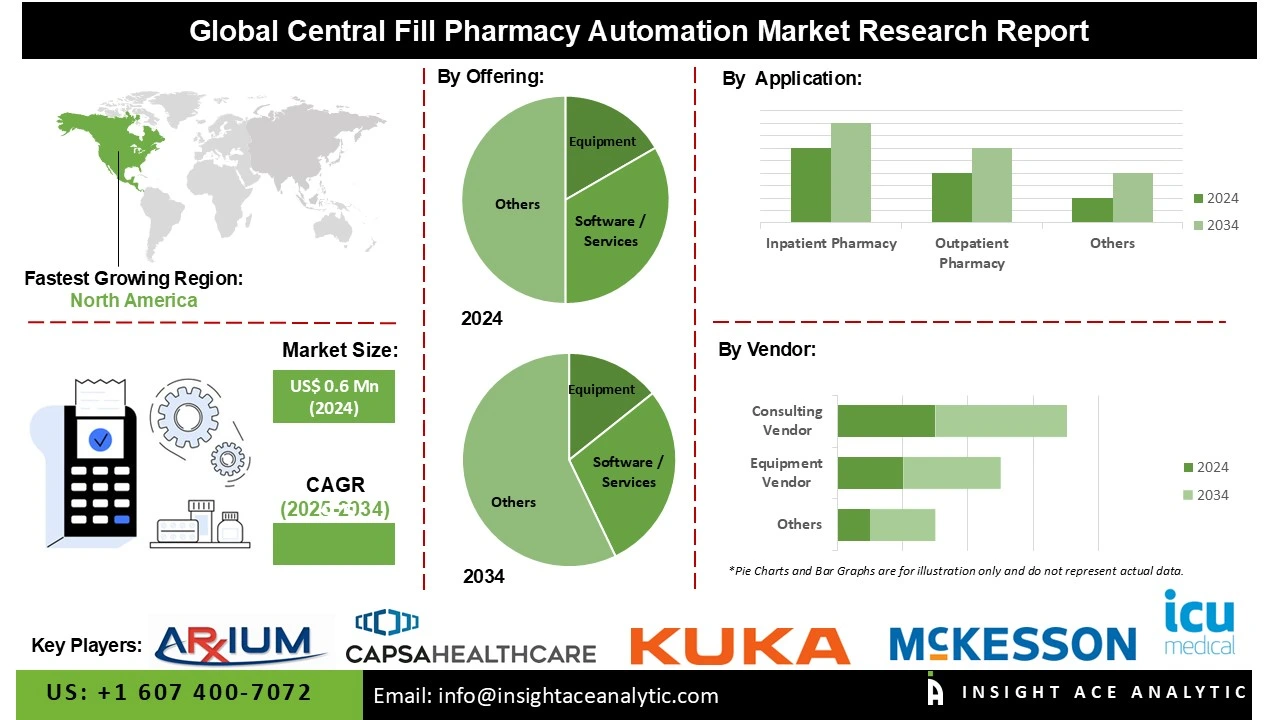

Global Central Fill Pharmacy Automation Market Size is valued at US$ 0.6 Bn in 2024 and is predicted to reach US$ 1.5 Bn by the year 2034 at an 9.5% CAGR during the forecast period for 2025 to 2034.

Central Fill Pharmacy Automation Market Size, Share & Trends Analysis Distribution By Type of Offering (Equipment (Automated Packaging and Labeling Systems, Integrated Workflow Automation Systems, Automated Tabletop Counters, Automated Medication Compounding Systems, Automated Storage and Retrieval Systems, and Others), and Software/Services (Consulting, Work Flow Optimization, Facility Designing, Customer Software Development and Others)), By Type of Vendor, By Application Area, By Type of Throughput Capacity, By End User and Segment Forecasts, 2025 to 2034

Central Fill Pharmacy Automation represents a fundamental shift in the pharmacy retail model. It leverages robotics and software to create a more efficient, accurate, and scalable prescription fulfilment system, enabling the modern pharmacist to transition from a primarily dispensing role to a more clinically-focused patient care provider. The central fill pharmacy automation market is growing rapidly due to increasing demand for efficiency, accuracy, and cost savings in pharmacy operations. Automation streamlines prescription fulfilment by reducing manual errors, speeding up processing, and improving inventory management.

A key driver is the reduction of drug wastage, as automated systems precisely dispense medications, track stock levels, and minimize expired or incorrectly filled drugs. Additionally, rising prescription volumes, focus on patient safety, and the adoption of advanced robotics and software solutions in hospitals and retail pharmacies further fuel market growth, ensuring consistent, reliable, and waste-efficient pharmacy operations.

The central fill pharmacy automation market is witnessing significant expansion, primarily due to the increasing demand for effective optimization of pharmacy workflows. Pharmacies are experiencing greater prescription volumes and intricate medication management needs, making manual processes time-consuming and prone to errors. Automation solutions, such as robotic dispensing, conveyor technology, and integrated software, improve accuracy, minimize dispensing errors, and expedite prescription fulfillment.

Further, increased usage of mail-order and e-pharmacy services accelerates demand for centralized, high-capacity filling systems. Cost savings, labor cost avoidance, enhanced patient safety, and regulatory compliance also promote investment in automated solutions. The trend toward personalized medicine and rising chronic disease prevalence also supports the market, as pharmacies seek scalable, streamlined operations to meet increasing patient needs.

Some of the Key Players in the Central Fill Pharmacy Automation Market:

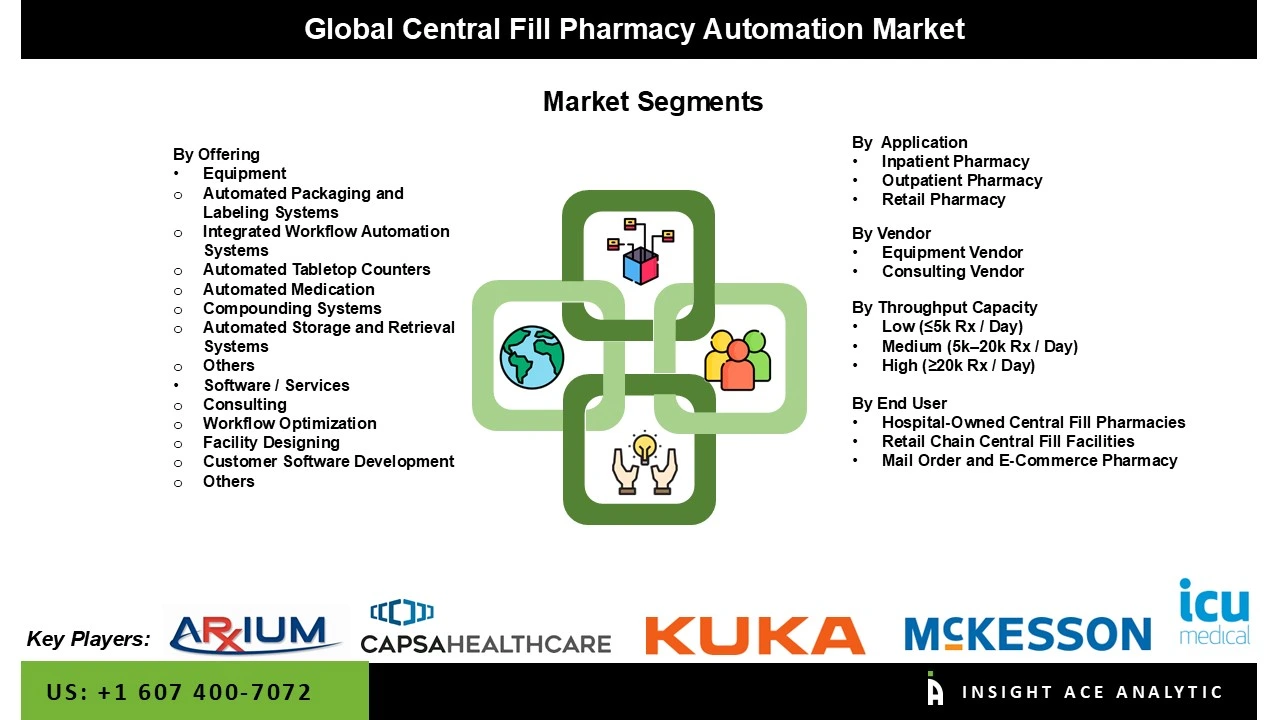

The market of Central Fill Pharmacy Automation is segmented by type of offering, by type of vendor, by application area, by type of throughput capacity, by end users and by region. By type of offering, the market is segmented into equipment (automated packaging and labeling systems, integrated workflow automation systems, automated storage and retrieval systems, automated tabletop counters, automated medication compounding systems, and others), and software/services (consulting, workflow optimization, Facility designing, customer software development and others). By type of vendor, the market is segmented into equipment vendor, and consulting vendor.

By application area, the market is segmented into inpatient pharmacy, outpatient pharmacy, and retail pharmacy. By type of throughput capacity, the market is segmented into low (≤5k rx / day), medium (5k–20k rx / day), and high (≥20k rx / day). By end users, the market is segmented into wearables, smartphones, and tablets. By type of deployment, the market is segmented into hospital-owned central fill pharmacies, retail chain central fill facilities, and mail order & e-commerce pharmacies.

In 2024, the equipment held the major market share over the projected period due to increasing demand for efficient, accurate, and high-volume prescription fulfillment in retail and hospital pharmacies. Rising medication errors, labor shortages, and the requirement to decrease operational costs are driving adoption of automated systems. Central fill automation enhances workflow efficiency, decrease human error, and ensures compliance with regulatory standards. Prominent equipment includes automated dispensing systems, robotic pill counters, carousel storage units, conveyor systems, labelling machines, and vision inspection systems, all designed to streamline prescription processing and expand patient security.

The central fill pharmacy automation market is dominated by equipment vendor due to the rising demand for efficient prescription fulfillment, minimizing human errors, and addressing workforce shortages in pharmacies. Increasing adoption of automated dispensing systems improves accuracy, throughput, and operational efficiency in retail and hospital pharmacies. Rising healthcare costs and the need for regulatory compliance also drive the shift toward automation.

North America dominates the market for central fill pharmacy automation due to the region’s increasing prescription volumes, a surge in chronic diseases, and the need to improve pharmacy efficiency and patient safety. Automation reduces medication errors, accelerates prescription processing, and optimises workflow in retail and hospital pharmacies. The rising adoption of mail-order and specialty pharmacies also drives demand for centralized automated systems. Furthermore, advancements in robotics, barcode scanning, and AI-based inventory management streamline operations and reduce labor costs. Supportive healthcare regulations and a focus on improving medication adherence further fuel market expansion in the region.

Moreover, Asia Pacific central fill pharmacy automation market is also fueled due to the region’s increasing demand for efficient, exact, and high-volume prescription fulfilment. Increasing workloads in retail and hospital pharmacies, coupled with staff shortages, create a requirement for automation to decreases dispensing issues and improve operational efficiency. Growing adoption of e-prescriptions and online pharmacy services further fuels demand. Additionally, the requirement to enhance patient safety, optimize inventory management, and comply with stringent regulatory standards encourages pharmacies to implement automated central fill systems.

· In Sept 2023, ARxIUM launched a new end-to-end, automated narcotic filling and storage system designed to improve safety, accuracy, and efficiency in hospital pharmacies by automating one of the most high-risk and labor-intensive processes.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 0.6 Bn |

| Revenue Forecast In 2034 | USD 1.5 Bn |

| Growth Rate CAGR | CAGR of 9.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type Of Offering, By Type Of Vendor, By Application Area, By Type Of Throughput Capacity, By End Users |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Scope | U.S., Canada, Germany, The UK, France, Italy, Spain, Rest of Europe, China, Japan, India, South Korea, Southeast Asia, Rest of Asia Pacific, Brazil, Argentina, Mexico, Rest of Latin America, GCC Countries, South Africa, Rest of the Middle East and Africa |

| Competitive Landscape | ARxIUM, Capsa Healthcare, ICU Medical, KUKA, McKesson, Neostarpack, Omnicell, Parata Systems, Providen Logistics, RxSafe, ScriptPro, Swisslog Healthcare, and Tension Packaging & Automation |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Central Fill Pharmacy Automation Market by Type of Offering-

• Equipment

o Automated Packaging and Labeling Systems,

o Integrated Workflow Automation Systems,

o Automated Tabletop Counters,

o Automated Medication Compounding Systems,

o Automated Storage and Retrieval Systems,

o Others

• Software / Services

o Consulting,

o Work Flow Optimization,

o Facility Designing,

o Customer Software Development

o Others

Central Fill Pharmacy Automation Market by Type of Vendor-

· Equipment Vendor

· Consulting Vendor

Central Fill Pharmacy Automation Market by Application Area-

· Inpatient Pharmacy

· Outpatient Pharmacy

· Retail Pharmacy

Central Fill Pharmacy Automation Market by Type of Throughput Capacity-

· Low (≤5k Rx / Day)

· Medium (5k–20k Rx / Day)

· High (≥20k Rx / Day)

Central Fill Pharmacy Automation Market by End-User-

· Hospital-Owned Central Fill Pharmacies

· Retail Chain Central Fill Facilities

· Mail Order and E-Commerce Pharmacy

Central Fill Pharmacy Automation Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.