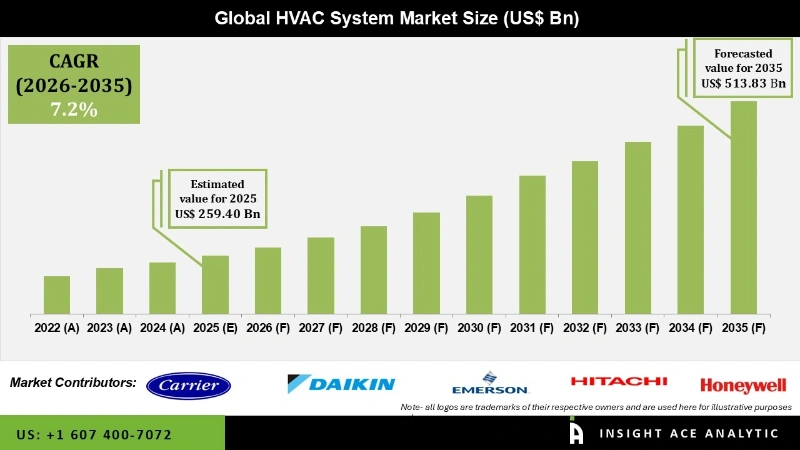

Global HVAC System Market Size is valued at USD 259.40 billion in 2025 and is predicted to reach USD 513.83 billion by the year 2035 at a 7.2% CAGR during the forecast period for 2026 to 2035.

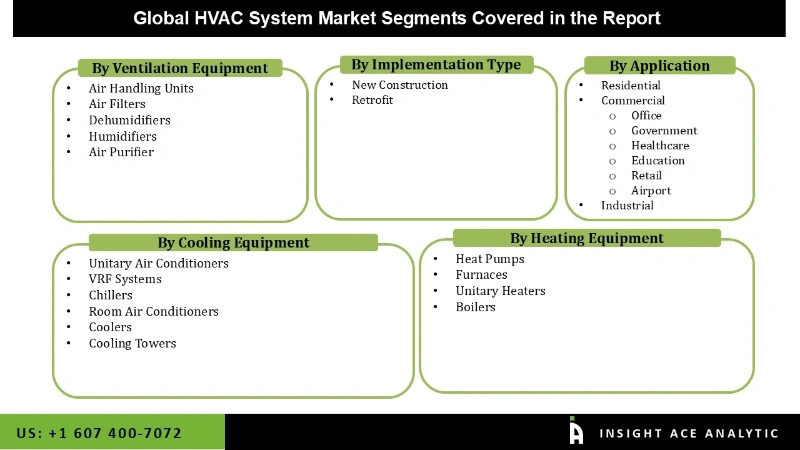

HVAC System Market Size, Share & Trends Analysis Report By Cooling Equipment (Unitary Air Conditioners, VRF Systems, Chillers, Room Air Conditioners, Coolers, And Cooling Towers), Heating Equipment (Heat Pumps, Furnaces, Unitary Heaters, And Boilers), Ventilation Equipment, Implementation Type, Application, By Region, And Segment Forecasts, 2026 to 2035.

Heating, ventilation, and cooling systems are used to transport air between indoor and outdoor spaces. They filter the interior air to keep the environment healthy and humidity comfortable. A key trend predicted to impact the market over the projected period is varying climatic conditions and the necessity to maintain an ambient climate in a building. Most customers have recently prioritized the availability of smart features and energy efficiency as essential purchase criteria, and this trend is projected to continue in the next years.

Furthermore, the increased building activity in the commercial and residential sectors and the demand from the food and beverage and telecommunications industries are expected to contribute considerably to market growth. Moreover, a shortage of competent professionals is projected to have a negative impact on market growth in the near future.

However, after the first occurrence of COVID-19 was revealed in December 2019, the global economy has seen tremendous disruption. The pandemic had a negative impact on global heating, ventilation, and cooling system market development in the first quarter of 2020. This is due to the lockdown effect that has occurred in nations such as Ireland, Germany, the United States, China, and others. The lockout interrupted production and diminished client demand for the equipment.

The HVAC System Market is segmented based on cooling equipment, heating equipment, ventilation equipment, implementation type and application. Based on cooling equipment, the market is segmented as unitary air conditioners, VRF systems, chillers, room air conditioners, coolers, and cooling towers. The heating equipment segment includes heat pumps, furnaces, unitary heaters, and boilers. By ventilation equipment, the market is segmented into air handling units, air filters, dehumidifiers, ventilation fans, humidifiers, and air purifiers. The implementation type segment includes new construction and retrofit. By application, the market is segmented into residential, commercial, and industrial.

The unitary air conditioners category is expected to hold a major share of the global HVAC system market in 2024. According to the International Energy Agency (IEA), cooling accounts for more than 10% of global electricity use. Increasing population and disposable incomes, particularly in hotter regions of the world, have encouraged the use of air conditioners, supporting the need for cooling equipment.

The residential segment is projected to grow rapidly in the global HVAC system market. The residential HVAC segment is expanding due to an increase in multi-family and single-family buildings. Residential HVAC (Heating, ventilation, and air conditioning) demand is predicted to remain more or less stagnant in developed areas of the world, but demand from emerging markets, particularly developing economies, is expected to be slightly higher. This is mostly due to the rising population in emerging economies and increased market maturity in mature markets.

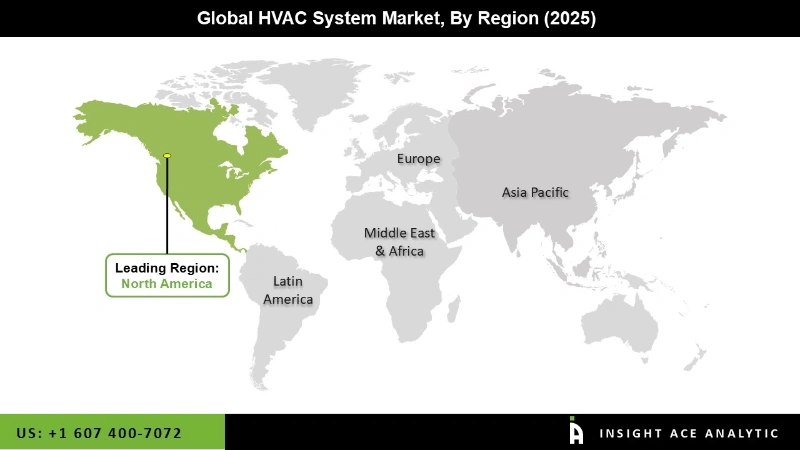

The Asia Pacific HVAC system market is expected to register the highest market share in terms of revenue in the near future. Rising urbanization, population expansion, and rising consumer disposable income have contributed to the region's phenomenal progress. Currently, the corporate sector has been increasingly offering opportunities for future regional growth. North America was the second-largest customer of HVAC systems, closely followed by Europe. The market for HVAC systems as a whole has matured; however, replacement sales owing to aged infrastructure or retrofit projects are opening new revenue streams for OEMs in addition to expanding into the services and maintenance area.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 259.40 Bn |

| Revenue forecast in 2035 | USD 513.83 Bn |

| Growth rate CAGR | CAGR of 7.2% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Cooling Equipment, Heating Equipment, Ventilation Equipment, Implementation Type And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Daikin Industries, Johnson Controls, Carrier, Trane Technologies plc., LG Electronics, Emersion Electronic Co., Honeywell International Inc., Mitsubishi Electric Corporation, Nortek Air Management, and Samsung Electronics. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

HVAC System Market By Cooling Equipment-

HVAC System Market By Heating Equipment-

HVAC System Market By Ventilation Equipment-

HVAC System Market By Implementation Type-

HVAC System Market By Application-

HVAC System Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.