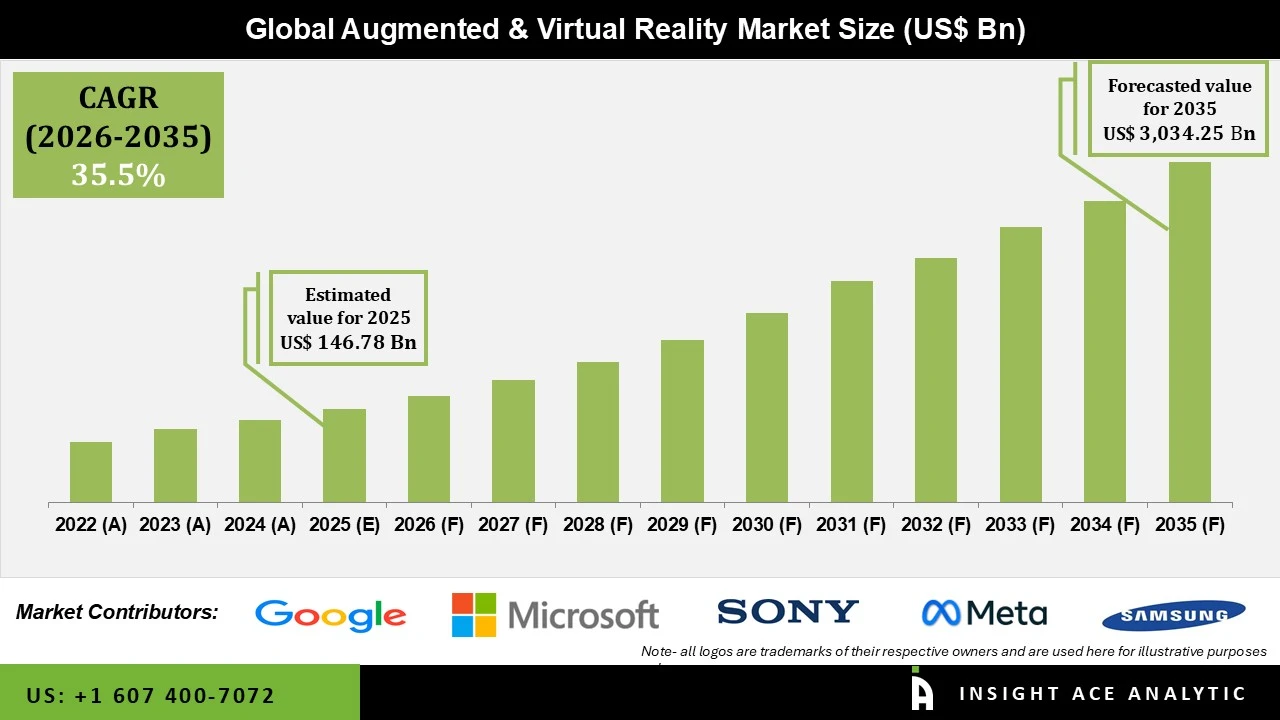

Augmented and Virtual Reality Market Size is valued at USD 146.78 Billion in 2025 and is predicted to reach USD 3034.25 Billion by the year 2035 at a 35.5% CAGR during the forecast period for 2026 to 2035.

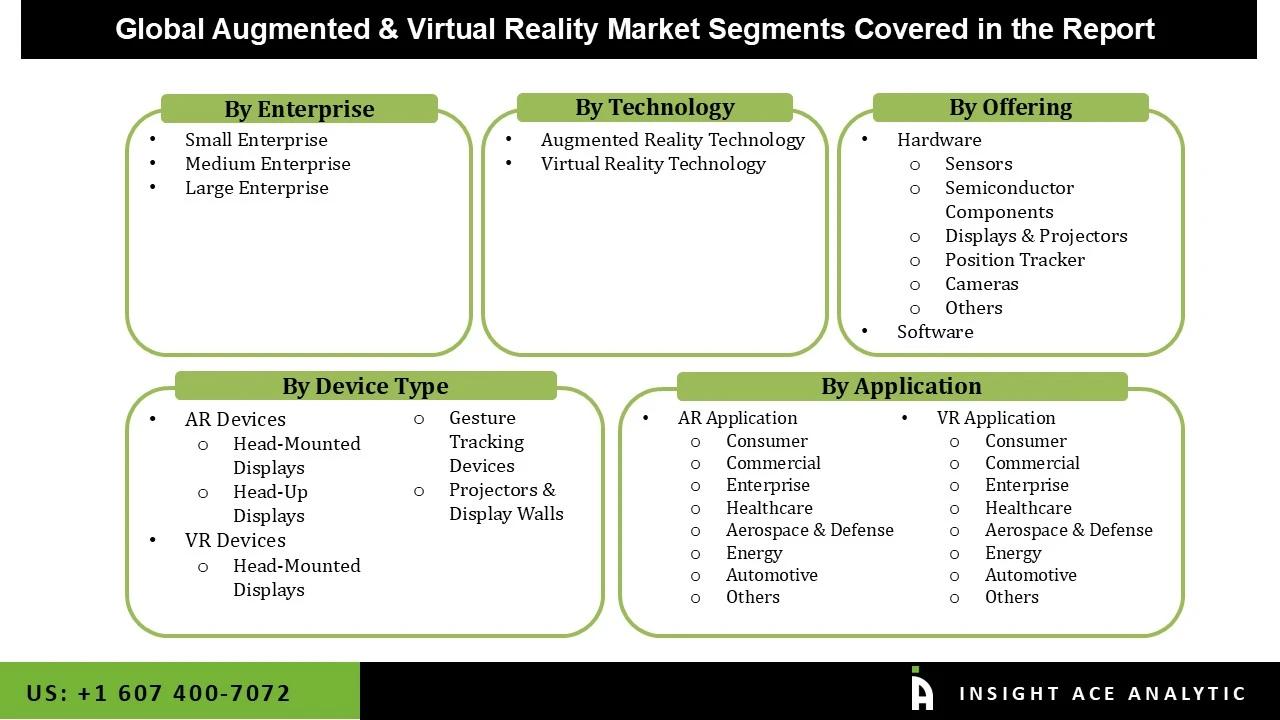

Augmented and Virtual Reality Market Size, Share & Trends Analysis Report by Enterprise (Small, Medium, Large), Technology ( AR and VR), Offering (Hardware, Software), Device Type (AR, VR Devices), Application (AR Application, VR Application), By Region, And By Segment Forecasts, 2026 to 2035

AR and VR technologies have transformative potential in healthcare, education, entertainment, and business industries, offering new ways to engage users and provide innovative solutions. Small and medium-sized enterprises (MSMEs) in today's market increasingly rely on this technology to differentiate themselves, stand out from the crowd, and win and keep customers. Industries are aggressively investigating uses for augmented reality (AR) technology in training, maintenance, support, and monitoring. Growth in the industry is expected to be spurred by the proliferation of smartphones and the popularity of apps. Furthermore, virtual reality (VR) technology allows for a completely new and unique experience by completely isolating users from their surroundings. In most cases, this is accomplished using a virtual reality (VR) headset equipped with a high-definition screen, a motion-tracking sensor, and sometimes even separate hand controllers.

However, the market growth is hampered by the strict regulatory criteria for safety and the lack of norms and protocols in the augmented & virtual reality market. The network's foundation becomes critical in determining the feasibility and quality of user experiences. Since increasingly more augmented reality apps are moving to the cloud, having a reliable and low-latency connection is more important than ever. This infrastructure is the backbone for continuous two-way communication between the digital and physical spheres. The outbreak and spread of COVID-19 have upset and damaged the stocks of companies manufacturing and supplying components for augmented and virtual reality devices because of the lockdowns imposed in several countries due to the COVID-19 outbreak, suppliers of components for augmented and virtual reality devices saw their stock levels plummet.

The augmented & virtual reality market is segmented based on enterprise, technology, offering, device, and application. As per the segment enterprise, the market is segmented into small, medium, and large. By technology, the market is segmented into AR and VR. According to the offering, the market is segmented into hardware and software. The hardware segment includes Sensors, Semiconductor Components, Displays and projectors, Position Tracker, Cameras, and Others. By device type, the market is segmented into AR devices, which include Head-Mounted Displays and head-up Displays, Whereas VR devices consist of Head-Mounted Displays, Gesture Tracking Devices, and Projectors and display Walls. The application segment comprises AR Applications and VR Applications. AR Applications include Consumer, Commercial, Enterprise, Healthcare, Aerospace and defence, Energy, Automotive, and Others. VR Application also consists of Consumer, Commercial, Enterprise, Healthcare, Aerospace and defence, Energy, Automotive, and Others.

The hardware augmented & virtual reality market is expected to hold a major global market share in 2024. Hardware is purpose-built to execute a task at lightning speed, and it can often accomplish this more swiftly than software alone. Hardware is more error- and corruption-resistant than software.

The VR application segment is projected to grow rapidly in the global augmented & virtual reality market. Virtual reality can aid in the understanding of fundamental ideas for both students and professionals. Learners can control their learning rate thanks to technological advancements. Understanding and remembering knowledge is greatly enhanced when students are able to picture it, especially in countries like the US, Germany, the UK, China, and India.

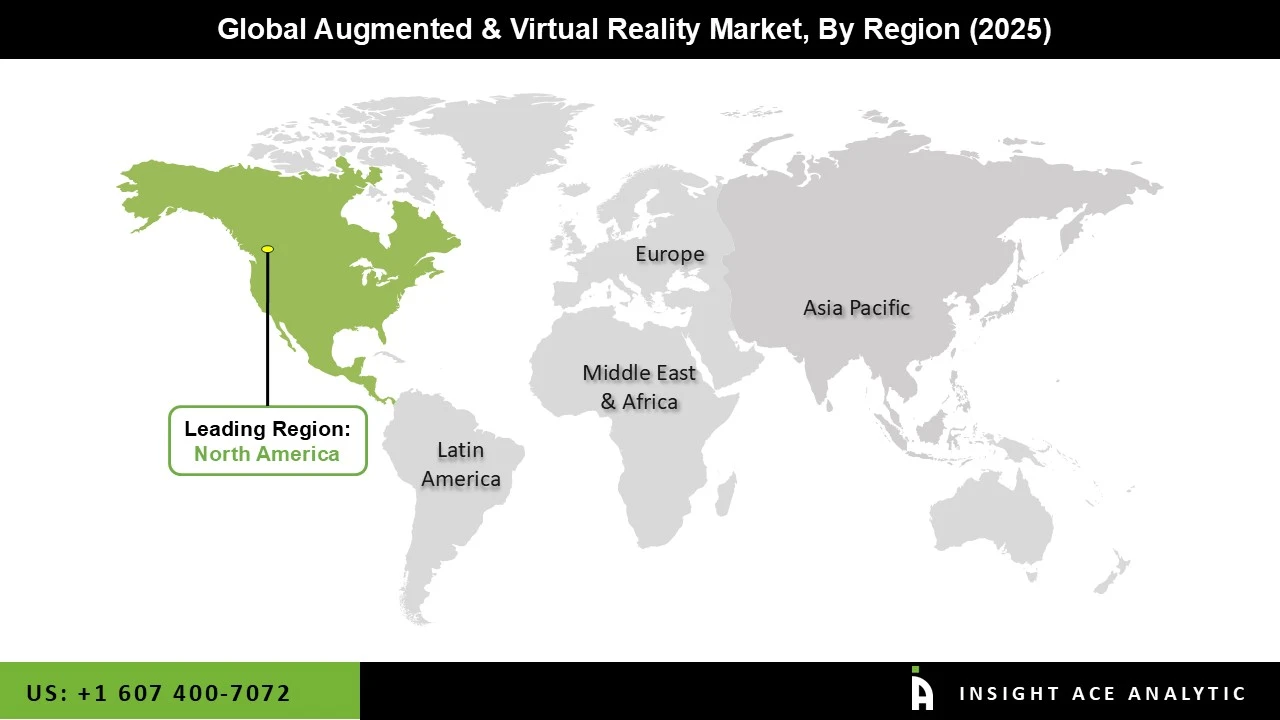

The Asia Pacific augmented & virtual reality market is expected to record the maximum market share in revenue in the near future. It can be attributed to corporations embracing innovation with open arms. It is the most lucrative market, generating a considerable share of AR's total sales. The proliferation of augmented reality devices among corporate users to boost productivity and accuracy has been a major element in the industry's growth. In addition, North America is projected to grow rapidly in the global augmented & virtual reality market because of rising demand for digital solutions in sectors including healthcare, retail, and transportation.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 146.78 Billion |

| Revenue Forecast In 2035 | USD 3034.25 Billion |

| Growth Rate CAGR | CAGR of 35.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn,and CAGR from 2025 to 2034 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Enterprise, Technology, Offering, Device Type, and Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Google (US), Microsoft (US), Sony Group Corporation (Japan), META (US), SAMSUNG (South Korea), HTC Corporation (Taiwan), Apple Inc. (US), PTC Inc. (US), Seiko Epson Corporation (Japan), Lenovo (China), Wikitude, a Qualcomm company (Austria), EON Reality (US), MAXST Co., Ltd. (South Korea), Magic Leap, Inc. (US), Blippar Group Limited(UK), Atheer, Inc (US), Vuzix (US), CyberGlove Systems Inc. (US), Leap Motions (Ultraleap) (US), Penumbra, Inc. (US), Nintendo (Japan), PSICO SMART APPS, S.L. (Spain), Xiaomi (China), Panasonic Corporation (Japan), Scope AR (US), Continental AG (Germany), Virtually Live (Switzerland), SpaceVR Inc (US), Intel Corporation (US), 3D Cloud by Marxent (US), WayRay AG (Switzerland), Craftars (Romania), Talespin Reality Labs, Inc. (US), BidOn Games Studio (Ukraine), appentus technologies (India), ByteDance (China), and DPVR (China) |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Augmented & Virtual Reality Market By Enterprise-

Augmented & Virtual Reality Market By Technology-

Augmented & Virtual Reality Market By Offering-

Augmented & Virtual Reality Market By Device Type

Augmented & Virtual Reality Market By Application-

Augmented & Virtual Reality Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.