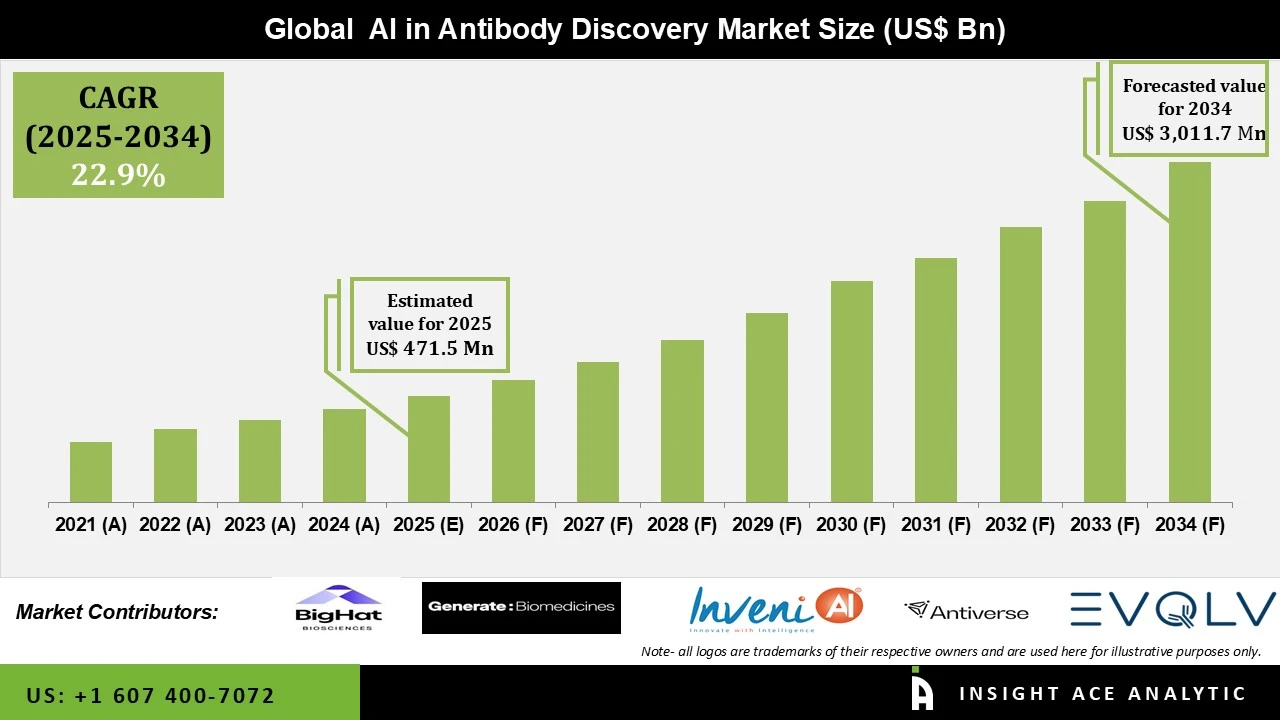

Global AI in Antibody Discovery Market Size is valued at USD 471.5 Mn in 2024 and is predicted to reach USD 3,011.7 Mn by the year 2034 at a 22.9% CAGR during the forecast period for 2025 to 2034.

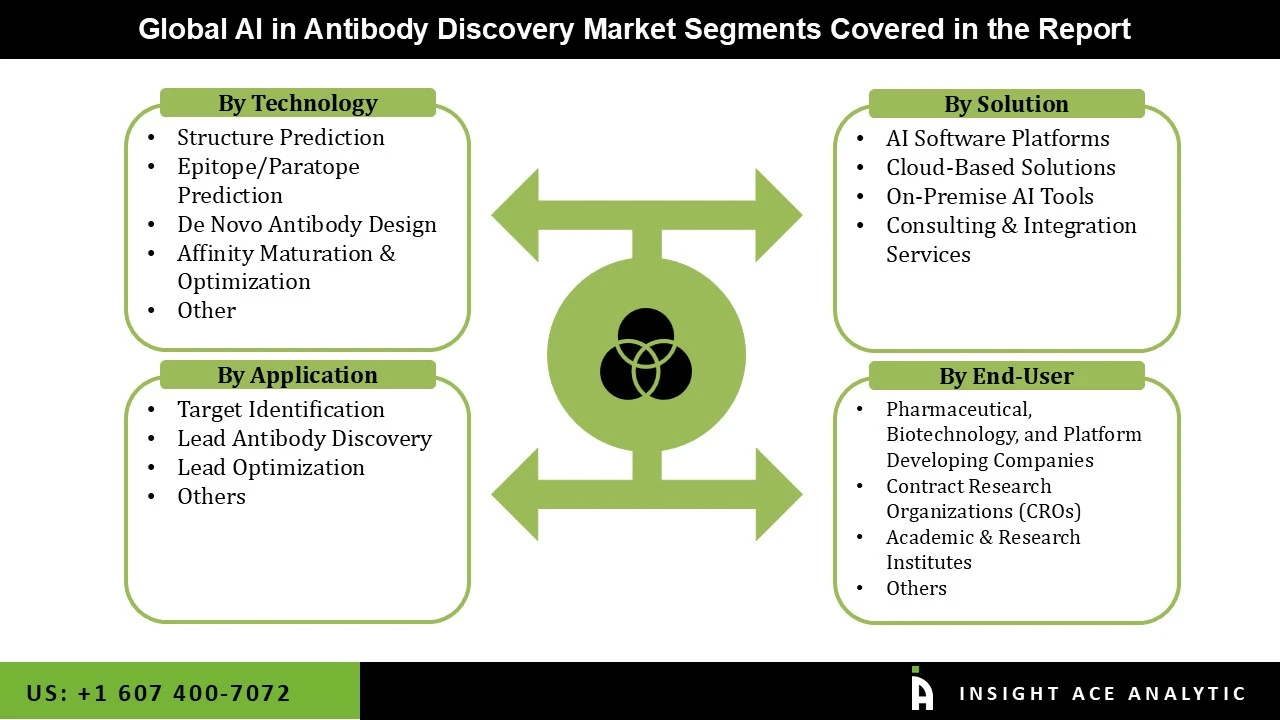

AI in Antibody Discovery Market Size, Share & Trends Analysis Distribution By Solution (AI Software Platforms, On-Premise AI Tools, Cloud-Based Solutions, and Consulting & Integration Services), By Technology (Structure Prediction, Affinity Maturation & Optimization, De Novo Antibody Design, Epitope/Paratope Prediction, and Others), By Application (Target Identification, Lead Optimization, Lead Antibody Discovery, and Others), By End-user (Pharmaceutical, Biotechnology, and Platform Developing Companies, Academic & Research Institutes, Contract Research Organizations (CROs), and Others), and Segment Forecasts, 2025 to 2034

The use of artificial intelligence (AI) and machine learning (ML) approaches to expedite and enhance the identification, design, and optimization of therapeutic antibodies is known as "AI in antibody discovery." AI models can accurately predict antibody binding affinity, specificity, stability, and immunogenicity by examining large biological datasets, including protein structures, genetic sequences, antigen–antibody interactions, and experimental binding data. Before beginning expensive laboratory investigations, these technologies assist researchers in quickly screening millions of possible antibody candidates, designing novel antibody sequences, and optimizing lead molecules. The AI in antibody discovery market is fueled by scientific breakthroughs, the growing need for focused treatments, and the rise in chronic illnesses including cancer and autoimmune diseases.

The high-throughput screening and artificial intelligence are being used more frequently, which has sped up the discovery process while increasing productivity and cutting expenses. The innovation in antibody discovery using AI is further fueled by partnerships between pharmaceutical corporations and academic organizations. Additionally, the AI in antibody discovery market expansion is supported by the increased emphasis on biosimilars and monoclonal antibodies. The market is also being shaped by trends including personalized medicine and the use of antibody-drug conjugates, which are increasing investment for AI in antibody discovery technologies worldwide and providing better therapeutic choices.

Additionally, another important field of AI-driven innovation is the engineering and optimization of antibodies for increased efficacy and decreased immunogenicity. This is anticipated to boost the AI in antibody discovery market expansion over the forecast period. Moreover, the increasing use of AI technologies in academic research institutes, which promotes a better comprehension of biological mechanisms and speeds up the conversion of scientific findings into workable treatment solutions, is driving the AI in antibody discovery market's growth trajectory. Despite the market's enormous potential, there are some limitations that could present difficulties, such as the initial high cost of implementing AI, the requirement for specialist personnel, and regulatory obstacles for AI-generated drug candidates. However, these constraints are constantly being addressed by continuing developments in deep learning, machine learning, and natural language processing.

Driver

Increasing Demand for Precision Therapies

The future growth in the AI in antibody discovery market is anticipated to be driven by the increasing demand for precision therapies. The precision therapies are the process of tailoring medical procedures and treatment strategies to each patient's unique needs. The antibody-based biologics are essential for treating complicated illnesses, including cancer, autoimmune diseases, and uncommon genetic diseases, because they are made to attach specifically to well-defined molecular targets. However, using traditional techniques to find antibodies with the best specificity, affinity, and safety profiles is expensive and time-consuming. In order to forecast the most promising candidates early in the discovery process, AI-driven platforms quickly analyze enormous databases of antigen structures, antibody sequences, and clinical insights. The usage of AI in antibody discovery is therefore increasing as pharmaceutical companies construct pipelines centered on precision biologics and tailored therapeutics, underscoring its significance as a critical facilitator of next-generation biologic drug development.

Restrain/Challenge

High Cost of Deploying AI-driven Platforms

The AI in antibody discovery market is severely constrained by the high cost of deploying AI-driven platforms, especially for small and mid-sized biotechnology companies and academic research institutes. A significant upfront investment in high-performance computing equipment, cloud resources, specialized software, and secure data management systems is necessary for the development and implementation of advanced AI systems. Furthermore, massive, high-quality biological and structural datasets—which are sometimes private, pricey, or require expensive license agreements—are necessary for training powerful AI models. The financial burden in the AI in antibody discovery market is further increased by the continuing expenses associated with system updates, regulatory compliance, model validation, and integration with current laboratory operations.

The structure prediction segment held the largest share in the AI in antibody discovery market in 2024 because of its vital significance in precisely modeling stability, 3D structures, and antibody folding. Pharmaceutical and biotechnology businesses can expedite the development of effective antibodies, improve binding affinity, and shorten experimental cycles by permitting exact structural predictions. Additionally, the speed and accuracy of predicting antibody structures, including variable sections and complementarity-determining regions (CDRs), have greatly increased thanks to developments in deep learning architectures, which were spurred by discoveries like protein structure prediction models. Furthermore, model training and performance are being improved by the increasing availability of high-quality structural and sequencing resources. The need for trustworthy structure prediction solutions keeps growing as precision biologics and next-generation antibody formats become more popular, propelling this category's steady expansion within the AI in antibody discovery market.

In 2024, the pharmaceutical, biotechnology, and platform developing companies segment dominated the AI in antibody discovery market because of its large infrastructure, significant investments in R&D, and knowledge of medication development. These platforms can finance antibody research initiatives and successfully negotiate the intricate regulatory processes for novel treatments. Additionally, they acknowledge the potential of antibodies as efficient remedies for a range of illnesses, spurring ongoing innovation. Their significant market share in the AI in antibody discovery market is a result of their capacity to commercialize antibody-based medications and treatments.

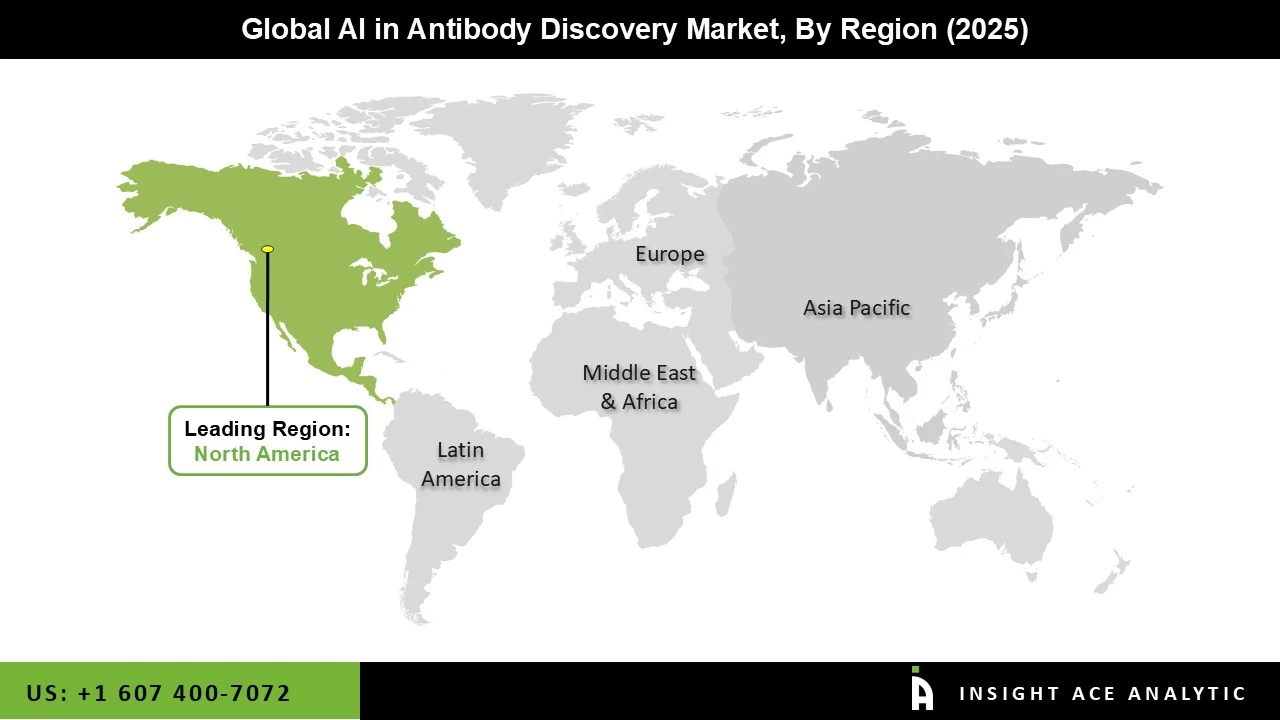

The AI in antibody discovery market was dominated by the North America region in 2024 because of the area's strong healthcare system, cutting-edge technology, and substantial investments in pharmaceutical R&D. With many AI-driven drug development projects spearheaded by large corporations like IBM Watson Health and Tempus, the United States stands out in particular.

North America's supremacy is further reinforced by government assistance, which includes financing for AI research and regulatory initiatives to expedite AI in antibody discovery. Moreover, the region is at the forefront of AI innovation in medication research due to the strong concentration of academic institutions and biotech and pharmaceutical industries.

May 2025: A strategic agreement to scale precision medicine through digital and computational pathology solutions was announced by Danaher Corporation. AI-assisted algorithms will be integrated to improve patient targeting for antibody-drug conjugates.

March 2025: To speed up antibody discovery in therapeutic areas like neurodegenerative and metabolic diseases, Nona Biosciences, a healthcare company, introduced Hu-mAtrlx, an AI-assisted drug discovery engine that integrates with their Harbour Mice platform, in the first half of 2025, according to Jingsong Wang, MD, PhD, CEO. Additionally, the company strengthened its international alliances with companies including Visterra, Invetx, UAB, and Atossa Therapeutics.

March 2024: To revolutionize drug discovery and expedite the creation of life-saving treatments, Cognizant and NVIDIA worked together to employ generative AI via the BioNeMo platform.

October 2023: An AI-powered antibody discovery platform was unveiled by SwiftPharma BV, a Belgium-based business that produces recombinant proteins from a proprietary plant-based system. This novel technology predicts high-specificity and high-affinity antibody-antigen binding quickly by combining artificial intelligence, big data, machine learning, and phage display approaches. Similar to natural language processing, this method produces a variety of antibody variations, allowing SwiftPharma to effectively build extensive antibody libraries.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 471.5 Mn |

| Revenue forecast in 2034 | USD 3,011.7 Mn |

| Growth Rate CAGR | CAGR of 22.9% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2034 |

| Historic Year | 2021 to 2023 |

| Forecast Year | 2024-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Solution, By Technology, By Application, By End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | LabGenius Therapeutics, InveniAI LLC, Antiverse, Cradle Bio B.V., EVQLV Inc., BigHat Biosciences, Inc., Generate Biomedicines, Inc., Chai Discovery Inc., MAbSilico, and Alloy Therapeutics, Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.