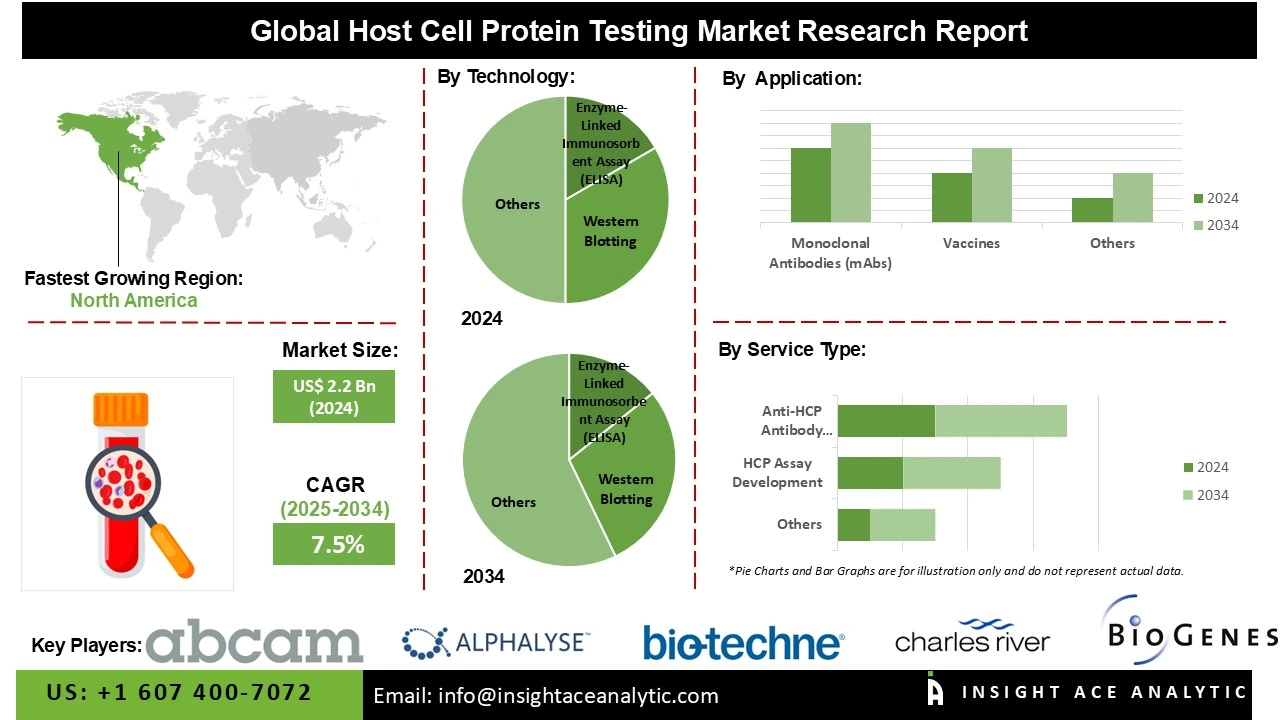

Global Host Cell Protein Testing Market Size is valued at US$ 2.2 Bn in 2024 and is predicted to reach US$ 4.5 Bn by the year 2034 at an 7.5% CAGR during the forecast period for 2025-2034.

Host Cell Proteins, or HCPs, are process-associated protein contaminants that the host bacterium produces during the manufacturing and development of biotherapeutics. It has emerged as a crucial step in the production of biopharmaceuticals, ensuring the safety and efficacy of biological products by identifying and quantifying any residual host cell proteins that can trigger immunogenic reactions in patients.

The market for host cell protein testing is primarily driven by the biopharmaceutical industry's explosive growth and the growing complexity of biological products. The U.S. Food and Drug Administration (FDA) reports that 157 biologics license applications (BLAs) were authorized between 2015 and 2020, indicating a steady increase in the number of approved biological goods. This pattern highlights the growing importance of robust HCP testing procedures in ensuring the efficacy and safety of products.

Moreover, the upgrades to biopharmaceutical research facilities and production facilities have been driven by the growing need for drugs to treat various types of cancer and inflammatory conditions. This need is driving the expansion of biopharmaceutical capabilities, which has further boosted the number of drugs produced. Moreover, the host cell protein testing market is expected to expand due to ongoing research & development efforts related to testing, as well as a growing number of regulatory approvals for testing apparatus.

Additionally, the global market would benefit from the impressive technological advancements in HCP testing equipment, with a focus on enhancing its capabilities and adding more features. Thus, this will accelerate the expansion of the host cell protein testing market.

Some of the Key Players in Host Cell Protein Testing Market:

· Promega Corporation

· Eurofins Scientific

· GE Healthcare Life Sciences (Cytiva)

· SGS Life Sciences

· Abcam

· Alphalyse

· BioGenes GmbH

· Charles River Laboratories

· Cygnus Technologies

· Intertek Group

· Kymos Pharma

· Lonza

· MilliporeSigma (Merck KGaA)

· Pacific BioLabs

· Toxikon (Labcorp)

· WuXi Biologics

· BioOutsource (Sartorius)

· Bio-Techne

· PPD (Part of Thermo Fisher Scientific)

· Syngene International

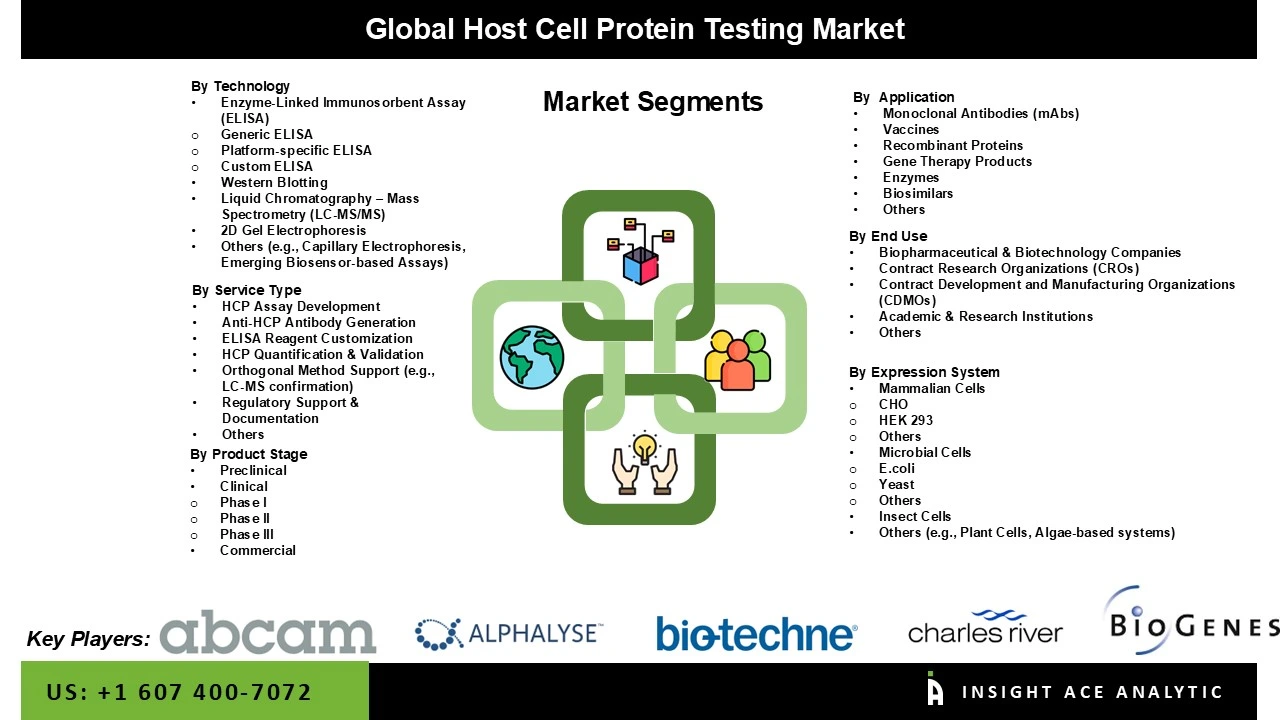

The Host Cell Protein testing market is segmented by service type, product stage, technology, application, expression system, and end-use. By service type, the market is segmented into HCP assay development, ELISA reagent customization, anti-HCP antibody generation, orthogonal method support (e.g., LC-MS confirmation), regulatory support & documentation, HCP quantification & validation, and others. By product stage, the market is segmented into preclinical, clinical (Phase I, Phase II, Phase III), and commercial. By technology, the market is segmented into enzyme-linked immunosorbent assay (ELISA) (Generic ELISA, Custom ELISA, Platform-specific ELISA), 2D Gel Electrophoresis, western blotting, liquid chromatography – mass spectrometry (LC-MS/MS), others (e.g., capillary electrophoresis, emerging biosensor-based assays). By application, the market is segmented into vaccines, monoclonal antibodies (mAbs), enzymes, gene therapy products, biosimilars, recombinant proteins, and others. By expression system, the market is segmented into insect cells, mammalian cells (CHO, HEK 293, others), microbial cells (e.coli, yeast, others), and others (e.g., Plant Cells, Algae-based systems). By End-use, the market is segmented into academic & research institutions, biopharmaceutical & biotechnology companies, contract development and manufacturing organizations (CDMOs), contract research organizations (CROs), and others.

The enzyme-linked immunosorbent assay (ELISA) category dominated the host cell protein testing category because these tests are widely used for detecting host cell proteins in biopharmaceutical products, offering strong sensitivity and specificity. These assays are a very dependable instrument in the industry's quality control procedures and have a long history of successful HCP testing. Their status as the market's top sector has been further cemented by their affordability, ease of use, and reliability in extensive testing.

In 2024, a significant portion of the host cell protein testing market's revenue came from the mammalian cells segment. This is because therapeutic proteins are increasingly being developed using mammalian cells. Because mammalian cells can create stable formulations with high-yield expression, they are used extensively. They are also favoured because they closely resemble human physiology, making them useful for research and the manufacturing of biopharmaceuticals.

The market for host cell protein testing is anticipated to be dominated by North America because of the region's developed healthcare system, substantial firms, and higher R&D expenditures. North America, especially the United States, is regarded as the cornerstone of worldwide expansion due to its abundance of novel drug discoveries. Investments in this industry have increased as a result of the proactive atmosphere this has produced for pharmaceutical R&D culture. Additionally, a strict regulatory environment and the growing demand for innovative treatments are supporting market expansion.

Throughout the projected period, the host cell protein testing market is expected to expand at the fastest CAGR in the Asia-Pacific region. The market is boosted by the quickly developing biopharmaceutical and biotechnology industries, as well as the expanding R&D activities, and the growing number of startups fuels industry growth. Additionally, businesses are required to disclose HCP testing data due to the quickly changing regulatory environment in many nations. Government agencies provide funding for therapeutic protein research and production.

Host Cell Protein Testing Market by Service Type-

· HCP Assay Development

· ELISA Reagent Customization

· Anti-HCP Antibody Generation

· Orthogonal Method Support (e.g., LC-MS confirmation)

· Regulatory Support & Documentation

· HCP Quantification & Validation

· Others

Host Cell Protein Testing Market by Product Stage -

· Preclinical

· Clinical

o Phase I

o Phase II

o Phase III

· Commercial

Host Cell Protein Testing Market by Technology-

· Enzyme-Linked Immunosorbent Assay (ELISA)

o Generic ELISA

o Custom ELISA

o Platform-specific ELISA

· 2D Gel Electrophoresis

· Western Blotting

· Liquid Chromatography – Mass Spectrometry (LC-MS/MS)

· Others (e.g., Capillary Electrophoresis, Emerging Biosensor-based Assays)

Host Cell Protein Testing Market by Application-

· Vaccines

· Monoclonal Antibodies (mAbs)

· Enzymes

· Gene Therapy Products

· Biosimilars

· Recombinant Proteins

· Others

Host Cell Protein Testing Market by Expression System-

· Insect Cells

· Mammalian Cells

o CHO

o HEK 293

o Others

· Microbial Cells

o E.coli

o Yeast

o Others

· Others (e.g., Plant Cells, Algae-based systems)

Host Cell Protein Testing Market by End-use-

· Academic & Research Institutions

· Biopharmaceutical & Biotechnology Companies

· Contract Development and Manufacturing Organizations (CDMOs)

· Contract Research Organizations (CROs)

· Others

Host Cell Protein Testing Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.