The Identity Threat Detection and Response (ITDR) Market Size is valued at USD 12.3 Bn in 2023 and is predicted to reach USD 58.0 Bn by the year 2031 at an 21.7% CAGR during the forecast period for 2024 to 2031.

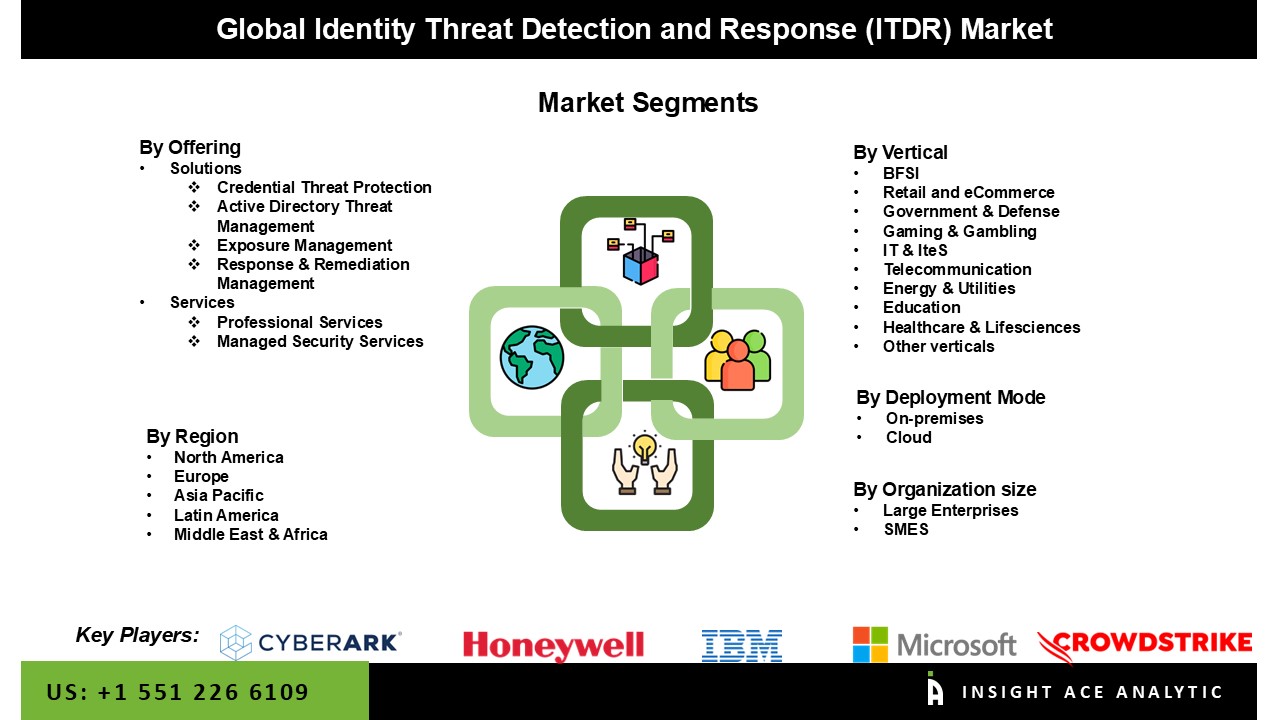

Identity Threat Detection and Response (ITDR) Market, Share & Trends Analysis Report By Offering (Solutions and Services), Deployment Mode (Cloud and On-premises), By Organization Size, By Vertical, By Region, and Segment Forecasts, 2024 to 2031

Identity Threat Detection and Response (ITDR) is a cybersecurity architecture and suite of technologies designed to detect, investigate, and mitigate threats that specifically target identities within an organization's digital environment. It focuses on protecting identity systems, such as privileged access management (PAM), identity and access management (IAM), and authentication services, which control access for users, devices, and applications to sensitive resources. ITDR represents a shift from traditional network perimeter defenses to an identity-centric security approach, which is particularly important as cloud services and remote work have weakened traditional perimeter protections. By monitoring for suspicious activities or anomalies related to user identities, such as unusual login patterns, credential misuse, or unauthorized access, ITDR tools leverage machine learning and behavioral analytics to detect deviations from typical user behavior. This proactive identity-based security framework is essential in safeguarding critical systems from credential-based attacks.

ITDR plays a critical role in helping organizations comply with key data protection regulations such as the EU's General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). GDPR imposes stringent requirements for safeguarding personal data, mandating that organizations implement appropriate technical and organizational measures, and ITDR helps ensure compliance by protecting identity systems. Similarly, HIPAA sets standards for the privacy and security of protected health information (PHI), making ITDR essential for healthcare organizations to prevent unauthorized access, use, or disclosure of PHI. A notable example of ITDR in action is the launch of Semperis' Lightning Identity Runtime Protection in May 2024. This advanced service, based on machine learning, is designed to counter identity attacks such as password spraying and credential stuffing, showcasing how ITDR technology is evolving to address modern cyber threats.

The Identity Threat Detection and Response (ITDR) Market is segmented based on the offering, deployment mode, organization size, vertical. Based on the offering, the market is divided into solutions and services. Based on the deployment mode, the market is divided cloud and on-premises. Based on the vertical, the market is divided into BFSI, retail and ecommerce, government & defense, gaming & gambling, it & ites, telecommunication, energy & utilities, education, healthcare &, lifesciences, other verticals. Based on organization size, the market is divided into large enterprises, SMES.

Based on the offering, the market is divided into solutions and services. Among these, the solution segment is expected to have the highest growth rate during the forecast period. The market is dominated by the solutions category because of its capacity to provide countermeasures against identity-based threats, such as password leaks and hacked user accounts. This is accomplished by quickly detecting any suspicious behavior through ongoing monitoring of user activity and access management logs. To improve the efficacy of the solution, additional data is collected from many identities and access management (IAM) sources. This includes gathering system logs and network traffic data to monitor and analyze it on endpoint devices such as workstations and laptops.

Based on the deployment mode, the market is divided cloud and on-premises. the cloud segment dominates the market. Cloud-based ITDR solutions often have lower upfront costs and reduced maintenance needs since they do not require extensive on-premises infrastructure. Many organizations prefer cloud-based models because they offer a subscription-based pricing structure, which lowers capital expenditure and shifts to an operational expenditure model. In contrast, on-premises solutions typically involve higher costs for hardware, software, and ongoing management. Cloud ITDR solutions often integrate more easily with existing cloud-based tools such as cloud identity and access management (IAM) platforms, security information and event management (SIEM) systems, and other security services. This ease of integration makes cloud-based ITDR solutions a more efficient choice for organizations already operating in the cloud.

North America, particularly the United States, faces a high volume of cyberattacks, including identity-based attacks such as credential theft, phishing, and privilege escalation. With cyber threats becoming increasingly sophisticated, organizations in North America are highly motivated to invest in robust ITDR solutions to protect identities and mitigate risks. North America is often at the forefront of adopting advanced technologies like cloud computing, artificial intelligence (AI), and machine learning (ML). ITDR solutions, which leverage AI and ML for identity-based threat detection, align well with the technological landscape in the region. The adoption of cloud-based solutions in North America is particularly high, which drives demand for ITDR systems that protect cloud environments.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 12.3 Bn |

| Revenue Forecast In 2031 | USD 58.0 Bn |

| Growth Rate CAGR | CAGR of 21.7% from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, By Deployment Mode, By Organization Size, By Vertical |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Microsoft, Ibm, Crowdstrike, Zscaler, Tenable, Varonis, Beyondtrust, Cyberark, Proofpoint, Quest, Oort (Cisco), Sentinelone, Vectra, Proficio, Qomplx, Adaptive Shield, Acalvio, Authomize, Illusive, Mindfire, Rezonate, Semperis, Silverfort, Stealthbits, Vericlouds, Microminder, Quorum Cyber, Mixmode, ZeroFox, Honeywell, Zimperium, Okta AI, Cisco, One Identity |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Identity Threat Detection and Response (ITDR) Market- By Offering

Global Identity Threat Detection and Response (ITDR) Market – By Deployment mode

Global Identity Threat Detection and Response (ITDR) Market – By Organization size

Global Identity Threat Detection and Response (ITDR) Market – By Vertical

Global Identity Threat Detection and Response (ITDR) Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.