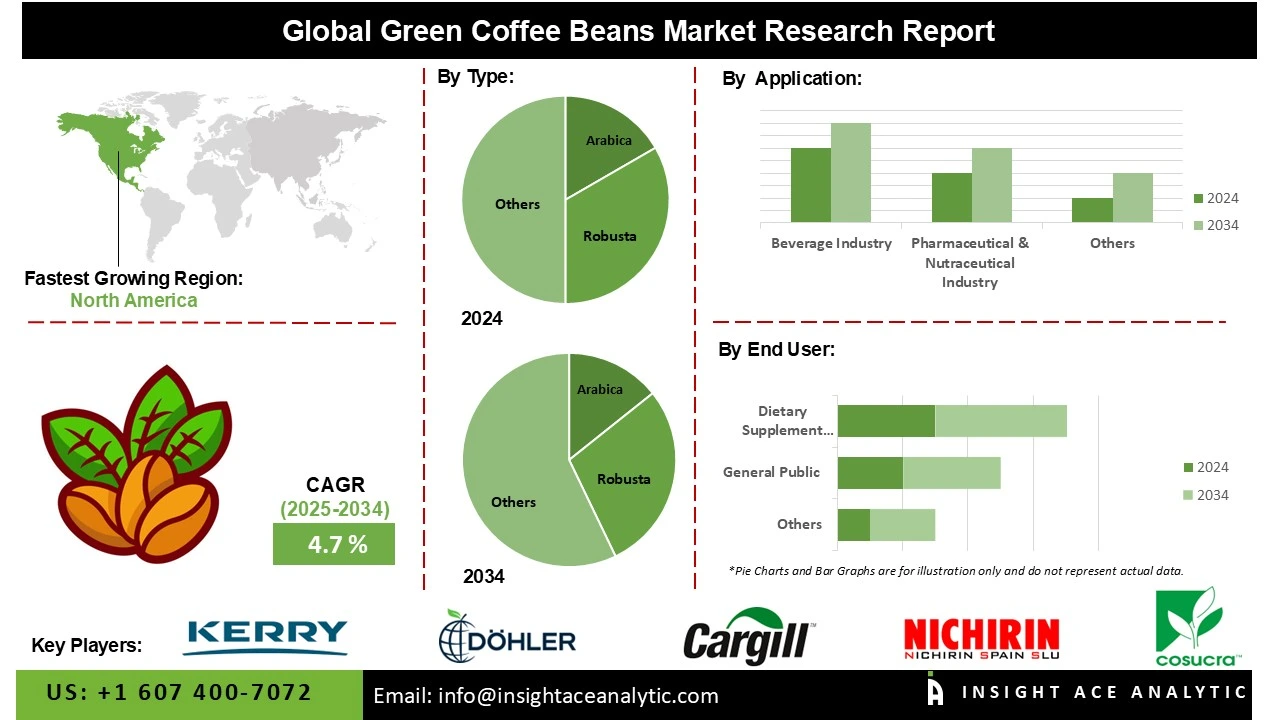

Global Green Coffee Beans Market Size is predicted to grow at an 5.0% CAGR during the forecast period for 2026 to 2035.

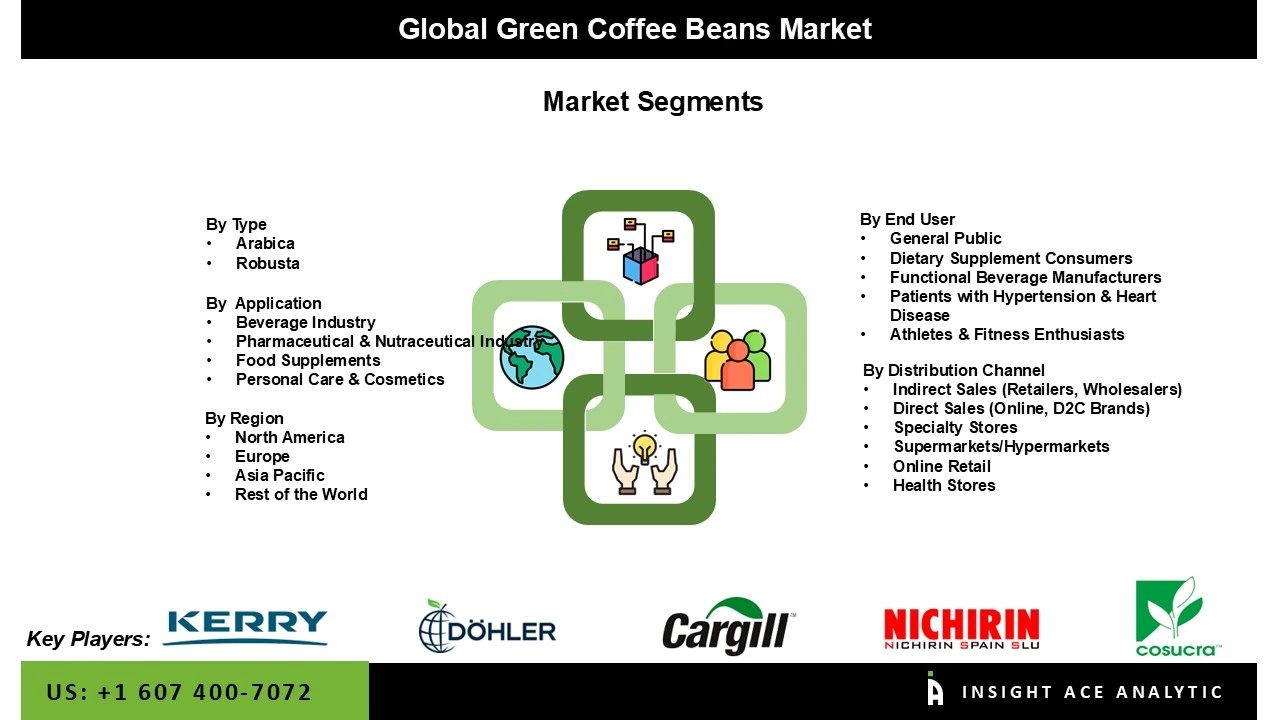

Green Coffee Beans Market Size, Share & Trends Analysis Distribution by Type (Robusta and Arabica), Application (Food Supplements, Beverage Industry, Personal Care & Cosmetics, Pharmaceutical & Nutraceutical Industry), Distribution Channel (Indirect Sales (Retailers, Wholesalers), Direct Sales (Online, D2C Brands), Supermarkets/Hypermarkets, Health Stores, Specialty Stores, and Online Retail), End-user, By Region and Segment Forecasts, 2026 to 2035

Green coffee beans are unroasted, raw seeds of the coffee plant. They maintain a verdant hue and are abundant in antioxidants such as chlorogenic acid. These beans are utilized for roasting to create conventional coffee or for the formulation of health supplements. They possess a subtle, herbal flavor and are predominantly cultivated in tropical areas such as Brazil, Ethiopia, and Vietnam.

Unroasted coffee beans are sold in the green coffee beans market and are necessary for preparing a range of coffee beverages. The consumers' increasing interest in health and wellness is leading them to place greater value on natural and minimally processed items. Thus, the green coffee's increasing popularity due to its purported health benefits is driving the green coffee beans market's growth.

The growing use of green coffee beans in the functional food and beverage sector is another important growth driver in the market. Green coffee beans are being used more often by food makers in a variety of products, such as ready-to-drink beverages, energy drinks, and nutritious snacks. Green coffee beans' modest flavor profile and adaptability make them easy to incorporate into a variety of compositions without sacrificing texture or flavor. Additionally, the growth of the green coffee beans industry has been significantly influenced by the development of digital retail platforms and e-commerce.

Some of the Key Players in the Green Coffee Beans Market:

The Green coffee beans market is segmented based on type, application, distribution channel, and end-user. By type, it includes Robusta and Arabica beans. In terms of application, the market covers food supplements, the beverage industry, personal care and cosmetics, and the pharmaceutical and nutraceutical industry. Based on distribution channel, green coffee beans are sold through indirect sales (such as retailers and wholesalers), direct sales (including online platforms and D2C brands), as well as through supermarkets/hypermarkets, health stores, specialty stores, and online retail outlets. By end-user, the market is segmented into general public, athletes & fitness enthusiasts, functional beverage manufacturers, dietary supplement consumers, and patients with hypertension & heart disease.

The Arabica category dominated the green coffee bean market in 2024. Weight management assistance, electrolyte and hydration, nutrient powerhouse, antioxidant-rich, and natural caffeine boost are among the numerous benefits that contribute to the market segment's expansion. Arabica coffee protects against chronic diseases by reducing inflammation. The development of the Coffee Arabica plant, which provides 90% water and daily hydration as well as milligrams of potassium for efficient blood pressure control, further propels the expansion of the green coffee beans market.

The market for green coffee beans was dominated in 2024 by the general public category. The popularity of green coffee among ordinary consumers as a health-conscious beverage drives this segment's dominance. The public has accepted green coffee as a component of a better lifestyle due to a growing understanding of its advantages, which include its antioxidant qualities and potential to help with weight management. Additionally, the green coffee beans market's segment expansion is ascribed to the expanding number of social media influencers, e-commerce platforms, superfoods, and natural medicines, as well as the growing consumer inclination for health and wellbeing.

In 2024, the market for green coffee beans was led by Europe. The developing e-commerce platforms, the growing demand for speciality coffee, the growing presence of a robust roasting industry, and the growing consumer trend toward health and well-being are all factors contributing to the region's market expansion. The world's largest importer of green coffee is Europe. Coffee from Indonesia, Kenya, Rwanda, Ethiopia, Bolivia, Brazil, Colombia, and many other countries is delivered to Europe by this importer. 87.7% of the 2.65 million tonnes of green coffee imported into Western Europe are consumed by European nations.

With the highest yearly growth rate for the green coffee beans market, the Asia Pacific is the fastest-growing region. There is an increased demand for premium coffee variants due to rising consumer discretionary spending. Furthermore, the growing demand for green coffee beans has been supported by the region's increased use of nutritional supplements and nutraceuticals due to the ageing population. Millennials in the area would drink more coffee as a result of the growing tendency to eat out and consume Western cuisine and beverages.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 5.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By Distribution Channel, By End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Cosucra Group, Glanbia, Prinova Group LLC, Thai Nichirin Company, Naturex, Nutraceutical Group, Archer Daniels Midland Company, Farbest Brands, AarhusKarlshamn, Espresso Coffee Global Group, Kerry Group, Dohler Group, Nestle, and Cargill |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

· Indirect Sales

o Retailers

o Wholesalers

· Direct Sales

o Online

o D2C Brands

· Supermarkets/Hypermarkets

· Health Stores

· Specialty Stores

· Online Retail

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.