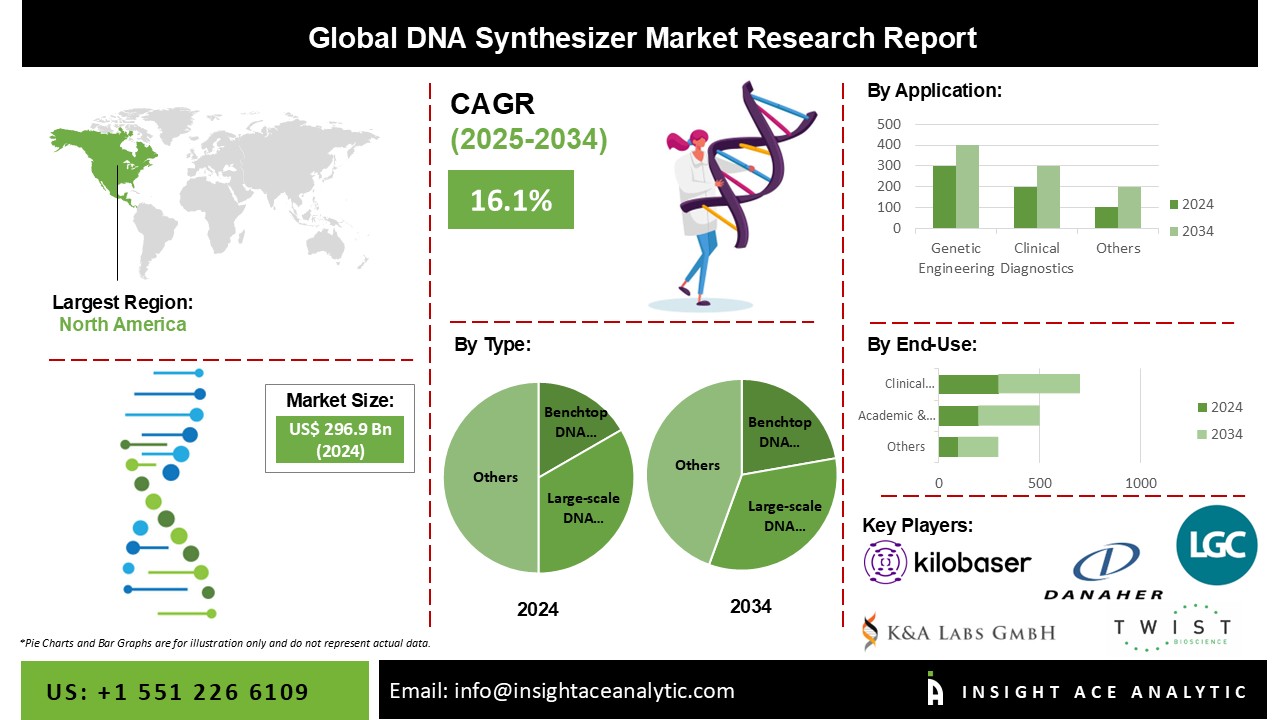

Global DNA Synthesizer Market Size is valued at USD 296.9 Billion in 2024 and is predicted to reach USD 1,278.9 Billion by the year 2034 at a 16.1% CAGR during the forecast period for 2025 to 2034.

DNA Synthesizer Market Size, Share & Trends Analysis Report By Type (Benchtop DNA Synthesizers And Large-Scale DNA Synthesizers), Application (Drug Discovery & Development, Genetic Engineering, And Clinical Diagnostics) And End Users (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies And Clinical Laboratories.), By Technology, Region And Segment Forecasts, 2026 to 2035

The DNA synthesizer market's growth is attributed to the increasing demand for efficient DNA synthesizers from life science laboratories, pharmaceutical and biotechnology companies. Advancements in genomics and life sciences and the rising importance of DNA synthesizers in synthetic and molecular biology are also driving market expansion. Furthermore, the demand for novel synthesis technologies, technological advancements, and the rise in demand for benchtop DNA synthesizers are significant factors contributing to the growth of the global market.

The increasing demand for innovative synthesis technologies and continuous technological improvements are driving the growth of the global market. These factors foster innovation and create fresh prospects for market participants. Enhancements in nucleic acid synthesis techniques have unlocked new possibilities, enabling the creation of DNA synthesizers that are more dependable and efficient. However, some institutions and researchers may be hesitant to adopt DNA synthesizers due to a lack of understanding of the technology, which hampers the market's potential for growth.

Additionally, growing market pressures and the continuous development of alternative efficient synthesis technologies are expected to expand the availability of affordable synthesizers. There is a notable increase in the demand for benchtop DNA synthesizers, mainly due to their potential to improve the speed and efficiency of research in academic and industrial laboratories. This trend will further boost the demand for benchtop solutions in the forecast period. As a result, manufacturers are focusing on developing reliable benchtop systems to cater to this growing demand.

· Thermo Fisher Scientific Inc.

· Agilent Technologies Inc.

· Twist Bioscience Corporation

· Integrated DNA Technologies (IDT, Danaher)

· GenScript Biotech Corporation

· BioAutomation Corporation

· GE Healthcare / Cytiva

· LGC Biosearch Technologies

· Bioneer Corporation

· OriCiro Genomics Inc.

· Evonetix Ltd.

· DNA Script SAS

· Camena Bioscience Ltd.

· Molecular Assemblies, Inc.

· Ansa Biotechnologies, Inc.

· Codex DNA (Telesis Bio Inc.)

· Ribbon Biolabs GmbH

· Arbor Biosciences

· Gen9 (Ginkgo Bioworks)

· OriGene Technologies

· Trilink Biotechnologies

· Eurofins Genomics

· Synbio Technologies

· ATDBio

· Ella Biotech

· Lucigen

· BaseClear

· Benchling

· Genomatica

· Elegen Biosciences

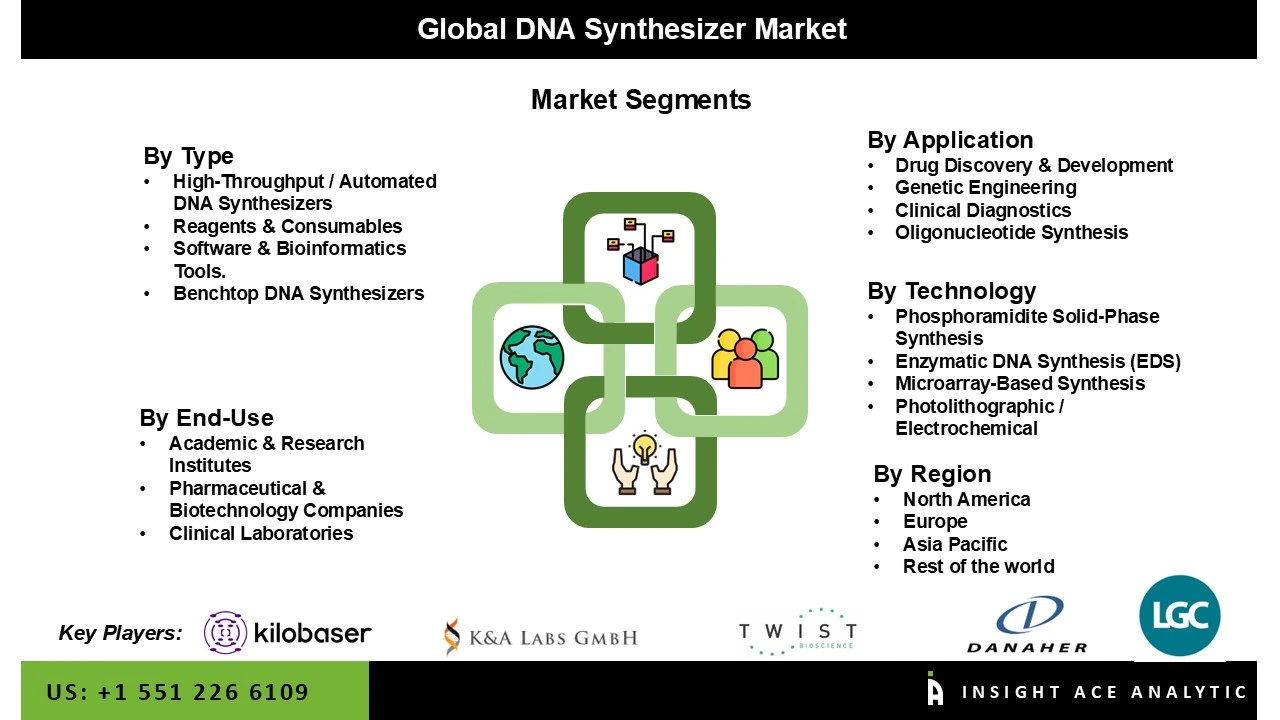

The DNA synthesizer market is segmented based on type, application and end users. The market is segmented based on type as benchtop DNA synthesizers and large-scale DNA synthesizers. The market is segmented by application into drug discovery & development, genetic engineering, and clinical diagnostics. End users segment the market into academic & research institutes, pharmaceutical & biotechnology companies and clinical laboratories.

The Benchtop DNA Synthesizers category will hold a major share of the global market in 2022. The category is expected to increase due to rising R&D spending, rising need for bespoke DNA synthesis, and strong demand from a wide range of end users. Another element contributing to benchtop models' larger revenue share is their cost-effectiveness. Benchtop models are more practical for small businesses and research labs because they are smaller and less expensive than pilot-scale synthesizers. Additionally, these synthesizers are frequently employed in site-directed mutagenesis, gene cloning, and PCR mutagenesis. The demand for synthesizers is further fueled by recent developments in synthetic biology and genetics, new product introductions, and pro-synthesis legislation.

The drug discovery & development segment is projected to grow rapidly in the global DNA synthesizer market. The medication discovery and development area was the most profitable in 2022. technologies developments, increased high-throughput technologies, widespread use of DNA synthesizers in drug discovery, and numerous market players with strong product portfolios are anticipated to drive segment expansion. Another element promoting segment expansion is the increased need from pharmaceutical companies for sophisticated synthesis tools to boost productivity.

The North American, DNA Synthesizer market is expected to register the highest market share. The main reason fueling the region's growth is the existence of a sizable number of market players and the numerous developments carried out by them. Technical improvements, significant R&D expenditures, and growing demand for cutting-edge synthesizers further support the regional market.

Additionally, market actors' investments in the area are increasing. In addition, Europe is projected to grow rapidly in the global DNA synthesizer market. This is due to the rise in interest in synthetic biology research and the expansion of R&D initiatives to create efficient treatments. Europe also has a high incidence of diseases due to lifestyle modifications. The development of the healthcare sector's infrastructure, the arrival of sizable biotechnology companies, and increased market participant investments are all anticipated to support the rise in demand for synthesizers.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 296.9 Bn |

| Revenue Forecast In 2034 | USD 1,278.9 Bn |

| Growth Rate CAGR | CAGR of 14.8 % from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Application, Technology And End Users |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; South Korea; Southeast Asia |

| Competitive Landscape | Danaher; Twist Bioscience; Kilobaser; LGC Limited; CSBio; K&A Labs GmbH; DNA Script; OligoMaker ApS; PolyGen GmbH; Biolytic Lab Performance Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.