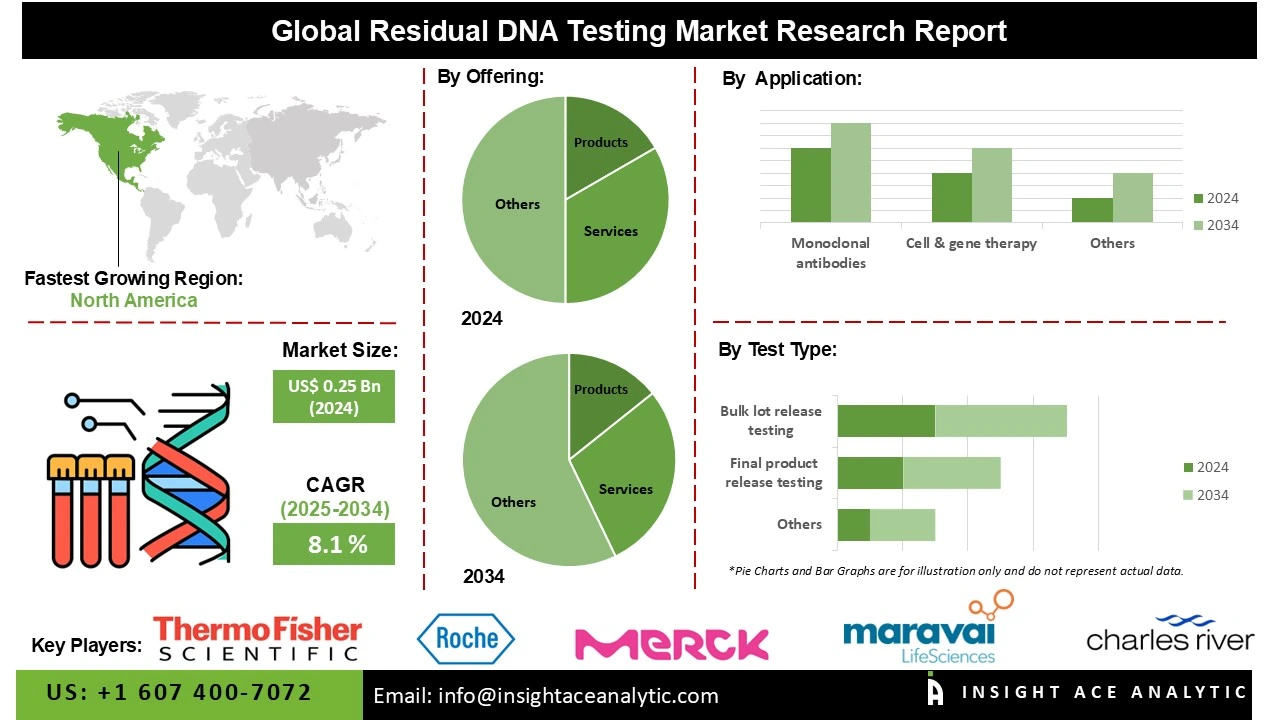

Residual DNA Testing Market Size is valued at US$ 0.25 Bn in 2024 and is predicted to reach US$ 0.54 Bn by the year 2034 at an 8.1% CAGR during the forecast period for 2025-2034.

Residual DNA testing is a quality control process used in biopharmaceuticals and vaccines to detect, measure, and ensure safe levels of host-cell DNA remaining after production, maintaining product safety, purity, and regulatory compliance standards. Rising biopharmaceutical R&D investments are a key driver for the residual DNA testing market, as stringent regulatory requirements mandate safety and purity validation in biologics and cell-based therapies. With the surge in monoclonal antibodies, vaccines, and gene therapies, companies are allocating higher budgets toward advanced quality control and analytical techniques.

Residual DNA testing ensures product safety, compliance, and reduced immunogenic risks, making it integral to biopharma workflows. As R&D pipelines expand globally, demand for sensitive, accurate, and regulatory-compliant DNA testing methods continues to strengthen, fueling market growth.

The residual DNA testing market is being strongly driven by the increasing number of biologics & biosimilar approvals worldwide. As regulatory agencies such as the FDA & EMA enforce stringent safety and quality standards, manufacturers of biologics and biosimilars are required to demonstrate that residual host cell DNA is within permissible limits.

With the growing demand for biologics in therapeutic areas like oncology, autoimmune disorders, and infectious diseases, and as biosimilar development for cost reduction is increasingly becoming a trend, the need for precise, sensitive, and validated residual DNA testing technology is more evident than ever before. This does not just ensure patient safety and regulatory compliance but also enables the speeding up of product commercialization.

Some of the Key Players in the Residual DNA Testing Market:

· Thermo Fisher Scientific Inc.

· Merck KGaA

· Eurofins Scientific

· Charles River Laboratories

· Bio-Rad Laboratories, Inc.

· QIAGEN

· Hoffmann-La Roche Ltd

· Maravai LifeSciences

· FUJIFILM Corporation

· SGS Société Générale de Surveillance SA.

· Jiangsu Hillgene Biopharma Co., Ltd

· Revvity

· Intertek Group plc

· WuXi AppTec

· Sartorius AG

· Lonza

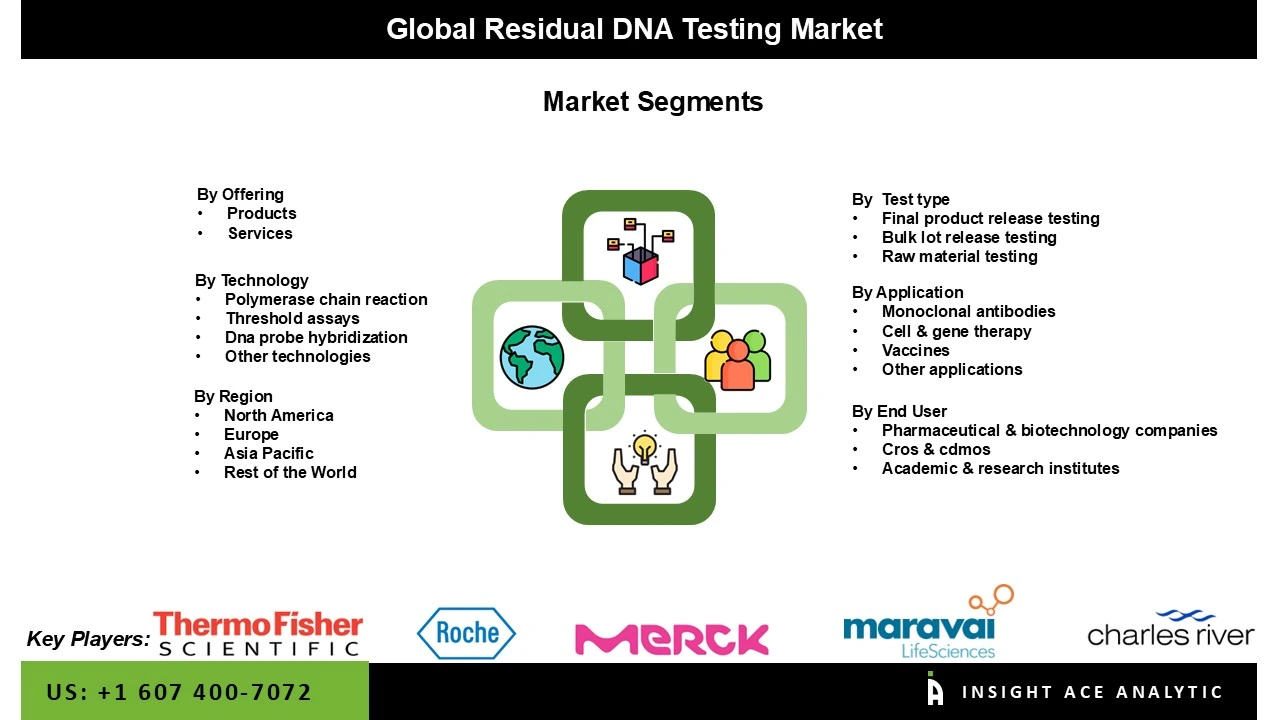

The residual DNA testing market is segmented by offering, test type, technology, application, and end-user. By offering, the market is segmented into product {consumables, instruments & software}, and services. By test type, the market is segmented into final product release testing, bulk lot release testing, and raw material testing. The technology segment covers polymerase chain reaction, threshold assay, DNA probe hybridization, and other technologies. Whereas, the application segment categorized into monoclonal antibodies, cell & gene therapy, vaccines, and other applications. By end-user, the market is segmented into pharmaceutical & biotechnology companies, CROS & CDMOS, and academic & research institutes.

In 2024, stringent regulatory emphasis on product safety and purity in biopharmaceutical manufacturing drives the monoclonal antibodies segment and expands market growth. Since mAbs are produced using host cell lines, residual host cell DNA can pose risks of immunogenicity, oncogenicity, or infectious agent transmission. Regulatory bodies like the FDA and EMA require accurate quantitation and elimination of residual DNA to acceptable safety levels, driving the uptake of sophisticated testing technologies like qPCR, ddPCR, and next-generation sequencing. Increasing demand for therapeutic mAbs in cancer, autoimmune disorders, and infectious diseases further increases the demand for secure residual DNA testing solutions.

The residual DNA testing market is dominated by products due to the rising demand for biologics and biosimilars, where ensuring product safety and purity is critical. Stringent regulatory requirements by agencies like the FDA and EMA mandate residual DNA testing, pushing pharmaceutical companies and research laboratories to adopt advanced, sensitive, and high-throughput testing technologies. Universal products comprise PCR-based kits, qPCR equipment, nucleic acid purification systems, electrophoresis equipment, DNA-specific fluorescent dyes, and chromatography-based solutions. These products are extensively used in biologics production, vaccines, cell and gene therapies, and biosimilars for ensuring compliance with regulatory requirements.

North America dominates the market for residual DNA testing due to the region’s stringent regulatory frameworks and quality control standards set by authorities like the FDA and Health Canada. Biopharmaceutical firms are increasingly using residual DNA testing in order to guarantee the safety, purity, and potency of biologics, vaccines, and gene therapies.

The high emphasis in the region on cutting-edge healthcare infrastructure, increased demand for monoclonal antibodies, and accelerated growth in cell and gene therapy further fuel the need for testing. Increased investments in research and clinical trials in biotechnology also stimulate the use of sensitive analysis techniques. The increasing emphasis on patient safety as well as compliance with global regulatory guidelines significantly fuels market expansion.

Europe is following as a second-largest region in the market for residual DNA testing. This is due to the stringent regulatory guidelines laid down by organizations like the European Medicines Agency (EMA) and the European Pharmacopoeia, which have very strict safety protocols for the biologics, vaccines, and cell- or gene-based treatments. Greater usage of biopharmaceuticals, coupled with the progress in molecular biology methods like quantitative polymerase chain reaction (qPCR) and next-generation sequencing, is necessitating accurate and sensitive residual DNA detection. Additionally, rising investments in biosimilar development, expansion of pharmaceutical manufacturing, and emphasis on patient safety further propel market growth. Growing collaboration between biotech firms and contract research organizations also enhances adoption across Europe.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 0.25 Bn |

| Revenue Forecast In 2034 | USD 0.54 Bn |

| Growth Rate CAGR | CAGR of 8.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, By Test Type, By Technology, By Application, By End-User and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Eurofins Scientific (Luxembourg), Charles River Laboratories (US), Bio-Rad Laboratories, Inc. (US), QIAGEN (Germany), F. Hoffmann-La Roche Ltd (Switzerland), Maravai LifeSciences (US), FUJIFILM Corporation (Japan), SGS Société Générale de Surveillance SA. (Switzerland), Jiangsu Hillgene Biopharma Co., Ltd (China), Revvity (US), Intertek Group plc (UK), WuXi AppTec (China), Sartorius AG (Germany), and Lonza (Switzerland) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Residual DNA Testing Market by Offering-

· Product {Consumables, and Instruments & Software}

· Services

Residual DNA Testing Market by Test Type -

· Final Product Release Testing

· Bulk Lot Release Testing

· Raw Material Testing

Residual DNA Testing Market by Technology-

· Polymerase Chain Reaction

· Threshold Assay

· DNA Probe Hybridization

· Other Technologies

Residual DNA Testing Market by Application-

· Monoclonal Antibodies

· Cell & Gene Therapy

· Vaccines

· Other Applications

Residual DNA Testing Market by End-User-

· Pharmaceutical & Biotechnology Companies

· CROS & CDMOS

· Academic & Research Institutes

Residual DNA Testing Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.