Global Hospital At Home Market Size is valued at USD 22.8 Bn in 2024 and is predicted to reach USD 1160.6 Bn by the year 2034 at a 48.9% CAGR during the forecast period for 2025 to 2034.

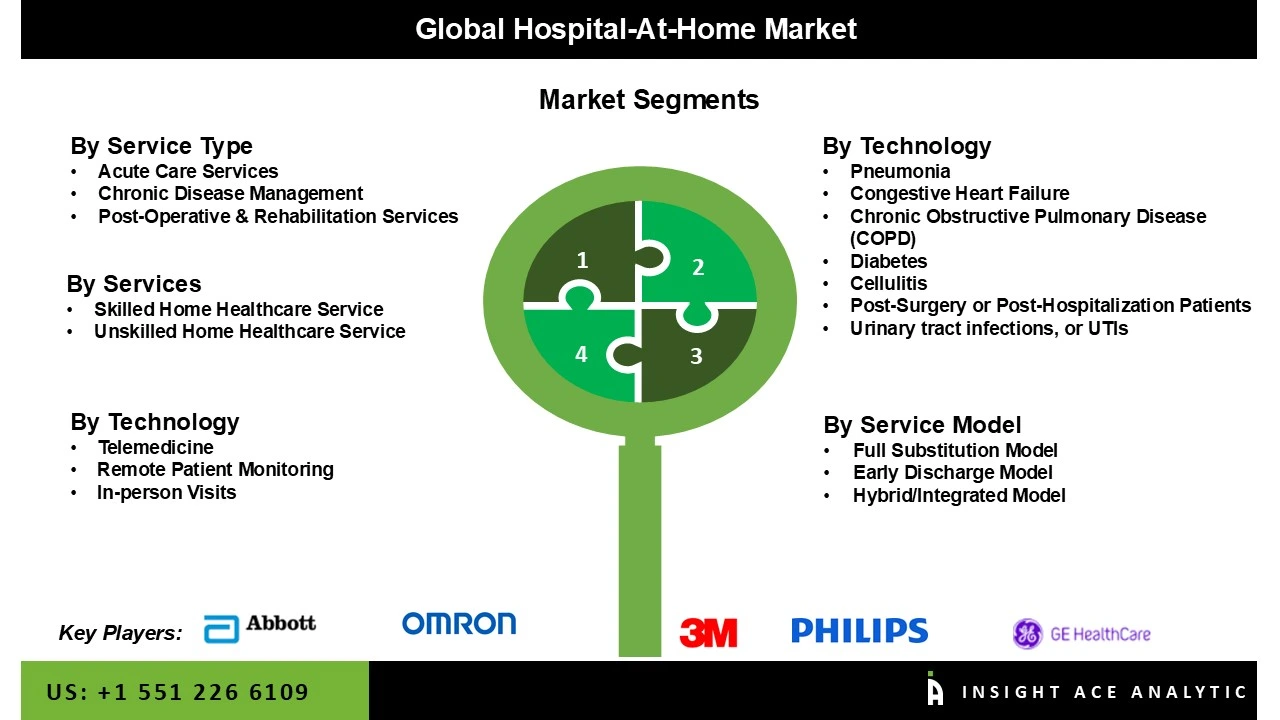

Hospital At Home Market Size, Share & Trends Analysis Report By Service Type (Therapeutic, Diagnostic), Application (Skilled Home Healthcare Service, Unskilled Home Healthcare Service), By Region, And Segment Forecasts, 2025 to 2034

The hospital-at-home business is growing because AI is being used everywhere. Hospital-at-home creates a smart, real-time world where most lines, paperwork, hassles, and drudgery are replaced by fast access to high-quality hospital care when and where it's needed most. Hospital-at-home offers a completely digital area that can be measured and can give the best care. Hospitals are having trouble finding enough beds for patients, so Hospital-at-Home markets are growing quickly.

The hospital-at-home sector offers various medical treatments for illnesses in residential settings. Injuries are treated at home, and overall health is improved. The doctor will decide on the course of treatment and any home treatments the patient might require. Depending on the patient's health, the duration of hospital-at-home might range from brief to long. Due to the rising need for blood glucose monitoring devices, home dialysis machines, and thermometers, there are many options for hospital-at-home devices, which accelerates market expansion.

The majority of developed and developing countries offer some level of partial or complete coverage for in-home services, which promotes market expansion. These services primarily consider geriatric chairs, bed rails, and belts as modes of movement. Nurses restricted patients' freedom of movement by preventing them from using the stairs, getting to their medications, organizing certain areas of the house, and performing other household tasks.

The hospital-at-home market is divided into Service Type and Application. Based on Service type, the market is segmented as therapeutic, and Diagnostic. By the Application, the market is segmented as Skilled Home Healthcare Service which comprises Physician/primary care, Nursing Care, Physical, Occupational, and/or Speech Therapy, Nutritional Support, Hospice & Palliative Care, Other Skilled Care Services. And another is Unskilled Home Healthcare Service.

The skilled nursing category is expected to hold a considerable share of the global hospital-at-home market in 2022. The wide range of daily tasks carried out by nurses to provide sufficient care for patients receiving homecare, the increased adoption of home-based treatments that require technical expertise in operating medical equipment, such as home dialysis equipment, home IV machinery, home oxygen therapy equipment, and the rising demand for home care for the elderly population are all factors contributing to the growth of this market.

The diabetes segment is projected to expand in the global hospital-at-home market growth. The increase in diabetes patients worldwide, who are more vulnerable to conditions like cardiovascular disease and Alzheimer's, is blamed for expanding this market. Additionally, the increased need for monitoring diabetes patients' blood pressure, cholesterol, hemoglobin, and heart rate also adds to the expansion of this market segment.

The North American region hospital-at-home market is expected to register the highest market share in revenue shortly. The U.S. market is expected to develop due to the population's high disposable incomes, an increase among individuals with chronic illnesses, and government initiatives to promote hospital-at-home. The use of hospital-at-home products and services is growing primarily due to factors like insufficiently developed healthcare systems, expensive in-hospital healthcare facilities, and chronic diseases requiring long-term care; businesses are concentrating on developing countries that will increase hospital-at-home services shortly.

In addition, the Asia Pacific region is projected to rise in the global Hospital-At-Home market. The growing number of older adults, a growing incidence of chronic diseases in developing countries, the growth of hospital-at-home expenditures in developing nations like China and India, and the preference for home-based treatments due to the increased costs of hospital services are all factors contributing to the regional market's expansion. The development of the Asia-Pacific hospital-at-home market is also driven by government efforts supporting home care and the introduction of innovative homecare goods.

| Report Attribute | Specifications |

| Growth rate CAGR | CAGR of 48.9 % from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Products, Services And Disease Indications |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; India; Japan; Brazil; Mexico; France; Italy; Spain; China; South Korea; Southeast Asia |

| Competitive Landscape | Amedisys, Aurora Enterprises, Bon Secours Mercy Health, Brookdale Senior Living, CenterWell Home Health, Central Logic, Conduit Health, Contessa, DispatchHealth, Encompass Health, HCA, Humana, Medalogix, Massachusetts General Brigham and Women's Hospital, Mayo Clinic, Medically Home, SENA Health, Senior Helpers, Trinity Health, UnitedHealth Group, Optum,LHC Group |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Hospital-At-Home Market By Service Type -

Hospital-At-Home Market By Services-

Hospital-At-Home Market By Technology-

Hospital-At-Home Market By Conditions-

Hospital-At-Home Market By Service Model-

Hospital-At-Home Market Companies:

Health Systems / Providers running HaH programs

Specialized HaH & Home Health Companies

Payers / Integrated Care Players

Technology & Enablers (care coordination / analytics)

Hospital-At-Home Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.