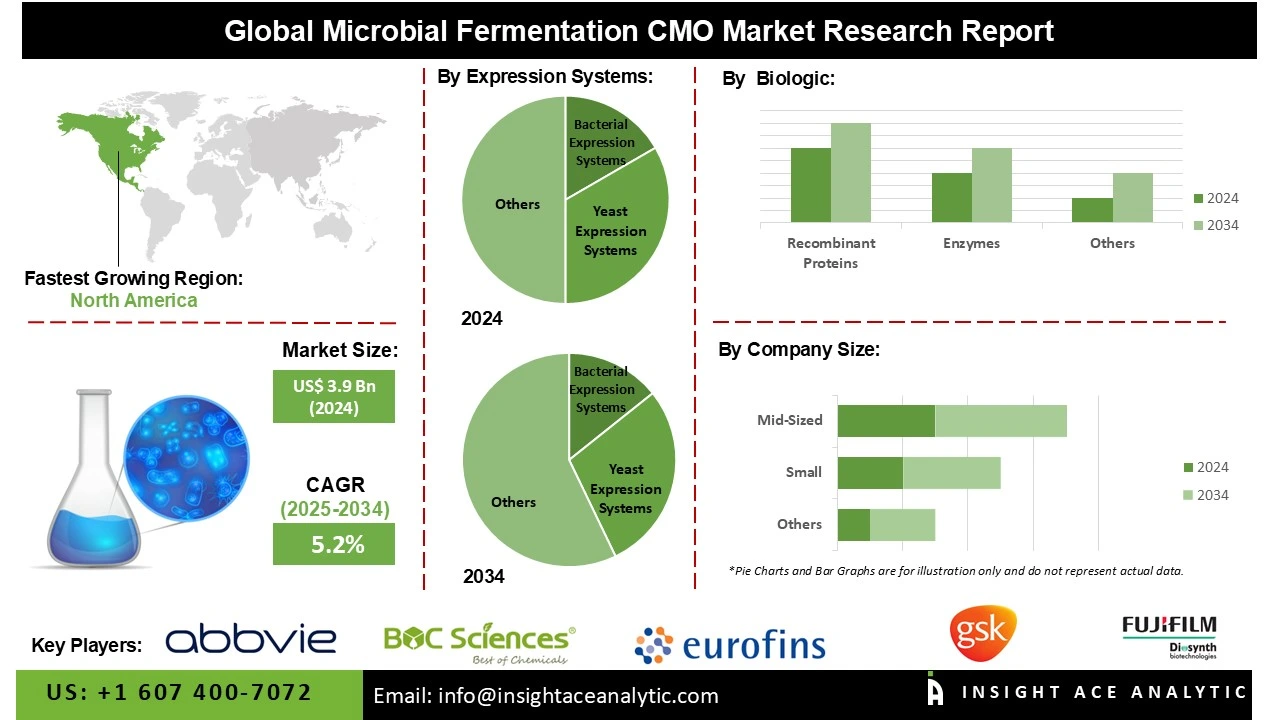

Microbial Fermentation CMO Market Size is valued at US$ 3.9 Bn in 2024 and is predicted to reach US$ 6.4 Bn by the year 2034 at an 5.2% CAGR during the forecast period for 2025-2034.

A Microbial Fermentation CMO (Contract Manufacturing Organization) is a specialized partner that produces commercial-scale products—such as therapeutics, enzymes, or food ingredients—using bacteria, yeast, or other microorganisms in large bioreactors. They provide the expertise, infrastructure, and capacity to ferment, purify, and scale processes that would otherwise require massive capital investment. Ideal for biotech, pharmaceutical, and industrial companies looking to outsource complex biological manufacturing.

The microbial fermentation CMO market is experiencing growth driven by the increasing popularity of alternatives to traditional antibodies, such as antibody fragments, nanobodies, and recombinant proteins. These next-generation biologics deliver advantages including higher stability, expanded tissue penetration, and lower immunogenicity compared to conventional monoclonal antibodies.

Microbial fermentation delivers a cost-effective, scalable, and efficient platform for producing these complex biologics with high yield and purity. As pharmaceutical and biotech firms increase pipelines in oncology, autoimmune, and infectious diseases, demand for specialized contract manufacturing services expands, positioning microbial fermentation CMOs as major enablers in advancing innovative therapeutic techniques.

The microbial fermentation CMO market is experiencing growth due to the increasing outsourcing of microbial fermentation processes by pharmaceutical, biotechnology, and food industries. Companies are outsourcing to CMOs to leverage specialized expertise, reduce capital expenditure, and accelerate time-to-market for products like probiotics, enzymes, antibiotics, and vaccines. Outsourcing allows firms to focus on core R&D while benefiting from scalable, high-quality production facilities that adhere to regulatory standards. Additionally, rising demand for biologics and personalized medicine, combined with complex fermentation technologies, drives firms to rely on experienced CMOs, fueling overall market expansion and efficiency.

Some of the Key Players in the Microbial Fermentation CMO Market:

The microbial fermentation CMO market is segmented by type of expression system, by type of biologic, by company size, by end-user and By Region. By type of expression system, the market is segmented into bacterial expression systems, yeast expression systems and other expression systems. By type of biologic, the market is segmented into recombinant proteins, enzymes, plasmid DNA, antibodies and others. By company size, the market is segmented into small, mid-sized, large and very large. By end-user, the market is segmented into pharma/biotech companies and academic/research institutes.

In 2024, rising demand for cost-effective, scalable, and rapid production of recombinant proteins, enzymes, and biopharmaceuticals drives the bacterial expression systems segment and expands market growth. Bacterial systems, particularly E. coli, deliver high yield, ease of genetic manipulation, and shorter development cycles, making them attractive for contract manufacturing. Growth is further fueled by rising biologics approvals, outsourcing trends, and the requirement for efficient large-scale microbial production.

The Microbial Fermentation CMO market is dominated by complex fractures due to the rising demand for biologics in pharmaceuticals, including vaccines, enzymes, and therapeutic proteins. Recombinant proteins require specialized microbial fermentation for efficient, scalable, and cost-effective production. CMOs offer advanced infrastructure, regulatory compliance, and expertise, enabling biopharma companies to accelerate development without heavy capital investment. Additionally, increasing prevalence of chronic diseases and technological advancements in microbial expression systems drive market growth by enhancing yield, consistency, and quality of recombinant proteins.

North America dominates the market for Microbial Fermentation CMO due to the region's rising demand for biopharmaceuticals, enzymes, and probiotics. Increasing outsourcing by biotech companies to specialized CMOs helps reduce production costs and accelerate time-to-market. In addition, escalating importance of personalized medicine and sustainable bio-based products heightens dependence on expert CMOs for high-quality microbial fermentation services, driving market growth in North America.

Moreover, Europe's microbial fermentation CMO market is also fueled by region's region's increasing demand for probiotics, biologics, and vaccines. Growth is driven by rising investment in R&D for biopharmaceuticals and subcontracting of intricate fermentation processes to expert CMOs. Europe's strict regulatory requirements stimulate collaboration with veteran manufacturers to facilitate compliance and high-quality output. Also, the increasing demand for personalized medicine and new drug discovery enhances the demand for large-scale microbial fermentation capabilities, for which CMOs are the first choice regarding efficiency, cost savings, and reduced time-to-market in European biotechnology.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 3.9 Bn |

| Revenue Forecast In 2034 | USD 6.4 Bn |

| Growth Rate CAGR | CAGR of 5.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type of Expression System, By Type of Biologic, By Company Size, By End-User and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | AbbVie , BOC Sciences, Eurofins, FUJIFILM Diosynth Biotechnologies, GSK, Lonza, and Sandoz |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Microbial Fermentation CMO Market by Type of Expression Systems-

· Bacterial Expression Systems

· Yeast Expression Systems

· Other Expression Systems

Microbial Fermentation CMO Market by Type of Biologic-

· Recombinant Proteins

· Enzymes

· Plasmid DNA

· Antibodies

· Others

Microbial Fermentation CMO Market by Company Size-

· Small

· Mid-Sized

· Large and Very Large

Microbial Fermentation CMO Market by End-User-

· Pharma / Biotech Companies

· Academic / Research Institutes

Microbial Fermentation CMO Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.