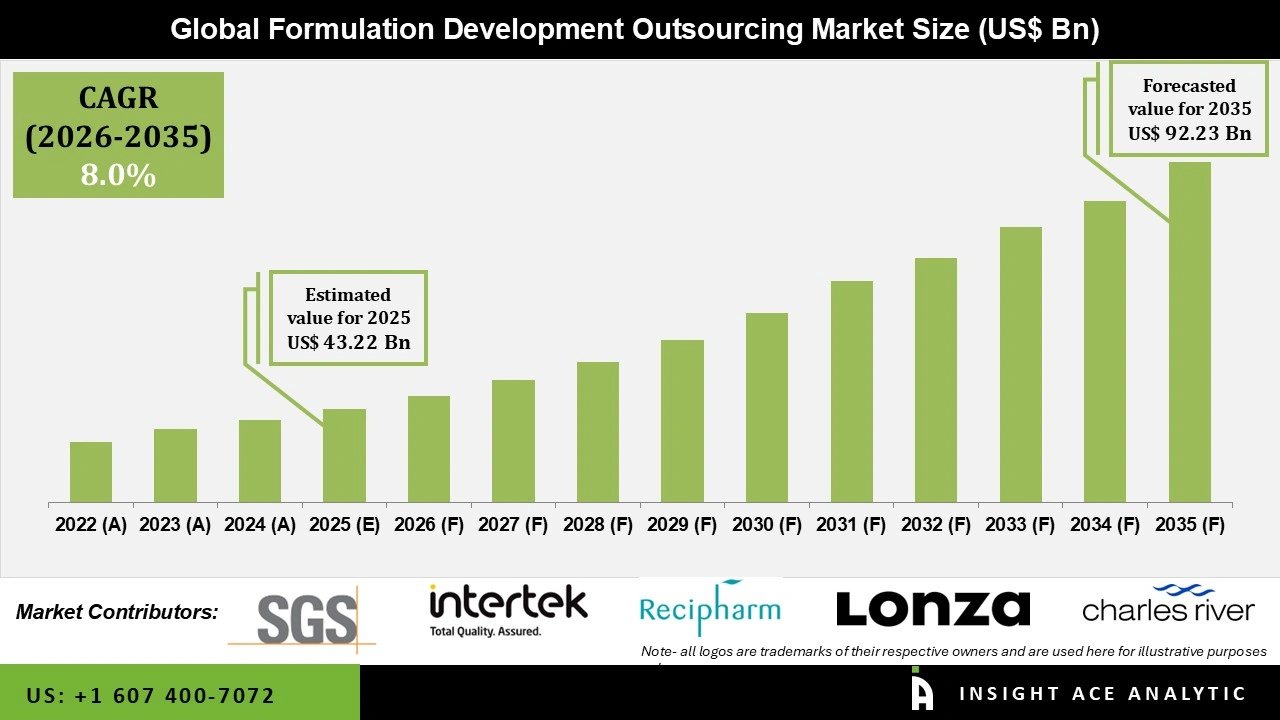

Global Formulation Development Outsourcing Market Size is valued at USD 43.22 billion in 2025 and is predicted to reach USD 92.23 billion by the year 2035 at a 8.0% CAGR during the forecast period for 2026 to 2035.

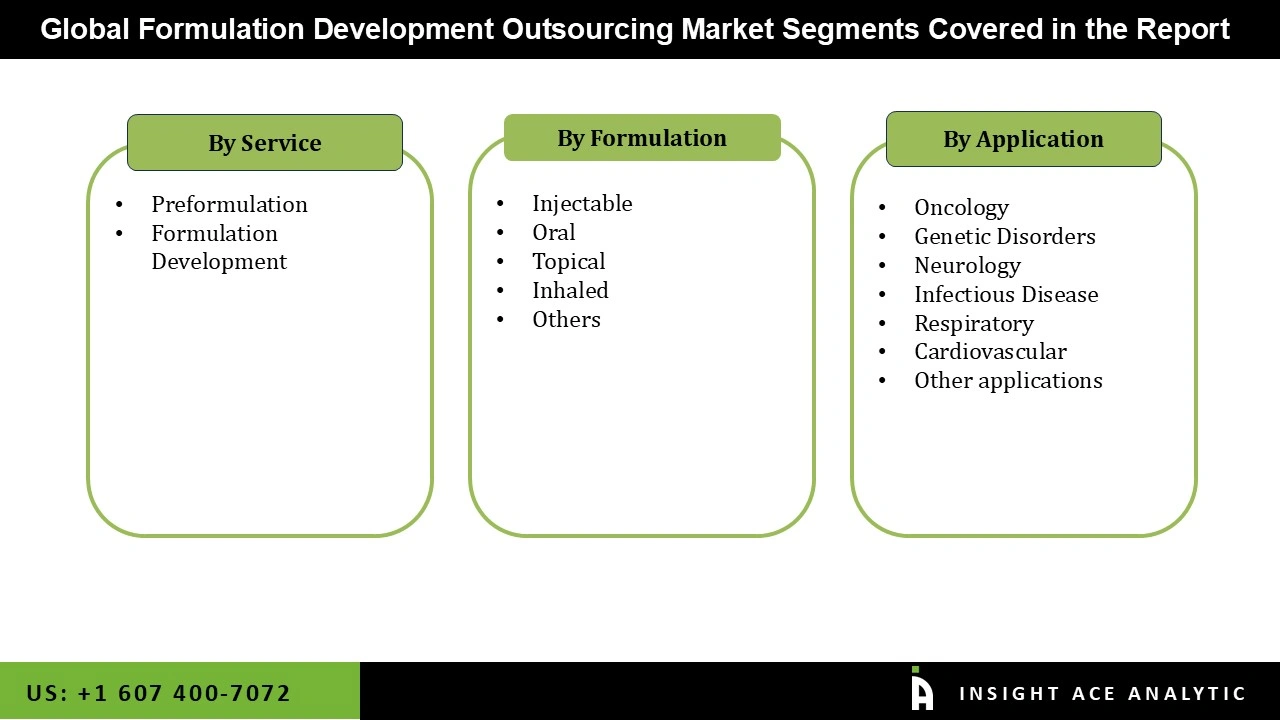

Formulation Development Outsourcing Market Size, Share & Trends Analysis Report by Service (Preformulation, Formulation Development), Application (Oncology, Neurology, Infectious Disease, Respiratory, Dermatology) And Formulation (Injectable, Topical, Inhaled, Oral), Region And Segment Forecasts, 2026 to 2035.

Formulation development outsourcing market factors driving market expansion include the increasing relevance of novel drug development due to the growing patent expiration of important pharmaceuticals and the increased outsourcing of formulation development services by most pharmaceutical and biotechnological companies. Most biopharmaceutical companies work with outsourcing services in their early phases to reduce the risk and save time and money as the drug develops.

The rising need for novel mediation due to the significant burden of infectious and chronic diseases is one of the main aspects pushing the demand for formulation development. These factors are anticipated to boost formulation development outsourcing growth in the upcoming years.

However, the COVID-19 pandemic slowed major pharmaceutical companies' production, supply chain, and export of some crucial APIs and medication. It also bought to light the world's reliance on China for various pharmaceutical APIs, Due to lockdown measures implemented by the Chinese government during the outbreak. It affected important materials. It has caused serval countries to launch plans for domestic API production, and countries around the EU have reviewed their healthcare system to combat pandemics and guarantee a steady flow of API production.

Manufacturing locally to reduce operating costs is one major business strategy manufacturers adopt in the formulation development outsourcing industry to benefit clients and enhance the market sector. Some of the formulation development outsourcing market players are:

The formulation development outsourcing market is segmented based on service, application and formulation outlook. The service segment includes Preformulation, Formulation Development. The application segment comprises oncology, neurology, infectious disease, respiratory, dermatology and others. The formulation segment includes injectable, topical, inhaled, oral and others.

The respiratory inhaler segmentation has been segmented by type into manually operated and digitally operated. The wearable segment dominated the market growth in 2023 and is projected to be the faster-growing segment during the forecast period. The main objective of manually operated inhaler equipment is to enhance medicine delivery to better manage respiratory disorders. The technique has some benefits, including a quick beginning of the effect, the ability to administer medication in precise quantities, and systematic absorption.

The oral segment accounted for the largest market share. An oral formulation is a licensed product administered orally and absorbed through the stomach, intestine, or gastrointestinal tract. The oral formulations are self-administering and do not require the assistance of a trained physician for medication administration. Furthermore, as compared to others, these formulations provide greater formulation design flexibility.

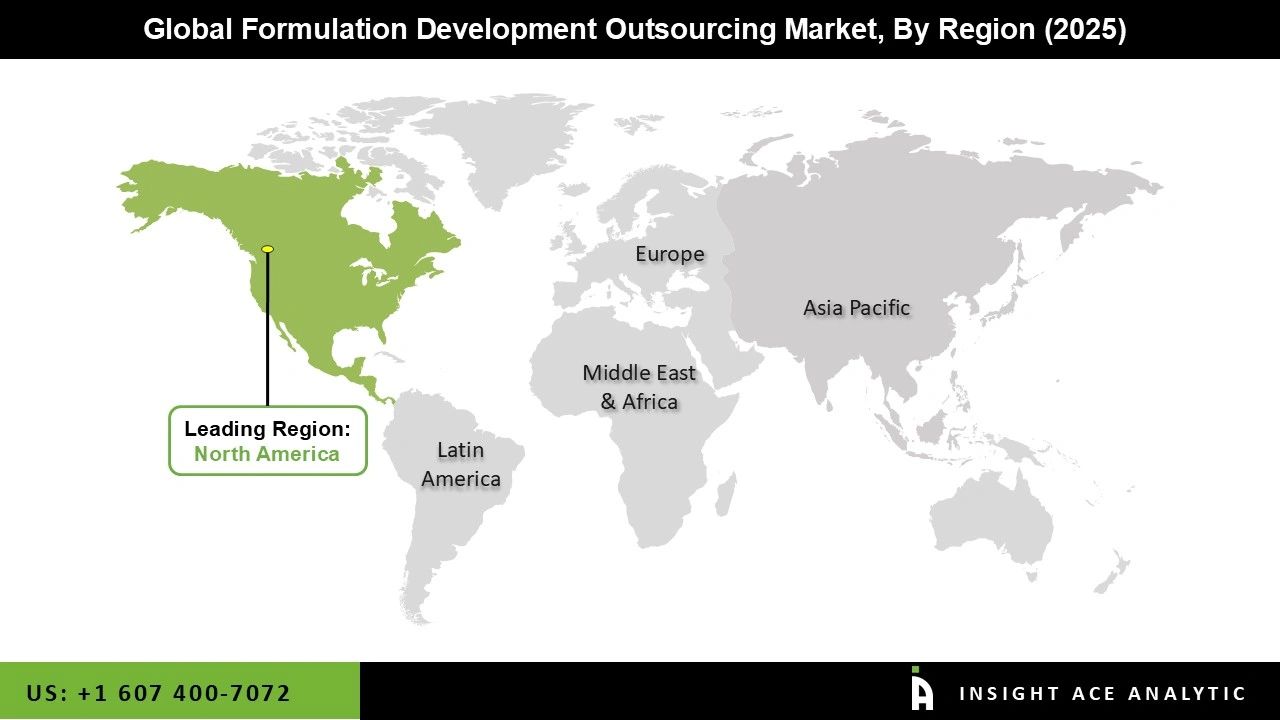

The North American formulation development outsourcing market will generate the highest revenue shortly. The regional growth can be attributed to the increasing burden of chronic disease and the existence of key players in the region, especially in the US. As most of the prominent drugs are in the stage of patent expiration, major players are involved in novel drug formulation development outsourcing, which may drive market growth in the region.

Moreover, the UK market of formulation development outsourcing held the largest market share, and the German market of formulation development outsourcing was the fastest-growing market in the region.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 43.22 billion |

| Revenue forecast in 2035 | USD 92.23 billion |

| Growth rate CAGR | CAGR of 8.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Service, Application And Formulation |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Charles Rover Laboratories (US), Laboratory Corporation of America (US), Intertek (US), Recipharm, Lonza, Element, Thermo Fisher Scientific, Inc. (Patheon) |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.