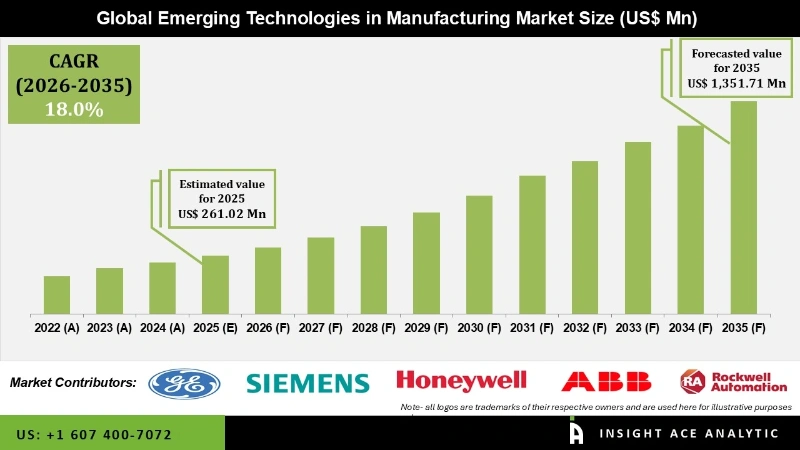

Emerging Technologies in Manufacturing Market Size is valued at US$ 261.02 Mn in 2025 and is predicted to reach US$ 1,351.71 Mn by the year 2035 at an 18.0% CAGR during the forecast period for 2026 to 2035.

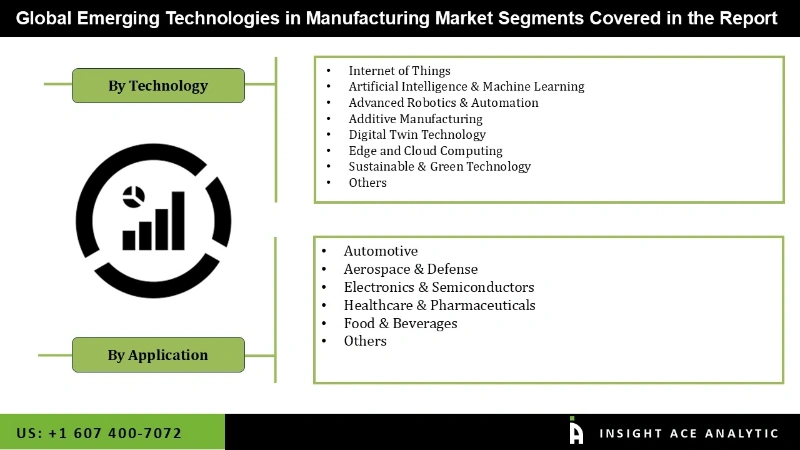

Emerging Technologies in Manufacturing Market Size, Share & Trends Analysis Distribution by Technology (Internet of Things, Artificial Intelligence & Machine Learning, Advanced Robotics & Automation, Additive Manufacturing, Digital Twin Technology, Edge & Cloud Computing, Sustainable and Green Technology), Application (Automotive, Aerospace & Defense, Electronics & Semiconductors, Healthcare & Pharmaceuticals, Food & Beverages, Others) and Segment Forecasts, 2026 to 2035.

Emerging technologies in manufacturing refer to advanced, innovative tools and processes, such as automation, AI, additive manufacturing, robotics, and IoT, that transform production systems by expanding efficiency, flexibility, sustainability, and competitiveness in industrial operations and global supply chains. The emerging technologies in the manufacturing market are significantly driven by the increasing adoption of automation, which is transforming efficiency, productivity, and quality across various industries.

Manufacturers in the automotive, electronics, aerospace, and consumer goods industries are integrating robotics, AI-powered systems, and Industrial IoT platforms to streamline processes and reduce human error. Automation enables predictive maintenance, real-time monitoring, and adaptive production lines that can respond quickly to market demand. Rising labour shortages and cost pressures further fuel the shift toward automated solutions. Additionally, smart factories powered by digital twins and cutting-edge sensors help achieve mass customisation and sustainability goals, making automation a cornerstone of next-generation manufacturing competitiveness globally.

Emerging technologies in the manufacturing market are experiencing strong growth, with advancements in 3D printing serving as a key driver. Additive manufacturing enables the rapid prototyping, customisation, and cost-efficient production of complex geometries that are challenging to achieve with traditional methods.

This flexibility accelerates product development cycles and reduces material waste, supporting sustainability goals. In industries such as aerospace, automotive, and healthcare, 3D printing enhances the design of lightweight components, improves spare part availability, and enables the production of patient-specific medical devices. Continuous improvements in multi-material printing, metal additive manufacturing techniques, and scalability are strengthening adoption across mass production. As manufacturers embrace Industry 4.0, integrating 3D printing with AI and IoT further boosts efficiency and competitiveness.

Some of the Key Players in the Emerging Technologies in Manufacturing Market:

· General Electric Company

· Siemens

· Honeywell International Inc.

· ABB

· Rockwell Automation

· NVIDIA Corporation

· Dassault Systèmes

· Autodesk Inc.

· FANUC CORPORATION

· Mitsubishi Electric Corporation

· Emerson Electric Co.

· Bosch Rexroth AG

· Intel Corporation

· Zebra Technologies Corp

· Schneider Electric

The emerging technologies in manufacturing market is segmented by application, and technology. By application, the market is segmented into internet of things, artificial intelligence & machine learning, advanced robotics & automation, additive manufacturing, digital twin technology, edge & cloud computing, sustainable and green technology. By technology, the market is segmented into automotive, aerospace & defense, electronics & semiconductors, healthcare & pharmaceuticals, food & beverages, others.

In 2024, the payments held the major market share due to the push toward electrification, lightweighting, and smart production systems. Automakers are adopting advanced robotics, AI-driven quality control, and digital twins to enhance precision, decrease expenses, and accelerate product development. Additive manufacturing allows rapid prototyping and customization of components, while advanced materials such as composites and alloys support lightweight vehicle design for expanded fuel efficiency and EV range. Industry 4.0 integration, such as IoT-enabled predictive maintenance, further optimises production lines, ensuring higher efficiency, sustainability, and flexibility in the automotive manufacturing sector.

The emerging technologies in the manufacturing market are dominated by additive manufacturing, which offers the ability to decrease production expenses, reduce material waste, and accelerate prototyping. Manufacturers are increasingly adopting 3D printing for the production of complex parts, lightweight structures, and customised products across various industries, including aerospace, automotive, and healthcare.

The technology supports on-demand production, shortening supply chains and reducing inventory costs. Furthermore, advancements in materials, including metals and composites, expand application possibilities. As sustainability pressures expand, additive manufacturing’s efficiency and reduced carbon footprint further expand its widespread adoption in modern manufacturing.

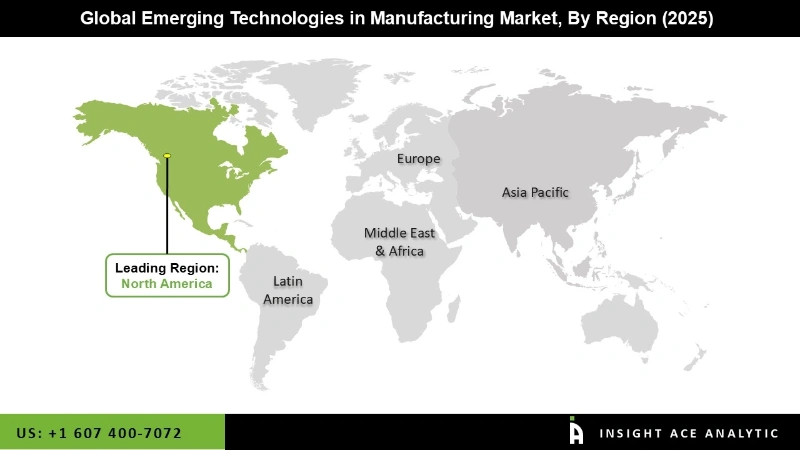

North America dominates the market for emerging technologies in manufacturing due to region’s rapid adoption of automation, AI, and Industrial IoT to improve efficiency, productivity, and supply chain resilience. Increasing labour expenses and skills shortages are prompting manufacturers to integrate robotics, digital twins, and predictive analytics for more efficient operations.

Government initiatives supporting reshoring and advanced manufacturing, particularly in sectors such as aerospace, automotive, and semiconductors, further fuel the deployment of technology. Additionally, sustainability goals and need for energy-efficient production processes allow investments in additive manufacturing, smart materials, and clean manufacturing solutions.

Moreover, Europe's emerging technologies in the manufacturing market are also fueled by the region’s strong concentration on Industry 4.0 adoption, sustainability, and competitiveness in global supply chains. Manufacturers are more and more using automation, IoT, AI, and additive manufacturing to drive productivity and lower costs.

The European Green Deal and ambitious carbon reduction targets are driving businesses towards smart, energy-efficient production systems. Moreover, digitalization initiatives supported by governments and R&D investments support the incorporation of robotics, advanced analytics, and digital twins. Increased demand for customised products and resilient supply chains further drives the adoption of cutting-edge manufacturing technologies in Europe's automotive, aerospace, and industrial industries.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 261.02 Mn |

| Revenue Forecast In 2035 | USD 1,351.71 Mn |

| Growth Rate CAGR | CAGR of 18.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, By Technology |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | General Electric Company, Siemens, Honeywell International Inc., ABB, Rockwell Automation, NVIDIA Corporation, Dassault Systèmes, Autodesk Inc., FANUC Corporation, Mitsubishi Electric Corporation, Emerson Electric Co., Bosch Rexroth AG, Intel Corporation, Zebra Technologies Corp, and Schneider Electric |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Emerging Technologies in Manufacturing Market by Application-

· Automotive

· Aerospace & Defense

· Electronics & Semiconductors

· Healthcare & Pharmaceuticals

· Food & Beverages

· Others

Emerging Technologies in Manufacturing Market by Technology-

· Internet of Things

· Artificial Intelligence & Machine Learning

· Advanced Robotics & Automation

· Additive Manufacturing

· Digital Twin Technology

· Edge and Cloud Computing

· Sustainable & Green Technology

· Others

Emerging Technologies in Manufacturing Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.