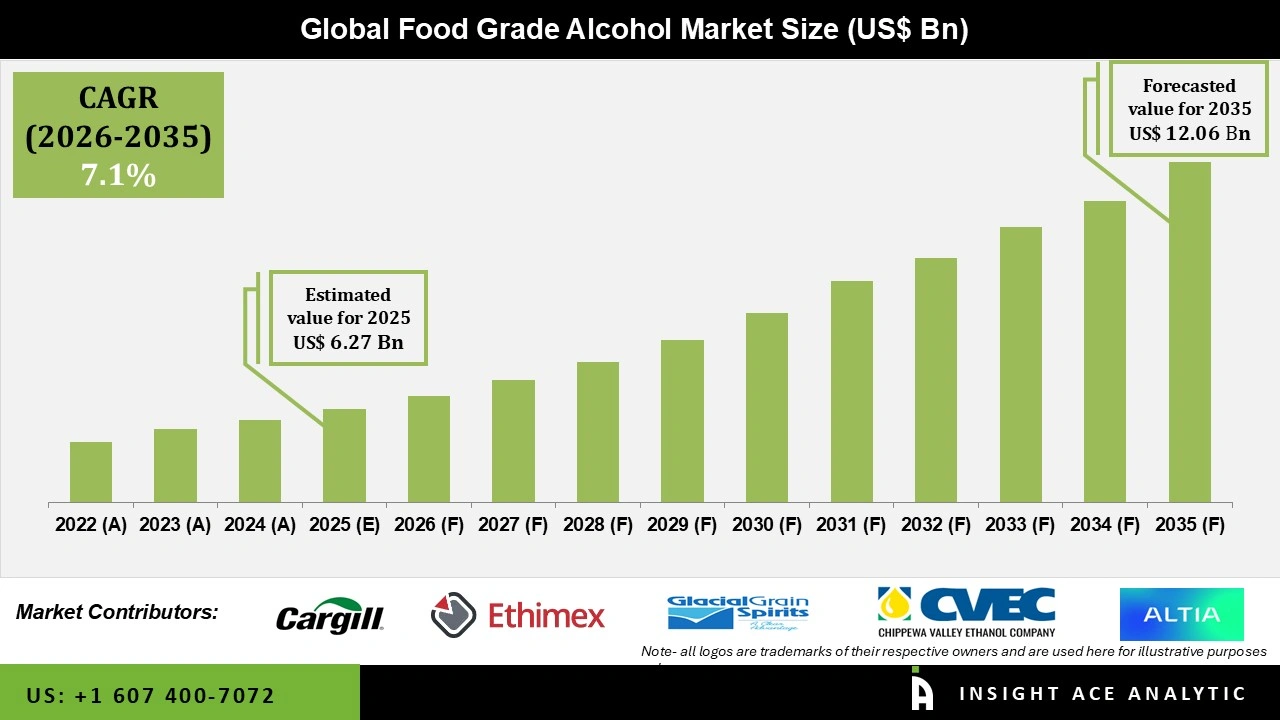

Global Food Grade Alcohol Market Size is valued at USD 6.27 Billion in 2025 and is predicted to reach USD 12.06 Billion by the year 2035 at a 7.1% CAGR during the forecast period for 2026 to 2035.

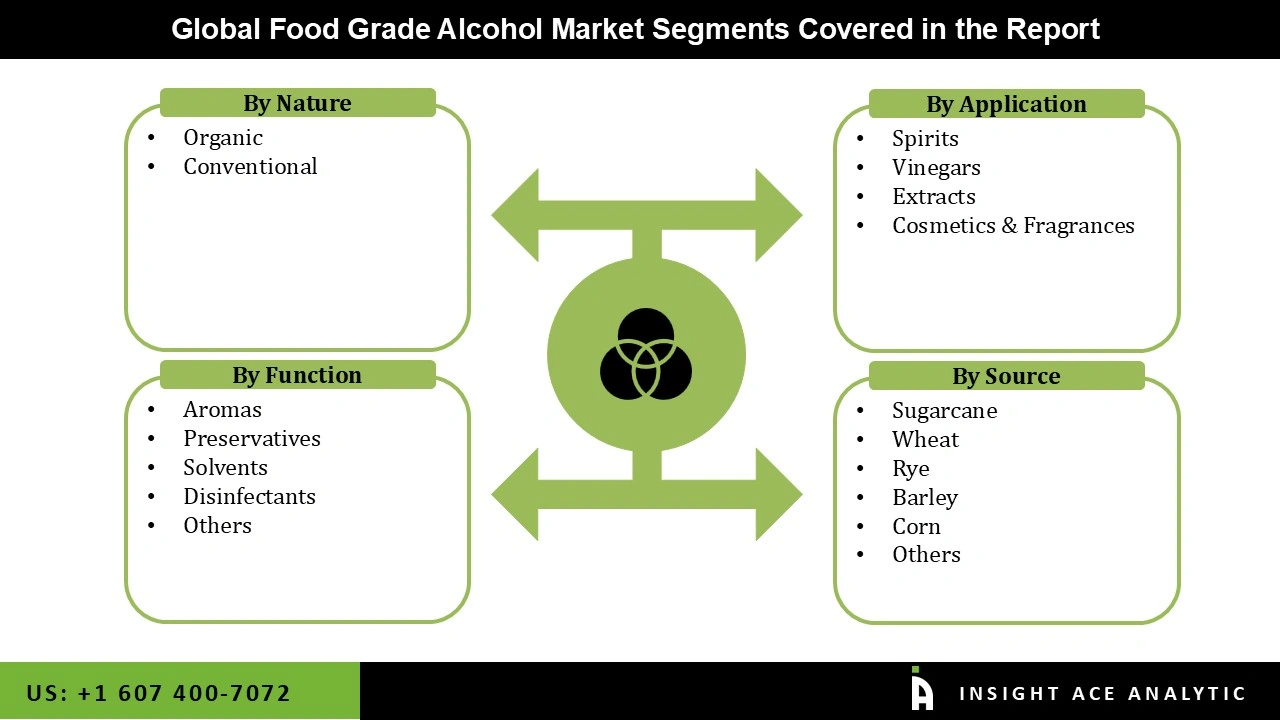

Food Grade Alcohol Market Sizae, Share & Trends Analysis Report By Nature (Organic, Conventional), By Application (Spirits, Vinegars, Extracts, Cosmetics & Fragrances), By Source, By Functions, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Food grade alcohol is ethyl alcohol that is safe to consume. Food-grade alcohol is also known as food-grade ethanol, non-denatured alcohol, grain alcohol, and Anhydrous Ethanol in the industry. Food-grade ethanol is a potent natural human-safe solvent that can be used in a variety of food-safe applications such as extraction and foods that may come into contact with people. The key driving reason assisting market expansion for food grade alcohol is an increase in consumer income and expenditure, as well as rising urbanization, which is resulting in growth in the processed food market. This increase in demand for food additives creates potential for expansion in the food grade alcohol market. Furthermore, the use of alcoholic beverages as part of social meet and greet events has fueled market growth. Polyols, for instance, are widely used in the pharmaceutical and nutraceutical industries as dietary supplements, functional food and beverages, and sanitization solutions.

Meanwhile, changing raw material prices and strict restrictions are projected to stymie expansion in the food grade alcohol market. However, due to new product development and the shift of associated products from the luxury to the basic’s segments, these barriers are expected to be insignificant in the next years.

The Food Grade Alcohol market is segmented on the basis of nature, application, functions, and sources. Based on nature, the market is categorized as Organic and Conventional. The application segment includes Spirits, Vinegars, Extracts and Cosmetics & Fragrances. By functions, the market is segmented into Aromas, Preservatives, Solvents, Disinfectants and Others. By sources segment, the market is segmented into, Sugarcane, Wheat, Rye, Barley, Corn and Others.

Sugarcane sources dominated the food grade alcohol market. The need is attributable to the fact that it is a major source of food-grade alcohol manufacturing. Due to extensive raw material availability, key countries sourcing alcohol from sugarcane include Brazil, India, China, and Thailand. Over the projection period, the grains segment is expected to rise at a CAGR. Its consumption in the production of various forms of alcohol is expected to drive growth. Wheat, corn, maize, and rice are some of the grains utilized in the manufacturing of alcohol. Corn and rye are frequently used in the production of whiskey all over the world. The fundamental function of rye grain is to impart flavour to the final product.

The spirit category dominated the market over the forecast period due to a rise in premium/super-premium whiskey consumption and a shift in demand from beer to distilled spirits, including rum, whiskey, vodka, and others. It's made by distilling grains, fruits, vegetables, or sugar that have already been fermented alcoholically. Distilled beverages are often slightly sweet, bitter, and have a scorching feeling, as well as a strong odour from the alcohol; the specific flavour varies depending on the type of liquor and the impurities it contains. As a result of its prompt growth rate and substantial revenue contribution, this segment is anticipated to deliver strong demand stability as well as a considerable return on investment for stakeholders.

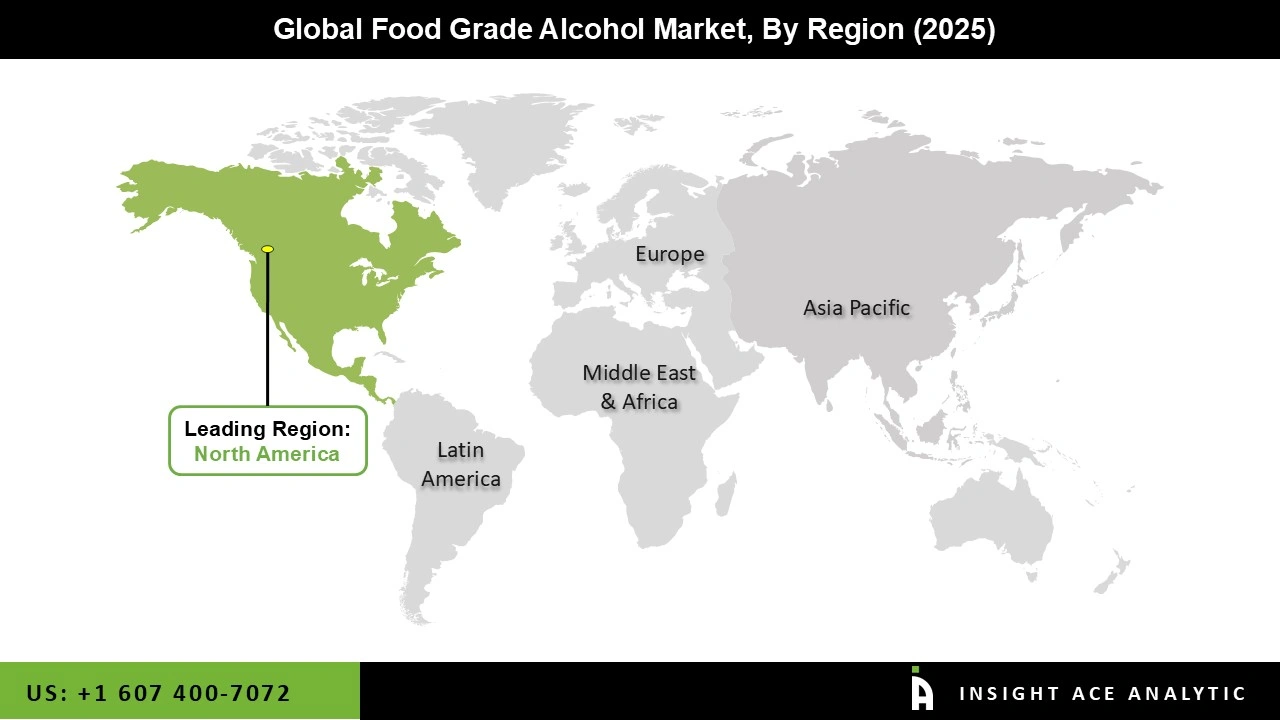

Europe held the largest market share. The demand is attributed to an upsurge in food and beverage consumption and expanded regional consumer expenditure. Europe is a large buyer of alcoholic beverages, with demand patterns altering significantly across the continent. Cultural changes, economic development, affordability, and easy access to alcohol are all necessary reasons for the region's high alcohol use.

The region of North America, on the other hand, is expected to grow at the fastest rate during the projection period. An increase in the consumption of food products made with food-grade alcohol is predicted to drive the expansion. The product is gaining popularity among customers as well as food and beverage producers due to its adaptability in providing a wide range of culinary flavors.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 6.27 Billion |

| Revenue Forecast In 2035 | USD 12.06 Billion |

| Growth Rate CAGR | CAGR of 7.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Nature, By Application, By Source, By Functions |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Cargill, Inc., Fairly Traded Organics, Ethimex Ltd., Organic Alcohol Company, GLACIAL GRAIN SPIRITS, CHIPPEWA VALLEY ETHANOL COMPANY, Essentica, MGP Ingredients, Altia Industrial, Highwater Ethanol, LLC, Roquette Frères, Grain Processing Corporation, Fonterra Co-Operative Group, Manildra Group and Other Prominent Player. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.