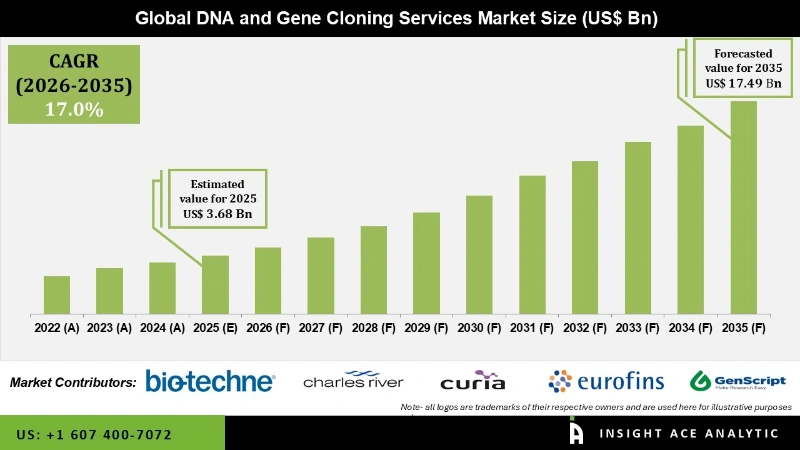

Global DNA and Gene Cloning Services Market Size is valued at USD 3.68 Bn in 2025 and is predicted to reach USD 17.49 Bn by the year 2035 at a 17.0% CAGR during the forecast period for 2026 to 2035.

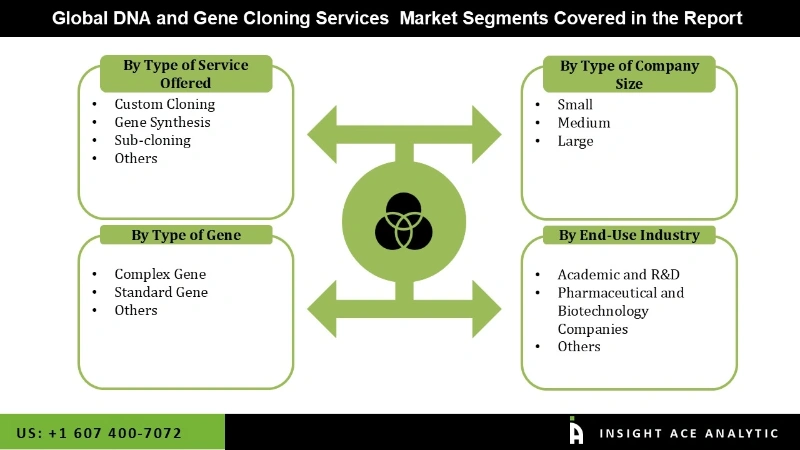

DNA and Gene Cloning Services Market Size, Share & Trends Analysis Report By Type of Service Offered (Custom Cloning, Sub-cloning, Gene Synthesis, and Others), Type of company size, Type of Gene, End-User Industry, By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The progress of genetic engineering and cloning techniques has made it possible to alter the genomes of microorganisms, allowing for synthesizing compounds with diverse research and medicinal applications. A method that assembles DNA sequences of interest by cutting and pasting them together using enzymes. The recombined DNA sequences can be inserted into vectors, molecules that transport DNA into a host cell. The specific recombined DNA sequence can be replicated or translated within this host cell. Gene probes produced using gene cloning offer a range of applications, including early detection of genetic disorders, forensic investigations, and routine diagnosis. This technology's industrial application gives novel antibiotics in the form of antimicrobial peptides and recombinant cytokines that can be employed as therapeutic agents.

Also, with the help of the cloning technique, It is possible to isolate a specific gene and identify its nucleotide sequence, and DNA control sequences can be found and examined. The function of proteins, enzymes, and RNA can be studied, and Mutations are detectable. Cloning techniques at the molecular level are fundamental to a wide variety of scientific fields in modern biology and medicine.

The market for DNA cloning and gene cloning services is expected to experience consistent growth in the years to come as a result of the rising demand for gene therapies and the introduction and adoption of novel and advanced DNA cloning technologies. These two factors are expected to drive the market for DNA cloning and gene cloning services. A favourable funding landscape for gene synthesis and cloning services, technological improvement in cloning and subcloning services, and an increase in synergistic activities in the market are some of the factors supporting the market's growth. In Aug 2020, Thermo Fisher revealed a $76 million expansion at its US location as part of its ongoing $650 million bioprocessing revamp.

While the worldwide gene synthesis market is expected to proliferate over the next few years, its development may be limited by a lack of qualified professionals and lengthy approval processes. Growth prospects may arise as a result of technological developments, strategic partnerships, and mergers and acquisitions in the biomedical and healthcare industries.

The DNA and Gene Cloning Services market is segmented into three main aspects, the type of services offered, which comprises Custom cloning, gene synthesis, sub-cloning and others. Type of Company Size includes Small, Mid-size, and Large. The third segment is the type of gene that includes complex gene and standard gene as sub-segments. The fourth significant segment is the end-user industry, and this comprises Academic and R&D, Pharmaceutical and Biotechnology Companies and other industries.

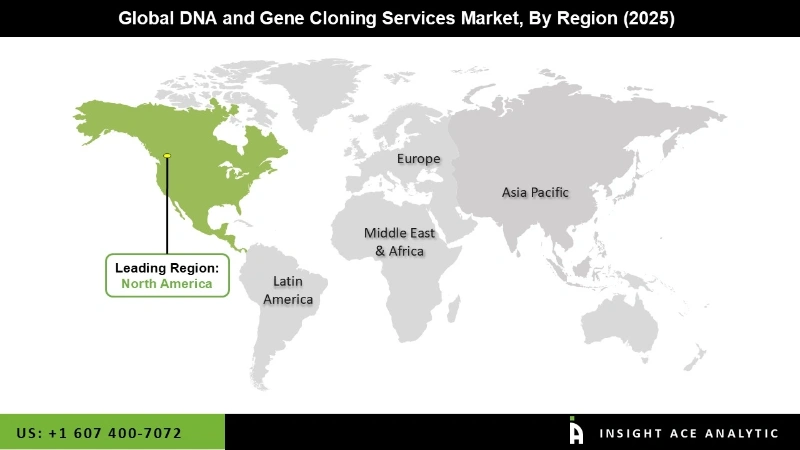

DNA and gene cloning are currently receiving a lot of attention in the life science research market in North America, which has led to increased investments, funding, and collaborations for industrial expansion in the foreseeable future.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 3.68 Bn |

| Revenue Forecast In 2035 | USD 17.49 Bn |

| Growth Rate CAGR | CAGR of 17.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type of Service Offered, Type of Company Size Type of Gene, End-User Industry |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ; France; Italy; Spain; South Korea; South East Asia; |

| Competitive Landscape | Bio-Techne, Charles River Laboratories, Curia, Eurofins, GenScript, Integrated DNA Technologies, MedGenome, Sino Biological, Syngene, Twist Bioscience, Thermo Fisher Scientific Inc., Eurofins Scientific, GenScript, Merck KGaA, Takara Bio Inc., Lonza, Sartorius AG, Creative Biogene, Cellecta, Inc., Synbio Technologies, TransGen Biotech Co., Ltd., Dobuss (Canvax), Azenta US, Inc., Macrogen, Inc., Codex DNA, Inc., Bio-Rad, and other key players. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global DNA and Gene Cloning Services Market, by Type of Service Offered

Global DNA and Gene Cloning Services Market, by Type of Company Size

Global DNA and Gene Cloning Services Market, by Type of Gene

Global DNA and Gene Cloning Services Market, by End-User Industry

Global DNA and Gene Cloning Services Market, by Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.