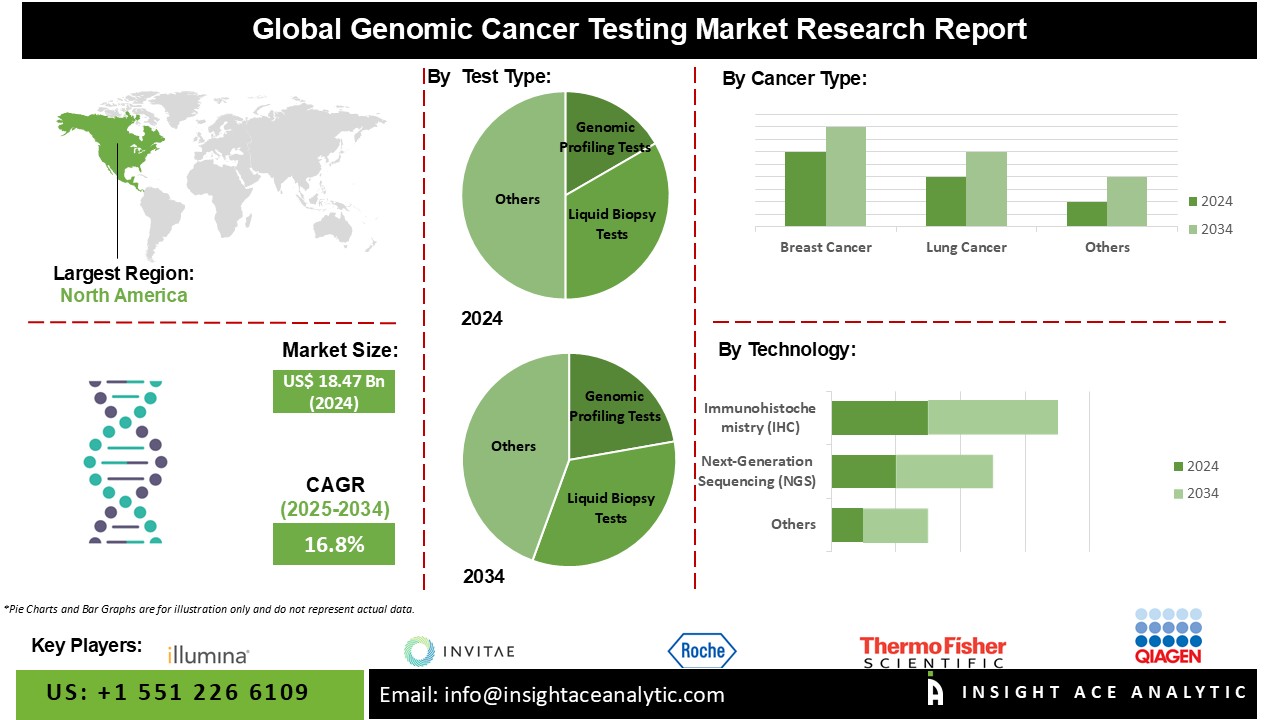

Genomic Cancer Testing Market Size is valued at USD 18.47 billion in 2024 and is predicted to reach USD 86.13 billion by the year 2034 at a 16.8% CAGR during the forecast period for 2025-2034.

Genomic cancer testing examines the DNA of cancer cells to detect hereditary abnormalities. This data informs individualized treatment strategies, such as precision medicines, tailored to the tumour's specific genetic characteristics. It offers predictive information, facilitates involvement in clinical studies, and assists in tracking the progression of cancer over time. This methodology improves precision medicine in oncology by customizing therapies based on the specific genetic traits of each individual.

The increasing demand for diagnostics, improvements in technologically advanced and cost-effective diagnostic technologies, and investments in the biotech and pharmaceutical industries are driving market expansion. Furthermore, the advancement of genetics in cancer care is aided by considerable research and development efforts to establish novel treatment techniques.

However, during the first stages of the pandemic, ordinary healthcare services, such as cancer screenings and elective operations, were disrupted. As a result, cancer diagnosis and treatments were delayed, potentially reducing demand for genetic cancer testing. However, telemedicine and virtual consultations became more popular during the pandemic to limit the danger of virus transmission. This transition influenced how people interacted with healthcare practitioners, including conversations regarding genomic testing possibilities.

The Genomic Cancer Testing Market is segmented based on test type, cancer type, technology, end-user, biomarker type, service provider, application, and testing setting. The product segment comprises Genomic Profiling Tests, Liquid Biopsy Tests, Companion Diagnostic Tests, Pharmacogenomic Tests, Hereditary Cancer Tests, and Other specialized genomic tests. The cancer type segment includes Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Ovarian Cancer, Melanoma, Leukemia, Lymphoma, and Other specific cancer types. By technology, the market is segmented into Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Fluorescence In Situ Hybridization (FISH), Microarray, Immunohistochemistry (IHC), and Other genomic testing technologies. The end-user segment includes Hospitals, Diagnostic Laboratories, Academic and Research Institutions, Cancer Centers, and Other healthcare providers. The biomarker type segment is segmented into Genetic Biomarkers, Protein Biomarkers, Molecular Biomarkers, and Epigenetic Biomarkers. The service provider segment includes Diagnostic Laboratories, Biotechnology Companies, Pharmaceutical Companies, and Contract Research Organizations (CROs). By application, the market is segmented into Targeted Therapy Selection, Disease Monitoring, Prognostic Testing, Companion Diagnostics, Risk Assessment, and Pharmacogenomic Testing. The testing setting segment includes In-House Testing and Outsourced Testing.

The Genomic Profiling Tests category is expected to hold a major share of the global Genomic Cancer Testing Market in 2022. The genomic cancer testing market, which is primarily driven by genomic profiling tests, is impacted by a number of variables that contribute to the growing adoption and demand for these tests. Genomic profiling entails examining the whole collection of genes in a person's tumour in order to understand the genetic changes that cause cancer. Genomic technology developments, such as next-generation sequencing (NGS), have considerably increased genomic profiling studies' efficiency, speed, and cost-effectiveness. This has aided in the widespread use of these tests in clinical settings.

The Breast Cancer segment is projected to grow at a rapid rate in the global Genomic Cancer Testing Market. Various factors contribute to the increased use and demand for genetic testing specifically customized for breast cancer patients, driving the genomic cancer testing market for breast cancer. In breast cancer, genomic testing provides information about specific molecular traits, allowing doctors to make more informed treatment decisions. Identifying targeted medicines for tumours with specific genetic alterations, such as HER2-positive breast cancer.

The North America Genomic Cancer Testing Market is expected to record the maximum market revenue share in the near future, owing to the high level of public awareness regarding cancer genomic testing in the United States and Canada. Because of the rise in the prevalence of breast cancer in BENELUX, Europe is the second most fastest growing region for the cancer genomic testing industry. In addition, Asia Pacific is estimated to grow rapidly in the global Genomic Cancer Testing Market because of an increase in the number of obese patients in nations such as India, China, and Japan. Because of a lack of awareness among people regarding cancer genomic testing, Latin America, the Middle East, and Africa are the least profitable regions for the cancer genomic testing business.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 18.47 Bn |

| Revenue Forecast In 2034 | USD 86.13 Bn |

| Growth Rate CAGR | CAGR of 16.8% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Test Type, By Cancer Type, By Technology, By End-User, By Biomarker Type, By Service Provider, By Application, By Testing Setting |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Illumina, Inc., Thermo Fisher Scientific, Inc., Qiagen N.V., F. Hoffmann-La Roche Ltd., Foundation Medicine, Inc. (Roche), Invitae Corporation, NeoGenomics Laboratories, Inc., Myriad Genetics, Inc., Genomic Health, Inc. (Exact Sciences Corporation), Caris Life Sciences, ArcherDX, Inc. (Invitae Corporation), Guardant Health, Inc., Personal Genome Diagnostics Inc., Biocept, Inc., and Tempus Labs, Inc., Danaher, PerkinElmer, Agilent Technologies, Inc., Quest Diagnostics, Luminex Corporation |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Genomic Cancer Testing Market By Test Type-

Genomic Cancer Testing Market By Cancer Type-

Genomic Cancer Testing Market By Technology-

Genomic Cancer Testing Market By End-User-

Genomic Cancer Testing Market By Biomarker Type-

Genomic Cancer Testing Market By Service Provider-

Genomic Cancer Testing Market By Application-

Genomic Cancer Testing Market By Testing Setting-

Genomic Cancer Testing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.