Digital Health in FSP Models Market Size is predicted grow at a 15.9 % CAGR during the forecast period for 2025 to 2034.

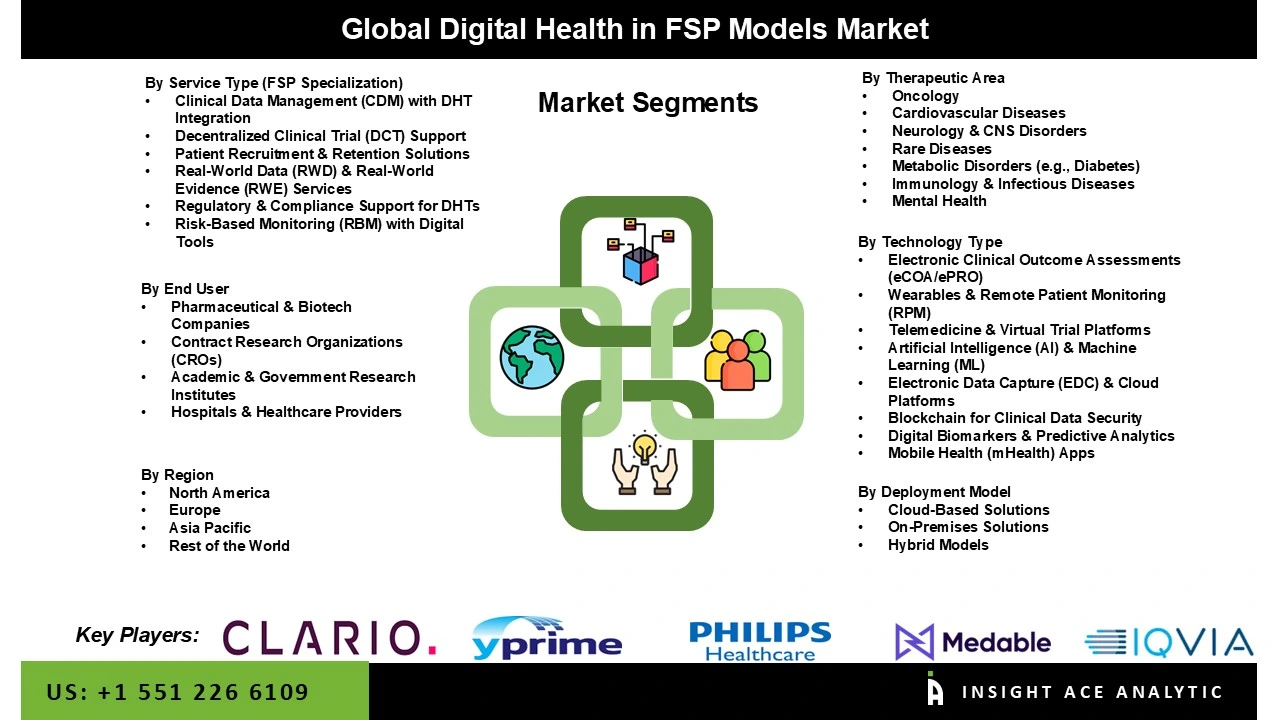

Digital Health in FSP Models Market, Share & Trends Analysis Report, By Technology Type( Electronic Clinical Outcome Assessments (eCOA/ePRO), Wearables & Remote Patient Monitoring (RPM), Telemedicine & Virtual Trial, Platforms, Artificial Intelligence (AI) & Machine Learning (ML), Electronic Data Capture (EDC) & Cloud Platforms, Blockchain for Clinical Data Security, Digital Biomarkers & Predictive Analytics, Mobile Health (mHealth) Apps), By Service Type, By Therapeutic Area, By End User, By Deployment Model, By Region, and Segment Forecasts, 2025 to 2034.

The integration of digital health into Functional Service Provider (FSP) models represents a paradigm shift from conventional staffing to a technology-enabled, expertise-driven partnership. Rather than merely supplying clinical personnel, this advanced FSP framework embeds digital health scientists, data engineers, and technology specialists directly into sponsor organizations to operationalize tools such as wearables, eCOA, and telemedicine. This on-demand access to specialized talent eliminates the need for pharmaceutical companies to develop costly in-house digital infrastructure, while ensuring seamless management of complex, real-time data streams and regulatory-compliant digital endpoints.

This evolution is propelled by mastering novel data modalities, enhancing patient-centric trial design, and optimizing R&D expenditure. By de-risking the adoption of digital measures and compressing timelines through embedded expertise, the digital-first FSP model accelerates decision-making and improves data quality. Consequently, it positions sponsors to achieve greater agility, reduce operational friction, and deliver innovative therapies faster transforming the FSP from a support function into a strategic accelerator of clinical success.

Some of the major key players in the Digital Health in FSP Models Market are

The digital health market in FSP models is segmented by technology type, service type, therapeutic area, end user, and deployment model. Accordig to the technology type, the market is segmented into electronic clinical outcome assessments (eCOA/ePRO), wearables & remote patient monitoring (RPM), telemedicine & virtual trial, platforms, artificial intelligence (AI) & machine learning (ML), electronic data capture (EDC) & cloud platforms, blockchain for clinical data security, digital biomarkers & predictive analytics, mobile health (mHealth) apps.

Based on the Service Type, the market is divided into clinical data management (CDM) with DHT integration, decentralized clinical trial (DCT) support, patient recruitment & retention solutions, real-world data (RWD) & real-world evidence (RWE) services, regulatory & compliance support for DHTS, risk-based monitoring (RBM) with digital tools. Based on the Therapeutic Area, the market is divided into oncology, cardiovascular diseases, neurology & CNS disorders, rare diseases, metabolic disorders (e.g., diabetes), immunology & infectious diseases, and mental health. Based on the end user, the market is divided into pharmaceutical & biotech companies, contract research organizations (CROs), academic & government research institutes, hospitals & healthcare providers. The deployment model segment includes cloud-based solutions, on-premises solutions, and hybrid models.

The telemedicine and virtual trial platforms segment is poised for the highest growth within digital health-enabled FSP models, effectively addressing core challenges in modern clinical research, including patient access, trial decentralization, and operational efficiency. By enabling remote participation, telemedicine eliminates geographic and logistical barriers, allowing patients—particularly in rural, rare-disease, geriatric, and pediatric populations—to engage from home with greater convenience and reduced burden.

This approach drives higher recruitment and retention rates, fosters demographic diversity, and enhances patient engagement, resulting in superior data quality and stronger regulatory alignment. FSPs leveraging these platforms can remotely manage site activities, ensure compliance, and capture real-time data without requiring physical visits, significantly streamlining trial execution and reducing operational overhead.

The Decentralized Clinical Trial (DCT) support segment commands the largest share of the digital health FSP market, serving as the foundational framework that integrates diverse digital technologies to transform trial design, execution, and oversight. By enabling fully or hybrid decentralized studies through electronic data capture, virtual site monitoring, and remote patient interaction, DCT support accelerates timelines, enhances data integrity, and prioritizes patient-centricity.

Sponsors increasingly adopt this model for its ability to minimize dropout rates, reduce site management and travel costs, and deliver actionable insights through real-time analytics—ultimately compressing development cycles. FSPs delivering robust, scalable DCT solutions gain a decisive competitive advantage by meeting the evolving demands of efficient, technology-driven clinical research with precision and agility.

North America, led by the U.S., maintains the dominant market position in digital health-integrated FSP models, underpinned by a mature ecosystem of electronic health records (EHRs), telemedicine infrastructure, wearable devices, remote monitoring systems, and AI-powered analytics. This advanced digital foundation enables FSPs to seamlessly embed cutting-edge tools into critical trial functions, including data management, clinical monitoring, and patient interaction.

The region is home to the world’s leading biopharmaceutical firms, contract research organizations (CROs), and technology providers—early adopters that drive sustained demand for innovative FSP services and decentralized trial capabilities. Moreover, widespread adoption of cloud computing, advanced data interoperability, and robust regulatory alignment creates an optimal environment for scalable, efficient integration of digital health solutions into FSP frameworks.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 15.9 % from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Technology Type, Service Type, Therapeutic Area, End User, Deployment Model |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Medable, YPrime, Clario, IQVIA eCOA, Castor, Philips Healthcare, ActiGraph, BioTelemetry (Philips), Huma, VivaLNK, Science 37, Curebase, Thread, MDClone, Saama Technologies, Unlearn.AI, PathAI, Deep 6 AI, Veeva Vault EDC, Medidata Rave EDC, Oracle Clinical One, ArisGlobal, Triall, Hashed Health, Parexel, ICON (PRA Health Sciences), Labcorp Drug Development, Syneos Health, Empatica, Koneksa, AiCure |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Digital Health in FSP Models Market - By Technology Type

· Electronic Clinical Outcome Assessments (eCOA/ePRO)

· Wearables & Remote Patient Monitoring (RPM)

· Telemedicine & Virtual Trial Platforms

· Artificial Intelligence (AI) & Machine Learning (ML)

· Electronic Data Capture (EDC) & Cloud Platforms

· Blockchain for Clinical Data Security

· Digital Biomarkers & Predictive Analytics

· Mobile Health (mHealth) Apps

Global Digital Health in FSP Models Market – By Service Type (FSP Specialization)

· Clinical Data Management (CDM) with DHT Integration

· Decentralized Clinical Trial (DCT) Support

· Patient Recruitment & Retention Solutions

· Real-World Data (RWD) & Real-World Evidence (RWE) Services

· Regulatory & Compliance Support for DHTs

· Risk-Based Monitoring (RBM) with Digital Tools

Global Digital Health in FSP Models Market – By Therapeutic Area

· Oncology

· Cardiovascular Diseases

· Neurology & CNS Disorders

· Rare Diseases

· Metabolic Disorders (e.g., Diabetes)

· Immunology & Infectious Diseases

· Mental Health

Global Digital Health in FSP Models Market – By End User

· Pharmaceutical & Biotech Companies

· Contract Research Organizations (CROs)

· Academic & Government Research Institutes

· Hospitals & Healthcare Providers

Global Digital Health in FSP Models Market – By Deployment Model

· Cloud-Based Solutions

· On-Premises Solutions

· Hybrid Models

Global Digital Health in FSP Models Market – By Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.