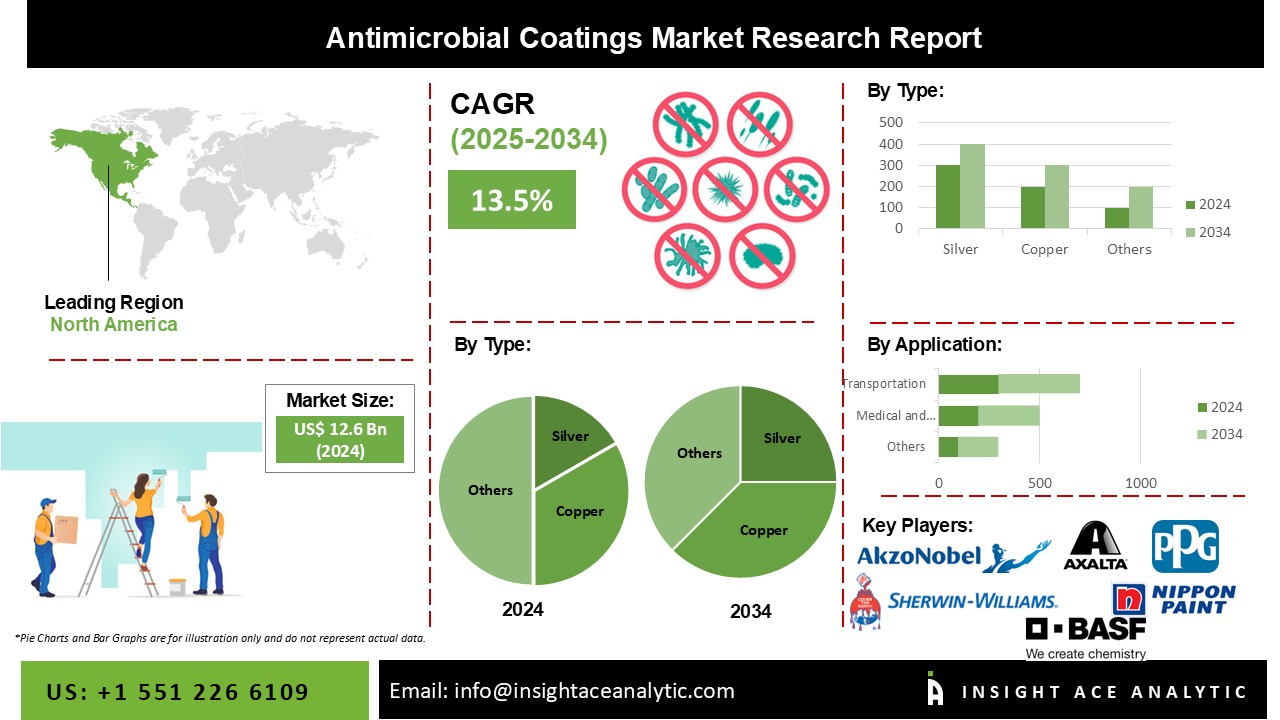

Antimicrobial Coatings Market Size is valued at 12.6 billion in 2024 and is predicted to reach 44.2 billion by the year 2034 at an 13.5% CAGR during the forecast period for 2025-2034.

The antimicrobial coating is a chemical substance that aids in stopping the development of dangerous bacteria, mould, viruses, and germs on the surfaces where it has been applied. The most often utilized antimicrobial coatings are used on walls, doorknobs, counters, and other frequently handled surfaces. By lowering the contamination, discoloration, and odor brought on by bacterial development, coatings increase value and enhance the functionality of the coated product.

Hospitals, clinics, the food and beverage industry, pharmaceutical manufacturing facilities, and new buildings frequently employ these coatings. Surfaces are being protected more often from bacteria and other microorganisms. It applies to more than only medical equipment and surfaces, and the demand is more widespread. Microbes are sensitive to everything, including people, clothing, and food. To stop the spread of germs, surfaces cannot be constantly cleaned, disinfected, or treated with potent chemicals. The most suitable alternative for cleaning seems to be antimicrobial coatings.

By preventing the growth of unwelcome bacteria, which can either cause diseases or cause the product to degrade, it protects against numerous microbial invasions. Additionally, it offers fungus protection, which is regarded as a crucial property for particular outdoor applications. The wider use of these coatings in the healthcare sector increases the need for antimicrobial coating.

Moreover, The elderly population, declining fertility rates, and increasing life expectancy are other factors. Healthcare delivery and health improvement depend heavily on medical devices. The growing number of healthcare sectors use specific infection control measures that use medical equipment treated with antibiotics.

The Antimicrobial Coatings Market is segmented into the type and end-use industry. Based on type, the market is segmented into silver, copper and titanium dioxide. Based on the end-use industry, the market is segmented into medical & healthcare, building & construction, protective clothing, HVAC system, and transportation automotive.

The silver category will hold the most substantial market share by product type during the forecast period. The effectiveness of these coatings against many viruses, bacteria, and other microbes is very significant. When silver-based antimicrobial coatings are applied to substrate surfaces, a controlled release of silver ions occurs, which prevents pathogens and bacteria from growing on the surface. The manufacturers' efforts and technological advancements to add silver-based antimicrobial coatings to medical devices, including surgical instruments and others, boost market expansion.

Based on the application, the medical devices segment is expected to have the largest market share: The medical & healthcare category is anticipated to hold the largest market share over the forecast period. The demand for antimicrobial coatings used on medical equipment has increased because they aid in preventing the growth of various bacteria, parasites, germs, and fungi on their surfaces. The availability of healthcare infrastructure is critical, and it is anticipated that both industrialized and developing countries will see a growth in the number of healthcare services.

The antimicrobial coatings market is predicted to be dominated by the North American area. Due to the existence of several manufacturing enterprises in this region, particularly the United States, it is anticipated that this region would hold a dominant position. During the projection period, the market growth in this area will be driven by the presence of government initiatives that guarantee better healthcare facilities for the general populace. Besides, the most considerable portion of the global market for antimicrobial coatings was represented by Asia Pacific. Growing prospects for investment in the Asia Pacific region are projected to arise from the construction, pharmaceutical, and food and beverage industries. The demand for medical products and medications has grown as a result of both an ageing population and a rise in the number of people suffering from chronic illnesses like diabetes and cardiovascular disease. Therefore, hospitals must take extra precautions for infection control and hygiene, which is likely to increase the demand for healthcare services in this region.

Antimicrobial Coatings Market Report Scope

| Report Attribute | Specifications |

| Market size value in 2024 | USD 12.6 billion |

| Revenue forecast in 2034 | USD 44.2 billion |

| Growth rate CAGR | CAGR of 13.5% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume in Ton and CAGR from 2023 to 2031 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Type, End-user Industry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | AkzoNobel N.V. (Netherlands), Axalta Coating Systems Ltd. (US), The Sherwin-Williams Company (US), BASF (Germany), PPG Industries Inc (US), Nippon Paint Holdings Co. Ltd. (Japan), RPM International Inc. (US), Koninkijke DSM N.V (Netherland), Sika AG (Switzerland), Lanxess AG (Germany) and others |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Antimicrobial Coatings Market By Type-

Antimicrobial Coatings Market By End use industry-

Antimicrobial Coatings Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.