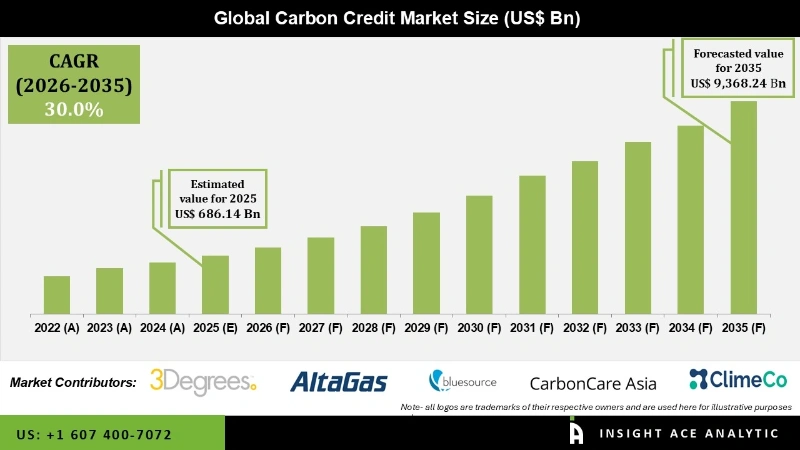

Global Carbon Credit Market Size is valued at USD 686.14 Billion in 2025 and is predicted to reach USD 9,368.24 Billion by the year 2035 at a 30.0% CAGR during the forecast period for 2026 to 2035.

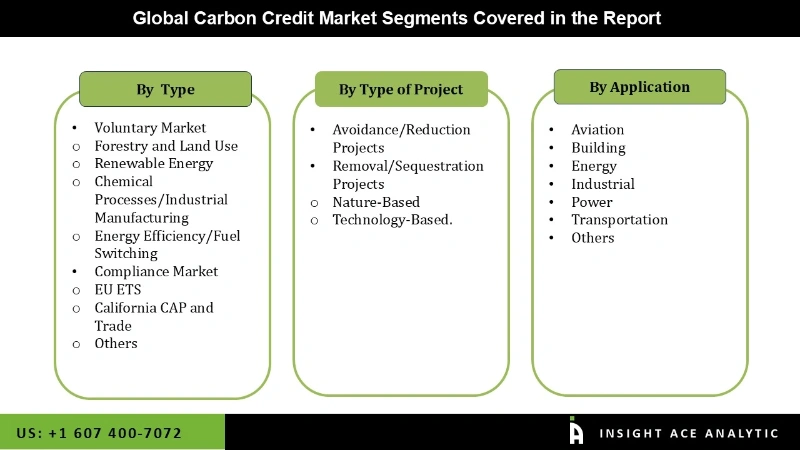

Carbon Credit Market Size, Share & Trends Analysis Report By Type (Voluntary Market, Compliance Market), Type of Project (Avoidance/Reduction Projects, Removal/Sequestration Projects (Nature-Based, Technology-Based)), Application (Aviation, Building, Energy, Power, Industrial, Transportation), By Region, And Segment Forecasts, 2026 to 2035.

A carbon credit is a tradable permit or certificate allowing the holder to emit one tonne of CO2 or the equivalent amount of another greenhouse gas. It is effectively an offset for those who produce such gases. As the global warming movement gains traction, carbon markets are becoming increasingly important in reaching net-zero greenhouse-gas emissions.

Carbon capture solutions are now leading the race against global warming as they develop and deploy innovative, scalable carbon capture technology that will allow us to stop the flow of carbon dioxide and extract the already emitted carbon dioxide. Around the globe, many international, national, and sub-national market mechanisms are being developed. The rising variety of carbon markets necessitates a robust regulatory framework to avoid hazards such as activities being counted twice.

However, against the backdrop of COVID consequences and economic recoveries, more emphasis is being made on the promise of carbon markets to achieve climate goals while also supporting other socioeconomic goals efficiently.

The Carbon Credit Market is segmented based on type, type of project, and Application. Type segment includes voluntary Market (forestry and land use, renewable energy, chemical processes/Industrial manufacturing, energy efficiency/fuel switching) and compliance market (EU ETS, California CAP and Trade, and others. The Type of Project segment includes avoidance/reduction projects and removal/sequestration projects (nature-based, technology-based). By Application, the Market is segmented into power, energy, aviation, transportation, building, industrial, and others.

The forestry and land use category is expected to hold a substantial share in the global market in 2024. Tropical forests encompass around 15% of the world's land surface and contain approximately 25% of the carbon on the planet's surface. Forest loss and degradation account for 15 to 20% of global carbon emissions. The majority of these emissions are caused by deforestation in the tropics, primarily as a result of forest conversion to more lucrative economic activities such as agriculture and mining. Over the last ten years, the Market for forest carbon credits has grown dramatically.

The power segment is projected to grow at a rapid rate in the global Carbon Credit Market. This segment's dominance can be ascribed to the strong demand for energy generation, which results in significant emissions from power utilities. As a result, there will be a high need for carbon trading platforms.

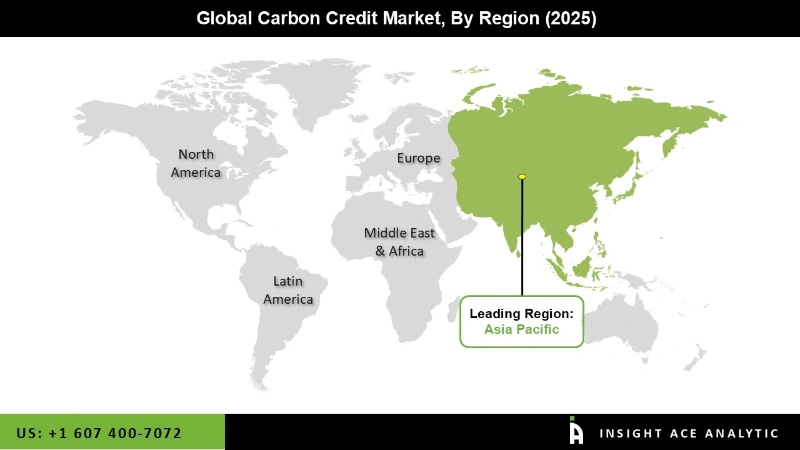

Between 2023 and 2031, Asia-Pacific is anticipated to experience the most rapid growth in the market, followed by Europe. Asia Pacific Carbon Credit Market position is expected to register the highest market share in terms of revenue in the near future. Investments in clean power generation and electrification, as well as acceptance of carbon credit by businesses and local government entities, are driving the regional market expansion.

Also, Europe region has also experienced substantial industrial growth, which has increased demand for carbon credit trading platforms. Many countries in Europe have publicly committed to achieving carbon neutrality by 2050. Because the carbon market is regarded as a vital tool for achieving these goals, the compliance and voluntary global market is expected to increase in the future years.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 686.14 Billion |

| Revenue forecast in 2035 | USD 9.368.24 Billion |

| Growth rate CAGR | CAGR of 30.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Type of Project, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | South Pole Group, 3Degrees, Finite Carbon, EKI Energy Services Ltd., NativeEnergy, CarbonBetter, Carbon Care Asia Limited, Terrapass, Climetrek Ltd., Carbon Credit Capital, NatureOffice GmbH, Climate Partner GmbH, Climate Trade, ForestCarbon, Moss. Earth, Bluesource LLC, TEM (Tasman Environmental Markets), Climate Impact Partners, Carbonfund, and Climeco LLC. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Carbon Credit Market By Type-

Carbon Credit Market By Type of Project-

Carbon Credit Market By Application-

Carbon Credit Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.