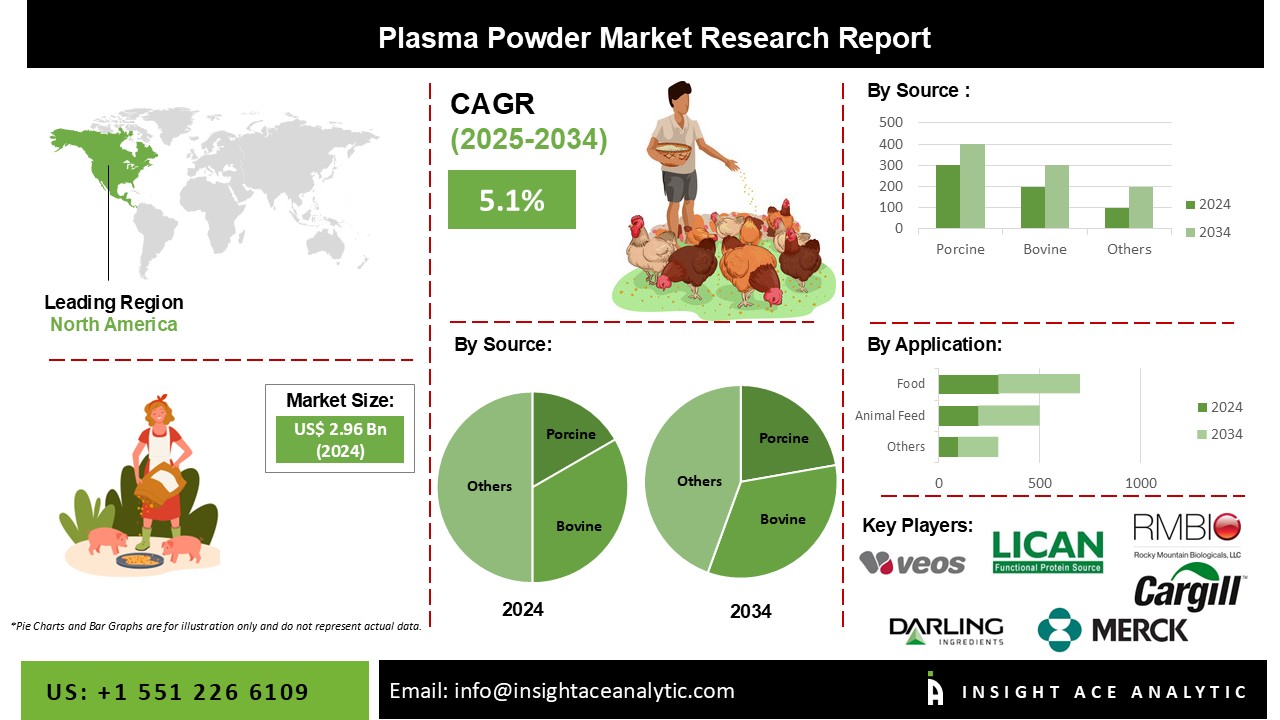

Plasma Powder Market Size is valued at 2.96 Billion in 2024 and is predicted to reach 4.78 Billion by the year 2034 at a 5.1% CAGR during the forecast period for 2025-2034.

Plasma powder includes a variety of physical and biological properties, including a good amino acid profile, immunoglobulins or antibodies that promote health, and great digestion. These powders have a 75% protein content, a high biological value, and are water-soluble. Another essential element promoting growth is the increasing need for food thickeners for soups, sauces, stews, and broths. Increased consumer preferences for high-protein foods and rising demand for ready-to-eat, high-nutrition foods would benefit the plasma powder business. Another issue impeding market expansion is the increased cost of raw materials necessary for the final product.

The increasing attention of major companies on developing safe and nutritious animal feed is a critical market driver. Increasing regulatory controls on antimicrobial growth promoters in major emerging economies and similar growth parameters between AMGP and plasma powder will be significant drivers pushing the plasma powder market globally over the forecast period.

Plasma powder has various advantages over standard protein-related additives in cow-feeding operations, including more remarkable growth, fewer scour days, better fecal scores, reduce dehydration, and lower mortality. Furthermore, rising pet production activities and a considerable increase in demand from pet manufacturers for adding new ingredients to improve pet health are expected to drive the market for plasma powder during the forecast period.

The Plasma powder market is segmented on the source and applications. Based on the source, the market is segmented into bovine, porcine and others. Based on applications, the plasma powder market is segmented into food, animal feed (poultry feed, swine, aquafeed, pet food, ruminant feed , others) and others.

The market's leading segment is bovine. The rising usage of bovine in the food industry is a key driver driving category expansion. Furthermore, the cattle feed business is increasing demand for bovine plasma powder due to an increased desire for immune-stimulating components to prevent animals from losing efficiency. It is also used in cattle feed because it contains proteins that aid in the digestion of young calves. On the other side, the porcine plasma powder market is expanding as it aids cattle in increasing animal weight.

Animal feed grabbed the highest revenue share, and it is anticipated that it will continue to hold that position during the anticipated time. Undigested protein in the intestine of animals can induce bacterial fermentation and pathogen overgrowth. Hence highly digestible proteins or plasma proteins are increasingly important in cattle farming. The rising demand for animal-derived food products such as fish, eggs, meat, and milk creates an urgent need to offer more nutrition to animals, which drives the demand for plasma powder in animal feed. Moreover, the plasma powder helps improve livestock's overall performance and mortality, creating demand for plasma powder.

The North American plasma powder market is expected to register the highest market share in revenue shortly. Owing to the significant prevalence of pet populations and the growing trend among livestock-producing communities toward AMGP alternatives, The United States, which has the majority of the pet population, has seen a considerable increase in high-protein pet food sales. In addition, Asia Pacific is projected to grow rapidly in the global plasma powder market. Increasing government laws restricting antimicrobial growth regulators in animal feed will likely drive the significant market demand for plasma powder throughout the area during the forecast period.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 2.87 Billion |

| Revenue Forecast In 2034 | USD 4.48 Billion |

| Growth Rate CAGR | CAGR of 5.28 % from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Source, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Veos Group, APC Inc, ACTIPRO, Lican food, Merck KGaA, Darling ingredients, Rock Mountain Biologicals and SARIA Group. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Source

By Application

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.