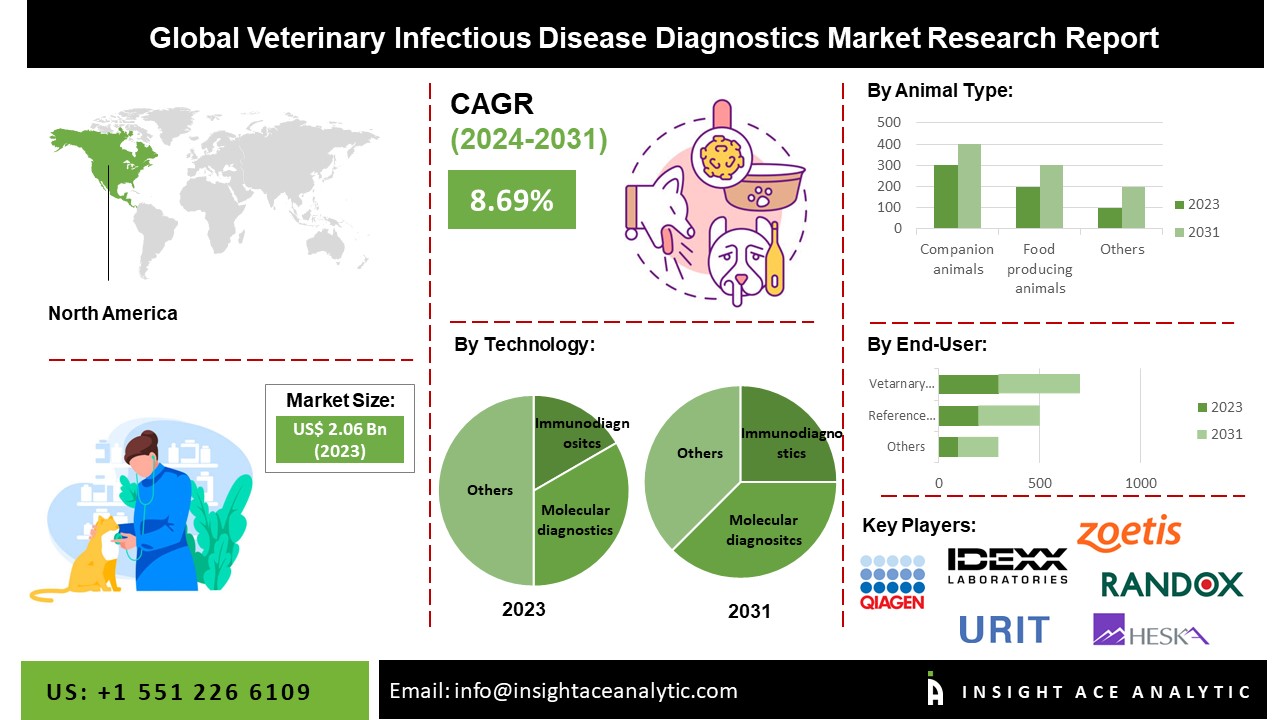

The Global Veterinary Infectious Disease Diagnostics Market Size is valued at USD 2.06 billion in 2023 and is predicted to reach USD 3.95 billion by the year 2031 at an 8.69% CAGR during the forecast period for 2024-2031.

Key Industry Insights & Findings from the Report:

Tests that assist in determining and identifying various animal illnesses are known as veterinary infectious disease diagnostics. These treatments are carried out using different techniques using tissue, excrement, and patient blood samples. Some of the factors that have led to the growth of this business include the prevalence of zoonotic diseases, the price of animal health, the number of veterinarians, the development of point-of-care diagnostics, and the level of discretionary money in emerging nations.

Veterinary infectious illnesses are the major sickness category in terms of market size. Animal diagnosis has a positive outlook, which promotes an increase in the species' population. The increasing prevalence of companion animals in households and farms will result in favourable market growth for the forecast period. Expanding research collaborations, growing research facilities, and growing direct and indirect research investments will increase the demand for the product.

The demand for pet insurance is rising, there is an increase in the number of companion animals, and there is an increase in the number of modern diagnostic tools for animals; as more companion animals contract various infectious diseases, the veterinary infectious disease diagnostics market is expanding. The development of the veterinary infectious disease diagnostics industry is, however, constrained by a need for more knowledge regarding using these instruments in less developed nations. The veterinary contagious disease diagnostics market will expand during the forecast mentioned above due to rising applications from emerging economies and increasing vegan trends, which will also present enormous opportunities.

The veterinary infectious disease diagnostics market is divided into technology, animal type, and end-use. Based on technology, the veterinary infectious disease diagnostics market is segmented into immunodiagnostics (lateral flow assays, elisa tests, other immunodiagnostics products), molecular diagnostic (polymerase chain reaction (PCR) tests, microarrays, other molecular diagnostic products) and other technologies. Based on animal type, the veterinary infectious disease diagnostics market is segmented into companion animals (cats, dogs, horses, other companion animals), companion animals by infection type (viral infections, bacterial infections, parasitic infections, other infections), food-producing animals (cattle, pigs, poultry, other food-producing animals) and food-producing animals, by infection type (viral infections, bacterial infections, parasitic infections, other infections). The veterinary infectious disease diagnostics market is divided into reference laboratories, veterinary hospitals and clinics, point-of-care/in-house testing, research institutes and universities.

The market's leading segment is immunoassays. The growing use of immunoassays in the diagnosis of infectious diseases, the creation of novel tests, the rising trend of automation, the rise in public awareness of fitness and health, and the decreased complications caused by the instruments are the fundamental causes of this market's domination. However, antibody and antigen detection by immunoassays is the primary method by which the infection is established in some infectious disorders, such as Lyme disease, cryptococcal meningitis, and syphilis. Immunoassays are increasingly available for point-of-care testing due to their simplicity, quick turnaround time, and generally excellent specificity. These elements will cause the market to see expansion throughout the anticipated timeframe.

Reference laboratories grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. The enormous number of samples from small and large animal practices sent to reference laboratories for analysis may cause a significant share of this end-user category. The healthcare sector's increased production of medical samples and developments in some medical specialties, including hematology and serology, is anticipated to be the primary growth drivers for the clinical reference laboratory services market. Another significant growth driver for the clinical reference laboratory services has been the research and advanced studies carried out in cytogenetics, tumors, and human genomes, all of which are fundamental components of the broader microbiology field.

The North American veterinary infectious disease diagnostics market is expected to register the highest market share. The cost increase demonstrates owners' desire to take their pets for diagnostic tests. These elements will cause the market to expand significantly in the future years. Due to the rapid adoption of pets, rising spending on animal health, the availability of advanced diagnostic technologies and favorable pet insurance coverage, the prevalence of major market players, and the rise in zoonotic diseases, the U.S. currently dominates the global market for veterinary infectious disease diagnostics. This trend is expected to continue during the forecast period. Besides, Asia pacific region is estimated to hold a significant market share. The region's market is expanding due to increasing zoonotic disease occurrences and rising demand for diagnostics for infectious diseases. Owners' desire to take their dogs for diagnostic tests is evident in the cost increase. The market will grow significantly in the coming years due to these factors. Additionally, the expansion of the regional market as a whole is being greatly aided by an increase in R&D activities and a good healthcare infrastructure.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 2.06 billion |

| Revenue Forecast In 2031 | USD 3.95 billion |

| Growth Rate CAGR | CAGR of 8.69% from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ illion and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Technology, Animal Type, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | IDEXX Laboratories, Inc. (US), ZOetis, Inc. (US), Thermo Fisher Scientific, Inc. (US), Virbac (France), bioMerieux SA (France) Heska Corporation (US), Idvet (France), NEOGEN Corporation (US), QIAGEN N.V. (a part of INDICAL Biosicence) (Europe), Randoxz Laboratories Ltd. (UK), Agrolabo S.pA. (Italy), Bio-Rad Laboratories (US), Bionote, Inc. (South Korea), Biogal Galed Labs (Isreal), BioChek (Netherlands),(UK) Biopanda Regrants (UK), URIT Medical Electric Co.Ltd. (China), MEGACOR Diagnostik GmbH (Germany), Fassisi GmbH (Germany), Alvedia (France), SKYER, Inc. (South Korea), Shenzhen Bioeasy Biotechnology Co., Ltd. (China) , and Precision Biosensor (US). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Technology

By Animal Type

By End User

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.