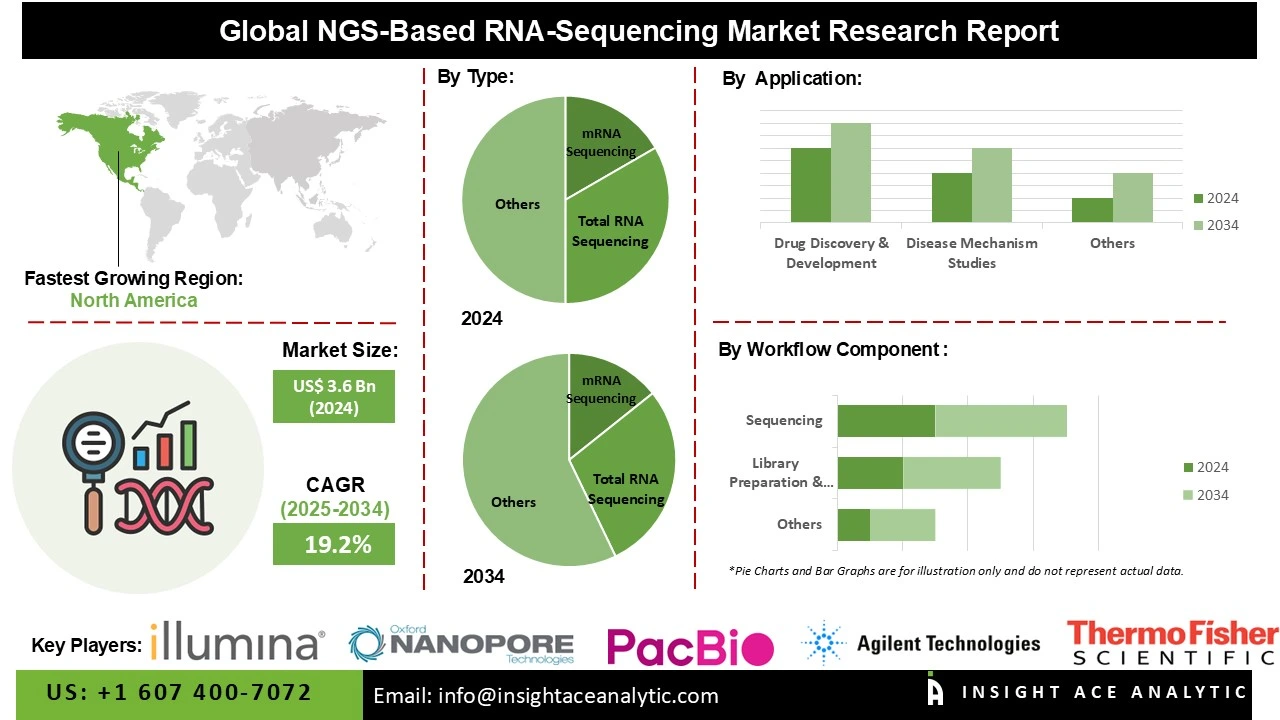

Global NGS-Based RNA-Sequencing Market Size is valued at US$ 3.6 Bn in 2024 and is predicted to reach US$ 20.3 Bn by the year 2034 at an 19.2% CAGR during the forecast period for 2025-2034.

Next-Generation Sequencing (NGS)-based RNA sequencing, or RNA-Seq, is a modern laboratory technique that uses high-throughput sequencing machines to analyze the quantity and sequences of RNA in a biological sample. By converting RNA into DNA and sequencing it, this method provides a comprehensive snapshot of gene activity, showing which genes are turned on or off.

It enables researchers to study gene expression, discover new RNA variants, and identify genetic mutations with a precision and depth that was not possible with older technologies. This makes it a fundamental tool in fields like genomics, cancer research, and drug development.

The NGS-based RNA-sequencing market is expanding due to a number of factors, such as the growing need for targeted therapies as well as personalized medicine, the escalation of chronic illnesses, including cancer and genetic disorders, and the expanding use of RNA-sequencing in drug development.

Furthermore, by facilitating more thorough and accurate analysis of RNA molecules, the introduction of cutting-edge sequencing technologies like single-cell RNA sequencing and nanopore sequencing is anticipated to accelerate the NGS-based RNA-sequencing market expansion further. While boosting the speed and precision of RNA sequencing, Next-Generation Sequencing (NGS) technologies have significantly reduced costs.

As a result, NGS-based RNA-seq is more widely available and appealing for clinical diagnosis and research, which boosts market expansion. Additionally, more genetic research is being done, especially in the fields of infectious diseases, neurology, and cancer. Advances in the study of gene expression, regulation, and splicing are made possible by NGS-based RNA-seq, which is driving the market.

Some of the Key Players in NGS-Based RNA-Sequencing Market:

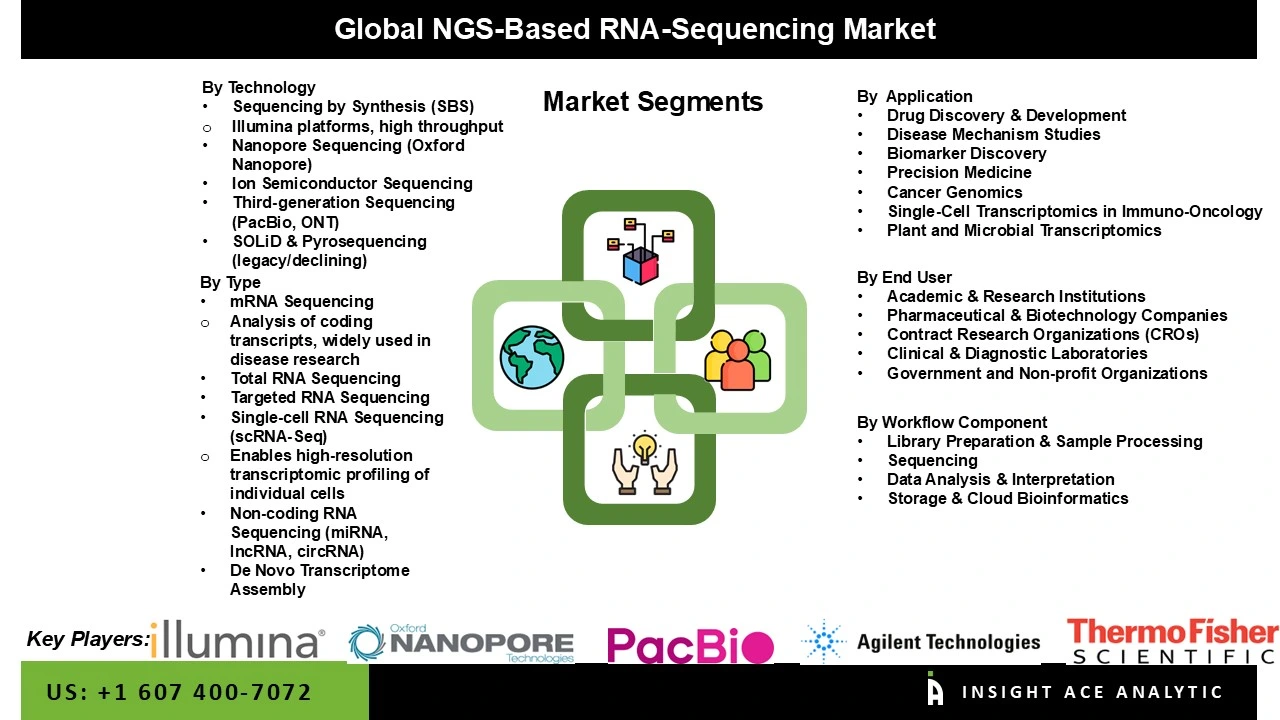

The NGS-based RNA-sequencing market is segmented by type, workflow component, technology, application, and end-user. By type, the market is segmented into targeted RNA sequencing, mRNA sequencing, total RNA sequencing, single-cell RNA sequencing (scRNA-Seq), de novo transcriptome assembly, and non-coding RNA sequencing (miRNA, lncRNA, circRNA). By workflow component, the market is segmented into sequencing, library preparation & sample processing, storage & cloud bioinformatics, and data analysis & interpretation. In technology, the market is segmented into sequencing by synthesis (SBS), third-generation sequencing (PacBio, ONT), ion semiconductor sequencing, nanopore sequencing (Oxford Nanopore), and SOLiD & pyrosequencing (legacy/declining). The application segment comprises precision medicine, drug discovery & development, cancer genomics, disease mechanism studies, biomarker discovery, single-cell transcriptomics in immuno-oncology, and plant and microbial transcriptomics. By end-user, the market is segmented into pharmaceutical & biotechnology companies, academic & research institutions, contract research organizations (CROs), government and non-profit organizations, and clinical & diagnostic laboratories.

The sequencing category led the NGS-based RNA sequencing market in 2024. This is explained by the growing use of high-throughput sequencing technologies, which offer quick and thorough insights into transcriptome profiles and gene expression. New developments in sequencing technologies that provide increased cost-effectiveness, scalability, and precision are also driving the boom. In oncology, neurology, and personalized medicine, the need for next-generation sequencing technology has increased along with research and clinical applications. Furthermore, the sequencing segment's leading position in the market has been cemented by its capacity to sequence a broad variety of RNA molecules, such as mRNA, non-coding RNAs, and splice variants.

The NGS-based RNA-sequencing market was dominated by medication development and discovery. This is because RNA-seq technologies are increasingly being used to accelerate the discovery of new therapeutic targets, define disease mechanisms, and find biomarkers. In oncology, neurology, and immunology in particular, RNA-sequencing facilitates more accurate gene expression profiling, which aids in the creation of tailored treatments. It is now crucial for pharmaceutical companies to incorporate RNA-seq data into their drug discovery pipelines as their focus shifts to personalized treatment. Its dominance in the drug development industry is further supported by RNA-seq's contribution to bettering medication efficacy and clinical trial design.

North America dominated the largest share of the NGS-based RNA sequencing market. The region's early adoption of cutting-edge genomic technologies, substantial research funding, and strong presence of top sequencing technology businesses are the main drivers of this dominance. The United States has a strong healthcare system, several genomics research projects, and the presence of major companies, which contributes to its majority of the market share. Furthermore, the U.S.'s increasing focus on tailored therapeutics and precision medicine has sped up the use of RNA sequencing technologies.

The NGS-based RNA sequencing market is expanding very fast in the Asia-Pacific region over the forecast period. Growing government investments in biotechnology, the expansion of the healthcare system, and the rise in chronic diseases that call for sophisticated diagnostic tools are all factors contributing to this quick growth. Moreover, the demand for RNA sequencing technologies is also being driven by these nations' expanding middle classes and increased awareness of precision medicine, which makes Asia-Pacific a crucial area for market expansion.

NGS-Based RNA-Sequencing Market by Type-

· Targeted RNA Sequencing

· mRNA Sequencing

· Total RNA Sequencing

· Single-cell RNA Sequencing (scRNA-Seq)

· De Novo Transcriptome Assembly

· Non-coding RNA Sequencing (miRNA, lncRNA, circRNA)

NGS-Based RNA-Sequencing Market by Workflow Component -

· Sequencing

· Library Preparation & Sample Processing

· Storage & Cloud Bioinformatics

· Data Analysis & Interpretation

NGS-Based RNA-Sequencing Market by Technology-

· Sequencing by Synthesis (SBS)

· Third-generation Sequencing (PacBio, ONT)

· Ion Semiconductor Sequencing

· Nanopore Sequencing (Oxford Nanopore)

· SOLiD & Pyrosequencing (legacy/declining)

NGS-Based RNA-Sequencing Market by Application-

· Precision Medicine

· Drug Discovery & Development

· Cancer Genomics

· Disease Mechanism Studies

· Biomarker Discovery

· Single-Cell Transcriptomics in Immuno-Oncology

· Plant and Microbial Transcriptomics

NGS-Based RNA-Sequencing Market by End-user-

· Pharmaceutical & Biotechnology Companies

· Academic & Research Institutions

· Contract Research Organizations (CROs)

· Government and Non-profit Organizations

· Clinical & Diagnostic Laboratories

NGS-Based RNA-Sequencing Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.