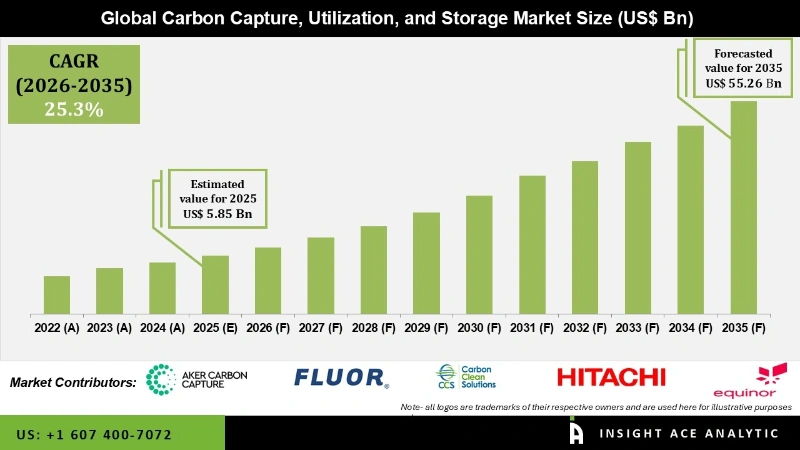

The Carbon Capture, Utilization, and Storage Market Size is valued at USD 5.85 Bn in 2025 and is predicted to reach USD 55.26 Bn by the year 2035 at an 25.3% CAGR during the forecast period for 2026 to 2035.

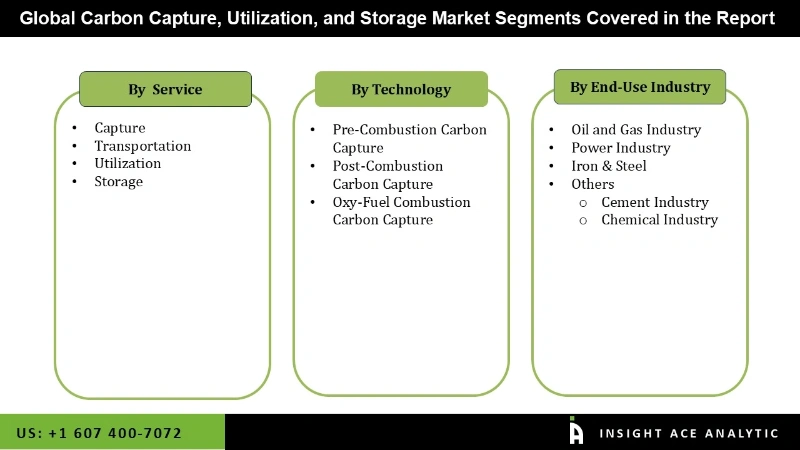

Carbon Capture, Utilization, and Storage Market Size, Share & Trends Analysis Distribution by Service (Capture, Transportation, Utilization, Storage), Technology (Pre-Combustion Carbon Capture, Post-Combustion Carbon Capture, Oxy-Fuel Combustion Carbon Capture), End-Use Industry, By Region, And By Segment and Segment Forecasts, 2026 to 2035.

The Carbon Capture, Utilization, and Storage (CCUS) market is vital in the global effort to reduce CO2 emissions from industrial processes and power generation. CCUS integrates three main processes: capturing CO2 emissions at their source using techniques like post-combustion, pre-combustion, and direct air capture; utilizing the captured CO2 in various applications such as producing chemicals, fuels, and construction materials; and transporting the CO2 for long-term storage in geological formations to prevent its release into the atmosphere. This approach not only mitigates climate change but also creates economic opportunities through the monetization of captured carbon.

The applications of CCUS are diverse, including enhanced oil recovery in the oil and gas sector, reducing emissions in power plants, and targeting significant emitters like the cement and steel industries. Captured CO2 can also be used in chemical production, promoting a circular carbon economy. The CCUS market's growth is driven by increasing global efforts to reduce greenhouse gas emissions, with governments implementing stringent regulations and policies aimed at carbon neutrality. Rising awareness of climate change impacts and regulatory support are propelling investments in CCUS technologies, as industries strive to adopt more sustainable practices and comply with environmental regulations.

The carbon capture, utilization, and storage market is segmented by service, technology, and end-use industry. By service the market is segmented into capture, transportation, utilization, storage, by technology market is categorized into pre-combustion carbon capture, post-combustion carbon capture, oxy-fuel combustion carbon capture. By end-use industry market is categorized into oil and gas industry, power industry, others (cement industry, chemical industry, iron & steel).

The Capture segment is the largest and a key driver of the Carbon Capture, Utilization, and Storage (CCUS) market due to its foundational role in the CCUS process. Capture involves isolating CO2 emissions from industrial sources and power generation before they enter the atmosphere, making it crucial for the success of subsequent transportation, utilization, and storage steps. Its broad applicability across diverse emission sources, such as coal-fired power plants and industrial processes like cement and steel production, ensures a steady demand for capture solutions. Moreover, ongoing technological advancements in post-combustion, pre-combustion, and direct air capture methods are improving efficiency and reducing costs, attracting investments and facilitating compliance with stringent environmental regulations. These factors collectively highlight the Capture segment’s critical importance and its substantial contribution to the growth of the CCUS market.

The Post-Combustion Carbon Capture segment is the largest and fastest growing in the CCUS market due to its proven effectiveness and broad applicability. This mature technology captures CO2 from flue gases after fossil fuels are burned, using established methods like solvent-based absorption. It can be retrofitted to existing infrastructure across various emission sources, including coal-fired power plants and industrial processes. With capture rates exceeding 90%, post-combustion capture offers high efficiency in reducing greenhouse gases, making it a preferred choice for industries aiming to meet stringent emissions regulations.

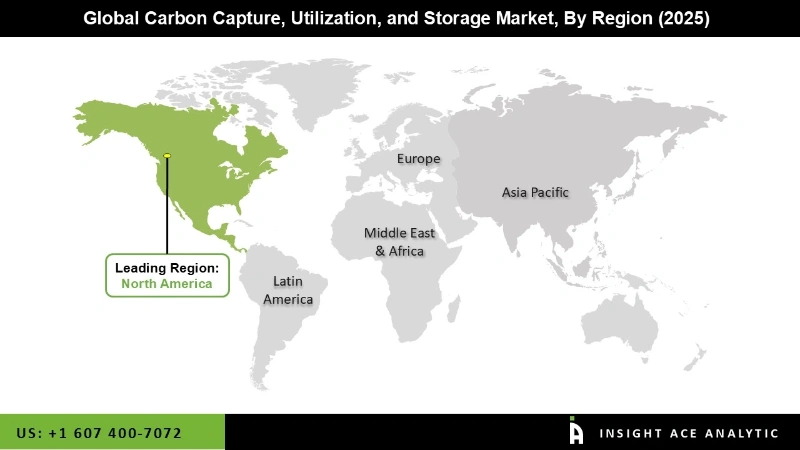

The U.S. leads globally in carbon capture capacity used in enhanced oil recovery (EOR), handling about 30 million metric tons annually, which significantly drives CCUS adoption in North America. Government incentives like the FUTURE Act provide tax credits for carbon capture projects, enhancing financial viability and investment. The presence of key players such as ExxonMobil, Fluor Corporation, Halliburton, and Schlumberger further stimulates innovation and deployment. Increasing demand for clean technologies and the maturity of the CCUS industry, with decades of commercial deployment in the oil and gas sector, offer North America established infrastructure, expertise, and economies of scale.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 5.85 Bn |

| Revenue Forecast In 2035 | USD 55.26 Bn |

| Growth Rate CAGR | CAGR of 25.3 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Units considered | Value (USD Million/Billion), Volume (ton) |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Service, By Technology, By End-Use Industry and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Aker Carbon Capture, Carbon Clean Solutions Limited, CarbonFree, C-Capture, Cemvita Factory Inc., Equinor ASA, ExxonMobil Corporation, Fluor Corporation, Halliburton, Hitachi, Ltd, Honeywell International Inc, JGC Holdings Corporation, Linde Plc, Mirreco, Mitsubishi Heavy Industries, Ltd., Neustark AG, Royal Dutch Shell, Schlumberger Ltd, SeeO2 Energy Inc., Shell plc, Siemens |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Carbon Capture, Utilization, and Storage Market by Service -

Carbon Capture, Utilization, and Storage Market by Technology -

Carbon Capture, Utilization, and Storage Market by End-Use Industry-

Carbon Capture, Utilization, and Storage Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.