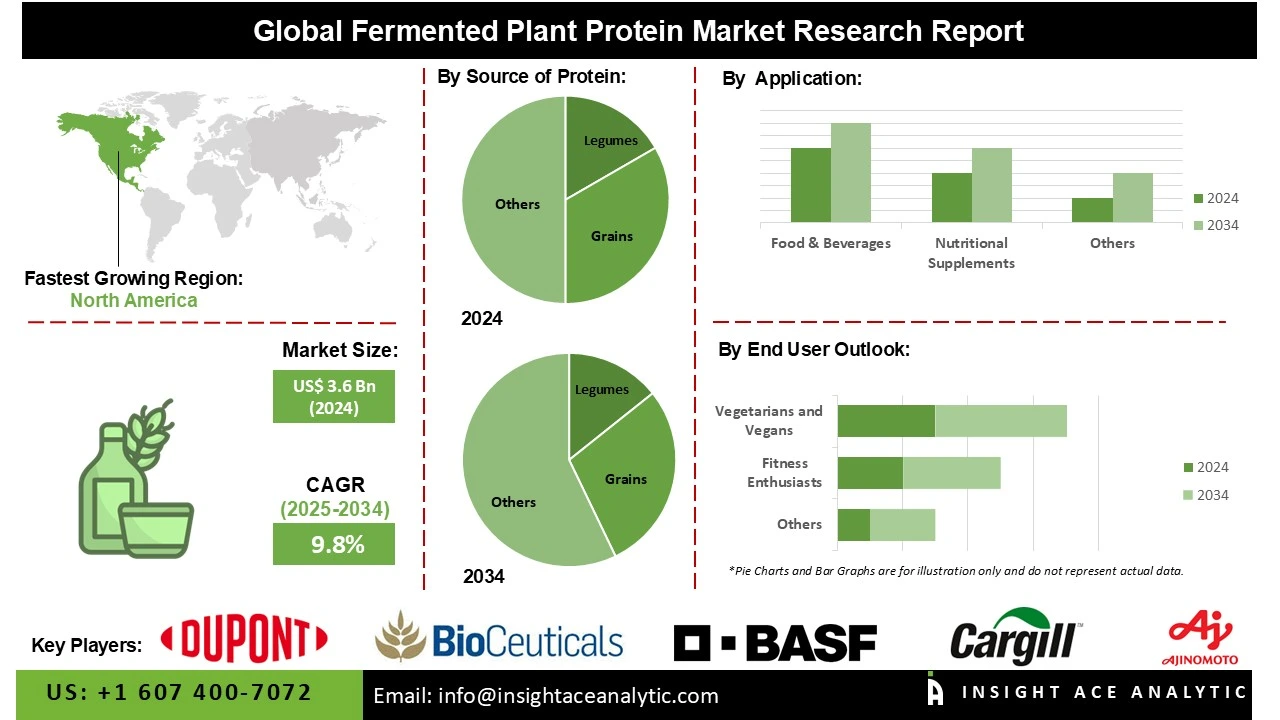

Fermented Plant Protein Market Size is valued at US$ 3.6 Bn in 2024 and is predicted to reach US$ 9.1 Bn by the year 2034 at an 9.8% CAGR during the forecast period for 2025-2034.

Fermented plant proteins are plant-based proteins (like soy or pea) that are processed using beneficial microbes through fermentation. This improves their digestibility, taste, and nutrient absorption, making them ideal for use in plant-based foods, supplements, and meat alternatives. Improvements in fermentation technologies, the growing use of fermented plant proteins in a variety of industries, and increased awareness of the environmental as well as health advantages of plant-based protein substitutes are all factors contributing to the growth of the fermented plant protein market.

In addition, concerns about animal welfare, environmental sustainability, and health are driving an increasing number of people to choose vegetarian and vegan lifestyles. The fermented plant proteins are becoming well-known for their higher nutritional content, improved flavour profile, and superior digestibility. Due to these qualities, health-conscious customers find fermented plant proteins to be an appealing alternative, which propels the fermented plant protein market expansion. Additionally, the development of fermentation technology is a major growth driver of the market. The quality and scalability of fermented plant proteins have greatly increased due to biotechnology advancements that have made it possible to create more economical and effective fermentation procedures.

Some of the Key Players in the Fermented Plant Protein Market:

The Fermented Plant Protein market is segmented by source of protein, form, application, distribution channel, and end-user. By source, it includes Legumes, Nuts And Seeds, Vegetables, Grains, And Fermented Algae. In terms of form, the market covers granules, powder, ready-to-drink beverages, capsules, and bars. Applications span across food & beverages, pharmaceuticals, nutritional supplements, cosmetic products, and animal feed. Distribution channels consist of direct sales, online retail, supermarkets and hypermarkets, specialty stores, and health food stores. Finally, the end-users include sports nutrition, fitness enthusiasts, vegetarians and vegans, general population, and health-conscious consumers.

In 2024, the market for fermented plant protein was led by the powder category. Many plant-based foods use the powder segment. The segment's longer shelf life and simplicity of storage make it suitable for a wide variety of food and beverage goods, which boosts the segment's expansion. Additionally, because powders are utilized in dietary supplements and nutritional items, they have a significant impact on market expansion. Customers' continued desire for fermented plant-based options in various food & beverage industries is likely to fuel the segment's expansion, keeping it a dominant player in the market.

Sports nutrition products, including protein powders, energy bars, and supplements, are increasingly using fermented plant proteins, such as soy, pea, and rice proteins, due to their ability to enhance muscle growth, performance, and recovery. Fermented plant proteins have become more popular in this market due to athletes' and consumers' rising desire for plant-based, clean-label sports nutrition solutions. These components are thought to be a sustainable and natural substitute for conventional casein or whey-based proteins, offering a superior and easily absorbed plant-based protein supply.

In 2024, the fermented plant protein market was dominated by the North American region. The need for fermented plant proteins in this area is being driven by the growing acceptance of veganism and the expanding availability of plant-based dietary products. For environmental and health reasons, an increasing number of people in the US and Canada are switching to plant-based diets. Furthermore, the market for fermented plant protein is anticipated to increase in North America due to the existence of a well-established food sector and the growing emphasis on natural and sustainable food components.

Moreover, the market for fermented plant protein is anticipated to grow significantly in the Asia Pacific region. The market for fermented plant proteins is being driven by consumers' growing preference for plant-based diets in countries such as China, India, and Japan. The region's market growth is further bolstered by the traditional use of fermentation in Asian cuisines and the prevalence of vegetarianism. Additionally, the increase in disposable income increases consumer demand for high-quality protein sources, which propels the expansion of the fermented plant protein market.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 3.6 Bn |

| Revenue Forecast In 2034 | USD 9.1 Bn |

| Growth Rate CAGR | CAGR of 9.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Source of Protein, By Form, By Application, By Distribution Channel, By End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Ingredion, Ajinomoto, DuPont, Genuine Health, Body Ecology, FIT-BioCeuticals, BASF, Jarrow Formulas, Sotru, Cargill, and PlantFusion |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Fermented Plant Protein Market by Source of Protein-

· Legumes

· Nuts and Seeds

· Vegetables

· Grains

· Fermented Algae

Fermented Plant Protein Market by Form-

· Granules

· Powder

· Ready-to-drink Beverages

· Capsules

· Bars

Fermented Plant Protein Market by Application-

· Food & Beverages

· Pharmaceuticals

· Nutritional Supplements

· Cosmetic Products

· Animal Feed

Fermented Plant Protein Market by Distribution Channel-

· Direct Sales

· Online Retail

· Supermarkets and Hypermarkets

· Specialty Stores

· Health Food Stores

Fermented Plant Protein Market by End-user-

· Sports Nutrition

· Fitness Enthusiasts

· Vegetarians and Vegans

· General Population

· Health-Conscious Consumers

Fermented Plant Protein Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.