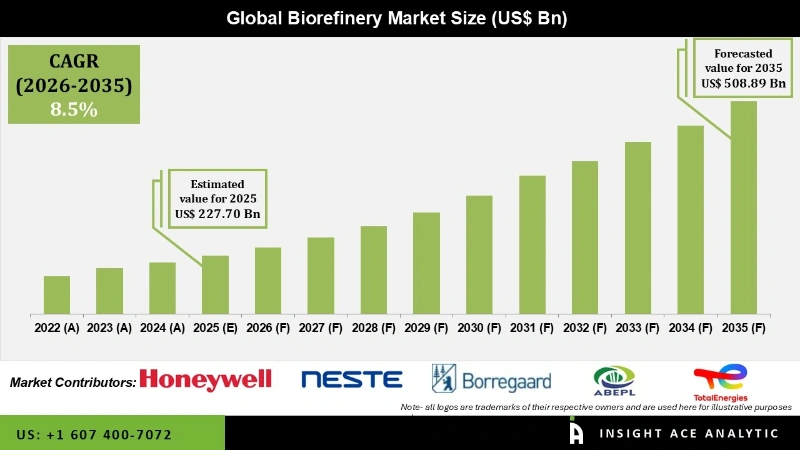

Biorefinery Market Size is valued at USD 227.70 billion in 2025 and is predicted to reach USD 508.89 billion by the year 2035 at a 8.5% CAGR during the forecast period for 2026 to 2035.

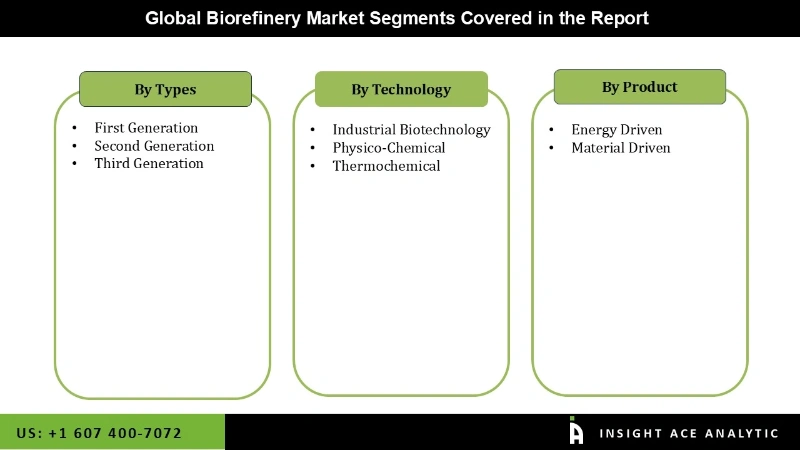

Biorefinery Market Size, Share & Trends Analysis Report By Type (First Generation, Second Generation, and Third Generation), Technology (Industrial Biotechnology, Physico-Chemical, and Thermochemical), Product (Energy driven, and Material driven), By Region, And Segment Forecasts, 2026 to 2035.

The market for biorefineries is still in its infancy, but it is anticipated to expand rapidly over the next ten years due to rising environmental concerns. Mandates and regulations worldwide are also expected to increase demand for goods made from biomass. The California Low-carbon Fuel Standard mandates that fuel suppliers cut GHG emissions by 10% by 2020. Also, the industry has been forced to turn its attention to biofuels due to the world's diminishing fossil fuel supplies to meet the rising need for energy.

Several end-use industries, including agriculture, transportation, chemicals, and aviation, have expressed interest in biomass-based goods. Yet, the sector needs help with building the required infrastructure. Major players in the market have been concentrating on applying the best technologies (for gasification, fermentation, and chemical conversion) to ensure that these bio-based products reach a break-even point to overcome this obstacle. Participants in the industry have been concentrating on the entire biomass product supply chain, from raw materials to end-use enterprises via distribution centers.

The Biorefinery market is segmented based on type, product, and technology. Based on type, the market is segmented as the first, second, and third generation. The product segment includes energy-driven and material driven. By technology, the market is segmented into industrial biotechnology, physicochemical, and thermochemical.

The first-generation biofuels category will hold a significant share of the global Biorefinery market in 2021. The biomass directly related to first-generation biofuels, such as ethanol and biodiesel, is frequently edible. Typically, GMO or conventional yeast strains like Saccharomyces cerevisiae ferment C6 carbohydrates, primarily glucose, to generate ethanol. Only a few different feedstocks are utilized to synthesize first-generation bioethanol, primarily sugarcane or corn.

The thermochemical segment is projected to grow at a rapid rate in the global Biorefinery market. Multiproduction is a promising option for thermochemical biorefineries looking to lower investment risk. It encourages revenue diversification, makes it possible to integrate materials and energy more effectively, and increases profitability, all of which could help thermochemical biorefineries develop more effectively in the future.

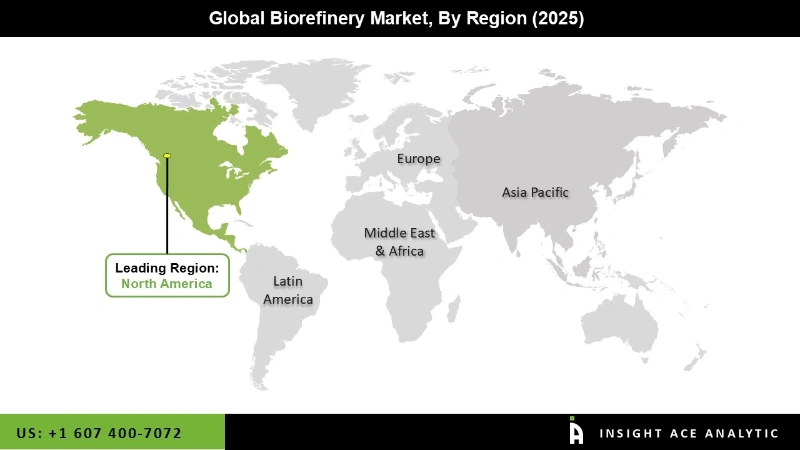

One of the largest aviation markets may be found in the North American continent, which also has a well-established fossil fuel-based infrastructure for land transportation. In order to reduce the greenhouse effect, North America has been at the forefront of reducing emissions. With noteworthy investments in R&D and a large number of biofuel patents to its name, the United States is the region's top producer of advanced biofuels. The United States produced 643 thousand barrels of oil equivalent of biofuel a day in 2021, up roughly 7.1% over the previous year's value, according to the BP Statistical Review of World Energy 2022. (602 thousand barrels of oil equivalent per day).

| Report Attribute | Specifications |

| Market size value in 2025 | USD 227.70 Bn |

| Revenue forecast in 2035 | USD 508.89 Bn |

| Growth rate CAGR | CAGR of 8.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Product, And Technology |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Valero, TotalEnergies, Neste, Renewable Energy Group, Vivergo Fuels, Borregard AS, Wilmar International Ltd., Godavari Biorefineries Ltd., Assam Biorefinery Private Limited., Sekab, Green Plains Inc., Cragil Incorporated, Clariant, Versalis SpA., and BP PLC. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Biorefinery Market By Type-

Biorefinery Market By Product-

Biorefinery Market By Technology-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.