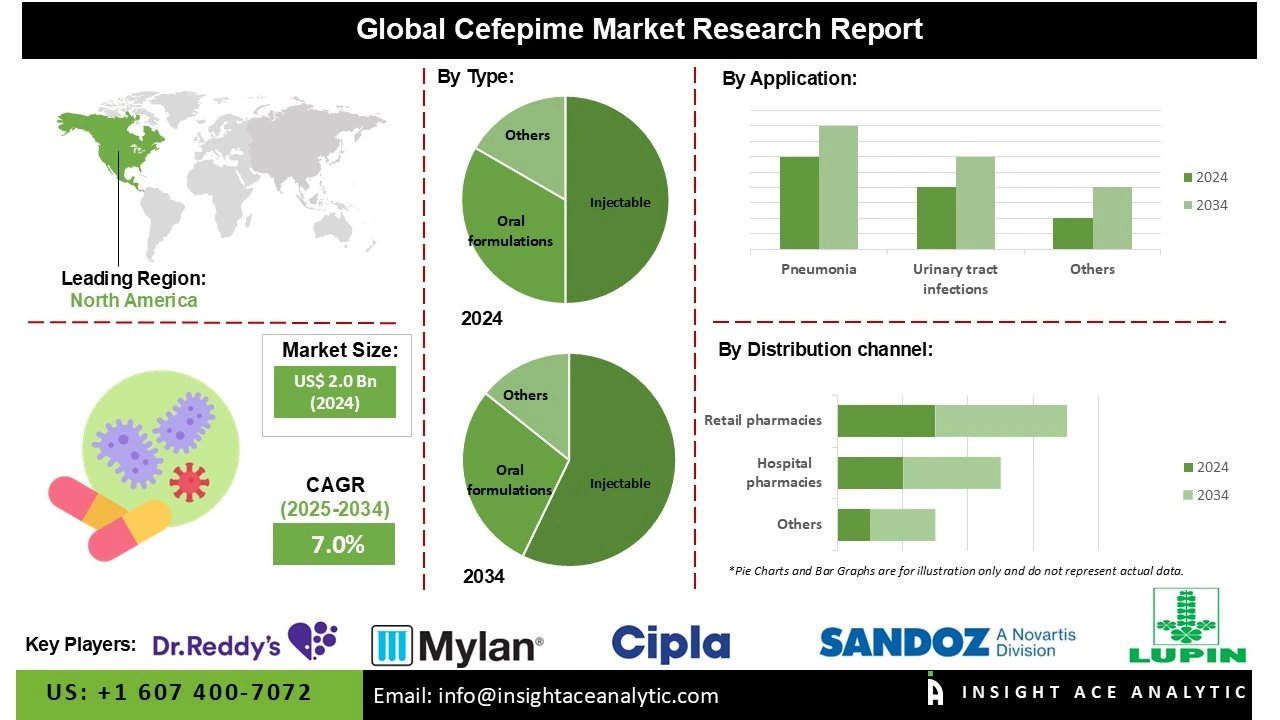

Global Cefepime Market is valued at US$ 2.0 Bn in 2024 and it is expected to reach US$ 3.86 Bn by 2034, with a CAGR of 7.0% during the forecast period of 2025 to 2034.

Cefepime Market Size, Share & Trends Analysis Distribution by Type (Oral Formulations, Injectable, and Combination Therapies), Application (Pneumonia, Meningitis, Urinary Tract Infections, Bloodstream Infections, Skin and Soft Tissue Infections, and Intra-abdominal Infections), Distribution Channel (Hospital Pharmacies and Retail Pharmacies), and By Segments Forecasts, 2025 to 2034

Cefepime, a fourth-generation cephalosporin antibiotic, serves as a fundamental agent in the treatment of severe bacterial infections within hospital environments. Its mechanism of action entails the inhibition of bacterial cell wall synthesis, resulting in the elimination of susceptible organisms.

A key feature of cefepime is its broad spectrum of activity, which encompasses both Gram-positive and Gram-negative bacteria, including Pseudomonas aeruginosa and many strains resistant to earlier-generation cephalosporins. It is a first-line agent for treating hospital-acquired pneumonia, complicated urinary tract infections, empiric therapy for febrile neutropenia, and other severe intra-abdominal and skin infections.

The sustained clinical demand for cefepime is driven by several interconnected factors. The global rise in antimicrobial resistance necessitates the use of potent, broad-spectrum agents like cefepime for empiric coverage. Furthermore, an aging population and a growing number of surgical procedures, which require prophylactic and therapeutic antibiotics, underpin its consistent use. The expansion of healthcare infrastructure, mainly in emerging economies, is increasing access to advanced injectable antibiotics. In response to these demands, the pharmaceutical industry continues to develop new formulations, such as ready-to-mix products, to enhance safety, convenience, and integration into hospital protocols. These factors collectively ensure cefepime's continued critical role in the antimicrobial arsenal.

Some of the Key Players in Cefepime Market:

The Cefepime market is segmented by Type, Application, and Distribution Channel. By Type, the market is segmented into Oral Formulations, injectables, and Combination Therapies. By Application, the market is segmented into Pneumonia, Meningitis, Urinary Tract Infections, Bloodstream Infections, Skin and Soft Tissue Infections, and Intra-abdominal Infections. The Distribution Channel segment comprises Hospital Pharmacies and Retail Pharmacies.

In 2024, the injectable formulation segment continues to dominate the cefepime market, a position reinforced by the drug's primary use in treating severe, hospital-managed infections. These intravenous solutions are commercially available in standardized concentrations, most commonly 500 mg/100 mL and 1 g/100 mL, to accommodate diverse dosing requirements based on infection severity and patient renal function. The solutions are characterized as sterile, non-pyrogenic, and transparent, ranging from colorless to a pale yellow liquid.

The sustained growth of this segment is primarily driven by the escalating global prevalence of serious bacterial infections, particularly those caused by multidrug-resistant organisms, where cefepime's broad-spectrum coverage remains critical. Market innovation is focusing on enhancing administration convenience and safety through advanced delivery systems, such as prefilled syringes and ready-to-mix formulations, which reduce preparation errors and improve workflow in clinical settings. Concurrently, ongoing pharmaceutical R&D aimed at optimizing injectable therapies to counter evolving antibiotic resistance provides further momentum for the segment's expansion.

The pneumonia category accounted for the largest share of the cefepime market in 2024. Growing pneumonia incidence and hospitalizations, particularly among older persons and other high-risk categories, have increased the number of patients requiring empiric and broad-spectrum IV therapy, which is driving higher demand for Cefepime within the pneumonia category. Additionally, as hospital-acquired and ventilator-associated pneumonia (HAP/VAP) and intensive care unit (ICU) admissions have increased, doctors have been forced to utilize agents with strong Gram-negative coverage, such as Cefepime, which is often used in empiric regimens advised by inpatient pneumonia guidelines.

In 2024, North America is projected to maintain its dominant position in the global cefepime market. This leadership is anchored by a confluence of key factors: a high concentration of leading pharmaceutical manufacturers, advanced and widely accessible healthcare infrastructure, and a significant clinical burden of bacterial infections. The region's stringent focus on infection control protocols and its role as a primary hub for medical innovation sustain a consistent demand for broad-spectrum antibiotics like cefepime. Furthermore, substantial and ongoing investment in biomedical research and development within the region is expected to solidify its market leadership for the foreseeable future.

Conversely, the Asia-Pacific region is forecast to experience the most rapid growth in the cefepime market during the projection period. This accelerated expansion is driven by powerful demographic and structural trends, including rising healthcare awareness, expanding population coverage, and improving access to advanced medical services. Major economies, notably China and India, are making significant investments in modernizing their hospital infrastructure, which directly facilitates the adoption of sophisticated antibiotics. This growth is further amplified by proactive government health initiatives aimed at curbing infectious diseases and streamlining regulatory pathways for essential medicines.

Cefepime Market by Type-

· Oral Formulations

· Injectable

· Combination Therapies

Cefepime Market by Application -

· Pneumonia

· Meningitis

· Urinary Tract Infections

· Bloodstream Infections

· Skin and Soft Tissue Infections

· Intra-abdominal Infections

Cefepime Market by Distribution Channel-

· Hospital Pharmacies

· Retail Pharmacies

Cefepime Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.