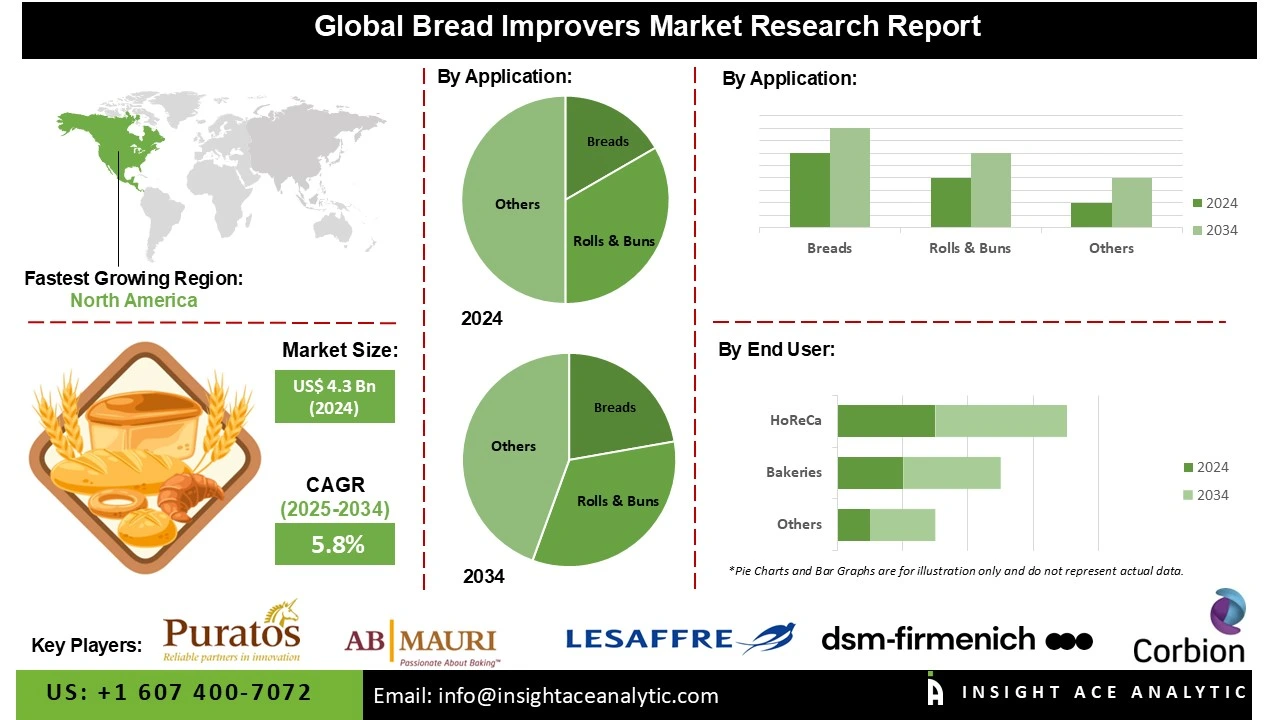

Global Bread Improvers Market Size is valued at US$ 4.3 Bn in 2024 and is predicted to reach US$ 7.4 Bn by the year 2034 at an 5.8% CAGR during the forecast period for 2025-2034.

Bread improvers, also referred to as dough conditioners, are culinary additives made out of soy flour, enzymes, emulsifiers, and oxidizing and reducing agents. They improve functionality, ease the baking process, and activate the gluten. They help to enhance the bread's tenderness, colour, flavour, texture, and composition. Additionally, they contribute to improved volume, workability, robustness, and waste reduction.

The growing bakery industry is driving the expansion of the bread improvers market. The need for innovative ideas to enhance product quality and meet customer preferences is increasing as the bread industry evolves and diversifies.

The demand for bread improvers is also being driven by the rising popularity of convenience foods and on-the-go snacks, as producers aim to create bakery goods that are convenient without sacrificing flavour or quality. Furthermore, as bakers strive to differentiate themselves from the competition in a crowded market, the growth of speciality bread types and artisanal bakeries further fuels the increasing use of bread ameliorators. Additionally, businesses in the market are launching new goods to increase their market share and fortify their positions.

However, the bread improvers market is challenged by regulatory restrictions and compliance, though. Food additives, labelling, and safety requirements are all governed by strict regulations that might vary greatly between nations and regions.

Some of the Key Players in the Bread Improvers Market:

The Bread Improvers market is segmented by Application and End-use. By Application, the market is segmented into Breads, Flatbreads, Rolls & Buns, and Others. By End-use, the market is segmented into Bakeries, Food Processing Companies, HoReCa, and Others.

Since bread is a staple item consumed worldwide, the bread segment is the largest and most significant consumer of bread improvers. In this section, bread improvers are used to increase volume, prolong shelf life, and improve dough handling qualities. The expansion of this market is being driven by the rising demand for specialized and artisanal bread, which demands a constant level of quality and texture. Further driving the market's expansion is the growing popularity of health-conscious bread products, such as whole-grain and gluten-free varieties, which require the use of speciality improvers.

Food processing enterprises dominate the global market for bread improvers because of their capacity for large-scale manufacturing and the steady need for consistent, high-quality bakery goods. To ensure product uniformity, superior texture, longer shelf life, and improved dough handling in automated production settings, these businesses primarily rely on bread improvers. Food processors require dependable ingredient solutions that enable high-speed manufacturing and long-distance distribution, driven by the growing demand for packaged and ready-to-eat bakery goods. In order to preserve brand quality, bread improvers allow them to remain consistent between batches and geographical areas.

In 2024, Europe dominated the global market for bread improvers. The robust demand for baked goods and a well-established bakery sector are the primary catalysts of this dominance. The market for natural and organic bread improvers is propelled by the region's rising inclination towards convenience foods and an escalating trend for clean-label and health-oriented bakery products. Europe possessed a significant share of the industry due to its innovative bakery products, rigorous quality standards, and vibrant bread culture. European bakeries possess a rich history of bread production and consistently innovate to satisfy evolving consumer preferences. The artisanal, industrial, and specialized bakeries comprising the region's flourishing baking sector rely on bread improvers to enhance the quality of their goods. Moreover, the European Union's stringent food safety regulations promote the extensive utilization of bread improvers to ensure compliance and satisfy consumer expectations.

Bread Improvers Market by Application-

· Breads

· Flatbreads

· Rolls & Buns

· Others

Bread Improvers Market by End-use-

· Bakeries

· Food Processing Companies

· HoReCa

· Others

Bread Improvers Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.