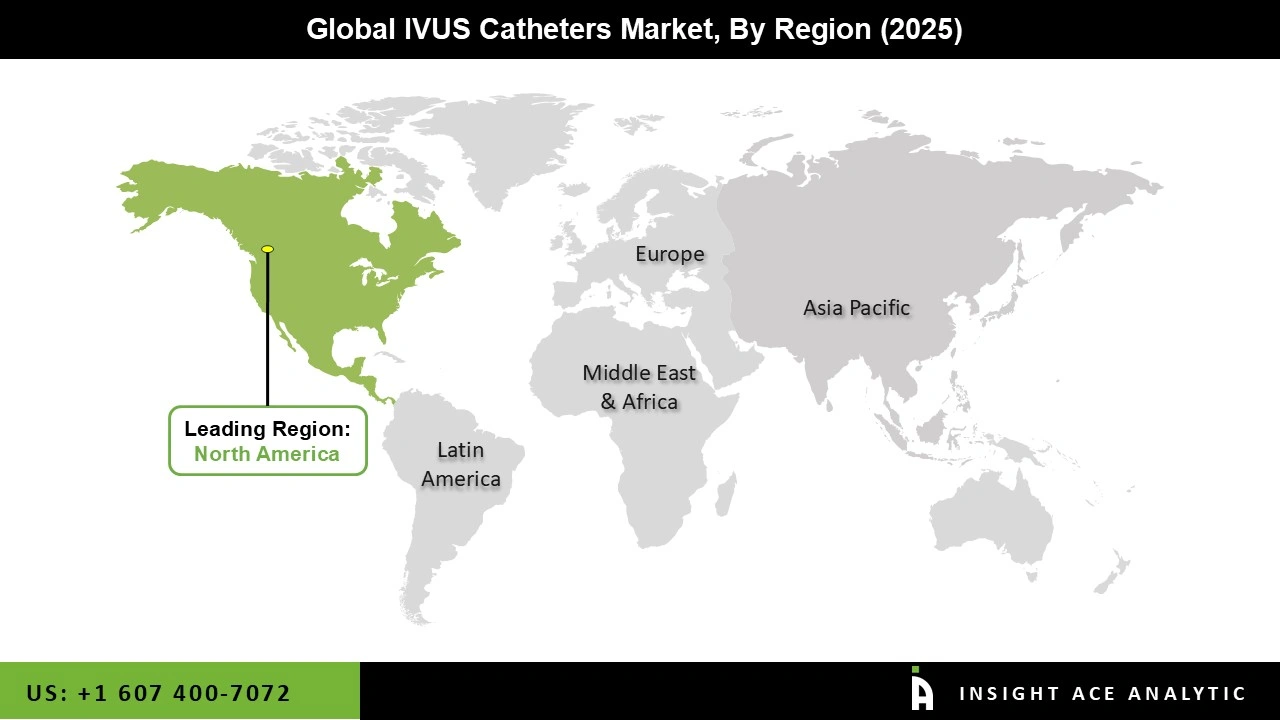

North America also holds significant growth in this market. This can be due to various factors, such as increased adoption of ultrasound technology in primary care settings, improved accessibility, and high healthcare spending in countries with efficient reimbursement policies. Additionally, the Asia-Pacific region emerges as the most dominant in the Intravascular Ultrasound (IVUS) catheters market, fueled by increasing healthcare expenditure, growing cardiovascular disease prevalence, and advancements in medical technology.

China and India, with their large patient pools and expanding healthcare infrastructure, drive significant market growth. Additionally, supportive government initiatives and rising awareness regarding early disease diagnosis further propel market expansion in the region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 669.23 Mn |

| Revenue Forecast In 2035 | USD 1273.98 Mn |

| Growth Rate CAGR | CAGR of 7.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, Age, Indication, Application, And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Abbott, ACIST Medical Systems, Boston Scientific Corporation, Cook, Cordis, GE HealthCare, ICU Medical, Inc., Infraredx, Inc. (Nipro Medical Corporation), Koninklijke Philips N.V., Medtronic, Terumo Medical Corporation, Other Market Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.