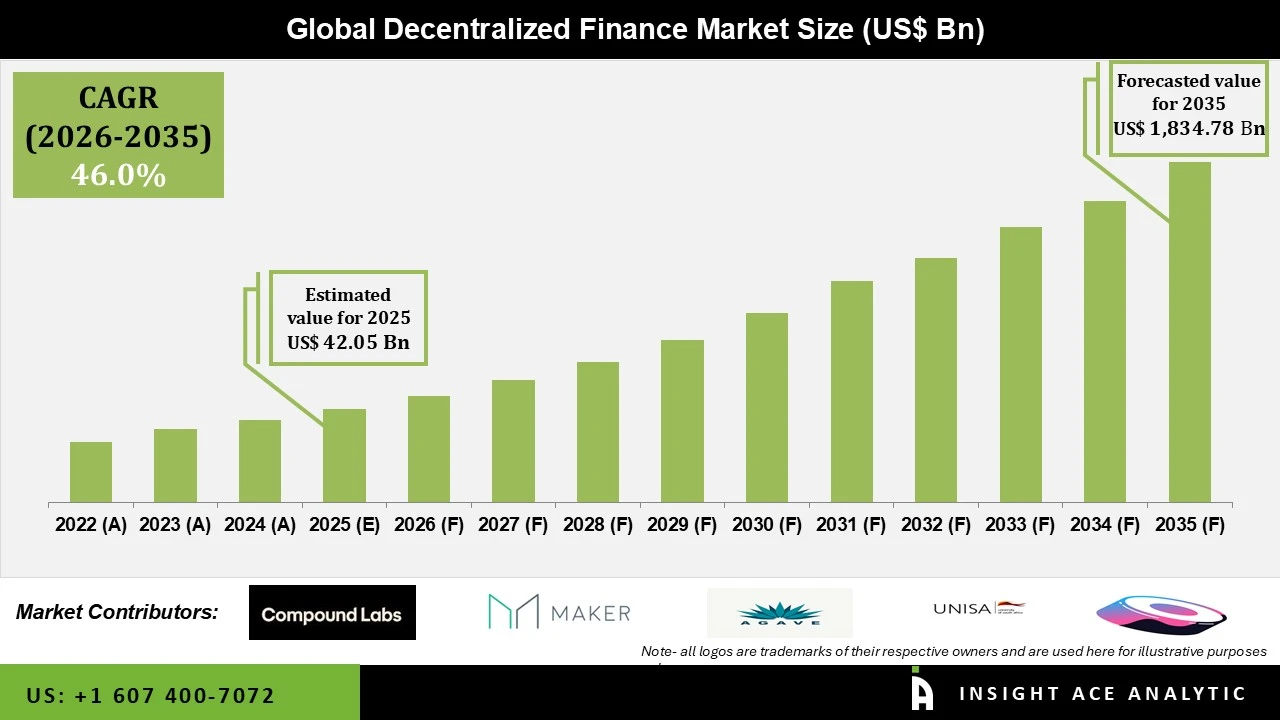

Decentralized Finance Market Size is valued at USD 42.05 Billion in 2025 and is predicted to reach USD 1834.78 Billion by the year 2035 at a 46.0% CAGR during the forecast period for 2026 to 2035.

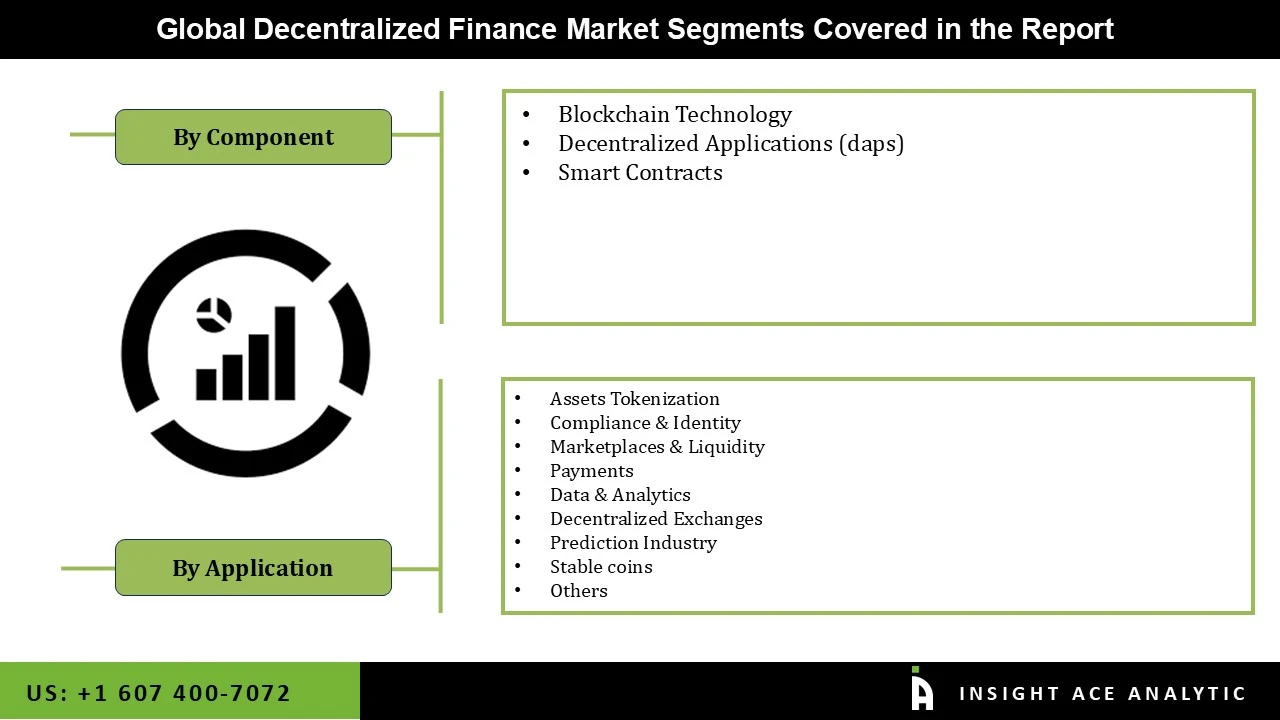

Decentralized Finance (DeFi) Market Size, Share & Trends Analysis Report By Product (Blockchain Technology, Decentralized Applications (DAPPS) And Smart Contracts), Application (Assets Tokenization, Compliance & Identity, Marketplaces & Liquidity, Others), By Region, And Segment Forecasts, 2026 to 2035

Decentralized Finance platforms were employed to boost productivity, contributing to the industry's success. An increase in e-sports and entertainment has also been cited as a key driver for decentralized finance platforms since developers use decentralized finance tokens for in-app transactions. Since they let users exchange tokens and expand their ecosystem, market games and artifacts are becoming more and more well-liked genres on the blockchain.

Decentralized finance tools also come with specific hazards, which could endanger global market expansion. Key drivers influencing the decentralized finance market growth include populations that are under and unban, venture capital funding in the technology sector, rising spending and rising demand for trying to cut technologies in the finance industry. Decentralized finance presents a wide range of opportunities. Distributed finance presents enhanced efficiency as its initial possibility. The efficiency of money transfers can be improved by decentralized finance.

Decentralized finance can enhance efficiency by using smart contracts in place of trust requirements. In a decentralized financial environment, two parties willing to exchange digital assets in tokens do not require a third party or financial intermediary. The main obstacles to industry expansion are user error, targeted hacks, and decentralized finance network security. However, in the years to come, the use and acceptance of blockchain-based prediction tools will widen new growth opportunities in the worldwide decentralized finance market expansion.

The decentralized finance market is segmented based on product and application. Based on product, the market is segmented as blockchain technology, decentralized applications (DAPPS) and smart contracts. By application, the market is segmented into assets tokenization, compliance & identity, marketplaces & liquidity, payments, data & analytics, decentralized exchanges, prediction industry, stablecoins and others.

The blockchain technology category is expected to hold a major share in the global decentralized finance industry in 2021. Blockchain technology can replace the present decentralised business model underpinnings by promoting decentralized trust, reducing cost, and boosting autonomous platforms. Decentralized financial services are often more inventive, interoperable, decentralized, borderless, and accessible, and blockchain technology facilitates their rise in the finance industry. Autonomous financial services powered by blockchain technology can expand financial inclusion, offer open access, encourage creativity, and create new opportunities for business and innovation.

The payment segment is projected to grow at a rapid rate in the global decentralized finance market. Decentralized finance protocols provide important advantages for data analysis and decision-making. Decentralized finance protocols aid in risk assessment and create economic prospects because they are open to data and network activity. Users can utilize a variety of dashboards and tools provided by decentralized finance marketplaces to compare yield and availability and assess platform risks., especially in countries such as the US, Germany, the UK, China, and India.

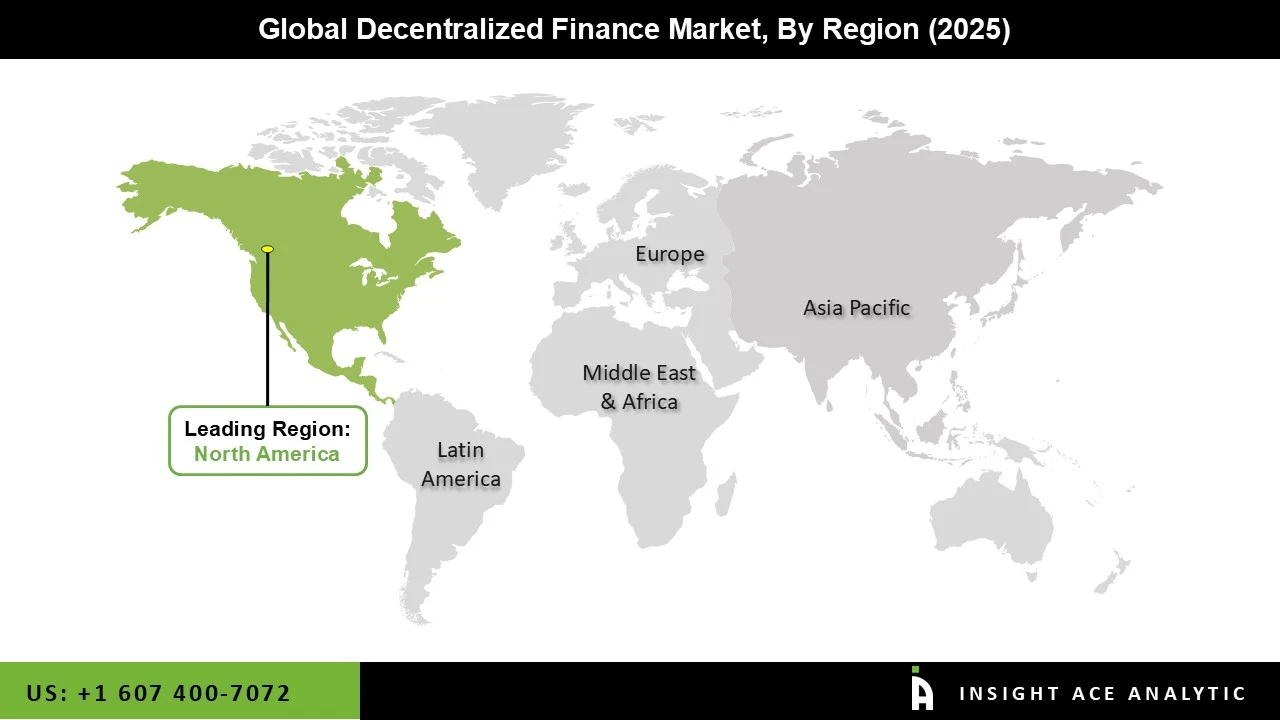

The North America decentralized finance market is expected to register the highest market share in terms of revenue soon. to growth in the use of cloud-based deploying applications for expanding customer needs, an increase in the demand for customer relationship management, and a rise in the level of automation in this area. In addition, Asia Pacific is projected to grow at a rapid rate in the global decentralized finance market. Increased market development and research efforts as well as increased cloud-based adoption will open more chances in this area.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 42.05 Billion |

| Revenue forecast in 2035 | USD 1834.78 Billion |

| Growth rate CAGR | CAGR of 46.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product, Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Compound Labs, Inc.; Maker DAO; Agave; Unisa; Sushi Swap; Curve Finance; Synthetic; Balancer, Bancorp Network; Badger DAO. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Decentralized Finance Market By Component

Decentralized Finance Market By Application

Decentralized Finance Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.