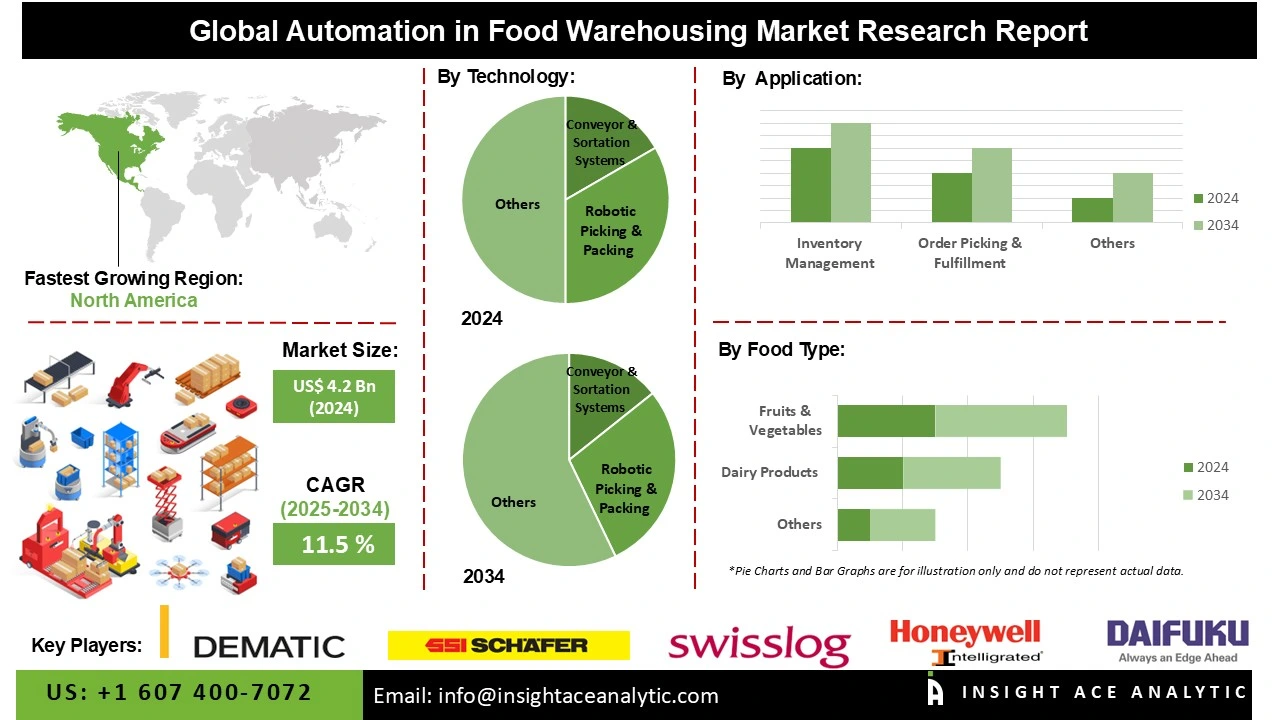

Automation in Food Warehousing Market Size is valued at US$ 4.2 Bn in 2024 and is predicted to reach US$ 12.0 Bn by the year 2034 at an 11.5% CAGR during the forecast period for 2025-2034.

Automation in warehousing is the process of automating certain processes in a warehouse setting, utilizing machines and technology. Robotics, conveyors, automated guided vehicles (AGVs), warehouse management software (WMS), and automated storage and retrieval systems (AS/RS) are all included in this. In food warehousing, automation seeks to boost productivity, decrease human error, and cut expenses. The increasing need for precise and effective food storage solutions, rising labor costs, and technological developments in automation systems are some of the reasons driving the growth of the food warehousing market's automation sector.

The growing need for operational effectiveness is a major factor in the growth of the food warehousing market. Food warehouses have to meet increased throughput requirements as e-commerce grows and the demand for quick, precise order fulfillment increases. Automated systems have become widely used due to the need to decrease human error, enhance inventory management, and expedite order picking. Additionally, the market for automation in food warehousing is being driven by the increased focus on sustainability and lowering carbon footprints. Automated systems are designed to maximize energy use, reduce waste, and increase productivity.

Some of the Key Players in Automation in Food Warehousing Market:

· Dematic

· Körber AG

· Elettric80 S.p.A.

· Honeywell Intelligrated

· SSI Schäfer

· Murata Machinery

· Vanderlande Industries

· Daifuku Co., Ltd.

· Swisslog Holding AG

· Mecalux

· AutoStore

· Knapp AG

· Blue Yonder (JDA Software)

· Locus Robotics

· Fetch Robotics

· Zebra Technologies

· GreyOrange

· Amazon Robotics

· Symbotic

· Bastian Solutions

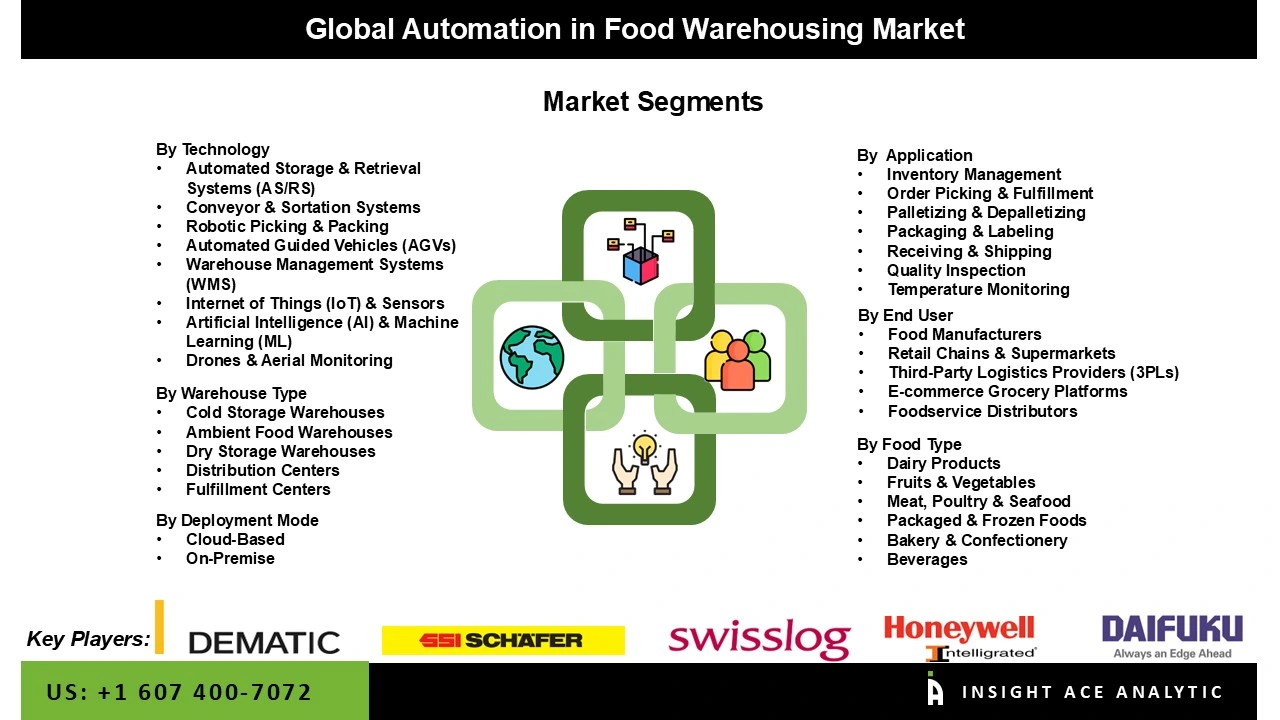

The Automation in food warehousing market is segmented by warehouse type, food type, technology type, application, deployment mode, and end-use. By warehouse type, the market is segmented into dry storage warehouses, cold storage warehouses, distribution centers, ambient food warehouses, and fulfillment centers. By food type, the market is segmented into dairy products, fruits & vegetables, packaged & frozen foods, beverages, bakery & confectionery, and meat, poultry & seafood.

By technology type, the market is segmented into warehouse management systems (WMS), automated storage & retrieval systems (AS/RS), automated guided vehicles (AGVs), robotic picking & packing, conveyor & sortation systems, internet of things (IoT) & sensors, drones & aerial monitoring, and artificial intelligence (AI) & machine learning (ML).

By application, the market is segmented into packaging & labeling, inventory management, palletizing & depalletizing, order picking & fulfillment, quality inspection, receiving & shipping, and temperature monitoring. By deployment mode, the market is segmented into cloud-based and on-premises. By end-use, the market is segmented into food manufacturers, e-commerce grocery platforms, third-party logistics providers (3PLs), retail chains & supermarkets, and foodservice distributors.

The cold storage segment led the automation in food warehousing market in 2024. Perishable goods like fruits, vegetables, dairy products, and meat must be kept in cold storage facilities. Product shelf life is increased, and the risk of spoilage is decreased in cold storage warehouses thanks to automation, which guarantees accurate temperature control. Palletizing systems and AS/RS are two examples of technologies that are very helpful in cold storage settings when low temperatures make manual handling difficult. As the worldwide supply chain for perishable commodities grows more intricate, there will likely be a greater need for effective cold storage solutions.

The automated storage & retrieval systems (AS/RS) segment dominated the automation in food warehousing market in 2024. The capacity of AS/RS to automate the placement and retrieval of items, which greatly lowers labor costs and increases storage density, makes them very desirable. These technologies are essential to contemporary warehouse operations, especially in settings where precision and fast throughput are critical. Significant gains in operational effectiveness and space utilization may arise from the adoption of AS/RS.

The market for automation in food warehousing was dominated by North America in 2024. The need for automated warehouses is rising sharply as e-commerce and internet shopping continue to expand. As an increasing number of consumers choose to purchase online, companies must manage high order quantities in a timely and effective manner. Warehouses that can manage inventory and complete orders more quickly are now essential due to the increase in demand. Automated technologies such as automated storage and retrieval systems (ASRS), robotic pickers, and conveyor systems enable process optimization, productivity gains, and the elimination of human labor. Additionally, the high rate of advanced technology adoption and the presence of major industry players are driving growth in the North American food warehouse automation market.

Over the projected period, Asia-Pacific exhibits profitable expansion in the food warehousing automation market. The retail and e-commerce industries in Asia-Pacific are expanding significantly, which is raising demand for effective and affordable food storage solutions. E-commerce is growing quickly in nations like China, Japan, and India, which makes food warehouse automation necessary to manage the growing number of online orders. Furthermore, government initiatives like the Make in India campaign, which encourages infrastructure investment, and the National Logistics Policy, which aims to reduce logistics costs, create an environment that is favorable for the adoption of cutting-edge warehousing technologies, which accelerates the market's rapid growth.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 4.2 Bn |

| Revenue Forecast In 2034 | USD 12.0 Bn |

| Growth Rate CAGR | CAGR of 11.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Warehouse Type, By Food Type, By Technology Type, By Application, By Deployment Mode, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Dematic, Körber AG, Elettric80 S.p.A., Honeywell Intelligrated, SSI Schäfer, Murata Machinery, Vanderlande Industries, Daifuku Co., Ltd., Swisslog Holding AG, Mecalux, AutoStore, Knapp AG, Blue Yonder (JDA Software), Locus Robotics, Fetch Robotics, Zebra Technologies, GreyOrange, Amazon Robotics, Symbotic, and Bastian Solutions |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Automation in Food Warehousing Market by Warehouse Type

· Dry Storage Warehouses

· Cold Storage Warehouses

· Distribution Centers

· Ambient Food Warehouses

· Fulfillment Centers

Automation in Food Warehousing Market by Food Type

· Dairy Products

· Fruits & Vegetables

· Packaged & Frozen Foods

· Beverages

· Bakery & Confectionery

· Meat, Poultry & Seafood

Automation in Food Warehousing Market by Technology Type

· Warehouse Management Systems (WMS)

· Automated Storage & Retrieval Systems (AS/RS)

· Automated Guided Vehicles (AGVs)

· Robotic Picking & Packing

· Conveyor & Sortation Systems

· Internet of Things (IoT) & Sensors

· Drones & Aerial Monitoring

· Artificial Intelligence (AI) & Machine Learning (ML)

Automation in Food Warehousing Market by Application

· Packaging & Labeling

· Inventory Management

· Palletizing & Depalletizing

· Order Picking & Fulfillment

· Quality Inspection

· Receiving & Shipping

· Temperature Monitoring

Automation in Food Warehousing Market by Deployment Mode

· Cloud-Based

· On-Premises

Automation in Food Warehousing Market by End-use

· Food Manufacturers

· E-commerce Grocery Platforms

· Third-Party Logistics Providers (3PLs)

· Retail Chains & Supermarkets

· Foodservice Distributors

Automation in Food Warehousing Market by Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.