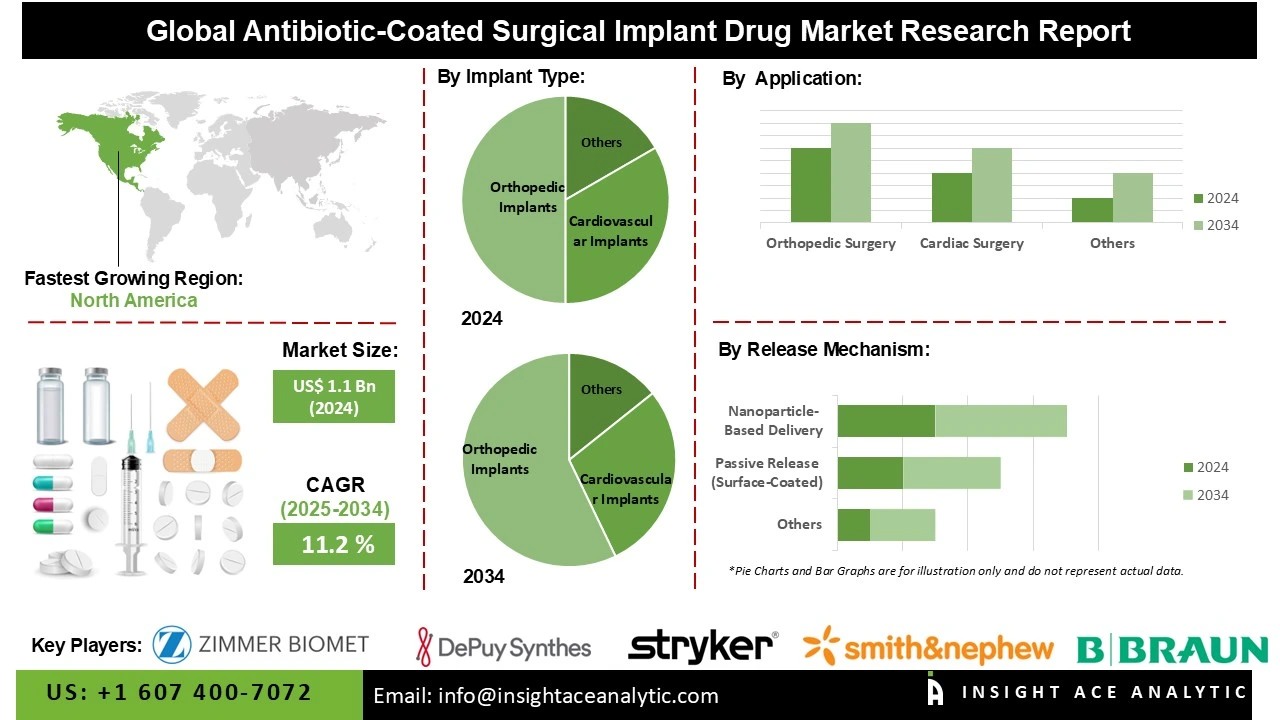

Global Antibiotic-Coated Surgical Implant Drug Market Size is valued at US$ 1.1 Bn in 2024 and is predicted to reach US$ 3.2 Bn by the year 2034 at an 11.2% CAGR during the forecast period for 2025 to 2034.

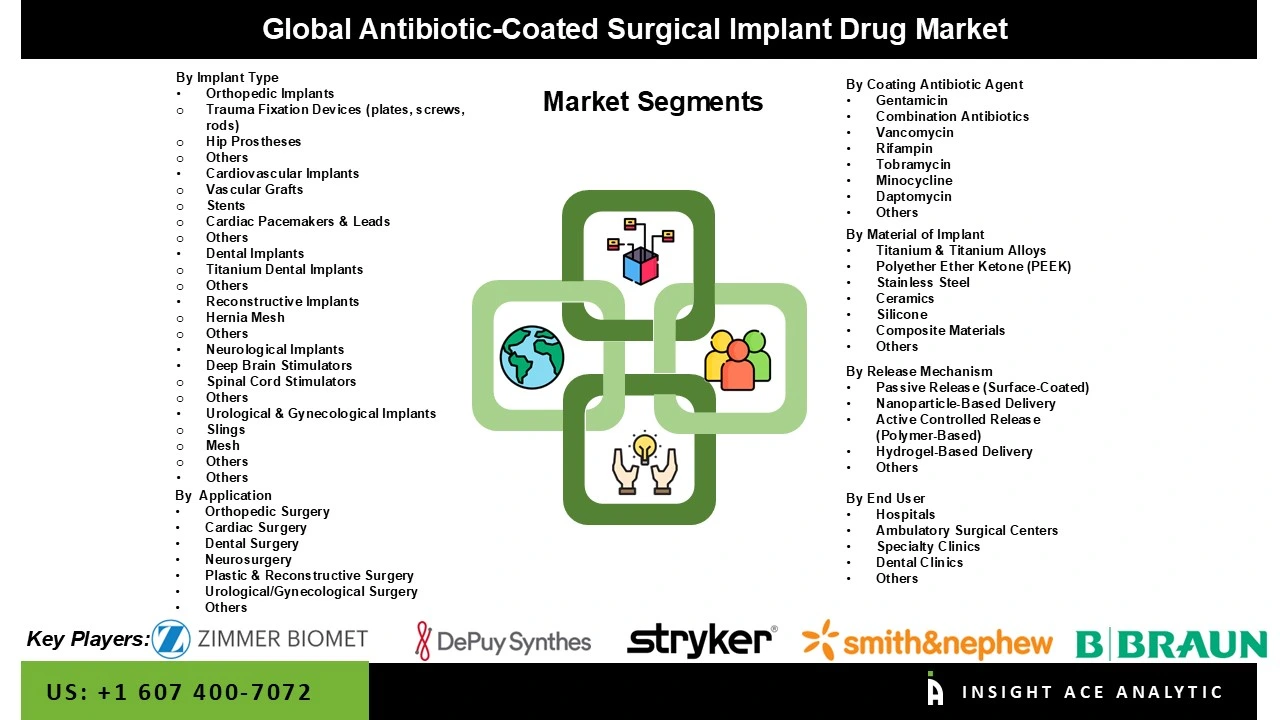

Antibiotic-Coated Surgical Implant Drug Market Size, Share & Trends Analysis Distribution by Coating Antibiotic Agent (Gentamicin, Tobramycin, Minocycline, Combination Antibiotics, Daptomycin, Vancomycin, Rifampin, and Others), Implant Type, Material of Implant, Application, Release Mechanism, End-use (Hospitals, Dental Clinics, Ambulatory Surgical Centers, Specialty Clinics, and Others), and Segment Forecasts, 2025 to 2034

The antibiotic-coated surgical implant market is a specialized, high-growth segment of the pharmaceutical and medical device industries dedicated to preventing postoperative infections. These implants including orthopedic joint replacements, fracture fixation devices, vascular grafts, and neurosurgical shunts are coated, impregnated, or loaded with antibiotics such as gentamicin, vancomycin, tobramycin, rifampin, or combinations thereof. By releasing antimicrobial agents directly at the implant-tissue interface, they achieve local drug concentrations hundreds to thousands of times higher than systemic antibiotics can safely provide, effectively inhibiting bacterial adhesion, colonization, and biofilm formation the primary culprits behind surgical site infections (SSIs) and difficult-to-treat periprosthetic joint infections (PJIs).

Growth of the market is propelled primarily by the global increase in implant procedures. An aging population, rising prevalence of chronic diseases (osteoarthritis, diabetes, cardiovascular conditions), and higher rates of trauma from road traffic accidents have dramatically increased surgical volume. Robust clinical evidence from randomized trials, registries, and meta-analyses demonstrating 40–70 % reductions in infection rates with antibiotic-loaded bone cement and pre-coated devices has driven widespread adoption, especially in high-risk cases such as revision arthroplasty, open fractures, and immunocompromised patients. Continued public and private investment in infection-prevention technologies further fuels innovation and market expansion.

A prominent emerging trend is the shift toward next-generation, sustainable antimicrobial coatings. Researchers and manufacturers are developing bio-based, biodegradable carriers (e.g., calcium sulfate, hydrogels, and antimicrobial peptides) and environmentally friendly alternatives to traditional synthetic antibiotics and non-resorbable polymers. These innovations address mounting regulatory and societal concerns about antimicrobial resistance and medical waste while maintaining or improving efficacy and biocompatibility. As healthcare systems worldwide prioritize both patient safety and environmental responsibility, these advanced, eco-conscious solutions are poised to play a central role in the continued evolution of the antibiotic-coated implant market.

Some of the Key Players in Antibiotic-Coated Surgical Implant Drug Market:

The antibiotic-coated surgical implant drug market is segmented by coating antibiotic agent, implant type, material of implant, application, release mechanism, and end-use. By coating antibiotic agent, the market is segmented into gentamicin, tobramycin, minocycline, combination antibiotics, daptomycin, vancomycin, rifampin, and others. By implant type, the market is segmented into orthopedic implants (trauma fixation devices (plates, screws, rods), knee prostheses, hip prostheses, spinal implants, others), dental implants (titanium dental implants, zirconia dental implants, others), cardiovascular implants (stents, vascular grafts, cardiac pacemakers & leads, others), reconstructive implants (breast implants, he ia mesh, facial implants, others), urological & gynecological implants (mesh, slings, others), neurological implants (spinal cord stimulators, deep brain stimulators, others), and others. By material of implant, the market is segmented into stainless steel, ceramics, titanium & titanium alloys, polyether ether ketone (peek), silicone, composite materials, and others. The application segment is categorised into cardiac surgery, neurosurgery, orthopedic surgery, dental surgery, plastic & reconstructive surgery, urological/gynecological surgery, and others. As per the release mechanism, the market is segmented into passive release (surface-coated), active controlled release (polymer-based), hydrogel-based delivery, nanoparticle-based delivery, and others. Whereas the end-use segment consists of hospitals, dental clinics, ambulatory surgical centers, specialty clinics, and others.

In 2024, the market for antibiotic-coated surgical implant drugs was dominated by the orthopedic implants segment. This is because a damaged bone has to be supported, and a missing joint or bone needs to be replaced. Orthopedic implants are frequently made of polymers, ceramics, and metallic alloys. In order to lower toxicity levels and lower the possibility of host rejection, researchers are creating innovative orthopedic implants using biomaterials. Three techniques anti-adhesion, contact-killing, and releasing-type are used to apply antibiotic coatings to orthopedic implants.

In 2024, the global market for antibiotic-coated surgical implant drugs was led by the orthopedic surgery segment in terms of application. The growing number of accidents and orthopedic conditions contributes to the segment's expansion. Around 30.5 million orthopedic procedures are anticipated to be carried out worldwide in 2024, a 4.5% increase over 2023. Common orthopedic conditions include rheumatoid arthritis, osteoarthritis, and osteoporosis. The segment's expansion is also driven by the rising number of post-menopausal women and the aging population.

The antibiotic-coated surgical implant drug market is dominated by North America in 2024. A successful decrease in HAIs and rising surgical equipment spending in the healthcare industry are predicted to increase demand for antibiotic-coated surgical implant drugs in the region. Furthermore, the region's market is expanding as a result of rising medical device exports, improvements in medical technology, and an increase in the demand for in-home healthcare services. Additionally, the US and Canadian medical device sectors have a strong cooperation due to their similar quality, proximity, and safety norms, which should encourage the expansion of the regional antibiotic-coated surgical implant drug market.

During the projected period, the antibiotic-coated surgical implant drug market is anticipated to expand at the quickest compound annual growth rate (CAGR) in Asia-Pacific. The necessity for surgery is exacerbated by the growing number of older adults and the increasing incidence of chronic illnesses. The market is growing as a result of the expanding medical device and healthcare industries. Government agencies finance the adoption and installation of cutting-edge medical technology in healthcare facilities. Additionally, foreign manufacturers are encouraged to establish their medical device production facilities in China by the Chinese National Medical Products Administration (NMPA). Furthermore, favorable trade rules that allow for the import and export of surgical implants have a positive effect on the antibiotic-coated surgical implant drug market expansion.

Antibiotic-Coated Surgical Implant Drug Market by Coating Antibiotic Agent-

· Gentamicin

· Tobramycin

· Minocycline

· Combination Antibiotics

· Daptomycin

· Vancomycin

· Rifampin

· Others

Antibiotic-Coated Surgical Implant Drug Market by Implant Type -

· Orthopedic Implants

o Trauma Fixation Devices (plates, screws, rods)

o Knee Prostheses

o Hip Prostheses

o Spinal Implants

o Others

· Dental Implants

o Titanium Dental Implants

o Zirconia Dental Implants

o Others

· Cardiovascular Implants

o Stents

o Vascular Grafts

o Cardiac Pacemakers & Leads

o Others

· Reconstructive Implants

o Breast Implants

o He ia Mesh

o Facial Implants

o Others

· Urological & Gynecological Implants

o Mesh

o Slings

o Others

· Neurological Implants

o Spinal Cord Stimulators

o Deep Brain Stimulators

o Others

· Others

Antibiotic-Coated Surgical Implant Drug Market by Material of Implant-

· Stainless Steel

· Ceramics

· Titanium & Titanium Alloys

· Polyether Ether Ketone (PEEK)

· Silicone

· Composite Materials

· Others

Antibiotic-Coated Surgical Implant Drug Market by Application-

· Cardiac Surgery

· Neurosurgery

· Orthopedic Surgery

· Dental Surgery

· Plastic & Reconstructive Surgery

· Urological/Gynecological Surgery

· Others

Antibiotic-Coated Surgical Implant Drug Market by Release Mechanism-

· Passive Release (Surface-Coated)

· Active Controlled Release (Polymer-Based)

· Hydrogel-Based Delivery

· Nanoparticle-Based Delivery

· Others

Antibiotic-Coated Surgical Implant Drug Market by End-use-

· Hospitals

· Dental Clinics

· Ambulatory Surgical Centers

· Specialty Clinics

· Others

Antibiotic-Coated Surgical Implant Drug Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.