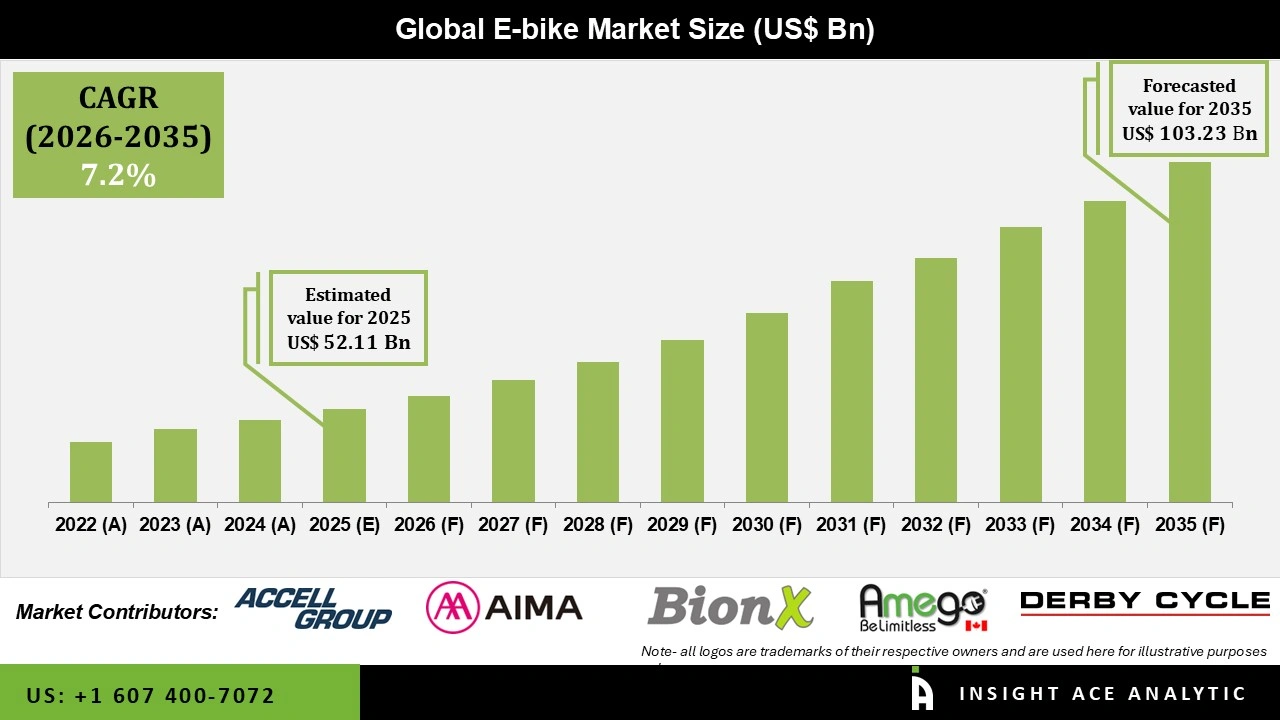

Global E-bike Market Size is valued at USD 52.11 Billion in 2025 and is predicted to reach USD 103.23 Billion by the year 2035 at a 7.2% CAGR during the forecast period for 2026 to 2035.

E-Bike Market Size, Share & Trends Analysis Report By Class (Class-I, II, III), Speed (Up to 25km/h, 25-45 km/h), Battery Type (Lithium-ion, Lithium-ion Polymer, Lead Acid), Mode (Pedal Assist, Throttle), Component (Batteries, Electric Motors, Frames With Forks, Wheels, Crank Gears, Brake Systems & Motor Controllers), Motor Type, Ownership By Region & Segment Forecasts, 2026 to 2035

Electric bikes (E-bikes) are convenient, flexible, environmentally reliable, and modern transportation. Consumers view them as the most suitable replacement for scooters, smart cars, and public transportation. E-bikes, because of their more compact size, capacity to ride further on a single charge, and beneficial impacts on health, have the potential to contribute to the easing of traffic congestion. These factors have contributed to the rapid increase in the popularity of electric bikes all around the globe.

It is anticipated that the market will expand as a result of factors such as the implementation of government regulations to encourage the use of electric bikes, consumer intention for using e-bikes as an environmentally friendly and efficient commute solution, an increase in the price of fuel, and a rise in interest in cycling as a form of exercise and recreational activity.

The E-bike Market expansion needs to be improved by the increased price of e-bikes and the ban on their use in China's major cities. Additionally, battery technology and bicycle infrastructure advancements are anticipated to present an attractive potential for expanding the electric bike market.

The e-bike market is segmented based on class, speed, motor type, mode, battery type, component, usage, and ownership. Based on class, the market is segregated into Class-I, Class II and Class III. Based on speed, the market is segregated into up to 25km/h and 25-45 km/h. Based on battery type, the market is segregated into lithium-ion, lithium-ion polymer, lead acid and others. Based on motor type, the market is segmented into hub and mid. Based on mode, the market is segmented into pedal assist and throttle. Based on components, the market is segregated into batteries, electric motors, frames with forks, wheels, crank gears, brake systems and motor controllers. Based on usage, the market is segmented into mountain, trekking, city/urban, cargo and others. Based on ownership, the market is segmented into shared and personal.

Currently, lithium-ion (Li-ion) batteries rule the e-bike industry. Due to their high energy density, prolonged cycle life, and low self-discharge rate, lithium-ion batteries are frequently utilized in e-bikes. These batteries are also smaller and lighter than other varieties, which makes them the perfect option for e-bikes, which need batteries that can supply enough power for long rides while also being lightweight. Li-ion batteries are also practical for e-bike users because they are simple to charge and have a significant amount of range per charge. E-bikes can now travel farther and faster because of the availability of high-capacity Li-ion batteries, further boosting customer interest in them.

The pedal segment is projected to grow at a rapid rate in the global E-bike Market. The pedal-assist category dominates the market for e-bikes, sometimes referred to as the pedelec segment. Pedal-assist e-bikes contain a motor that helps the rider while they pedal; the level of assistance may be changed to suit the rider's preferences. This e-bike is intended to simplify cycling, especially for those who might find it challenging to ride a traditional bike, such as elderly folks or those who are physically limited. Because of their convenience and adaptability, pedal-assist e-bikes are becoming more and more popular. They provide riders with the best of both worlds by enabling them to benefit from cycling's physical advantages while having access to an electric motor when necessary. They are now a well-liked option for commuting, recreational riding, and other uses.

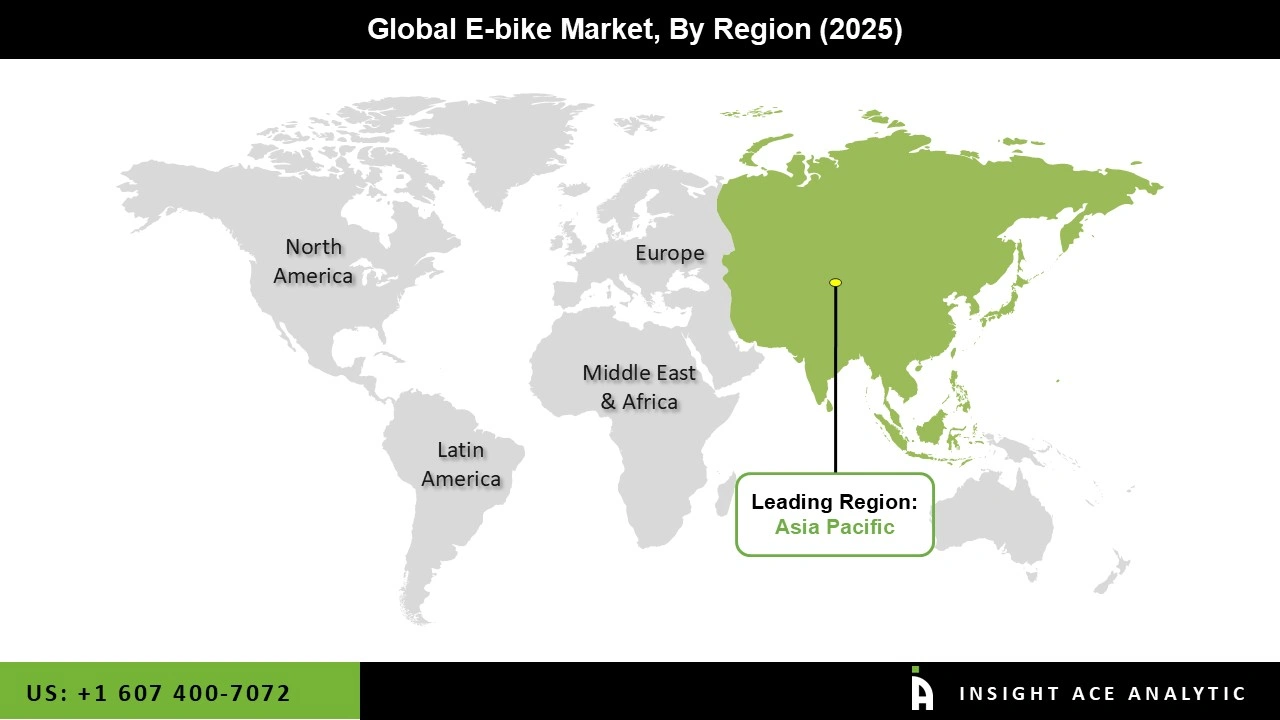

The Asia Pacific E-bike Market is expected to record the highest market share in revenue shortly. Due to a significant increase in the production and demand for e-bikes, the Asia Pacific region has become the world leader in the e-bike market. A certain percentage of market revenue is concentrated in the area, with China leading the pack and producing most of the e-bikes sold worldwide. This is expected to fuel the region's e-bike market growth even more.

Moreover, the e-bike market in the Middle East and Africa is still in the early stages of adoption and is expected to develop at the quickest rate in the future years. The rapid development of micro-mobility infrastructure in the area is the main factor causing the region to grow tremendously. Additionally, the region has recently been looking for enticing demand for bike-sharing programs.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 52.11 Billion |

| Revenue forecast in 2035 | USD 103.23 Billion |

| Growth rate CAGR | CAGR of 7.2% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, Volume (Thousand Units) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Class, Speed, Motor Type, Mode, Battery Type, Component, Usage, And Ownership |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Accell Group (Netherlands) Pon. Bike (US), Merida Industry Co.Ltd. (China), Giant Manufacturing Co.Ltd. (Taiwan), and Yamaha Motor Company (Japan) |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.