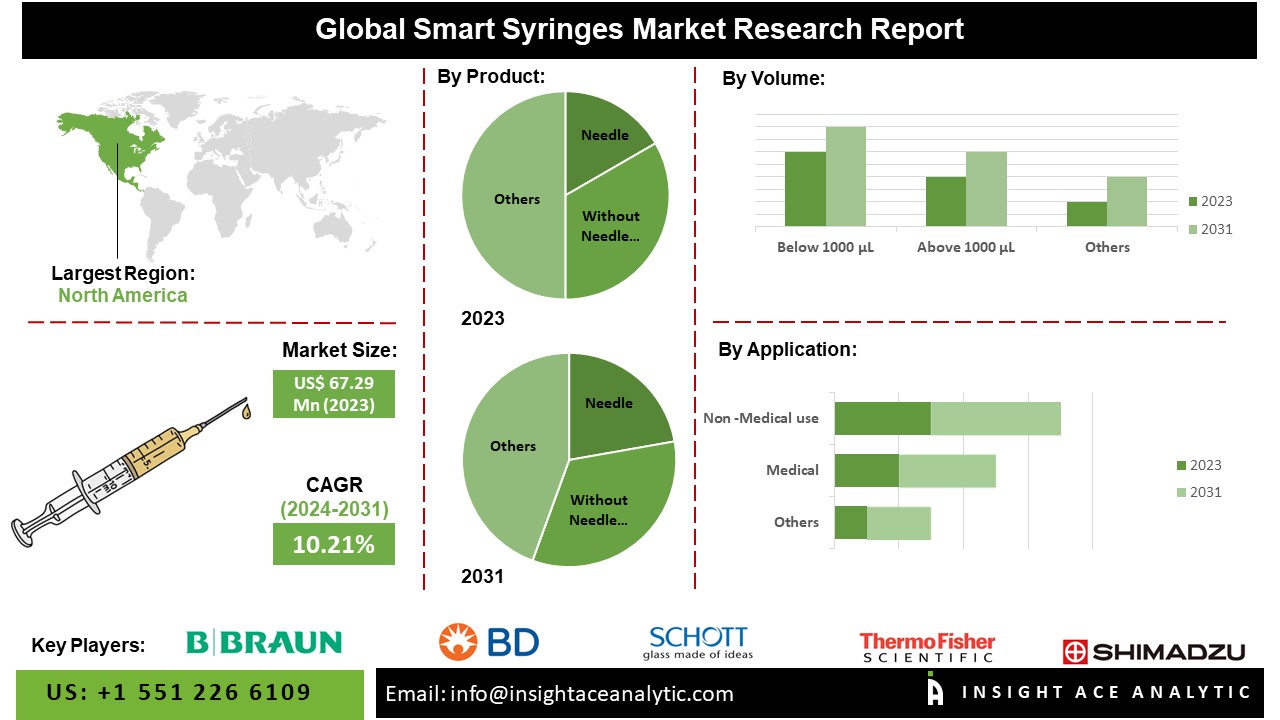

The Smart Syringes Market Size is valued at USD 67.29 Mn in 2023 and is predicted to reach USD 145.62 Mn by the year 2031 at a 10.21% CAGR during the forecast period for 2024-2031.

The increased cases of chronic diseases, including diabetes, cancer, and autoimmune disorders, drive the demand for smart syringes, which are used to give medications and immunizations. Due to the advancement of cutting-edge technologies like auto-disable syringes, prefilled syringes, and needle-free injectors, the market for smart syringes is growing. Because pediatric patients are increasing annually and this age group is more sensitive to infectious diseases, paediatrics is the most lucrative subspecialty.

Significant growth is projected due to the rising prevalence of several target diseases, the rising vaccination rate, the rise in the number of older adults, and the necessity to prevent infections that can be contracted in hospitals or clinics.

Additionally, the market for smart syringes is expanding as more hospitals and health maintenance organizations (HMOs) around the world are adopting smart syringes. In addition, smart syringes are also being used by mental and diabetic patients more frequently to prevent needle stick injuries.

The senior population is predicted to experience chronic diseases due to age-related risk factors and ongoing adoption of poor lifestyle habits. As a result of this rise in diseases, it is anticipated that utilization rates of syringes in the market will increase. The significant unmet needs in many developing nations and the change in healthcare systems toward safe injection techniques offer enormous market growth potential, which is anticipated to fuel the use of smart syringes over the forecast period.

The Smart Syringes market is segmented based on product, volume and application. Based on product, the Smart Syringes market is segmented as with and without needles. The market is segmented by volume into below 1000 μL and above 1000 μL. By application, the Smart Syringes market is segmented into medical use and non-medical use.

The needle type category will hold a major share of the global Smart Syringes market 2022. The rising usage of needle-type smart syringes in the healthcare industry reflects a growing trend toward improving patient safety, medication administration accuracy, and healthcare efficiency. Smart syringes are medical devices designed with features that enhance their functionality, reduce the risk of needlestick injuries, and ensure proper dosing of medications. These devices incorporate various technologies to provide benefits such as automatic retraction of needles, digital dose measurement, and connectivity for data tracking and analysis.

The medical use segment is projected to grow rapidly in the global Smart Syringes market. The rising use of smart syringes in the medical field is driven by various factors contributing to enhanced patient safety, improved healthcare outcomes, and increased efficiency in medical procedures. Smart syringes integrate advanced technologies and features beyond traditional syringes, offering benefits such as precision dosing, connectivity, data collection, and enhanced infection control.

The North America Smart Syringes market is expected to register a tremendous market share. The market is anticipated to grow even more in the upcoming years due to ongoing improvements in medical practices at healthcare facilities around the area.

The American region is anticipated to experience considerable expansion due to rising private and public medical costs, better healthcare facilities, and increased awareness of the risks associated with using hazardous syringes. In addition, Asia Pacific is projected to grow rapidly in the global smart syringes market. The main factors supporting the market expansion over the projection period are increases in public and private healthcare expenditure levels to support initiatives to stop disease transmission and improve patient care.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 67.29 Mn |

| Revenue Forecast In 2031 | USD 145.62 Mn |

| Growth Rate CAGR | CAGR of 10.21 % from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product, Volume, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Agilent Technologies, Inc., Schott AG, Shimadzu Corporation, Thermo Fisher Scientific Inc., Trajan LEAP PAL Parts + Consumables, Clayens-np, Becton, Dickinson and Co., B. Braun Melungeon AG, Terumo Medical Corporation, Baxter International, Inc, Retractable Technologies, Inc, Smith's Group Plc, Merck & Company Inc., Medtronic Plc (Covidien), Unilife Corporation, Revolutions Medical Corporation, AdvaCare Pharma, Cardinal Health, Parker Hannifin Corp., Numedico Technologies Pty Ltd, Thomas Scientific (U.S), McKesson Medical-Surgical Inc. (U.S) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Smart Syringes Market By Product

Smart Syringes Market By Volume

Smart Syringes Market By Application

Smart Syringes Market By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.