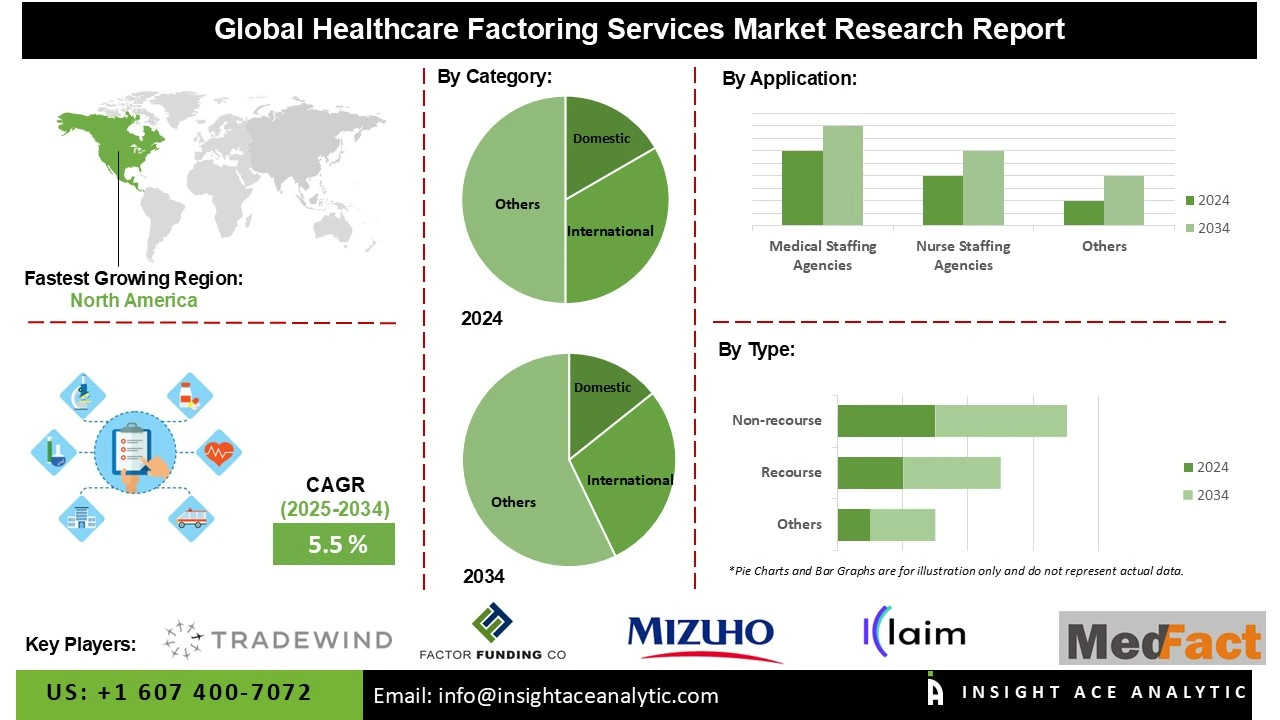

Global Healthcare Factoring Services Market Size is predicted to grow at an 5.5% CAGR during the forecast period for 2025 to 2034.

Healthcare Factoring Services Market Size, Share & Trends Analysis Distribution, By Category (Domestic and International), By Typem (Recourse and Non-recourse), By Application (Medical Staffing Agencies, Nurse Staffing Agencies, Home Healthcare, and Others), and By Segments Forecasts, 2025 to 2034

Healthcare factoring converts slow-paying insurance and government claims into immediate working capital, smoothing cash flow and mitigating AR volatility without adding balance-sheet debt. Providers use advances to cover payroll, supplies, and invest in equipment or expansion while avoiding loan underwriting hurdles.

Funding flexibility scales with receivables and payer credit quality, helping clinics, hospitals, labs, DME suppliers, and staffing firms manage growth. Outsourced collections and back-office support reduce administrative burden, accelerate reimbursement, and preserve provider–payer relationships, while non-recourse factoring limits credit risk. The global market for Healthcare Factoring Services is expanding due to the Rising healthcare spending, increased desire for liquidity among providers, and the expanding complexity of healthcare payment systems.

The growing elderly population is a key factor driving the healthcare factoring services market. Rising cases of chronic illnesses such as diabetes, cardiovascular diseases, and cancer are increasing patient volumes and overall healthcare utilization, further intensifying the need for reliable cash-flow solutions. According to the WHO, there were 125 million people aged 80 and above in 2018, and the proportion of individuals over 60 is projected to nearly double from 12% in 2015 to 22% by 2050. Despite this demand, limited awareness of factoring options among smaller providers continues to restrain adoption. However, the integration of digital platforms and fintech-driven tools is expected to unlock significant growth opportunities for the healthcare factoring services market throughout the forecast period.

Some of the Key Players in Healthcare Factoring Services Market:

· Waqati

· MedFact

· Factor Funding Co.

· Mizuho Factors, Ltd. (a subsidiary of Mizuho Financial Group, Inc.)

· Tradewind

· Klaim AI

· PRN Funding Inc.

· Viva Capital

· Charter Capital Holdings

· US MED Capital

· Xynergy Healthcare Capital

· Porter Capital

· Factor Funding Co.

· Others

The healthcare factoring services market is segmented by category, type, and application. By category, the market is segmented into domestic and international. By type, the market is segmented into recourse and non-recourse. By application, the market is segmented into medical staffing agencies, nurse staffing agencies, home healthcare, and others.

The Domestic segment led the healthcare factoring services market in 2024. This convergence is fueled by increasing frequency of chronic diseases, growing populations, and rising healthcare spending are the main factors driving the segment's rise. Despite having limited access to traditional bank financing, they can conduct operations, maintain supply chains, and make infrastructure investments by selling receivables to factoring companies, which gives them instant access to working cash. Healthcare providers, especially smaller clinics and pharmacies, are using factoring services to deal with cash flow issues.

Recourse factoring represents the largest and fastest-growing segment, driven by the rising need for flexible financing as healthcare demand accelerates due to urbanization, population growth, and the increasing prevalence of chronic diseases. Many providers are turning to external funding to scale operations, purchase supplies, meet payroll, and upgrade infrastructure without assuming long-term debt. Recourse factoring is particularly valuable because it offers quick access to short-term liquidity, enabling organizations to pursue expansion initiatives and respond rapidly to changing patient care requirements. By avoiding prolonged waiting periods for claim settlements, healthcare providers can maintain smooth operations and support strategic growth.

North America dominated the healthcare factoring services market in 2024. The United States is at the forefront of this expansion. Because its vast, insurance‑driven healthcare system creates large receivables and long payment cycles from Medicare, Medicaid, and private payers, making factoring a common working‑capital tool for providers and vendors. A mature financial ecosystem, widespread fintech‑enabled factoring platforms, and clear legal frameworks support high adoption, while provider consolidation and complex billing/RCM workflows further expand AR volumes and demand for specialized, HIPAA‑aware factors.

With private healthcare sector becoming more and more common in the Asia-Pacific area, the healthcare factoring services market is expanding at the strongest and fastest rate in this region. Additionally, as insurance penetration climbs, and medical costs rise, swelling receivables and lengthening reimbursement cycles that favor factoring adoption. Rapid digitalization e-invoicing, real-time payments, and fintech platforms lowers onboarding friction and broadens access to working-capital solutions for clinics, hospitals, labs, and staffing firms. Coupled with SME growth and cross-border trade, these factors give APAC the highest CAGR in factoring, with healthcare a standout end-market

Healthcare Factoring Services Market by Category

· Domestic

· International

Healthcare Factoring Services Market by Type

· Recourse

· Non-recourse

Healthcare Factoring Services Market by Application

· Medical Staffing Agencies

· Nurse Staffing Agencies

· Home Healthcare

· Others

Healthcare Factoring Services Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.